"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

Tariff policy conversations have taken center stage in recent months, with speculation about demand destruction dominating media headlines as shifting trade dynamics create strategic complexities for supply chain stakeholders.

While the stop-and-start nature of elevated tariffs has created some abnormal freight movements and periods of regional volatility, the data tells a more nuanced story. In fact, the prevailing market narrative remains one of typical seasonality amid ongoing rebalancing—and that’s likely to continue for as long as demand levels hold.

April and early May supply indicators confirm that narrative. Capacity tightened as equipment went offline during the Commercial Vehicle Safety Alliance’s (CVSA) Roadcheck Week alongside increased early peak season spot activity, supporting our position that supply has become more vulnerable to upside demand risks.

If the trade war de-escalates and economic indicators improve, those risks could soon materialize. But if negotiations reverse course and demand dramatically softens, supply would contract in turn, leaving the market more vulnerable to disruption when volume returns.

As that story unfolds, some shippers are using this window to reevaluate supply chain and production strategies, such as reformulating SKUs to reduce reliance on tariff-exposed suppliers. Freight flows are also being reshaped in ways that will keep stakeholders on their toes. For example, new lanes and shifting demand patterns are reconfiguring capacity networks, driving further change in an already dynamic environment.

As the market responds to these pressures, the year-end picture will continue coming into sharper focus. While shippers will face varying levels of tariff exposure and must navigate accordingly, peak season should otherwise be business as usual. Beyond that, patience, planning and strategic preparation around evolving trade policy and capacity shifts will be key to managing risk on the road ahead.

For a closer look at what’s happening across demand, supply and rates, keep reading.

