"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

The summer peak season is one of two key litmus tests for the freight market, but a number of variables at play this year made for somewhat complicated results.

Coming off a June that underperformed historical patterns, this year’s Fourth of July ramp-up largely followed suit. With many shippers holding well-stocked inventories after pulling freight forward to avoid tariffs, typical seasonal tightness arrived late and fizzled quickly, making the holiday week a fleeting high point amid an otherwise soft peak season.

The short-lived volume surge offered carriers a brief reprieve from the persistently low rate environment. Supply showed some signs of strain but recovered quickly, indicating that current market conditions will likely persist or deteriorate further before improving.

For now, the only upside demand risk is the possibility that the Supreme Court rules that the use of the International Emergency Economic Powers Act (IEEPA) to enact retaliatory tariffs was illegal — a decision that could reverse the current policies and restore trade flows. Otherwise, demand will likely continue to fade in Q3 and remain soft well into next year.

The combination of low demand, soft rates and high carrier operating costs remains the most significant risk to capacity. If current conditions persist, reductions will continue in the form of carrier exits and smaller truck counts at active fleets. Federal Motor Carrier Safety Administration initiatives like English proficiency requirements also pose a risk — the impacts have been limited so far, but that could change if enforcement ramps up.

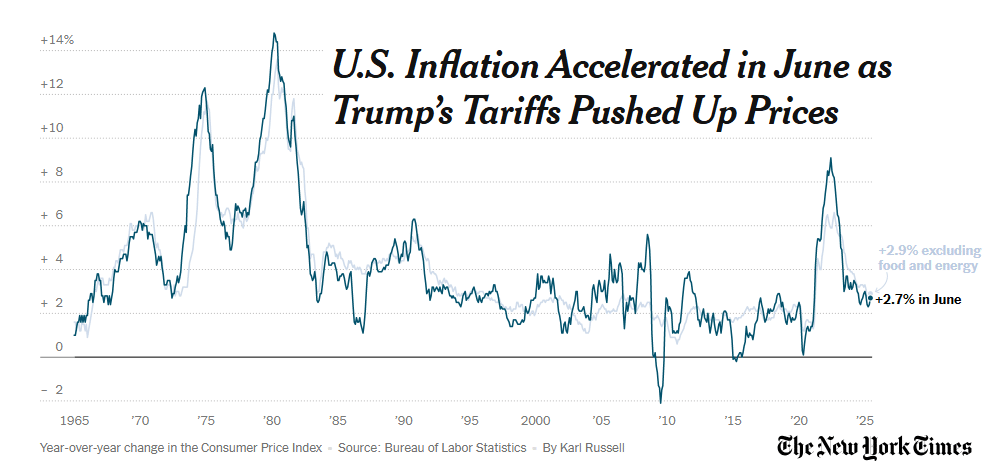

A healthy broader economy and relatively strong consumer spending should continue to support demand for now. The next period of volatility will come as the back-to-school shopping season begins, though rising inflation later this year could limit its impact.

That said, shippers and carriers can expect more of the same market conditions in August.

Keep reading for a closer look at what’s unfolding across demand, supply and rates.

