"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

Q4 kicked off with a supply shake-up following the announcement of new non-domiciled CDL regulation. While the potential for sudden tightness and sharp rate increases had the market on edge initially, recent tender rejection and rate trends suggest the worst of the disruption has already passed and that lingering impacts will not persist.

That said, as we move into the back half of October, tender rejection trends are showing tightness outside of typical seasonal patterns. The Diwali holiday and recent driver exits are the likely culprits, but if the trend persists into November, it will be worth watching for signs of a broader disruption.

For now, capacity tightness remains a regional story rather than a national trend. However, if it spreads to additional regions, that would signal the recent capacity crunch may be more than just a short-term blip.

Assuming recent volatility fades in the coming weeks, Q4 market conditions will likely be defined by stable demand and balanced to slightly contracting supply. Typical seasonal patterns should bring temperature-controlled tightness ahead of Thanksgiving and Christmas as food and beverage shipments pick up, and dry van tightness in the later weeks of both November and December as peak retail season coincides with drivers taking time off around the holidays.

On the demand side, consumers are still spending amid labor market challenges, but inflation and higher borrowing costs will continue to weigh on durable goods volumes. Additional tariff threats are also creating further uncertainty, as limited visibility into the timing or scope of potential changes makes it challenging to anticipate how these factors will impact future freight volumes.

These variables, plus the fact that most retail imports were already pulled forward earlier in the year, suggest a muted holiday peak season could be on the horizon.

On the supply side, persistently weak equipment orders — along with any long-term impacts from recent or future regulatory shifts — will make capacity increasingly vulnerable to disruption once demand picks back up.

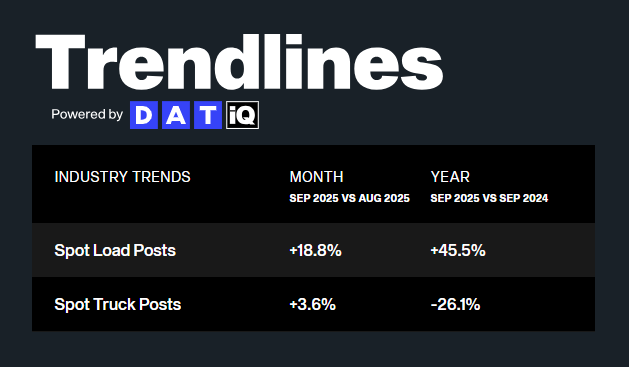

Demand indicators showed some unusual trends in September. FreightWaves reported accepted contract volumes were down roughly 18% year-over-year, while DAT showed spot load posts up 45% over the same period. Cass reflected a 5.4% year-over-year decline in total shipments, but its truckload component remained slightly positive. These trends would typically point to a market undergoing more disruption, but rate volatility was kept to a minimum throughout the month.

Through the rest of this year, demand is likely to remain soft with muted seasonal spikes around the holidays. Meanwhile, labor market challenges, inflation, interest rates and tariff policy all remain risks to near-term volumes and meaningful barriers to a broader demand recovery. However, if recent tender rejection trends persist, spot volumes could take off, particularly as we get closer to the holidays.

Supply contracted again in September as fleet sizes continued to shrink and equipment orders remained below replacement levels despite a notable month-over-month increase. Tender rejections also rose on a regional basis amid the CDL regulation-related disruption late in the month.

2025 has seen private fleets give back market share to for-hire carriers, presumably as investment in fleet growth slows. This is working to prop up for-hire demand and keep a portion of drivers in their seats amid persistently soft freight volumes and elevated operating costs. Together, these trends point to a supply side that is slowly tightening but still able to service current demand.

Capacity is expected to remain stable or contract slightly through the end of the year — but if low equipment orders persist amid a shrinking fleet base and aging equipment pool, available capacity will become increasingly vulnerable to future demand shocks.