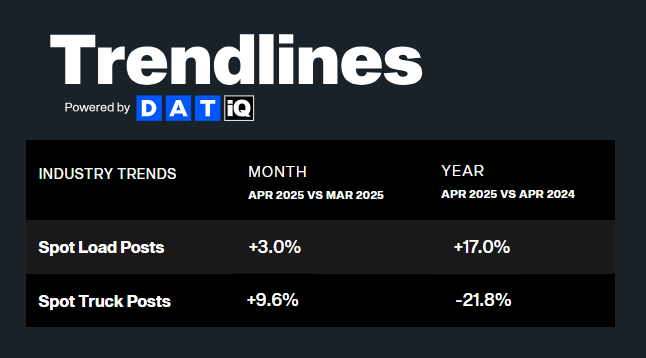

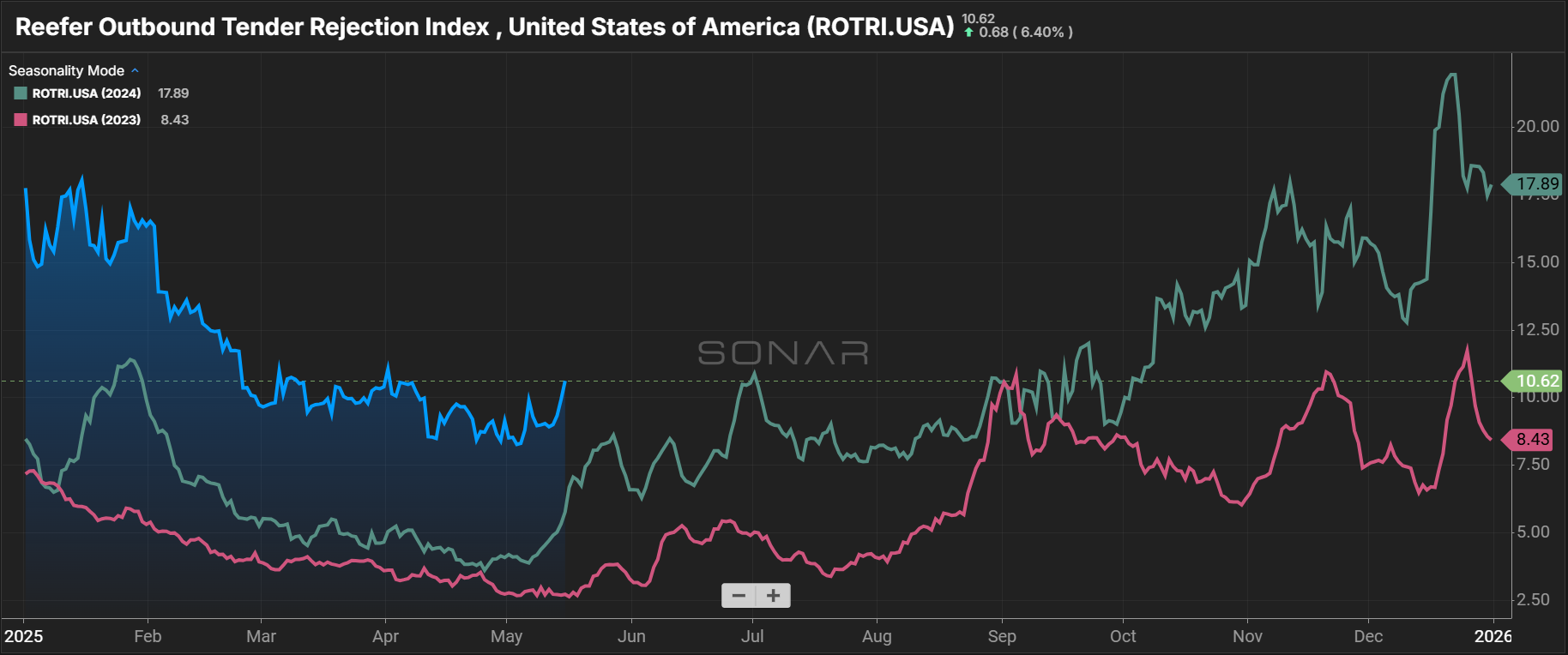

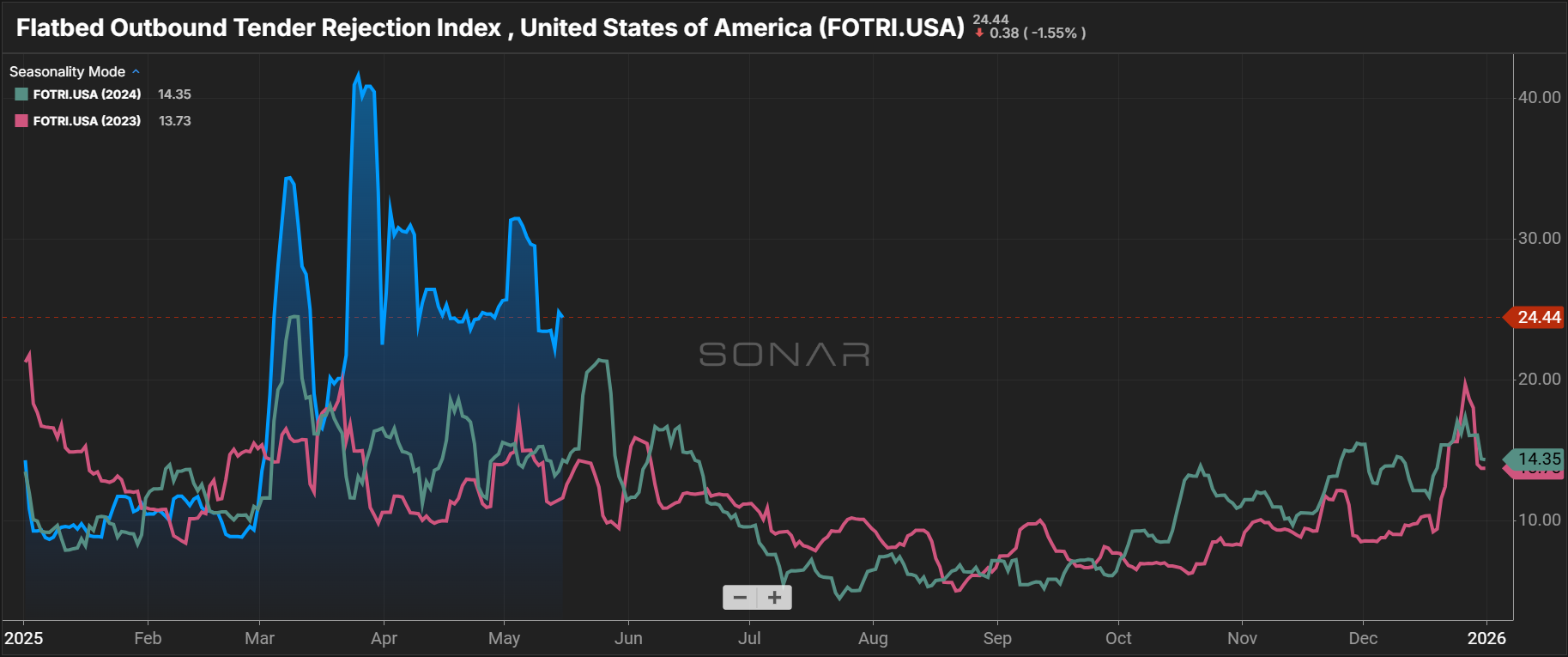

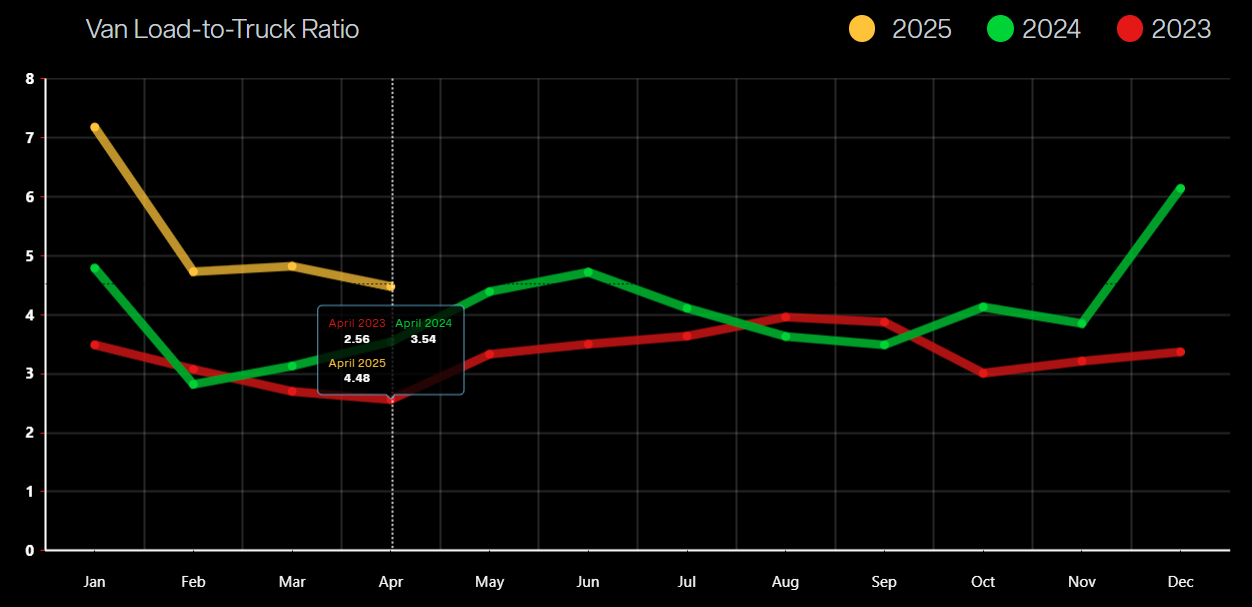

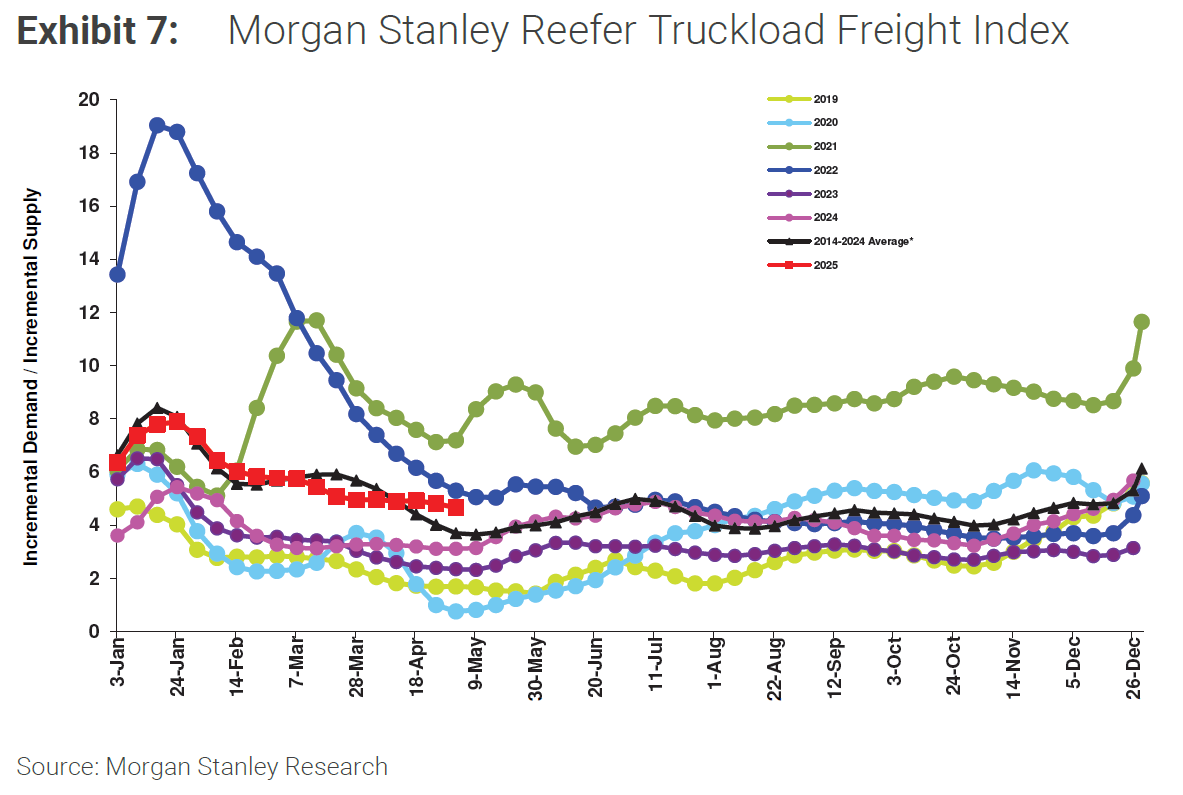

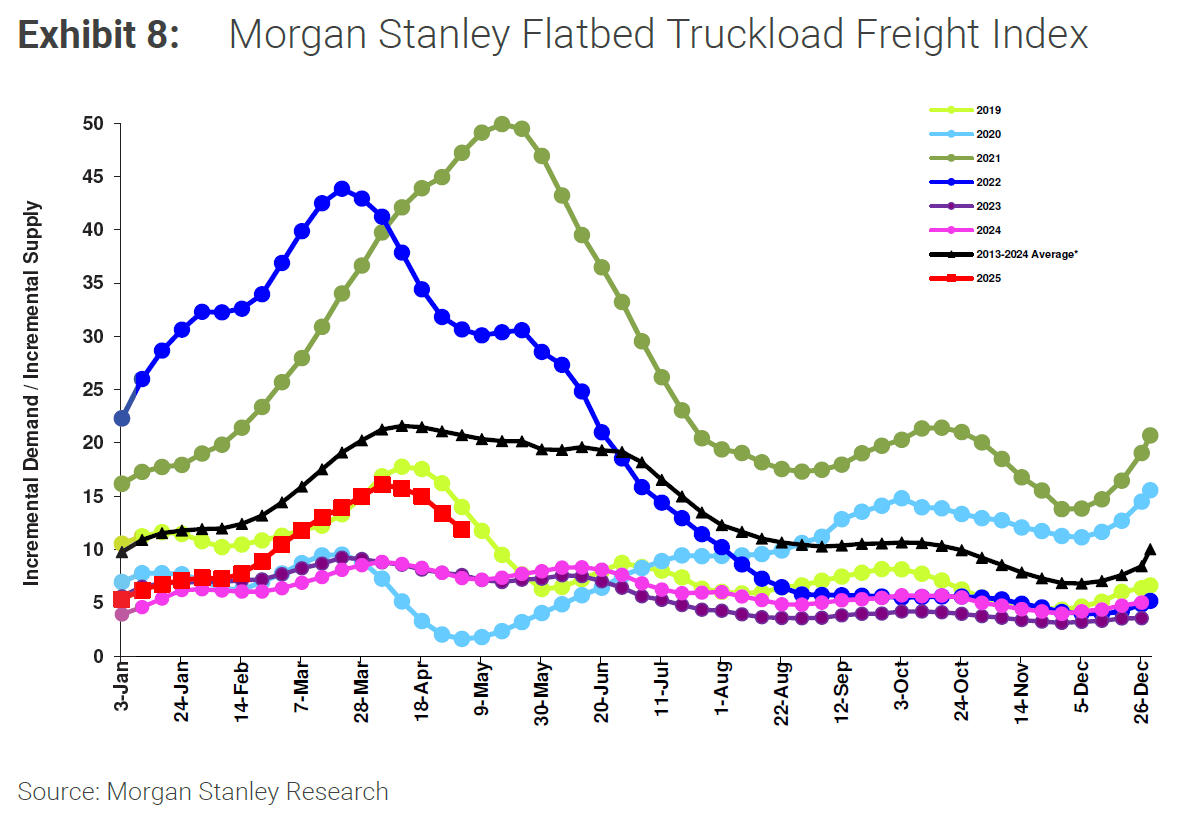

April data continued to reflect typical seasonal trends. Volumes were down