"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

The freight market has largely followed typical seasonal patterns year-to-date, but some abnormal freight activity has been a clear side effect of recent tariff implementations and threats. Pull-forward volumes, alternative sourcing and supply chains stalling as they await tariff relief have caused temporary, unique demand fluctuations. In the case of Mexico and Canada, we have seen strong freight activity leading up to tariffs being followed by slowdowns once tariffs were live and in place.

Except for China, larger retaliatory tariffs on goods from other trade partners are paused until July 9th for negotiations. Once the pause ends, elevated tariffs on most imports are possible, meaning short-term volume gains will probably be temporary spikes.

Without tariffs, broader demand trends remain down, creating a moving target for supply and keeping rate disruptions minimal, aside from typical seasonal tightening. Should the downside risks to demand materialize, the chances of a sustained disruption in 2025 will become even less likely. With no clear evidence of upside risks to demand in the forecast, the chances of a disruption in 2025 were already looking subdued.

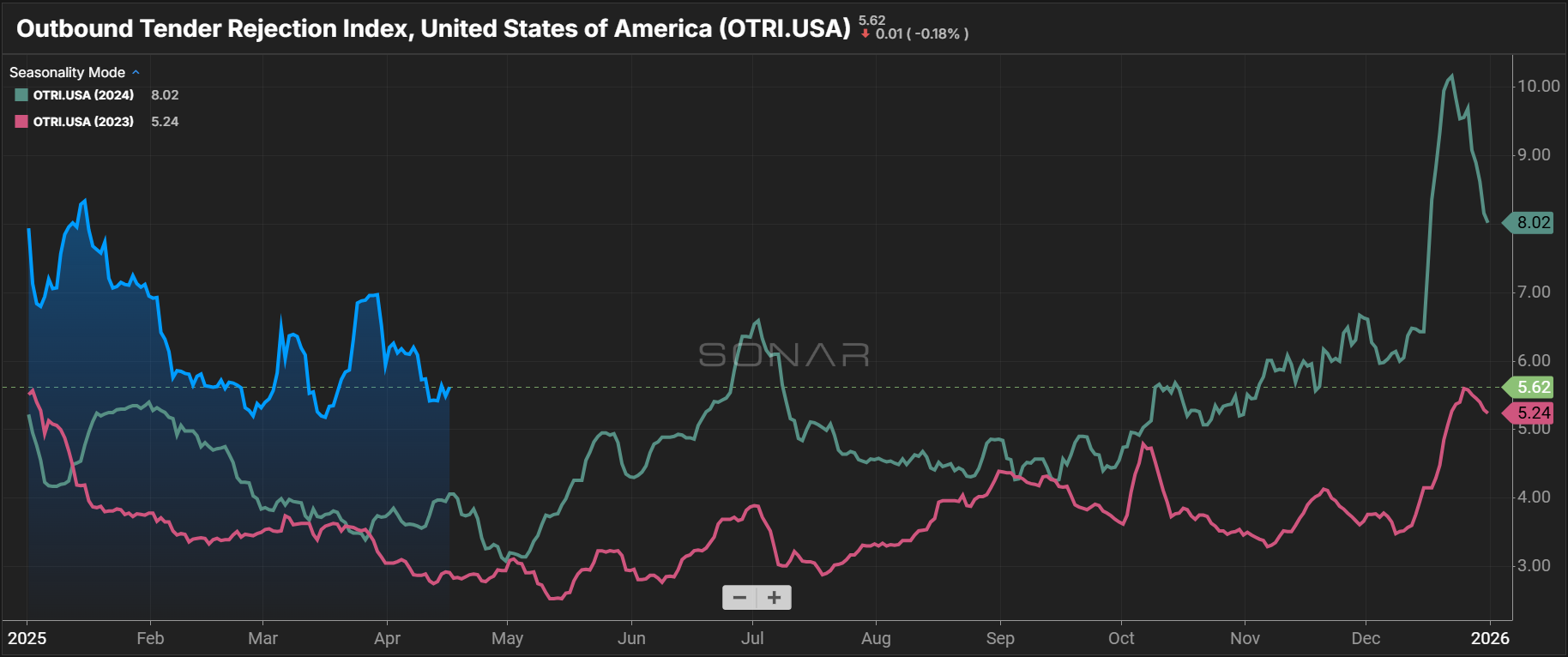

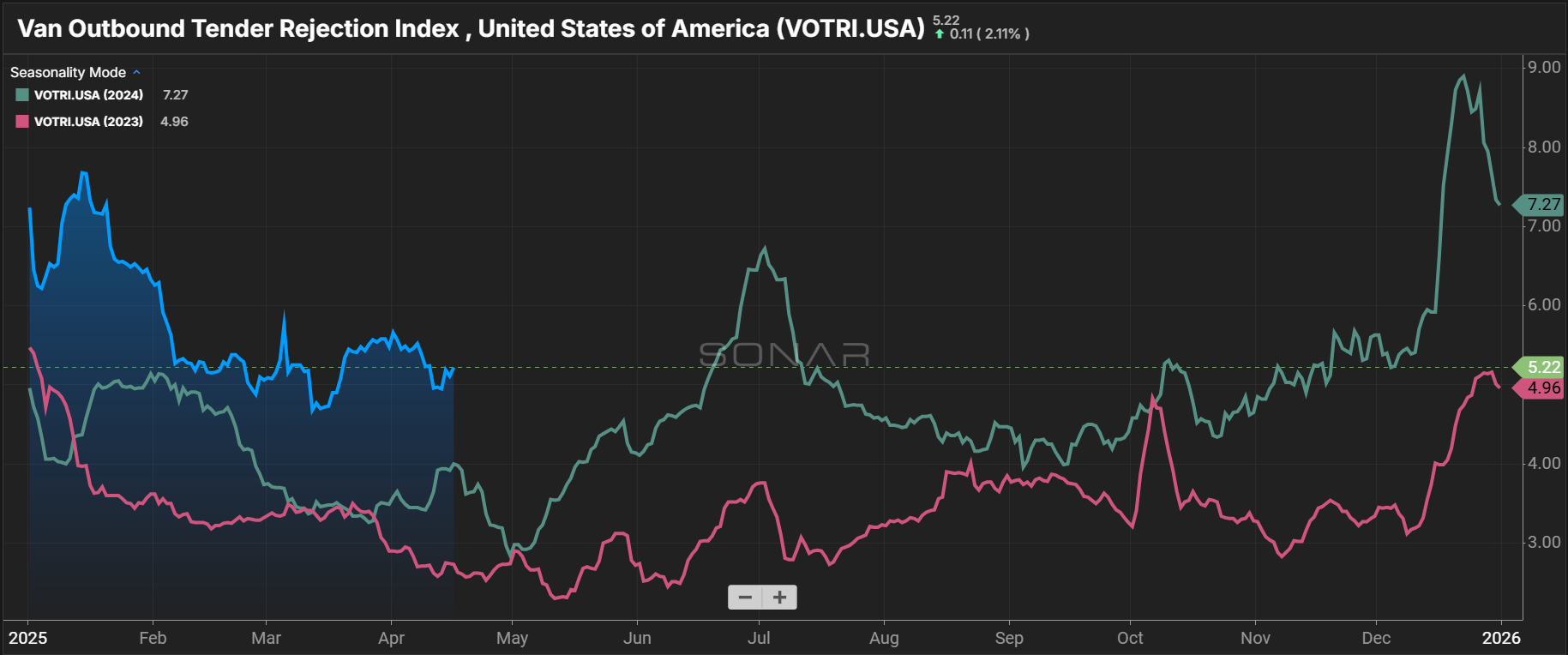

Supply-side trends are also adding complexity to this month’s narrative. With tender rejections up year-over-year across all modes, capacity is largely in equilibrium with demand and has become increasingly vulnerable to demand shocks. Trucking employment and carrier revocation data indicate stability as of late, evidence of more balanced conditions. With demand illustrating greater downside risk, equipment orders have fallen below replacement levels as carriers are not appearing optimistic about future freight conditions. This pattern makes sense but also sets the market up for increased risk of disruption if and when demand does make a meaningful recovery.

With that, the only certainty for the market seems to be more uncertainty ahead. From how broader economic trends will shape demand to whether or not capacity will falter under increased seasonal pressure, the next 90 days will reveal whether recent activity marks the beginning of a meaningful shift or is just another brief blip in the rebalancing cycle.

Keep reading for a closer look at the data behind these trends and what they could mean for your network in the months ahead.

