"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

Market indicators were a mixed bag this month. After a relatively busy stretch around Labor Day, soft demand and ample capacity remain the prevailing narrative.

The holiday triggered a stronger seasonal response than usual — likely amplified by the tail end of the midsummer import surge and shifting produce demand — but conditions have since eased.

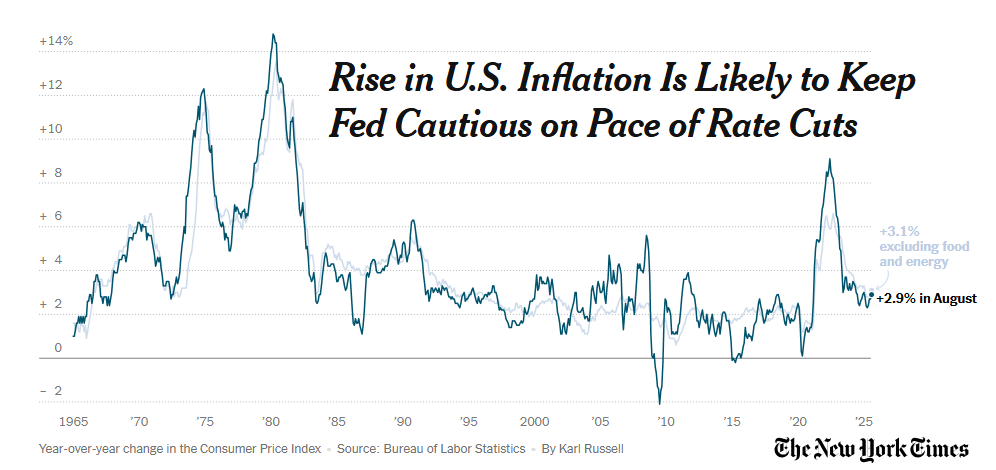

With imports fading, retailers pulling back and inflation weighing increasingly on consumers, demand is expected to remain subdued into the fourth quarter and early 2026. Supply is still stable for now, but persistently low equipment orders could reduce capacity and leave the market vulnerable if demand trends reverse.

Consumers are still spending. Even so, inflation remains a headwind, and the latest interest rate cut will likely have no near-term impact on demand. For now, the outlook calls for stable conditions before typical fourth-quarter seasonality sets in.

Read the full report for deeper insights across demand, supply and rates.