slightly year-over-year, but the major indices showed no evidence of a looming near-term cliff. Truck postings outpaced spot load postings month-over-month, bringing down the overall load-to-truck ratio—a typical shift for this time of year. Among the three major equipment types, reefer and flatbed were the most active.

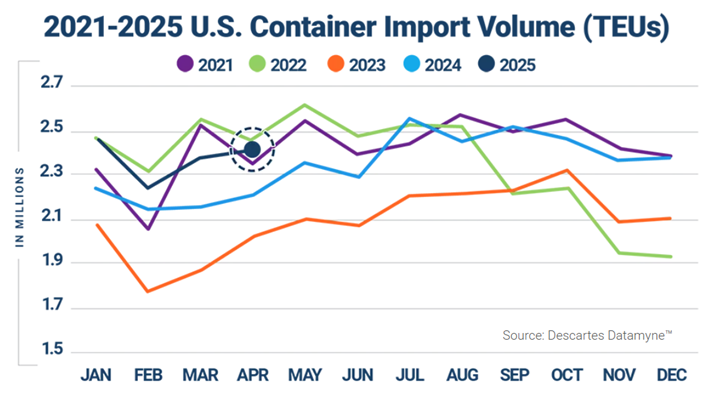

On the import side, indicators point to an uptick from March, with April volumes landing near record 2022 levels—well above the dramatic lows some analysts expected. Import pullbacks are expected in May, but the recent tariff pause with China should lead to a recovery in June or July.

