"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

Slow but steady demand and elevated capacity levels created soft market conditions again in March and early April. Dry van and reefer spot rates hit new cycle lows and flatbed increased in line with typical seasonality.

Tightening is likely as we approach the CVSA Roadcheck (“DOT Week”) and Memorial Day in May, but the market will remain relatively soft overall amid a surplus of capacity.

Below are the key takeaways from this month’s carrier update:

What’s Happening: The market is quieter than usual for this time of year.

Why It Matters: Low volatility today could indicate a muted summer peak season awaits.

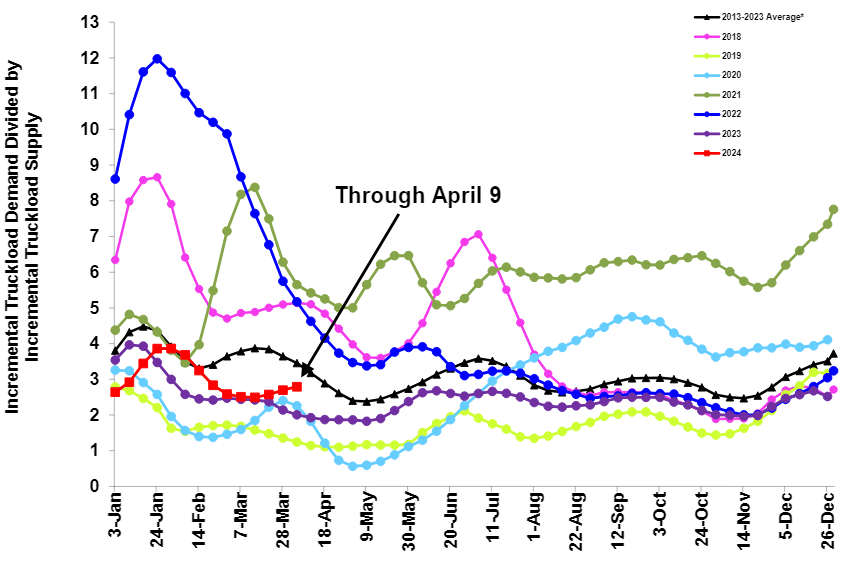

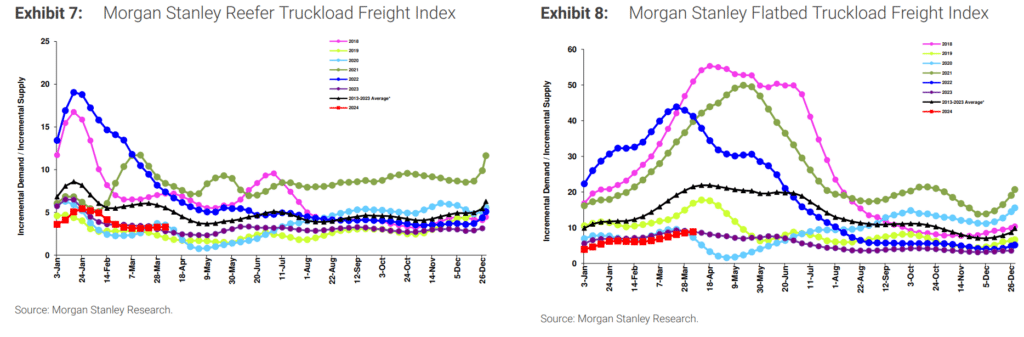

The Morgan Stanley Dry Van Freight Index is another measure of relative supply; the higher the index, the tighter the market conditions. The black line with triangle markers on the chart provides a great view of what directional trends would be in line with normal seasonality based on historical data dating back to 2007.

Market conditions remained relatively flat in March. The slight uptick in the Morgan Stanley reading differed from the 10-year trend, which typically shows softening conditions during this time of year. Conditions will likely remain relatively flat ahead of the 100 Days of Summer and start to tighten as produce and other in-demand summer products hit the roads.

The most recent (February) ACT Supply-Demand Index reading was 53.5, up from 50.2 in January. February’s reading marks seven straight months of tightening conditions, driven primarily by capacity declines and slight volume increases. The streak indicates the market is trending toward equilibrium as the capacity correction continues.