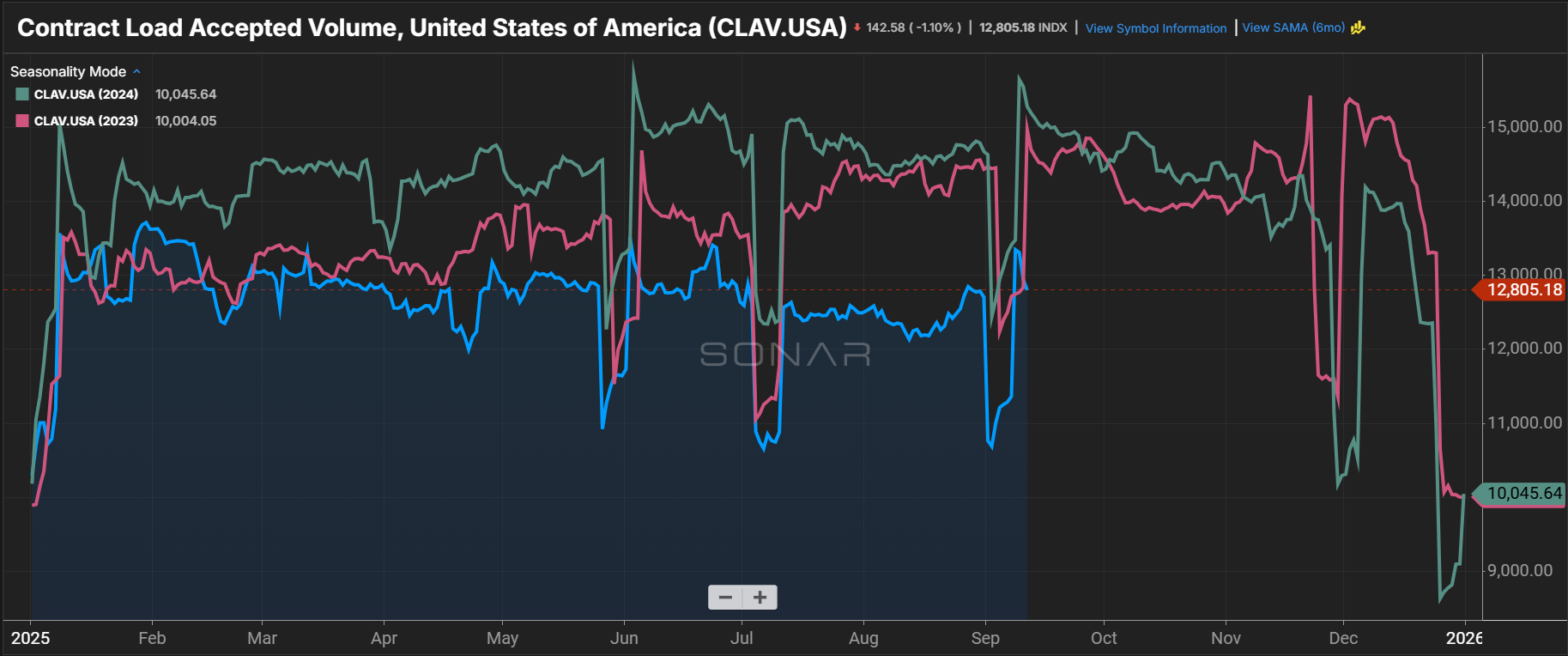

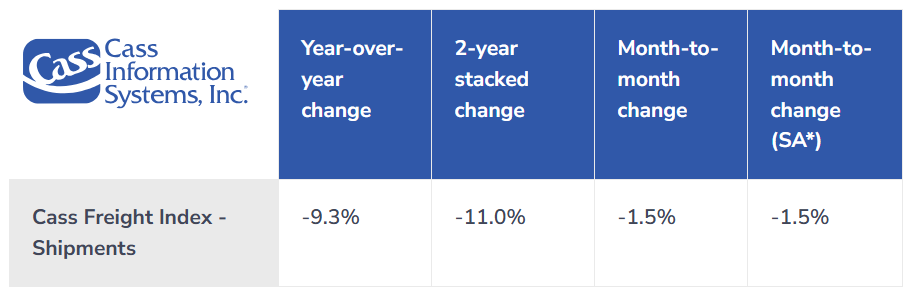

Demand remained relatively soft in August aside from some pre-Labor Day and tariff-related lifts. Import volumes declined from July’s near-record levels, led by pullbacks from China following the sharp rebound earlier in the summer.

Last month, rail appeared to absorb much of the midsummer import wave. As volumes leveled off, however, over-the-road tenders out of Southern California began to climb, indicating that equipment imbalances may have driven some demand back into the truckload market. In any case, the slowdown suggests the market has entered the tail end of the import recovery period.