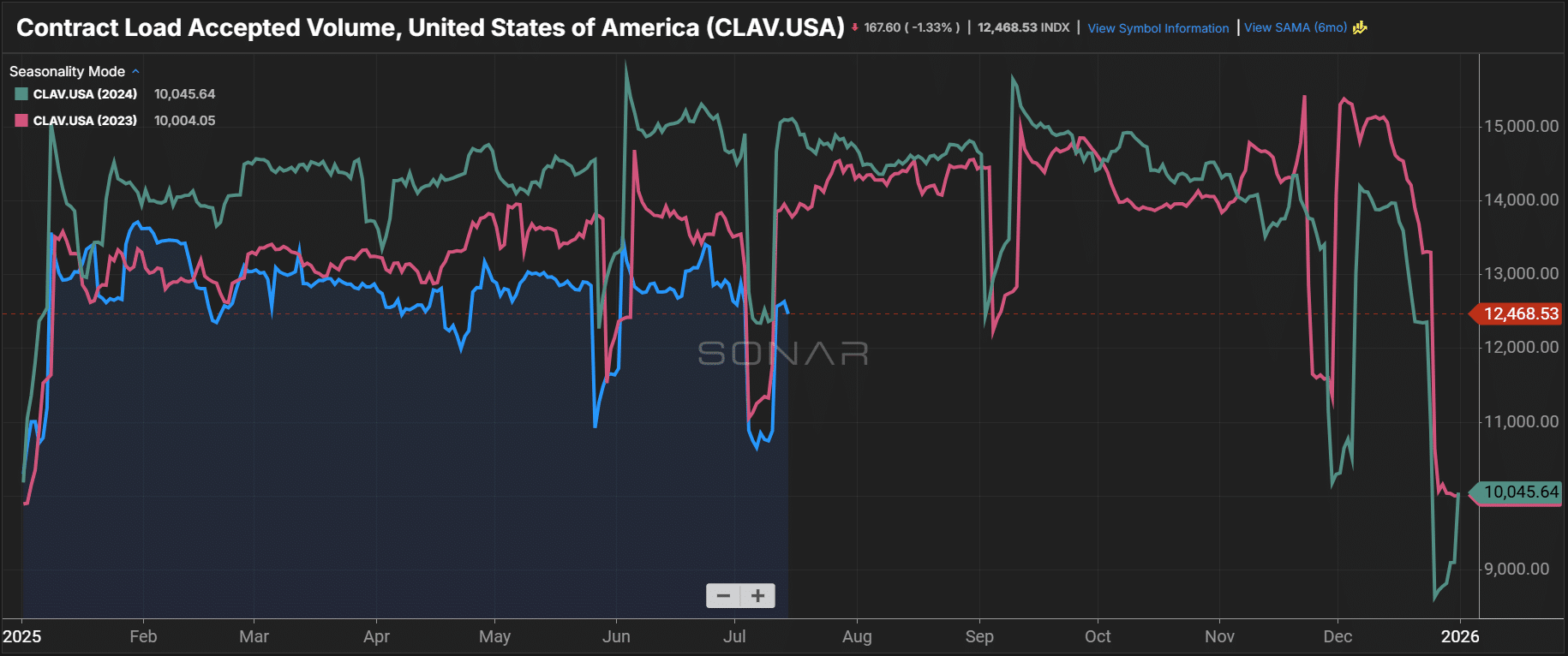

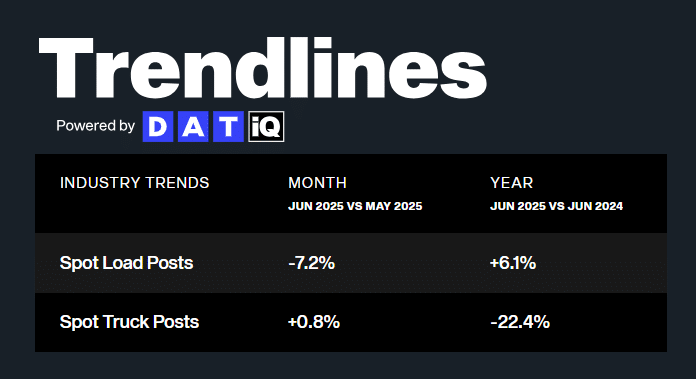

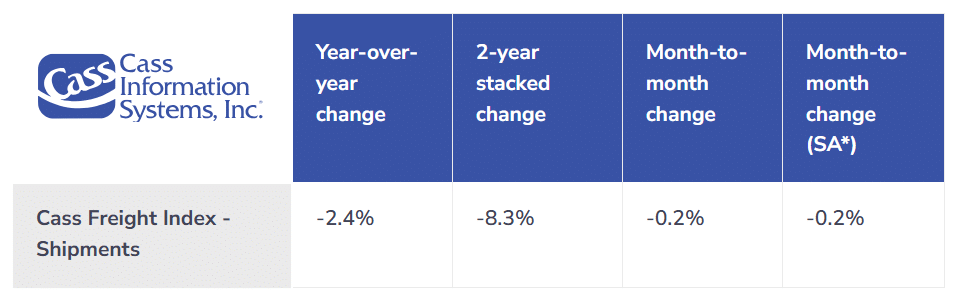

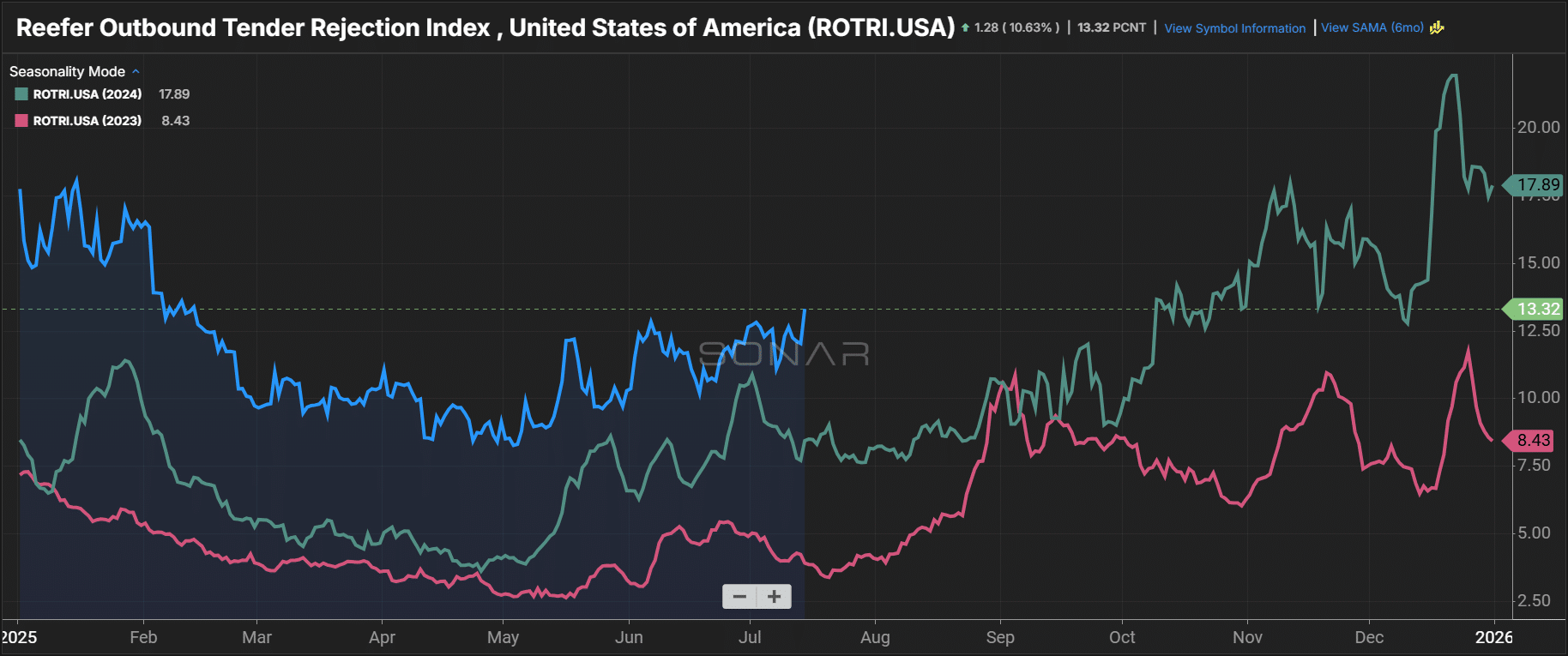

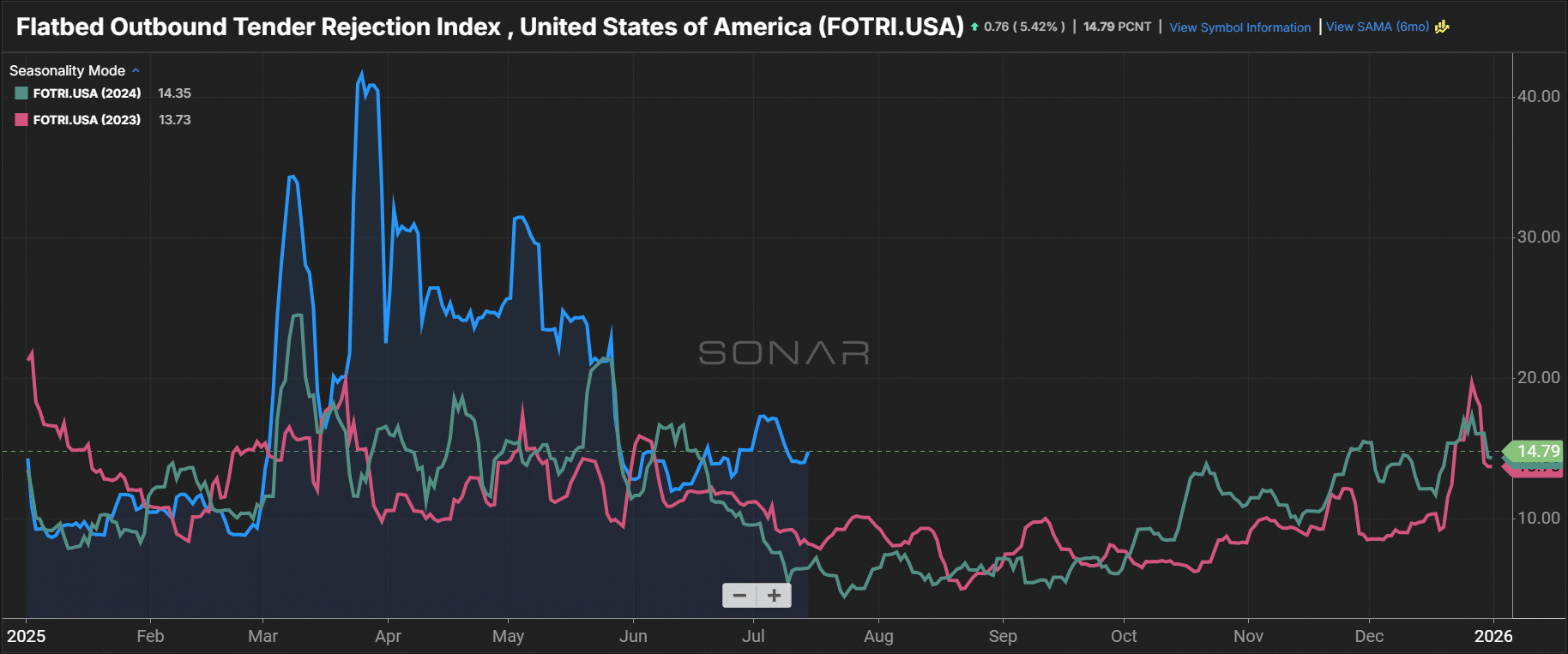

Accepted contract volumes remained below prior-year levels in June. Spot activity rose 6% year-over-year, driven primarily by reefer and flatbed, while van volumes held flat.

The spot market lift likely stemmed from seasonal routing guide disruption — amplified by end-of-quarter pressure and fiscal year closeouts — alongside stabilizing import volumes in June. With tariffs on Chinese goods lifted in May, many shippers rushed to frontload freight, which should support continued import strength through the remainder of July.

With peak season and pull-forward activity winding down — and new import orders following suit — freight volumes are set to continue to see downward pressure through August. Back-to-school shopping may bolster volumes slightly but not nearly enough to drive a significant market shift. The outcome of the Supreme Court’s tariff decision remains a key variable, but until then, our forecast calls for muted demand well into next year.