Near-term peak season conditions should remain relatively stable, but even as import volumes from China begin to recover, several leading indicators point to potential demand headwinds later this summer.

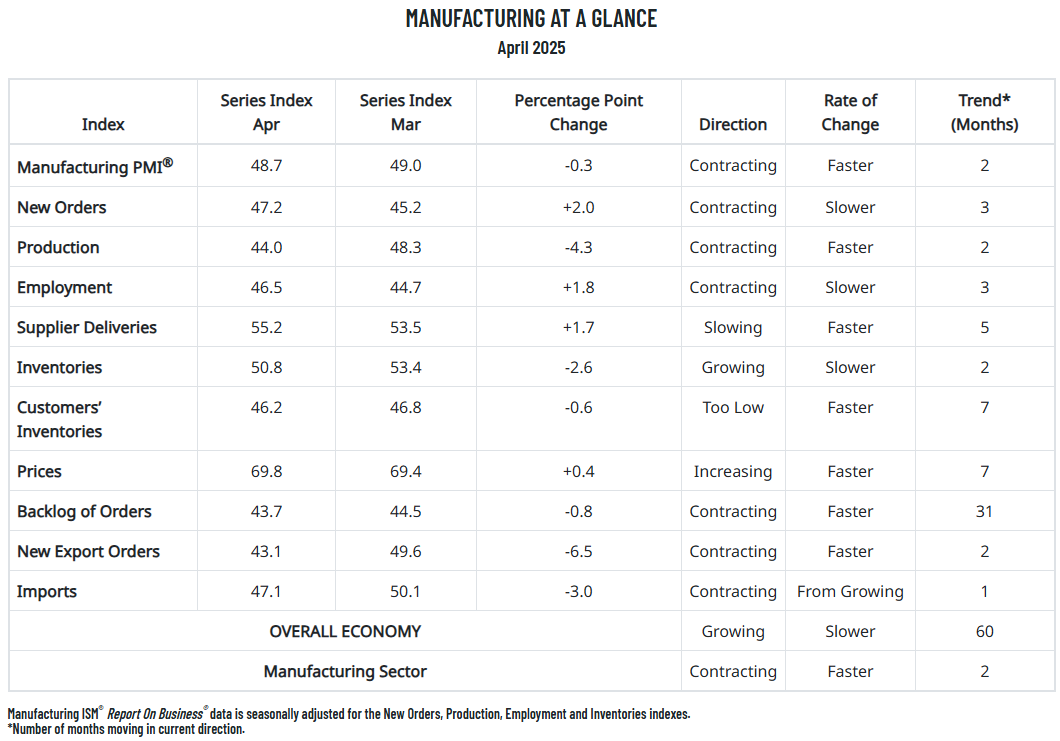

Most notably, the manufacturing sector—a key contributor to domestic freight volumes—is showing signs of contraction. New orders have declined for three straight months, while production fell and backlogs shrank for the last two, indicating a growing downside demand risk. This trend also mirrors data from past periods of shifting trade policy.

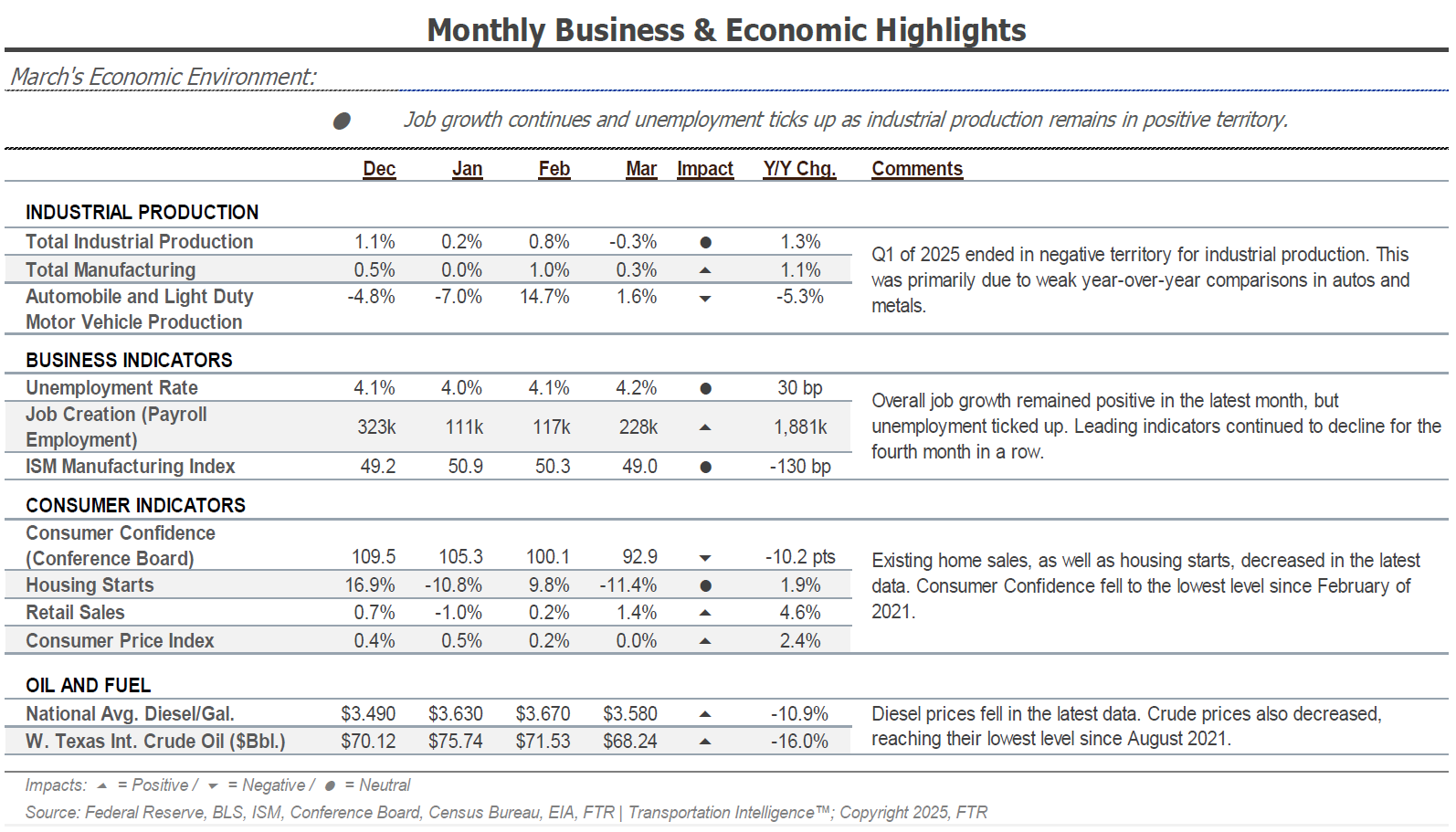

These and other signals have prompted more cautious outlooks from analysts. FTR Transportation Intelligence (FTR), for example, recently lowered its economic forecast, citing declining import activity and ongoing tariff uncertainty as key risks that could weigh on freight demand in the months ahead.