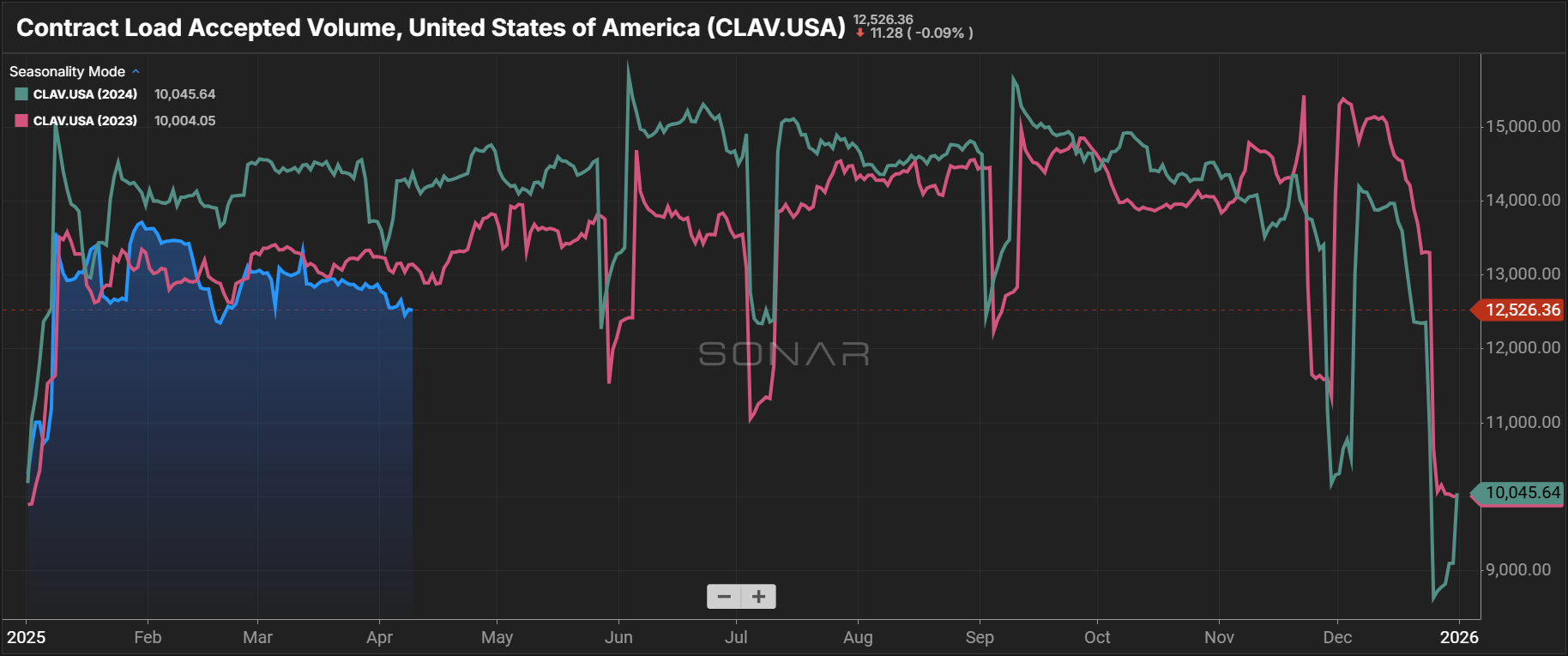

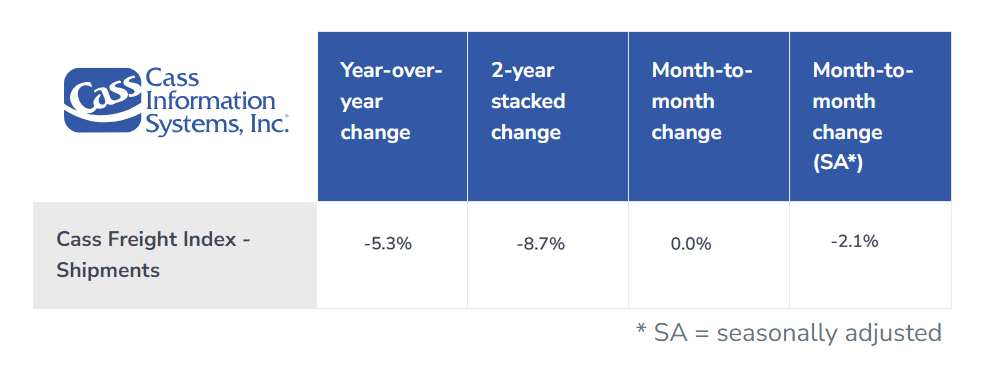

Demand weakness has created a moving target in the balancing of the truckload freight market. This is reflected in the ongoing decline of the Contract Load Accepted Volume Index (CLAV) since October 2024 and further illustrated by Cass Freight Index data, which shows a 5.3% year-over-year and 8.7% two-year stacked decline in shipment volumes.