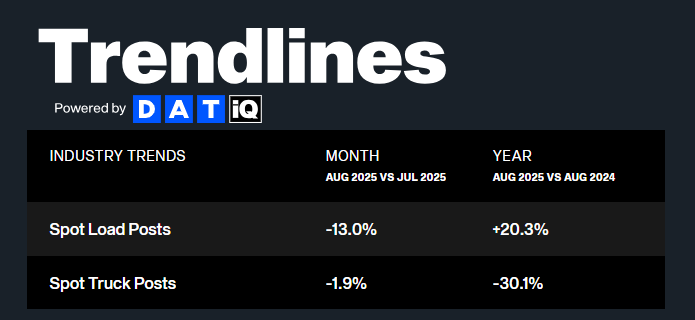

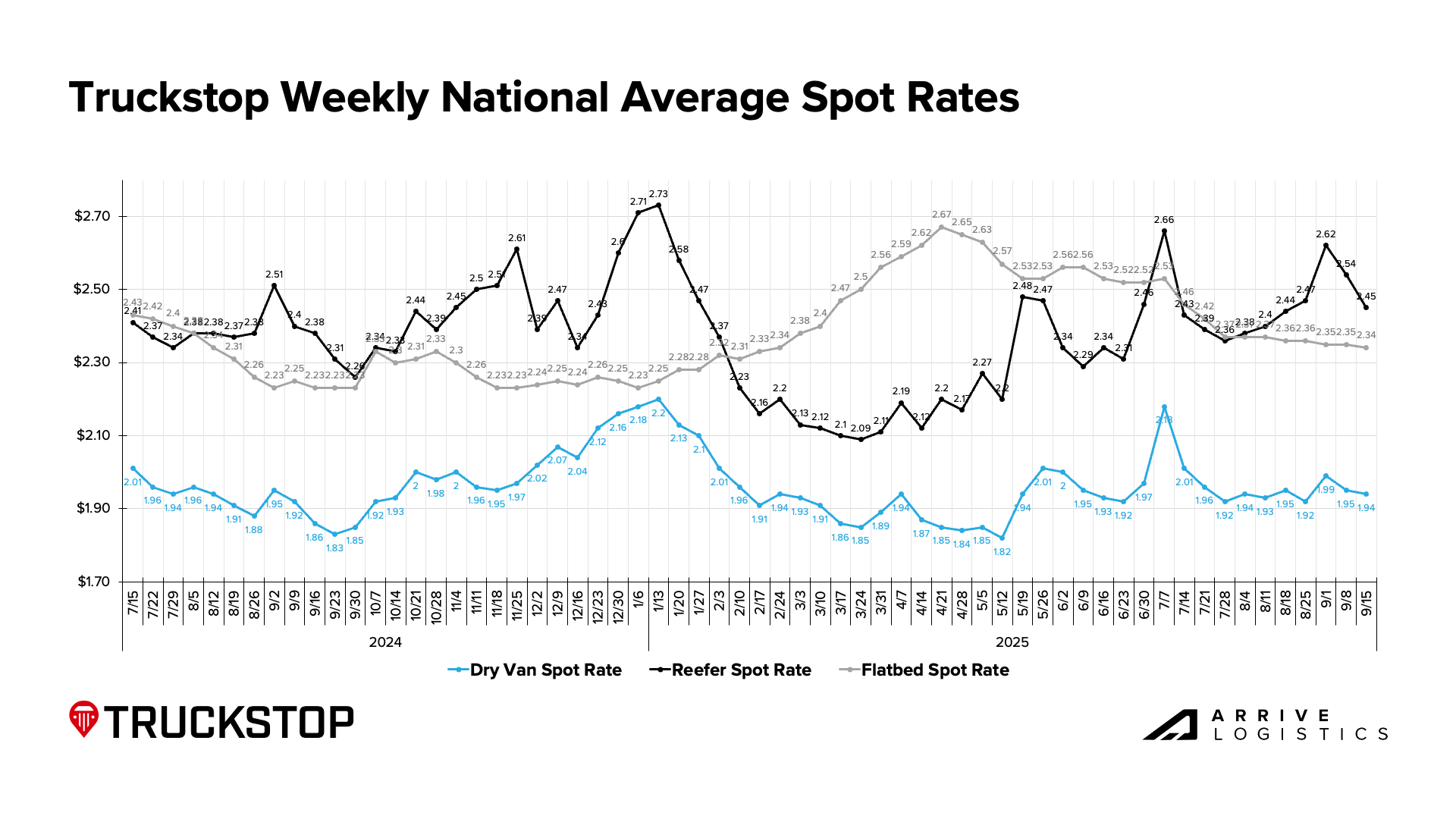

Spot market activity also increased year-over-year in August but slipped compared to July. Much of that late-month activity stemmed from an earlier Labor Day holiday push, with temperature-controlled freight leading the charge.

With most retail imports already in place for the season, demand will likely remain muted through late September and into early Q4. Import forecasts call for continued pullbacks, and if August declines do in fact mark the end of the tariff-driven rebound, sharper drops could follow.

Manufacturing data also indicates continued weakness, as contraction persists even with new orders showing modest improvement. Moving forward, seasonal spikes and risks such as severe weather may create short bursts of spot market volatility, but any gains are likely to be short-lived without a sustained demand recovery.