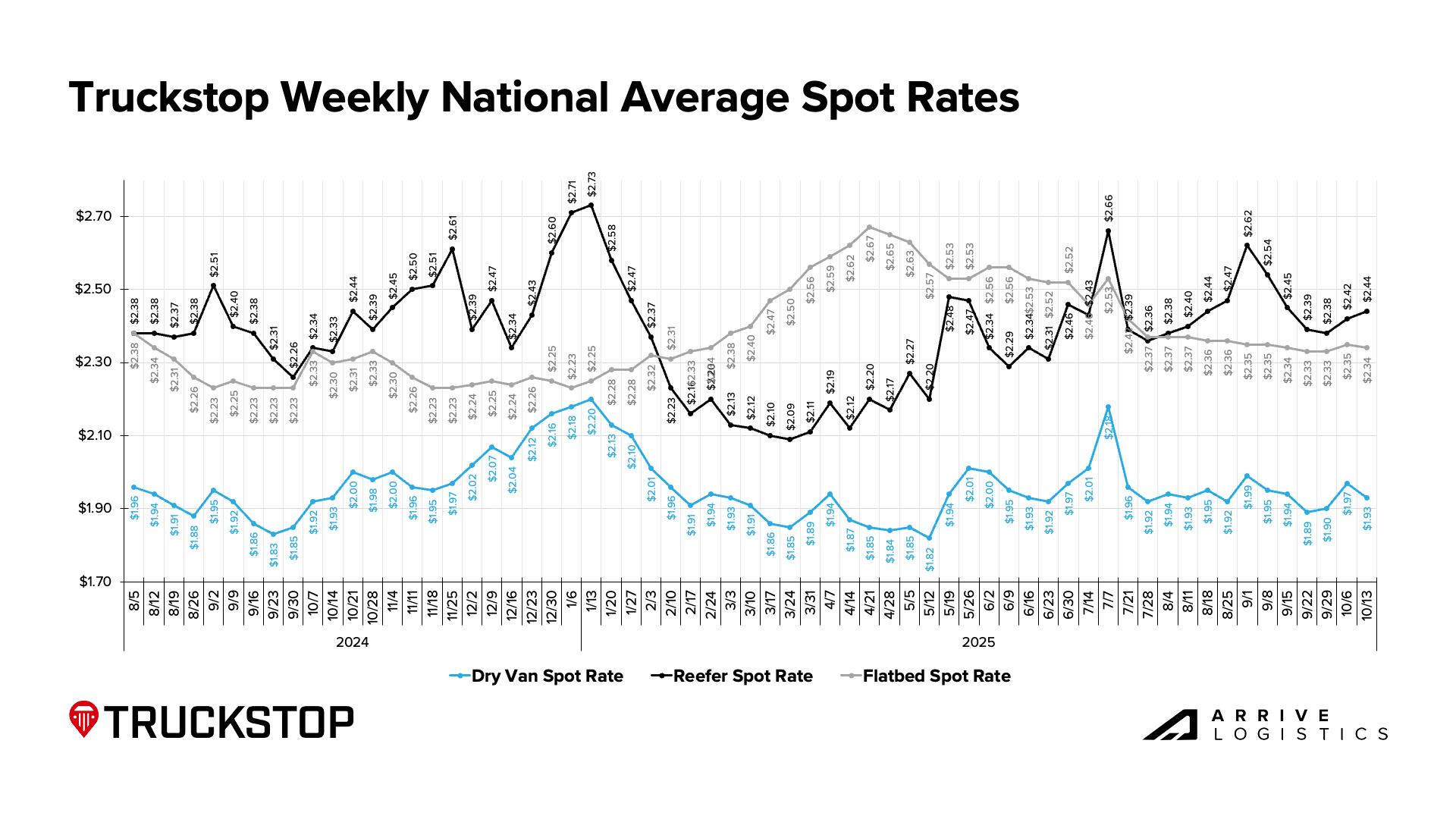

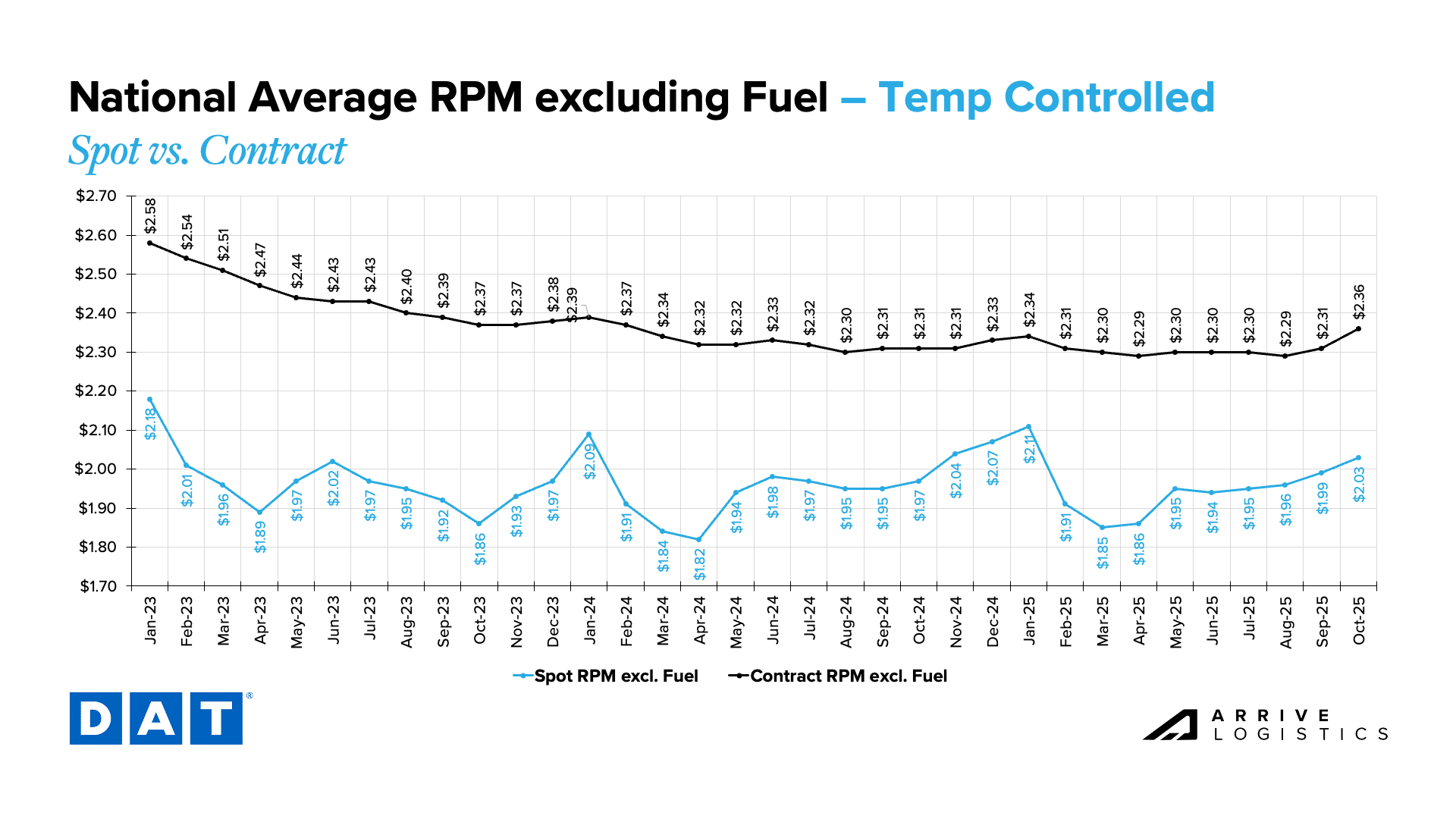

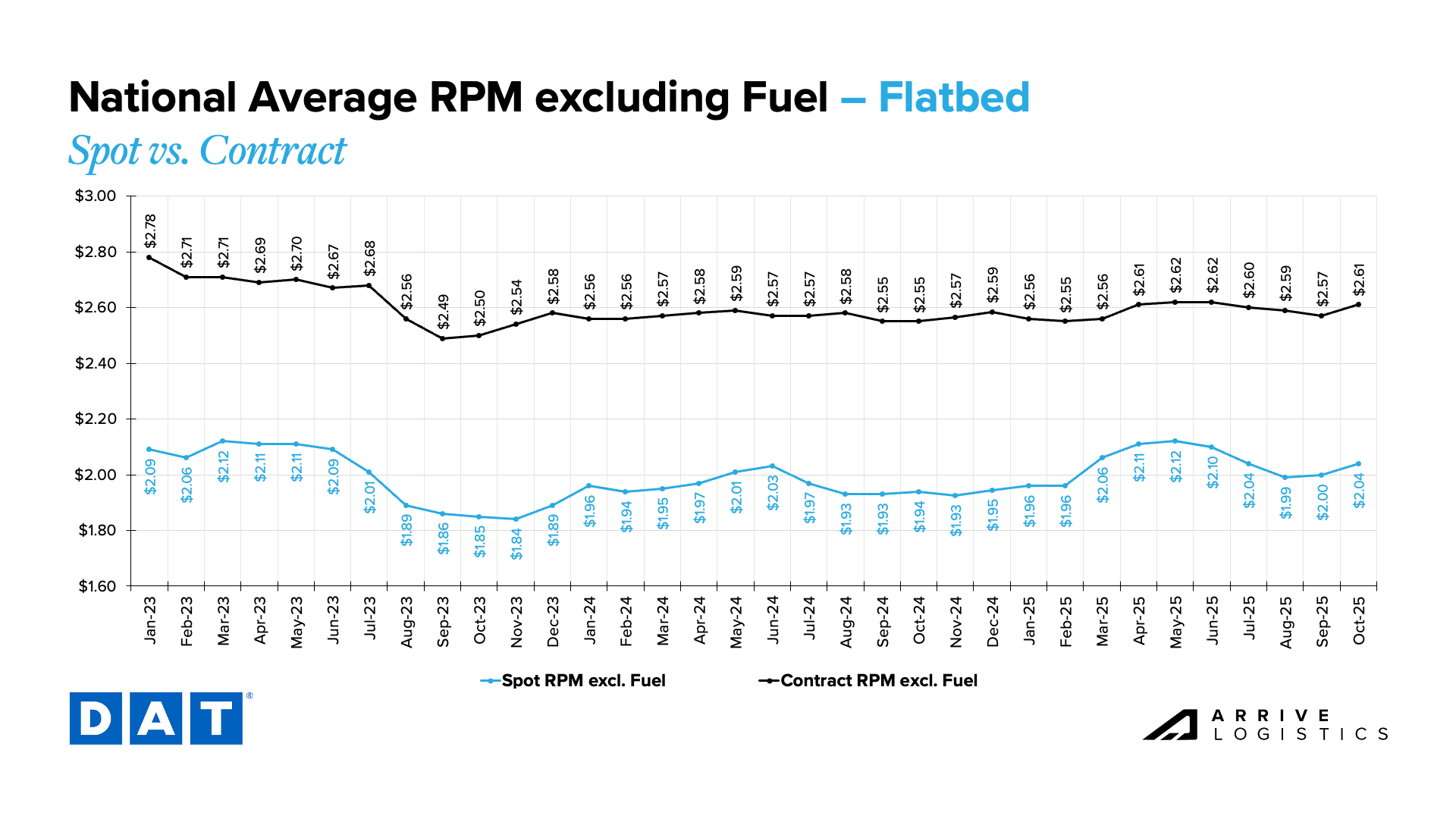

Rates followed typical seasonal patterns through September, with van and reefer markets both spiking around Labor Day before easing through the rest of the month. A brief rate bump also hit the market at the end of September and into early October, driven by disruption surrounding the non-domiciled CDL regulation.

Aside from the typical disruptive periods in Q4, rates are expected to follow normal seasonal trends through the remainder of the year. Recent trends in mid-October point to a potential unseasonal disruption, but normalization in early November is expected after Diwali and end-of-month pressures fade.