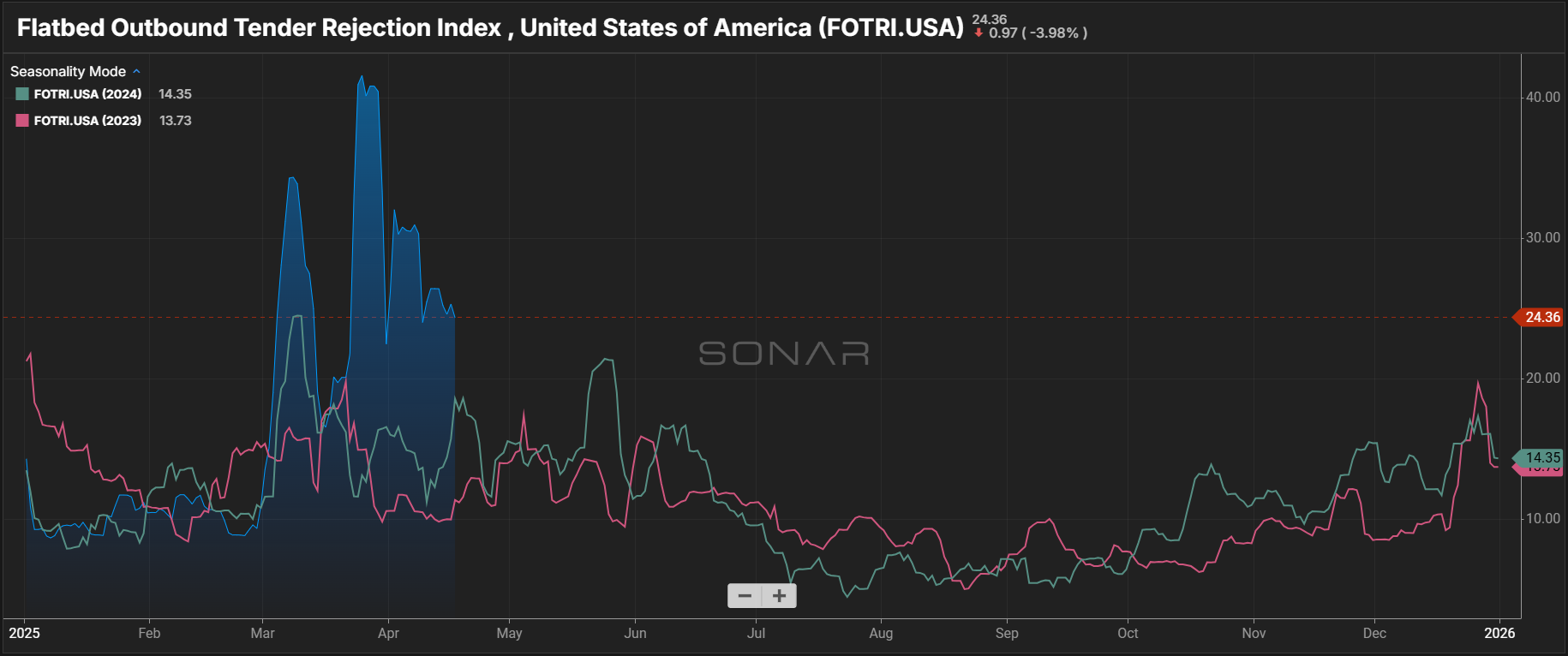

Tariff-related uncertainty has positively and negatively impacted freight demand as shippers react to rising costs of imported raw materials and finished goods from global trade partners. Spot load volumes jumped significantly from February to March, rising 22% year-over-year as shippers pulled freight forward to mitigate tariff risks. Additional business days and the end-of-quarter push in March further contributed to the increase. Flatbed activity led the way, surging 39% as shippers moved up shipments of steel, aluminum and other tariffed materials. Flatbed rejections also spiked, and spot rates climbed well above 2024 levels.

March import data supports this narrative. Total import volumes increased as shippers front-loaded freight, while imports from China—which faced a 10% tariff on February 4th and another 10% on March 4th—declined. Meanwhile, volumes from other key trade partners rose, suggesting a clear shift in sourcing strategies to minimize tariff exposure.

The freight market will be tested again over the next 90 days. Seasonal demand from produce season and the 100 Days of Summer will put upward pressure on rates and tighten capacity, especially as supply indicators point to increased sensitivity to demand shocks compared to recent years.