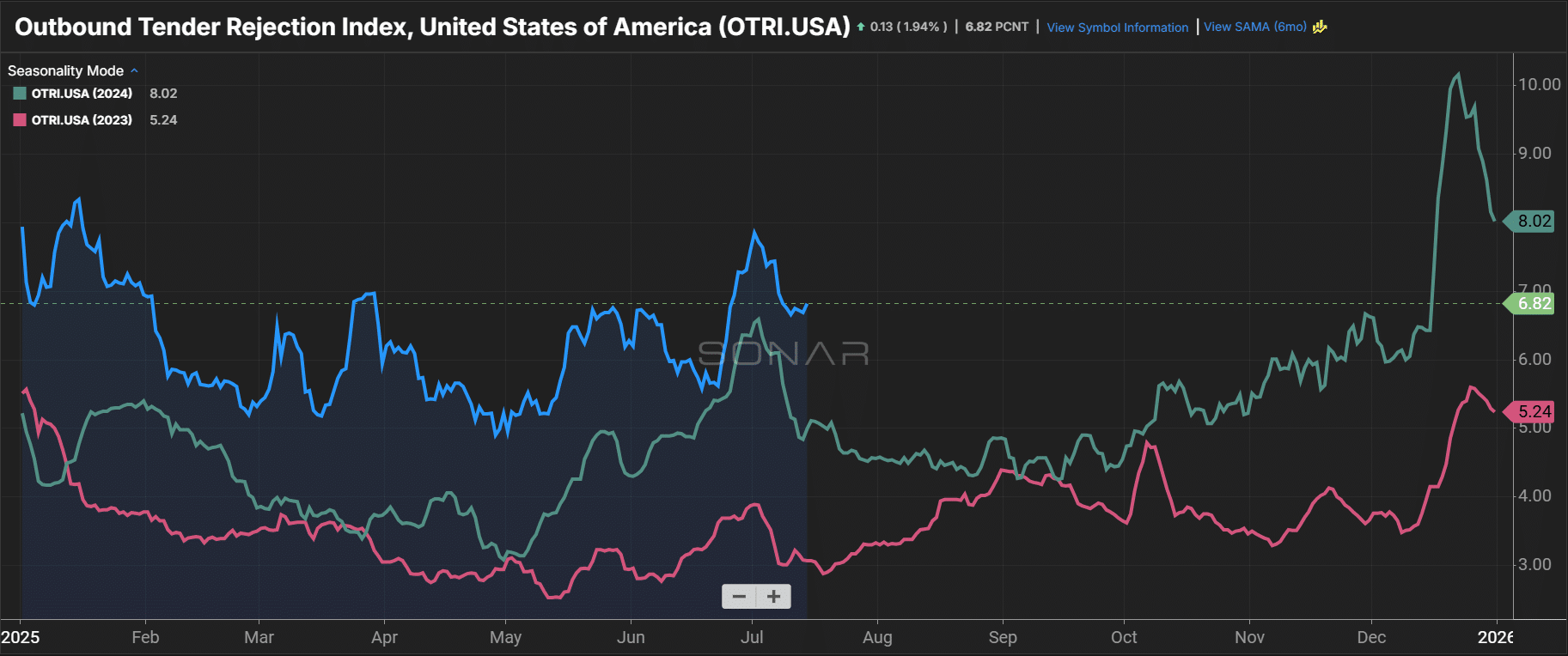

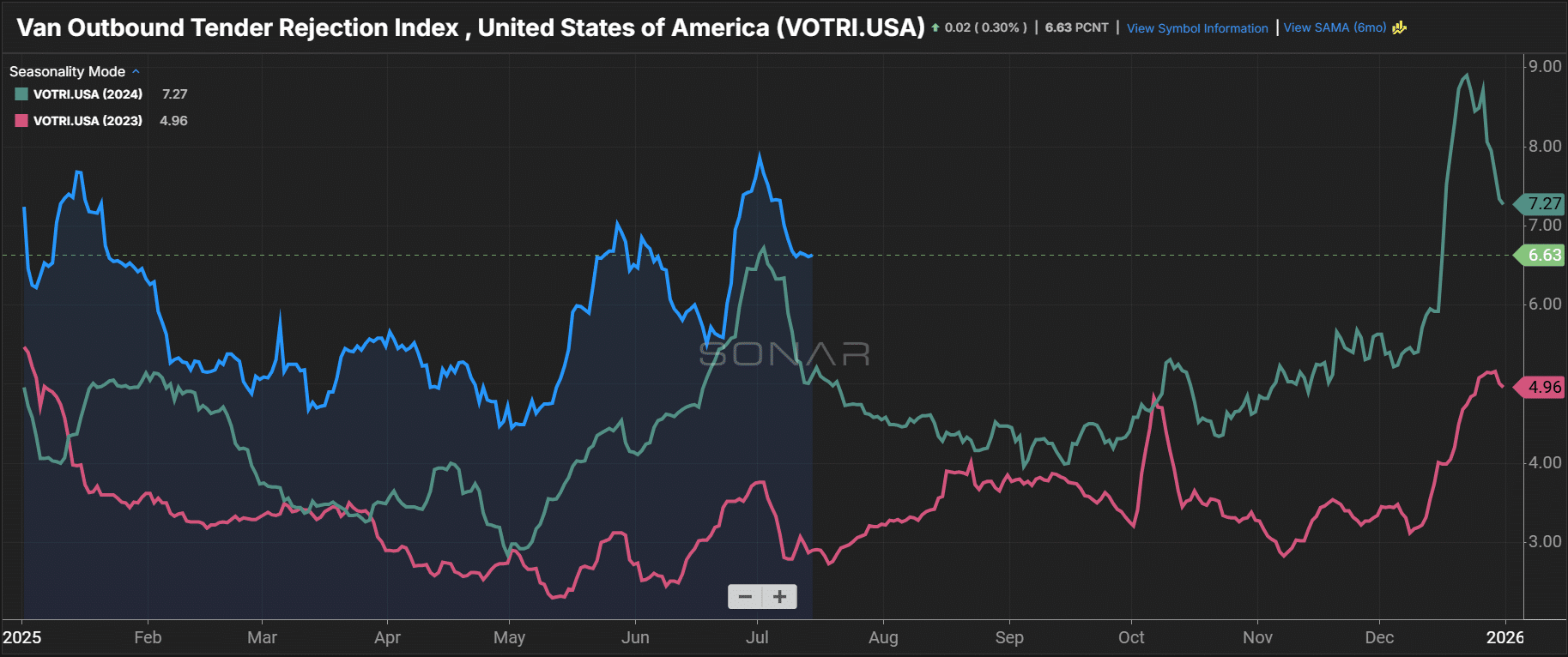

Supply easily handled June’s muted seasonal demand surge. Van rejection rates ticked up in the back half of the month but stayed well below historical norms and failed to generate meaningful pricing pressure. Reefer rejections were slightly higher year-over-year but followed a similar pattern.

Class 8 truck orders were below replacement levels for the fifth straight month, as carriers remained hesitant to invest in fleets amid weak demand. Trucking employment and active carrier counts also continued to decline, signaling that supply is still slowly but steadily contracting.

Unless near-term volumes rebound significantly, capacity reductions will continue this year. And with a major demand shock remaining unlikely, capacity reduction alone won’t be enough to drive a meaningful market shift.