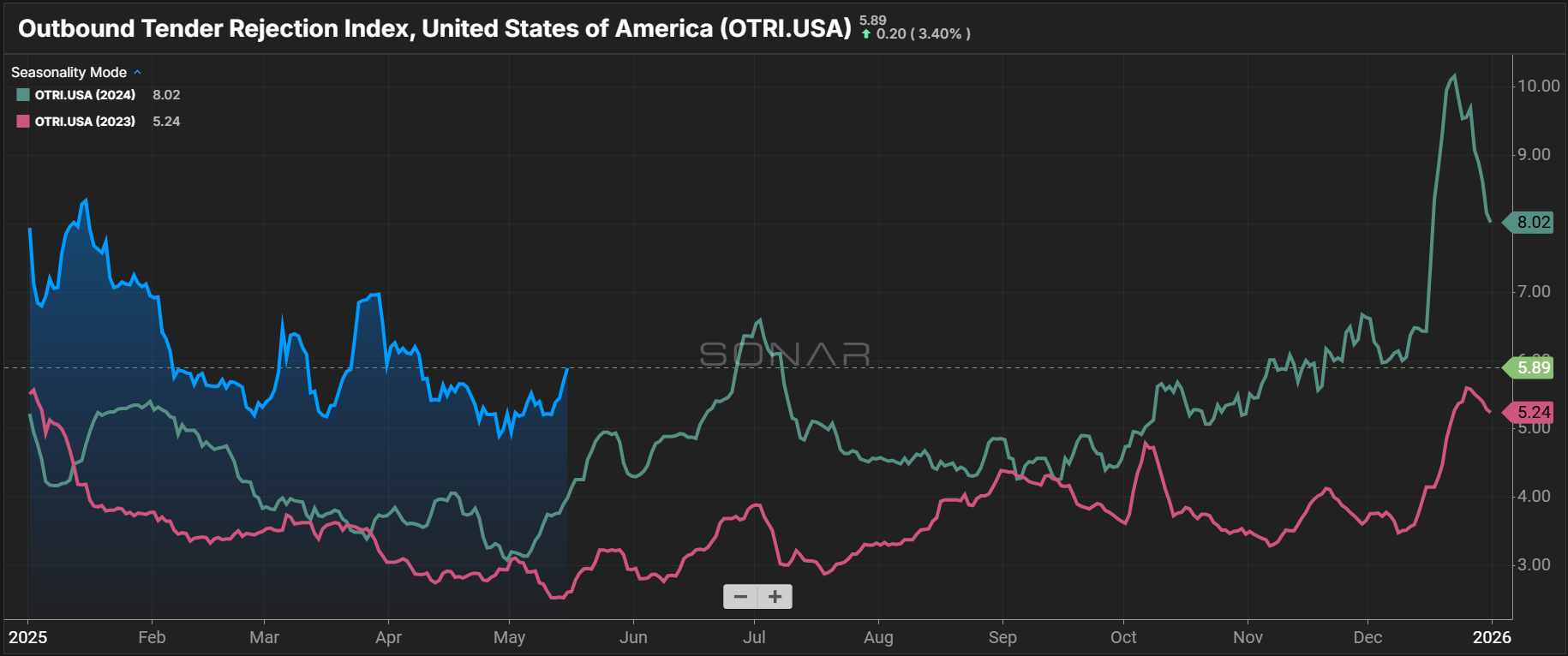

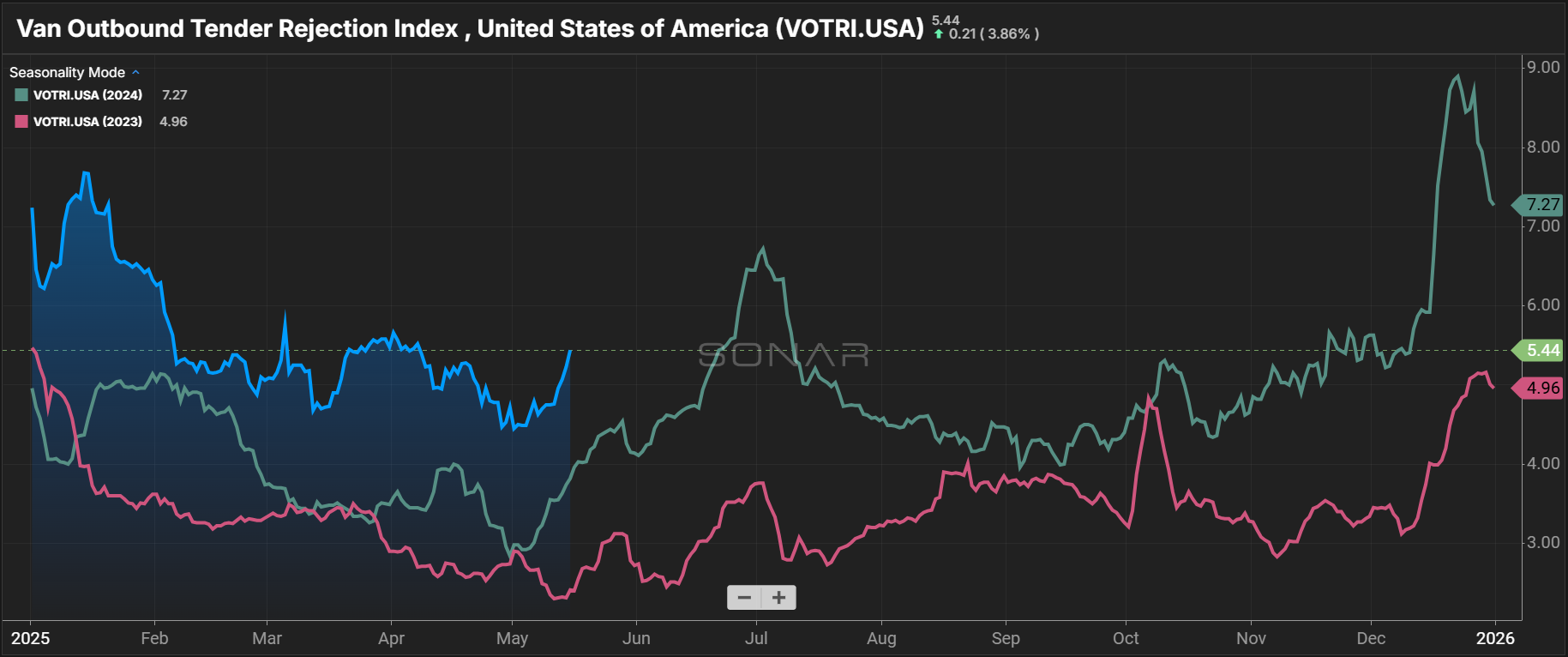

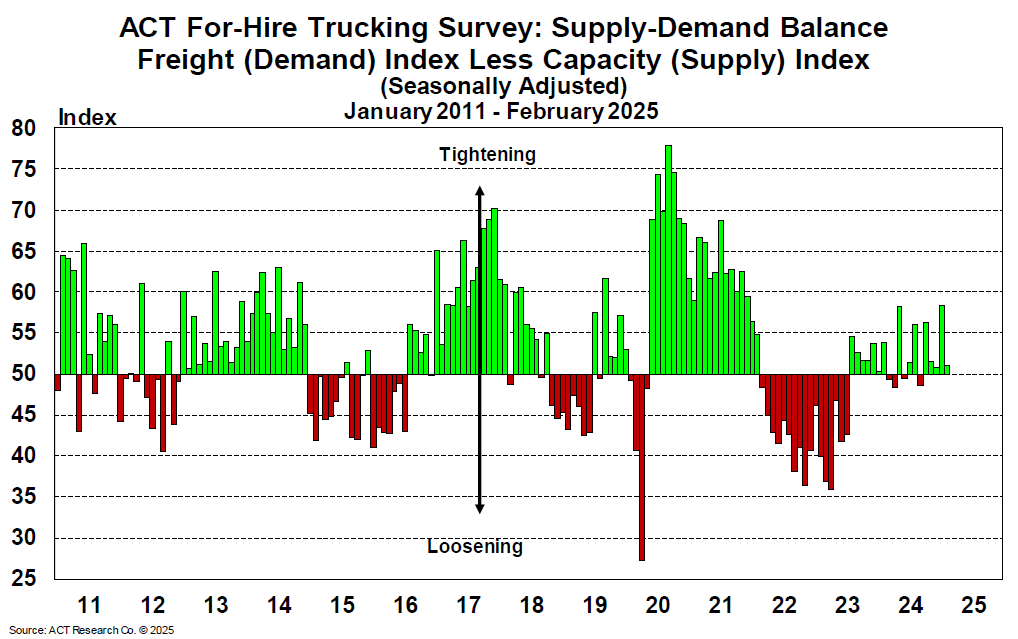

Capacity conditions softened in April, with rejection rates easing across the three major equipment types in line with seasonal expectations. However, they remained elevated above year-ago levels ahead of CVSA Roadcheck Week and the 100 Days of Summer. As expected, rejection rates have increased sharply with the onset of Roadcheck Week and are expected to remain elevated through the Fourth of July as seasonal demand increases.