Shifting trade flows add another layer of complexity. Heavy tariffs on China and paused tariffs on other global trade partners could accelerate the rerouting of freight away from West Coast ports and into East and Gulf Coast entry points, as importers rush to purchase goods from paused countries ahead of potential tariff implementation. This added volume would further strain capacity in already busy regions like the Southeast.

The tariff landscape remains one of the most significant market risks, as any extension or expansion of current policies could trigger more pull-forward activity and introduce downside risk to normal freight patterns heading into Q3.

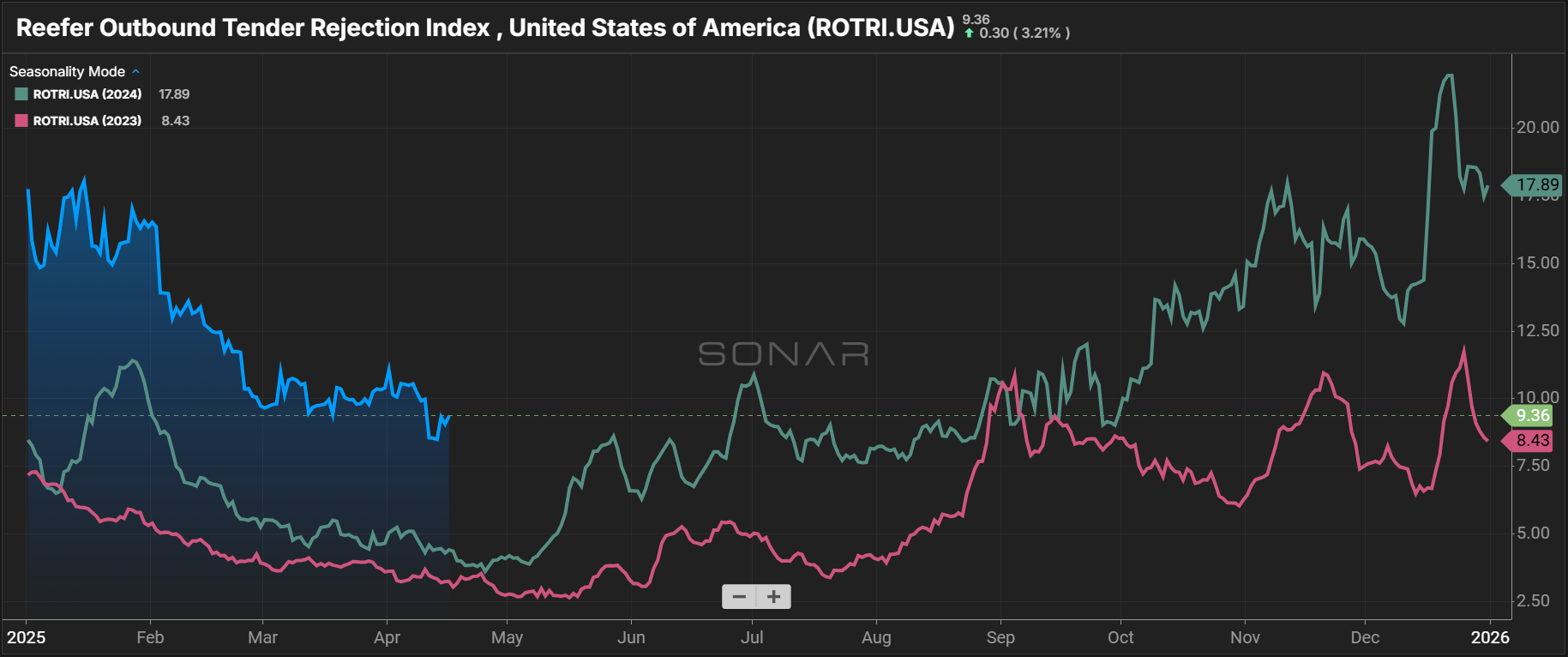

With tender rejections trending above 2024 levels, capacity continues to signal greater balance and a reduced ability to support demand shocks across the three major modes. Van and reefer supply trends show signs of tariff-related strain, though reefer equipment has followed more consistent seasonal patterns.

The sharp rise in flatbed rejections and load-to-truck ratios—driven by tariff-related demand coinciding with the onset of flatbed peak season—could offer early insight into what to expect during the summer peak for van and reefer equipment. As freight volumes remain elevated, rejection rates and spot rate volatility are likely to surpass 2024 levels.