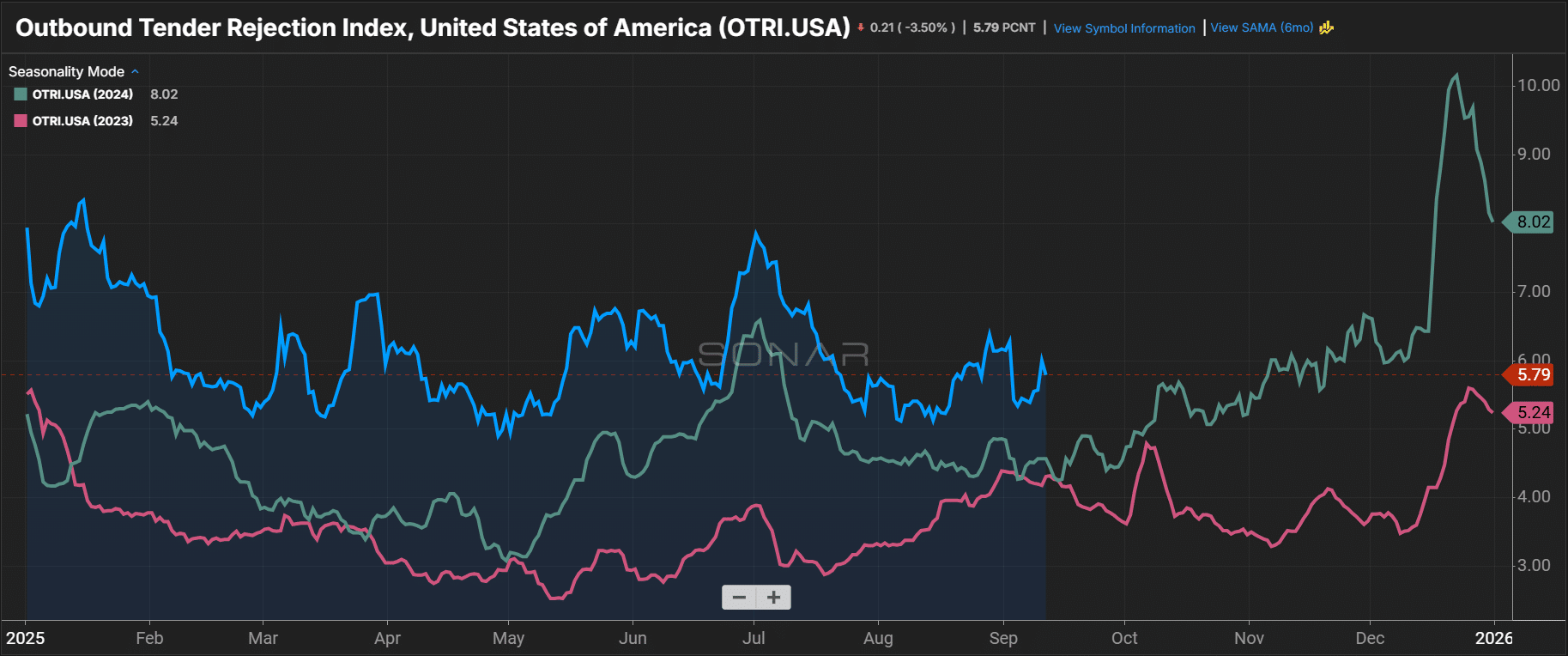

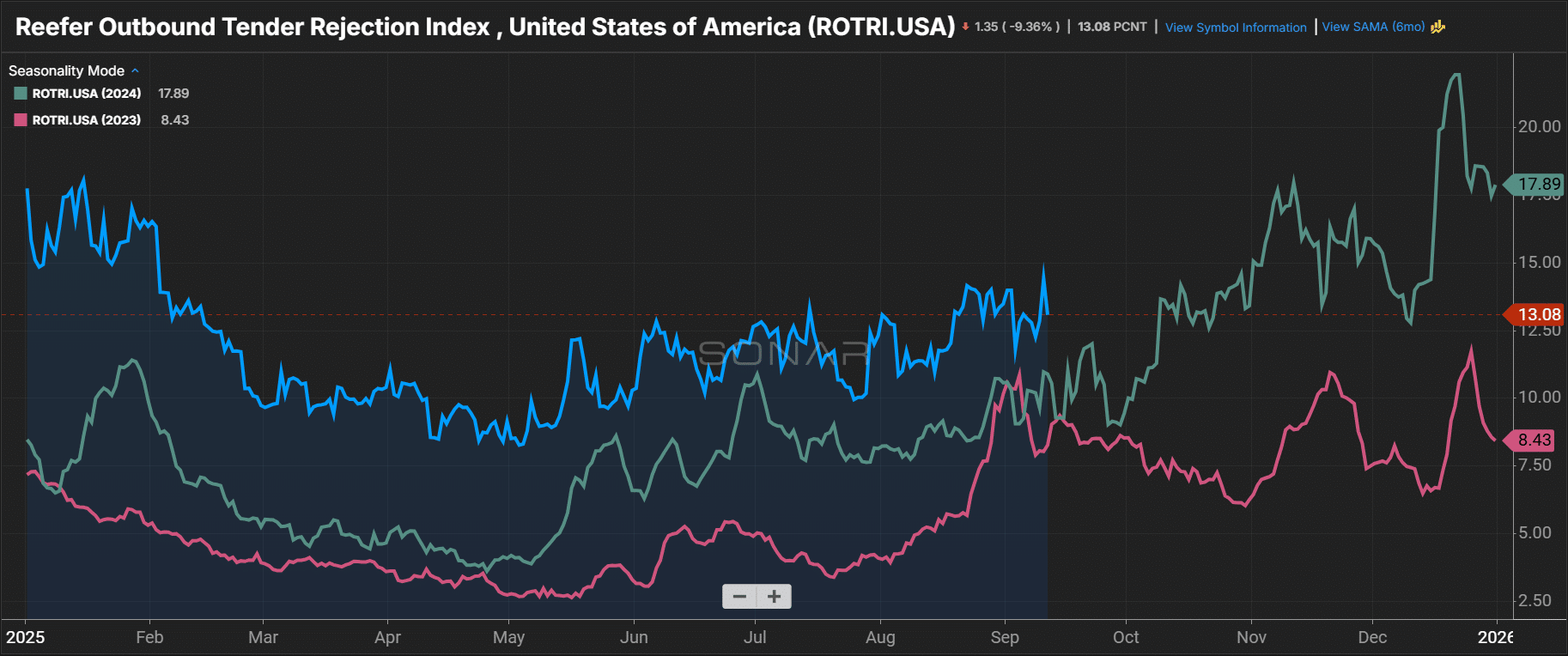

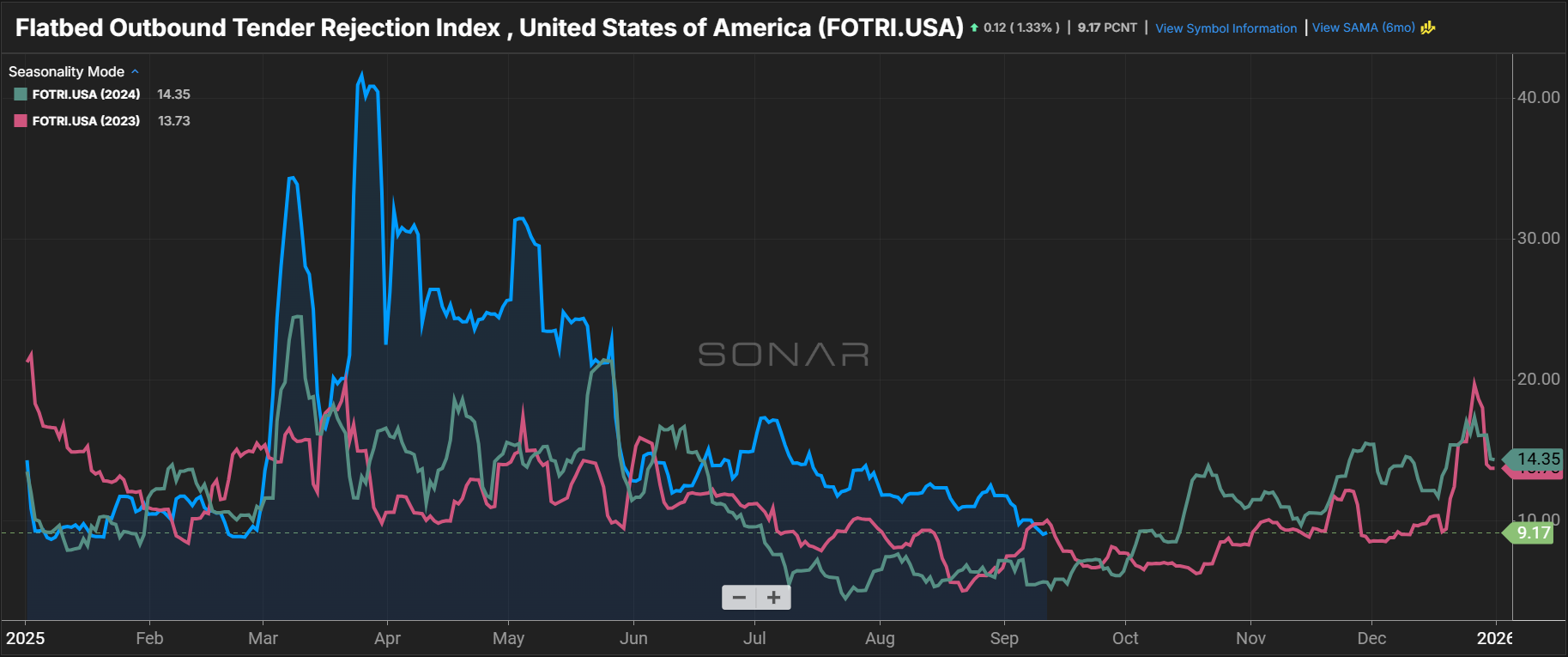

Capacity showed a slightly earlier and stronger response to Labor Day demand this year, contributing to regional tightness that lingered into early September. Those pressures have since mostly eased, with van and reefer rejection rates returning to typical seasonal patterns by mid-month.