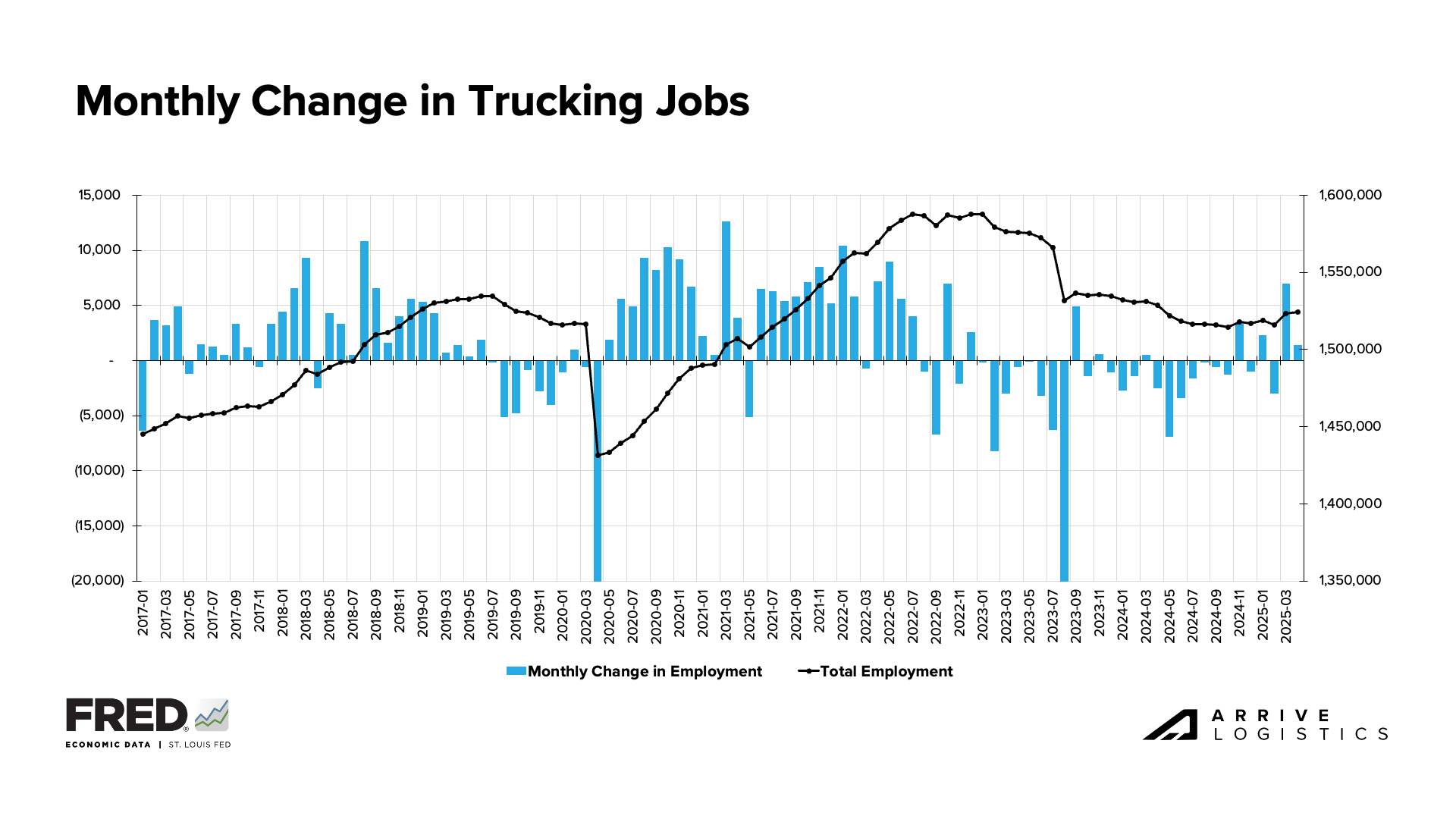

Notably, capacity got a meaningful boost in April. A total of 555 new carriers entered the market—the largest increase since mid-2022—driven in large part by short-term opportunities tied to tariff-related freight activity. More than 8,000 trucking jobs were also added over the last few months, with total transportation and warehousing payrolls rising even faster, reinforcing the near-term supply strength narrative.

While recent growth supports near-term supply strength, the longer-term outlook is less certain as trade negotiations make demand forecasting difficult.

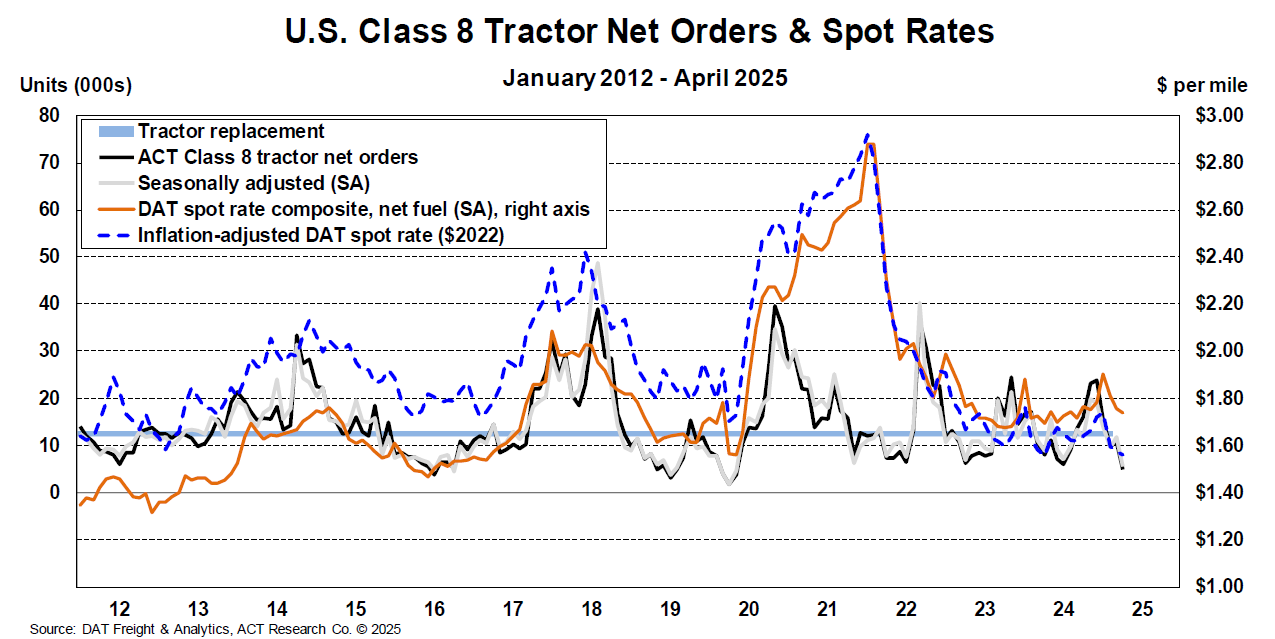

April Class 8 tractor orders fell well below replacement levels, signaling that carriers may already be adjusting to a weaker outlook. Additionally, OEMs are scaling back production and raising prices to offset tariff-related costs, then passing those increases along to buyers—a shift that could further discourage new truck purchases and slow private fleet expansion.

Taken together, declining equipment orders, reduced fleet investment and fewer new entrants amid an uncertain volume outlook could gradually tighten available capacity, even if demand holds steady.