Carrier exits have slowed, but growth remains mostly stagnant. March had the highest number of new entrants since September 2024, yet revocations still outpaced new authorities, resulting in flat net growth. That uptick may be seasonal and driven by reinstatements or the return of smaller carriers. Overall, the carrier population remains near a cycle low.

With tender rejections already elevated heading into produce and summer peak season, van rejections could surpass 10% if current trends continue—a threshold historically associated with market disruption. These conditions suggest supply and demand are nearing equilibrium, meaning even a modest volume surge could trigger significant supply tightening.

At the same time, weakening demand may limit the duration of any disruption. Spot market volatility could ease rapidly once seasonal peaks pass without sustained pressure. Carrier population growth will be a key variable to watch—if soft demand continues and more capacity exits the market, conditions will become increasingly vulnerable to sudden increases in truckload volumes.

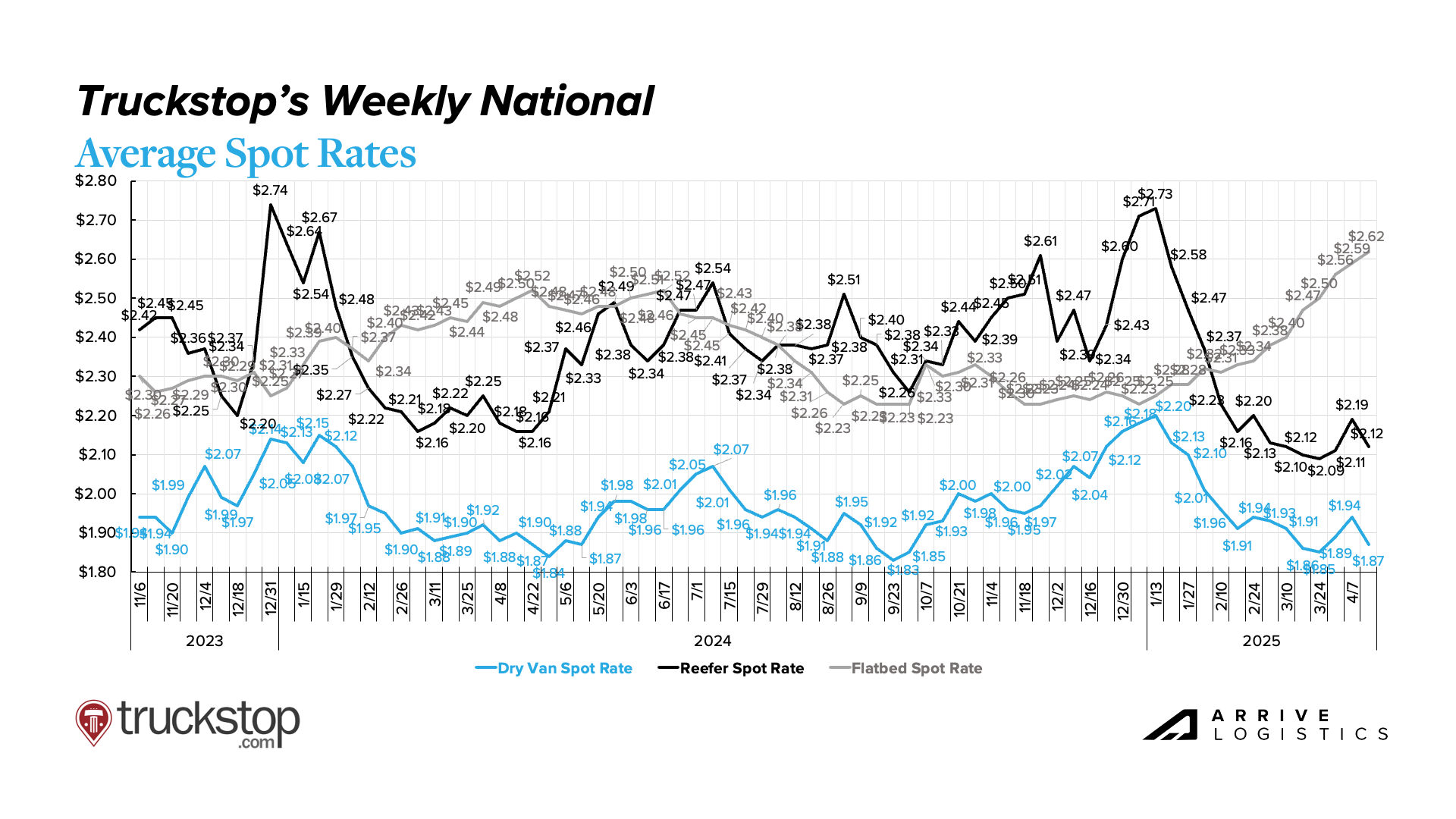

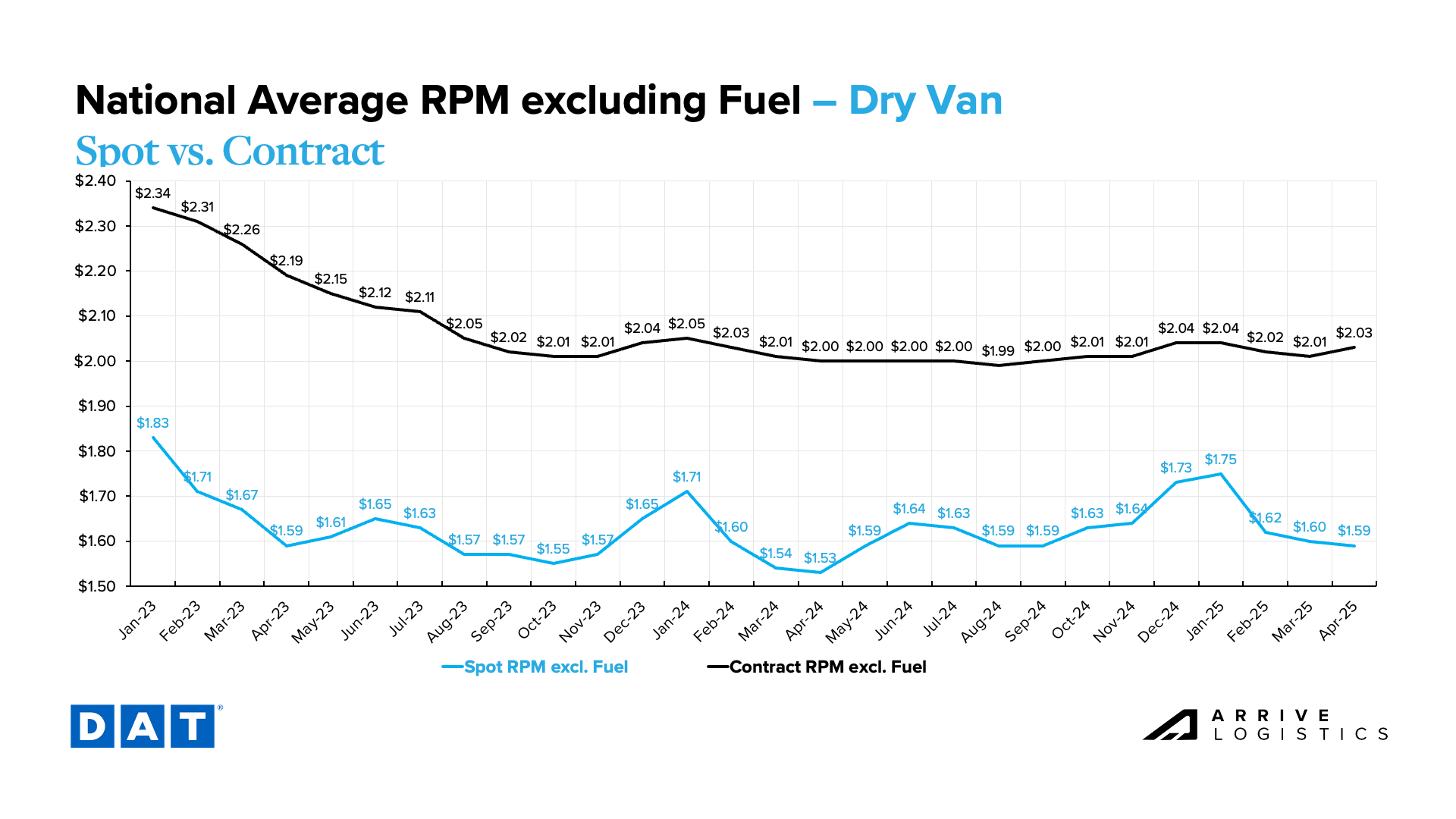

Rates largely followed seasonal norms in March and early April. Dry van rates fell $0.02 per mile from February to March, while reefer rates dropped $0.08. Both modes are now approaching their seasonal floors ahead of the summer peak. Despite these declines, year-over-year comparisons are showing an increase. As of April, dry van linehaul rates are up 3.3% from 2024 levels, while reefer rates are up 1.1%.