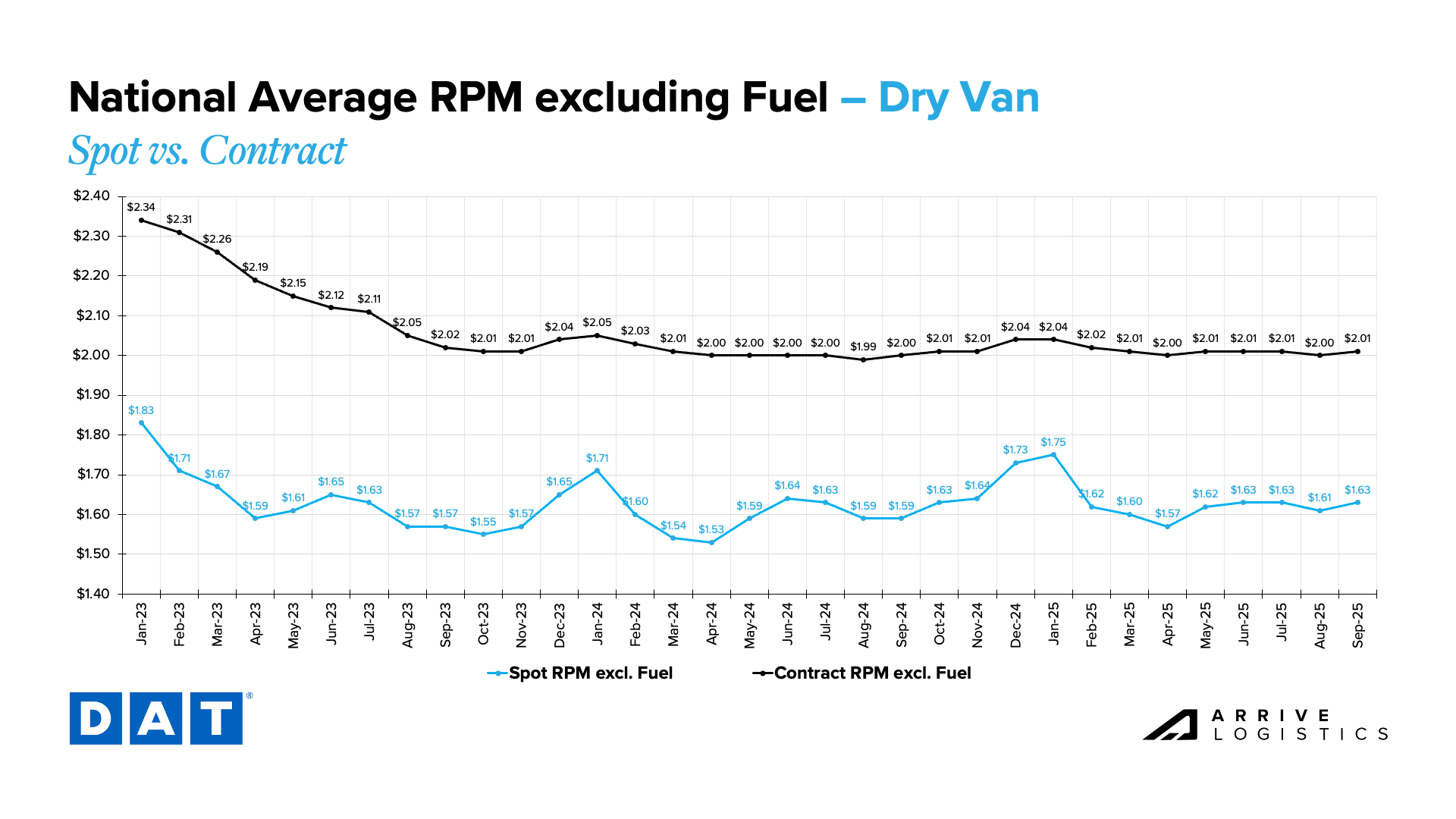

Despite the persistently depressed demand environment, supply has not shown the usual attrition patterns that often emerge at this stage in the cycle. Carrier counts have grown modestly in recent months, while trucking employment has held stable. Together, these trends indicate a relative balance between supply and demand that is somewhat unusual given the long stretch of challenging trucking conditions.

Capacity is likely to remain at or near current levels through late September and into early Q4. While seasonal demand spikes or severe weather may cause short-lived disruption, rejection rates should also stay in check in the near-term.

One potential longer-term risk is truck orders, which have remained below replacement levels for several months. While not yet influencing current conditions, this trend could eventually lead to reduced equipment levels and tightening capacity once demand begins to recover.

For now, however, the outlook calls for continued stability on the capacity side, unless key risks materialize.