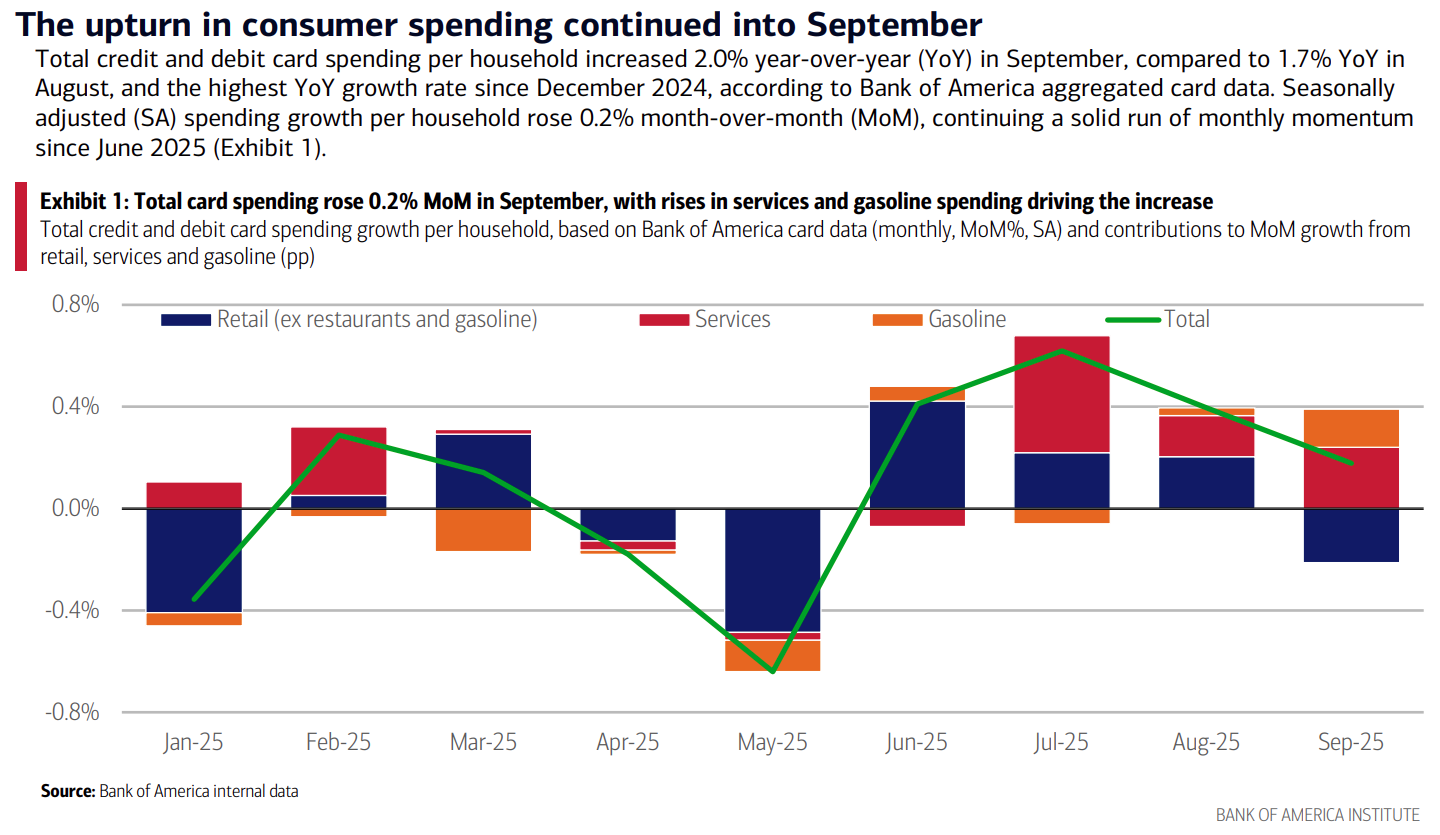

Consumer spending held steady in September, and while the latest CPI reading has yet to be released, it’s expected to remain within recent ranges. With that, and without new labor data available at the time of writing, the broader economic picture remains largely unchanged from last month.

Economic conditions should help keep freight volumes at or near current levels. However, interest rates, inflation and labor uncertainty remain risks. Further rate cuts would help stimulate housing and durable goods demand, which in turn would greatly benefit freight volumes.

Get this free report delivered straight to your inbox every month.