Meanwhile, a demand surge has pushed flatbed spot linehaul rates up $0.16 per mile since February, bringing year-over-year gains to 8.1%—a trend that reflects flatbed rejections and tightening supply.

As spot rates eased, the spot-contract rate gap widened across van and reefer equipment types. The dry van gap grew from $0.29 per mile in January to $0.42 in April, and reefer widened from $0.23 per mile to $0.48 over the same period, indicating pricing stability in the near term.

Seasonal rate pressure is expected to build through May and into July as produce season continues and the summer peak season begins. Dry van and reefer rates may begin rebounding from recent floors, though the pace of recovery will depend on how demand trends evolve through early summer.

Flatbed rates are expected to continue rising in the coming months, supported by ongoing demand strength and tightening capacity. If these trends continue, the market may see year-over-year gains this peak season.

While the widening spot-contract gap points to less immediate risk of rate volatility, any sharp demand shock—especially in already tight regions—could close that gap quickly and create short-term pricing pressure.

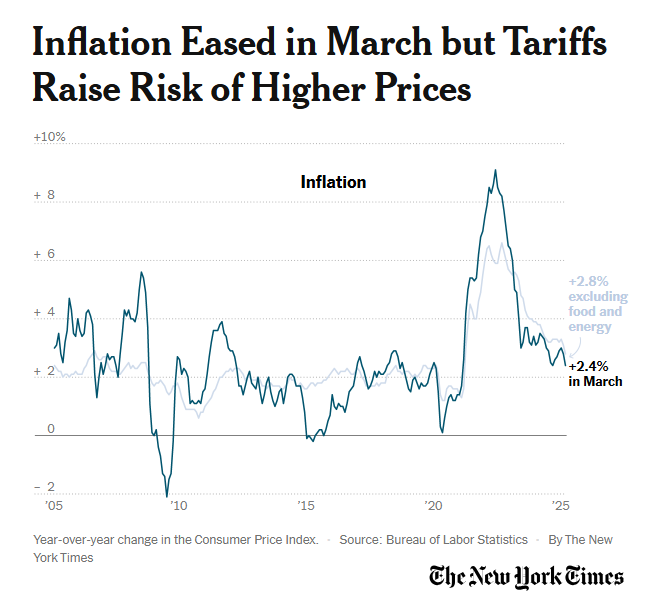

Inflation has leaned toward the downside in recent months, which is positive news for consumers. The Fed, however, is still indicating it plans to be patient with any changes to interest rates. The labor market has also remained relatively stable, with the unemployment rate hovering around 4.2%, a sign that no indications of fracture are present yet.

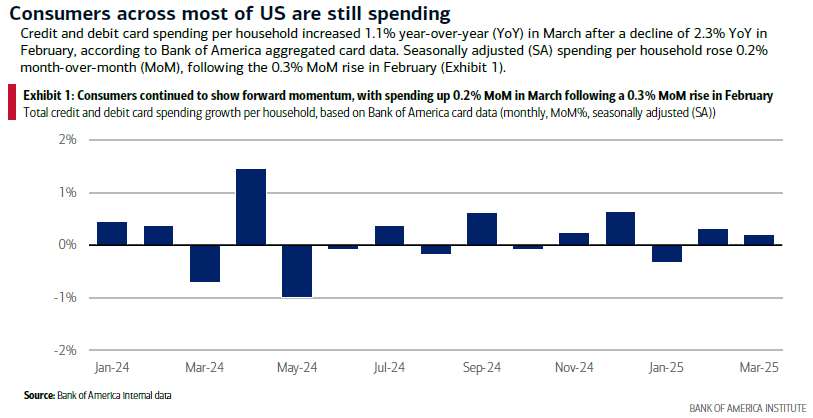

Consumer spending has shown modest growth, even though sentiment indicators have trended somewhat negatively. That contrast suggests households are still willing to spend, particularly on essentials, though discretionary spending has shown some early signs of softening amid economic concerns among consumers.

Inflation will likely remain somewhat of a wildcard in the coming months. While conditions indicate the Fed will hold off on further rate increases, any renewed inflationary pressure or economic challenges could quickly shift that stance in either direction.

Ongoing uncertainty around the impact of tariffs and overall economic conditions will likely keep businesses and consumers playing it safe with major spending decisions in the near term. Whether or not this caution is justified, its impact on capital deployment and consumer behavior will be important to watch in the coming months.

Get this free report delivered straight to your inbox every month.