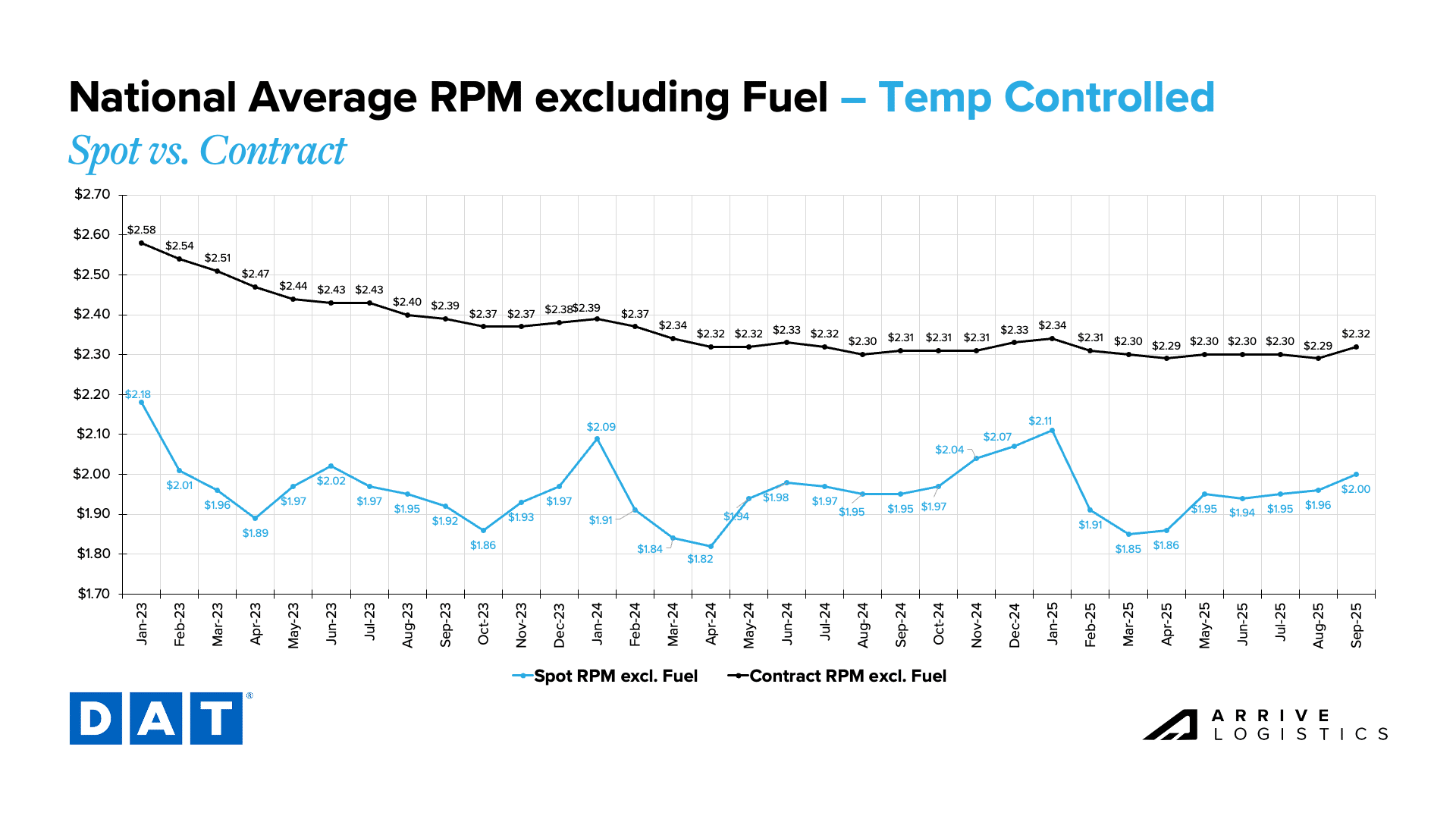

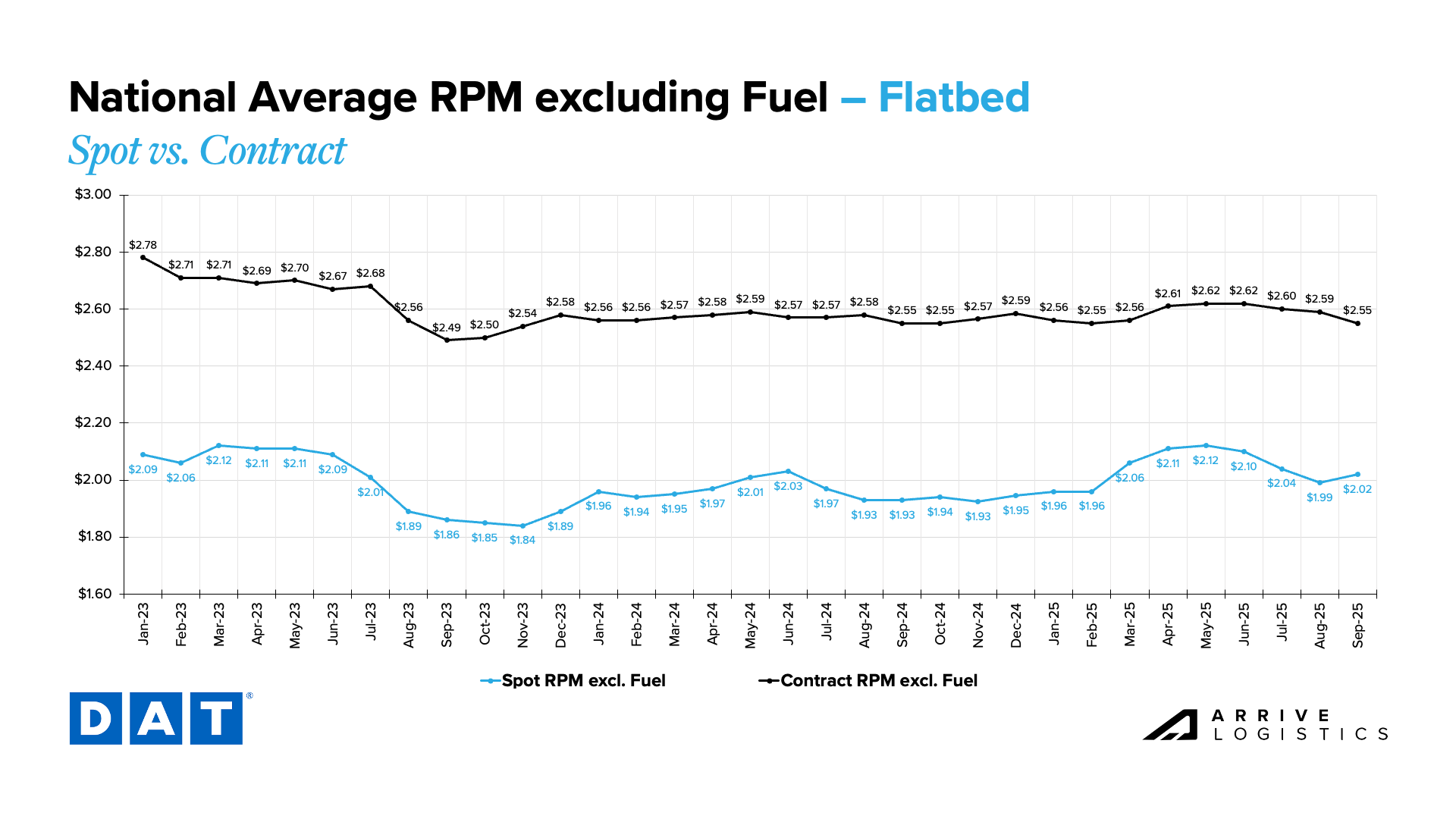

Van and reefer rates both spiked around Labor Day, showing a slightly stronger and longer-lasting response than usual before easing back into typical post-holiday softening by mid-month. Trends were broadly consistent with last year despite variables like lingering import flows and northern produce pockets.

With the Labor Day bump fading and imports declining, rates are expected to follow seasonal norms into late September. At this point, the near-term forecast looks steady and should remain as such through year-end, though retail peak season and the back half of hurricane season still present risks. A typical pattern would call for rate volatility in late November and the second half of December. This will likely be the case again this year.

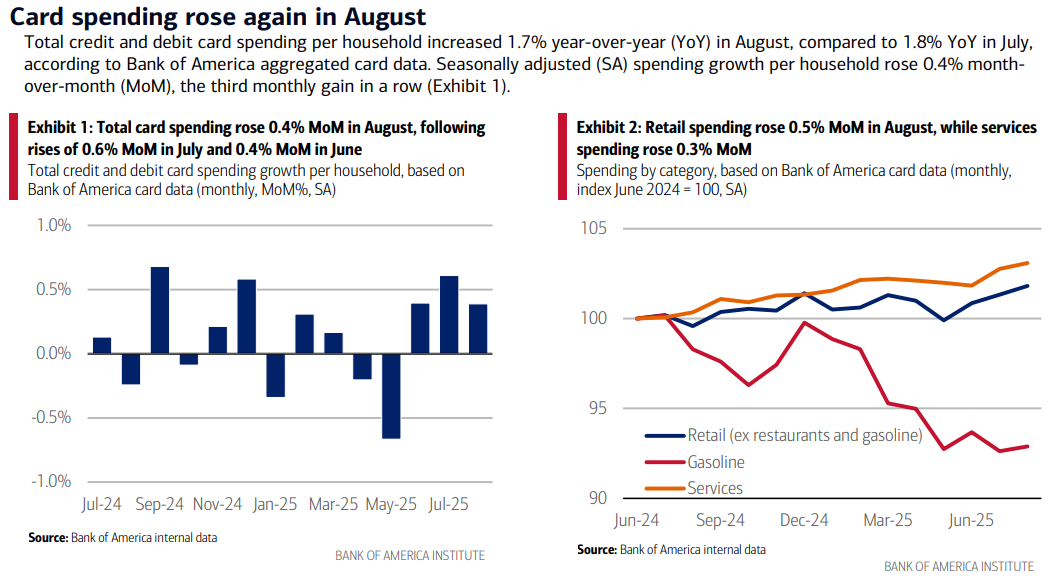

Consumer spending slipped slightly but remained resilient overall in August, rising 1.7% year-over-year after a 1.8% increase in July. Spending was broad-based across both goods and services, signaling that household demand has held steady despite ongoing economic pressures. However, inflation and the unemployment rate ticked higher during the month, and recent revisions to government jobs data pointed to cracks in the labor market.

Spending strength should continue to support freight demand in the near term, but inflation and labor market softness pose risks to the outlook. The Federal Reserve cut interest rates by 25 basis points in its September meeting, but any meaningful impact on freight demand would take time — and likely require several more cuts — to materialize. For now, consumer activity remains a bright spot, though rising prices and labor uncertainty may create challenges as we approach year-end and move into 2026.

Get this free report delivered straight to your inbox every month.