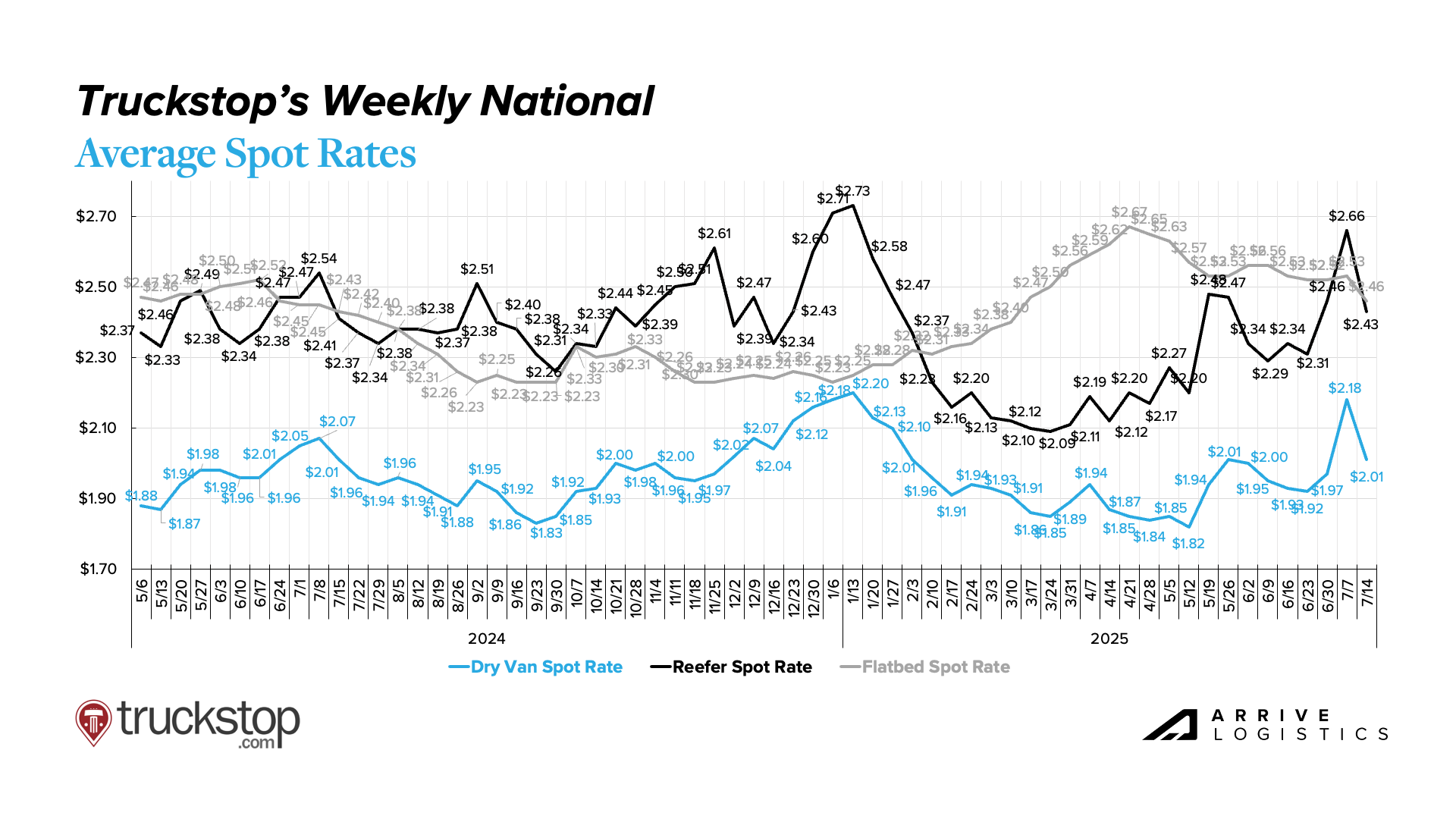

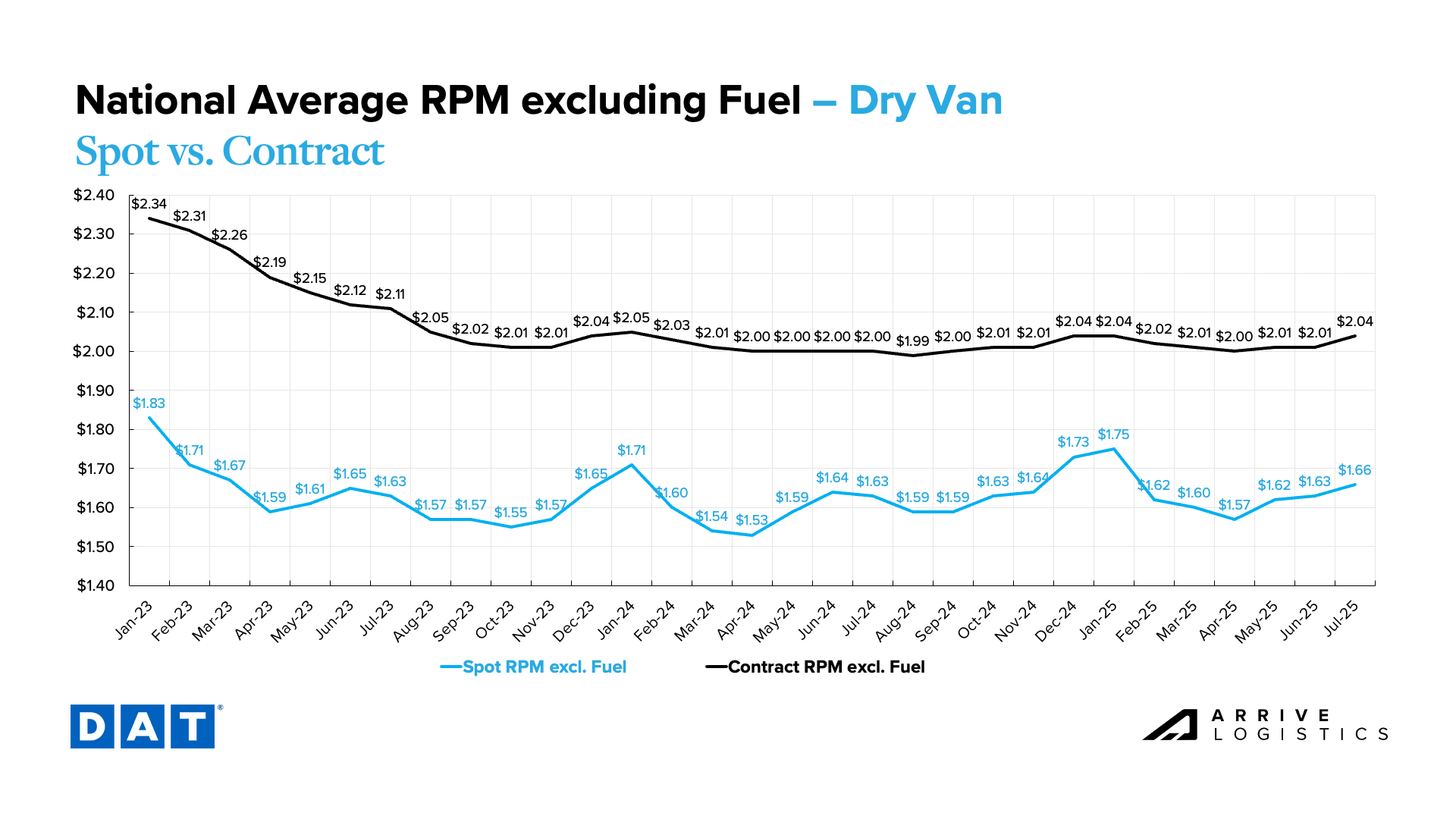

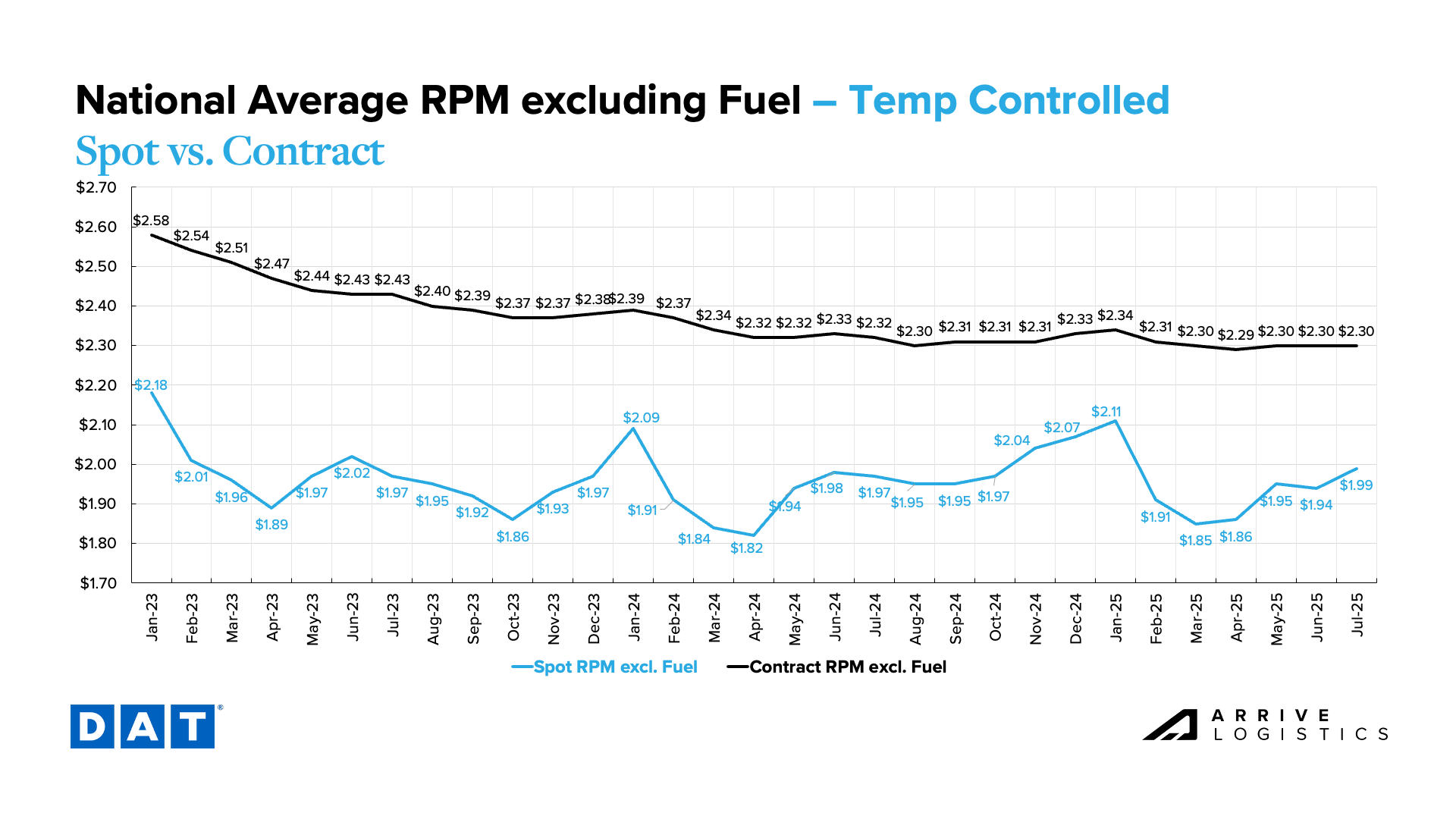

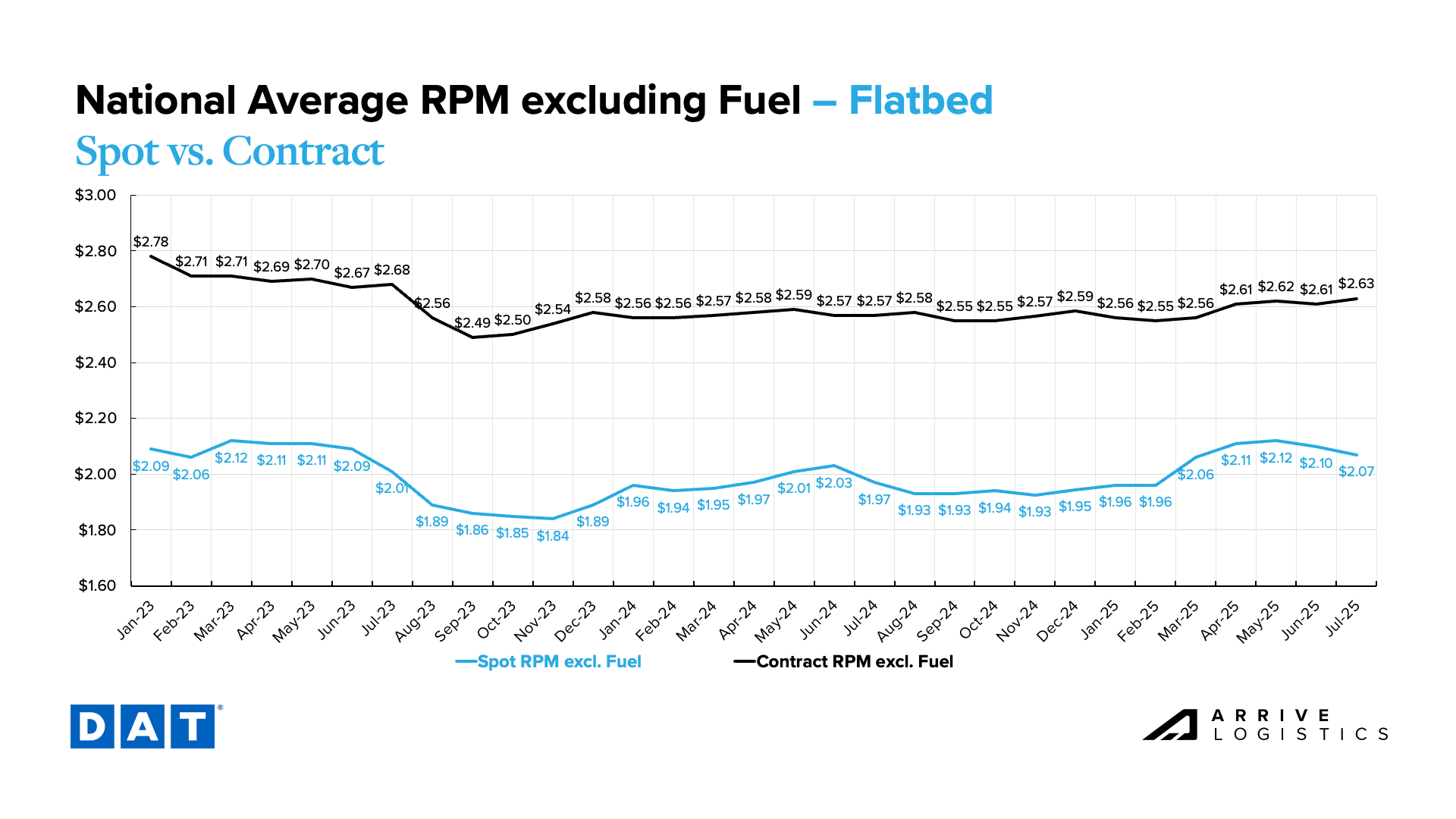

Spot rates were volatile around the Fourth of July, but the surge faded as quickly as it arrived, particularly for dry van equipment. National