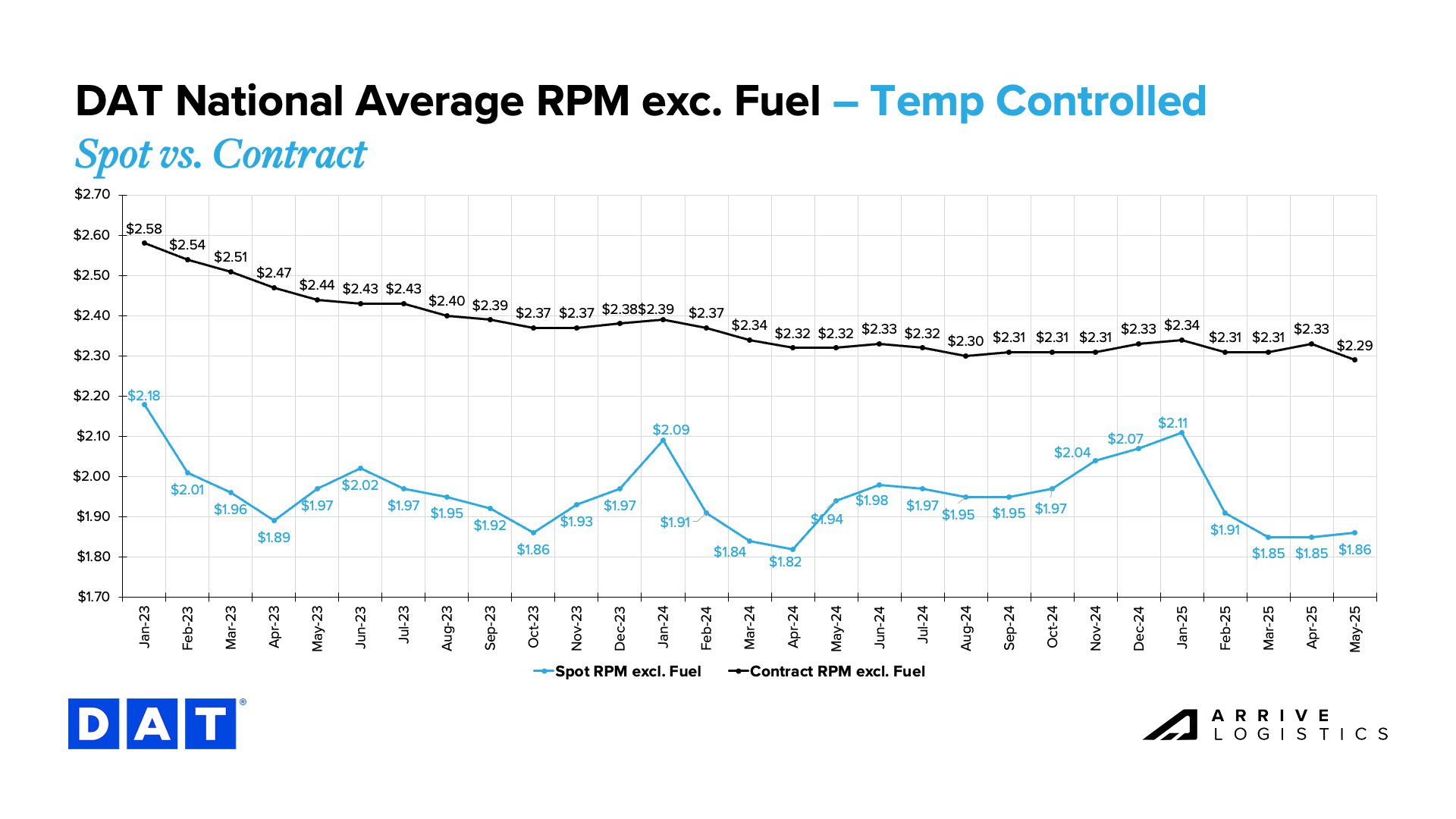

Truckload rates held mostly steady through April and early May, following normal seasonal patterns amid what is typically a slower demand period. However, costs have picked up quickly in mid-May as Roadcheck Week reduced available capacity.

Van and reefer rates have closely aligned with year-ago levels and flatbed rates dipped slightly from recent highs, but remained elevated, especially in construction-heavy areas.

All-in rates trended slightly below year-ago levels as declining diesel prices contributed to lower fuel surcharges. While not a primary rate driver, soft global diesel demand has offered cost relief for carriers and helped reduce total landed costs for shippers.

Rates will likely continue trending upward as stable to increasing demand drives tightness through Memorial Day. Van and reefer rates should rise modestly, with flatbed expected to remain elevated as well.

If downside demand risks begin to materialize after the holiday, rate pressure could increase in turn. However, ongoing capacity reductions should help limit any dramatic declines.

If global diesel demand continues to weaken while production stays elevated, domestic fuel prices should remain relatively low, easing shipper costs and supporting improved carrier margins.

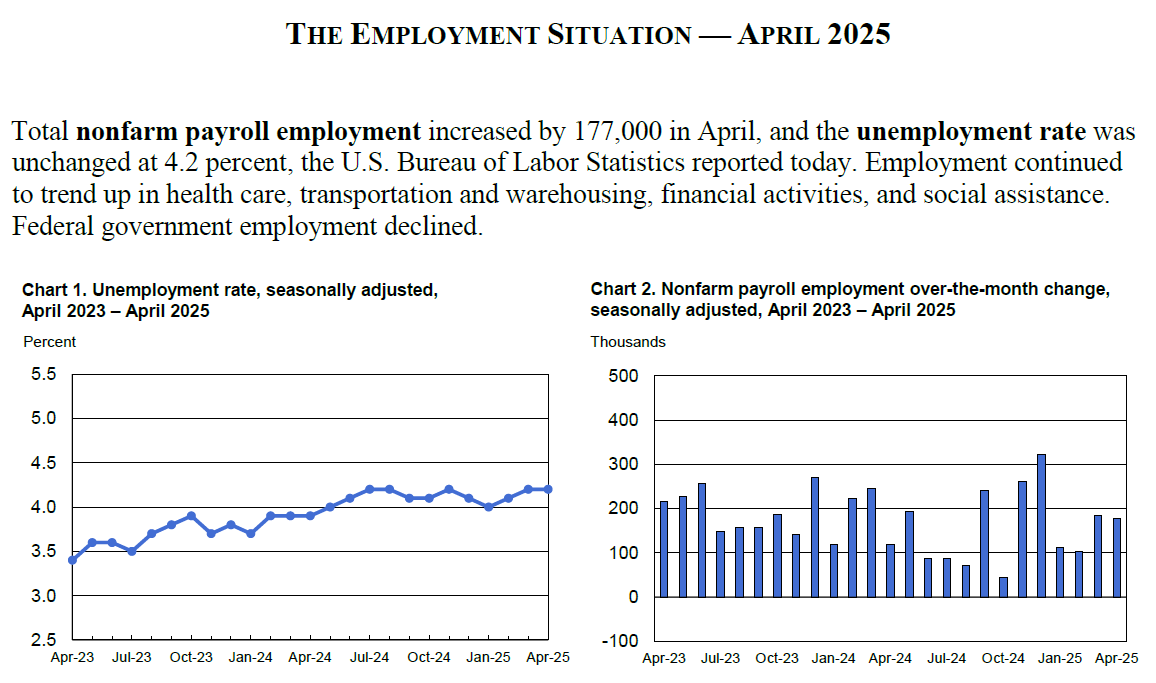

Economic conditions remained relatively stable through April. Labor market strength supported steady consumer spending, which could get an additional boost from recent pull-forward activity. Inflation held near the mid–2% range, offering little direction for the Fed regarding monetary policy in either direction.

Early indicators suggest a steady economic outlook through the end of Q2. Labor market stability should continue to support consumer demand, and with inflation tracking near target levels and no immediate catalysts for policy change, the Fed is likely maintain its “wait-and-see” position.

Get this free report delivered straight to your inbox every month.