trends softened further as the month progressed and indicators point to flat or declining year-over-year rates through the remainder of July as the market finds a new floor.

Rates will likely follow historical trends through August amid declining demand and slow capacity attrition. Some volatility could emerge around Labor Day, but any disruption is expected to be muted and short-lived.

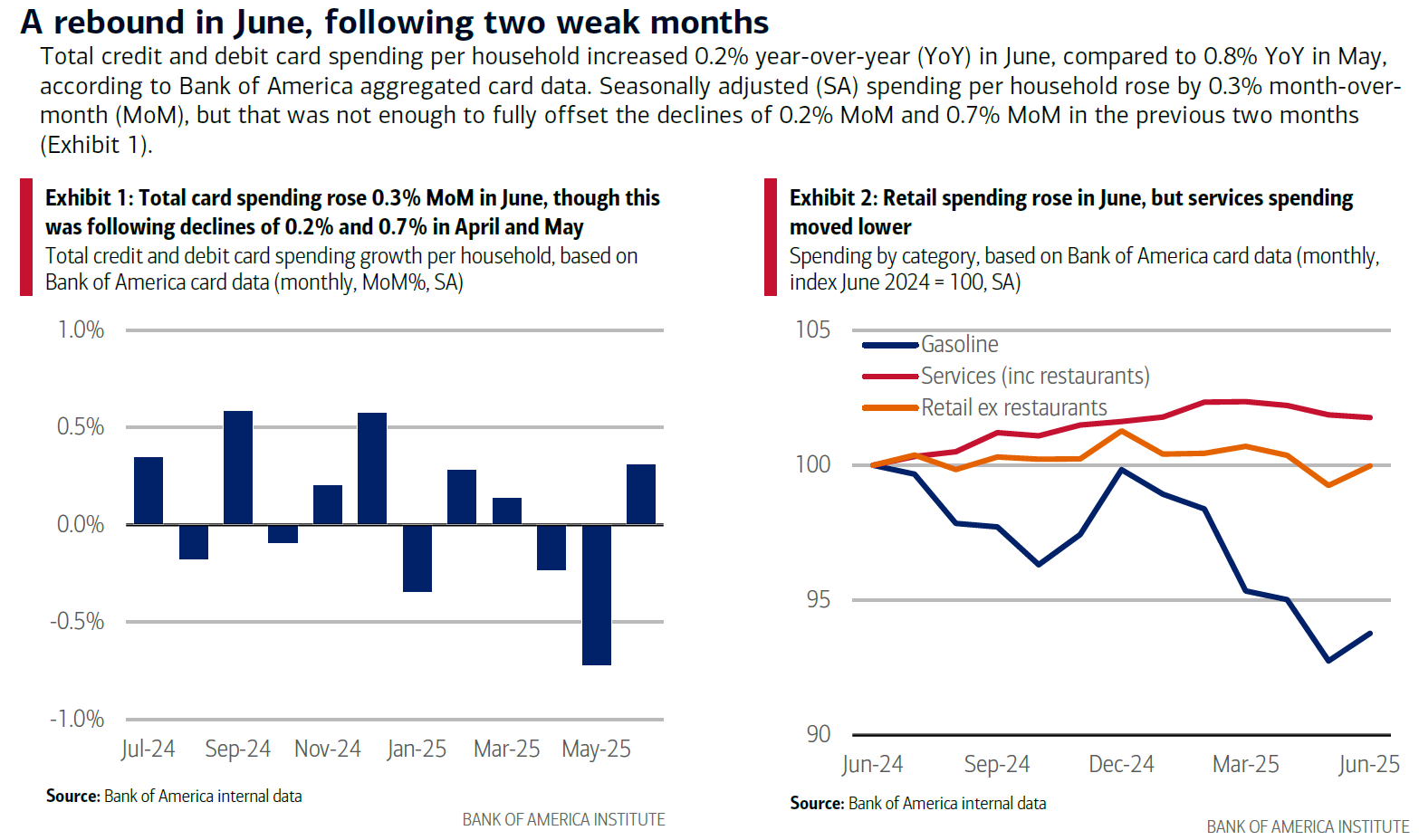

June data showed a moderate month-over-month increase in consumer spending and more labor market strength as unemployment dipped slightly. Inflation also ticked up but it has yet to directly impact freight demand.

A strong labor market should continue to support consumer health through the end of the quarter, but rising prices for consumer goods due to tariff-related hikes remain a real risk to spending.

Get this free report delivered straight to your inbox every month.