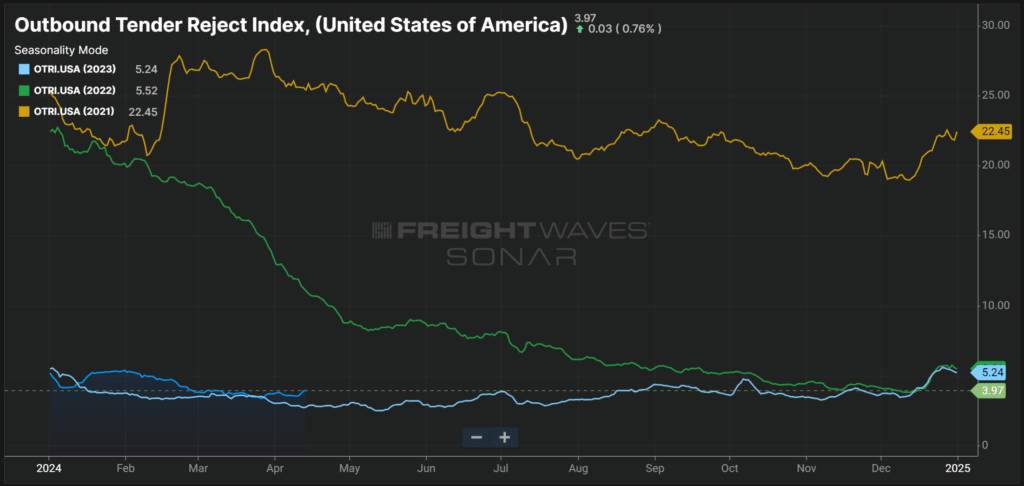

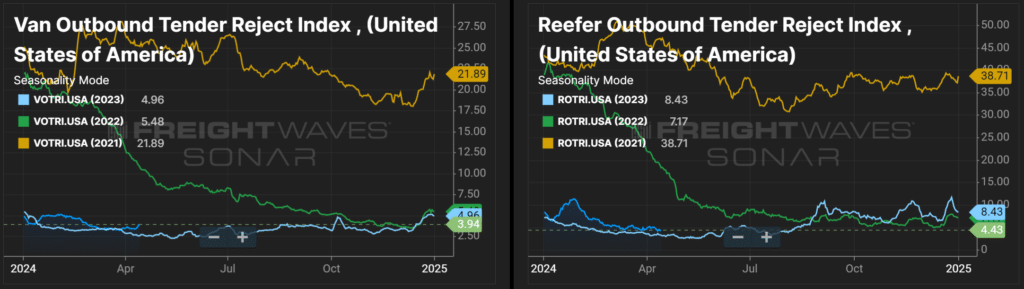

Soft demand amid a surplus of capacity continues to elongate the downcycle. The Sonar Outbound Tender Reject Index (OTRI), which measures the rate at which carriers reject freight they are contractually required to take, has hovered around 5% since early March. While rejection levels today are slightly higher than during this time last year, they are still significantly lower than in 2021 and 2022 and will likely remain stable as the 100 Days of Summer approaches. Van tender rejections have been below 4% for the past few months and remain slightly higher than in early April. Reefer tender rejections are also flat, hanging just above 4%.

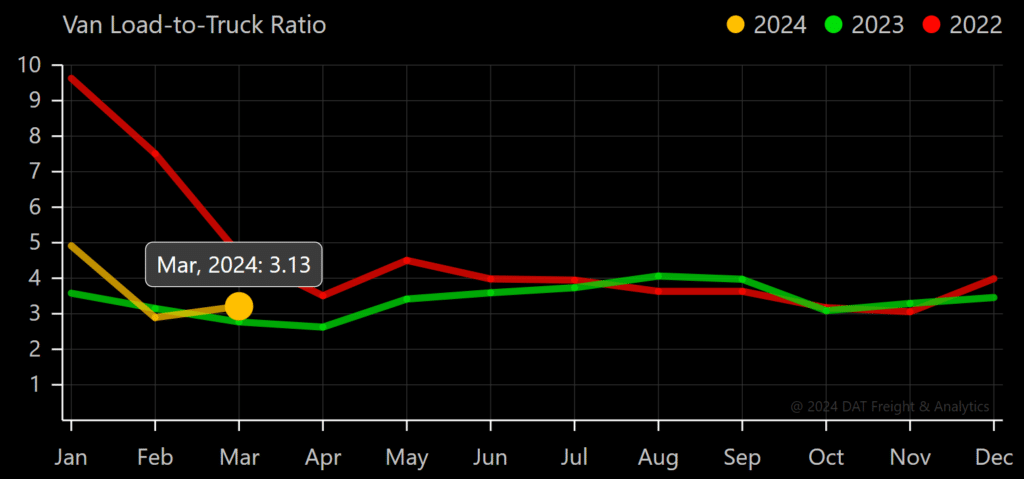

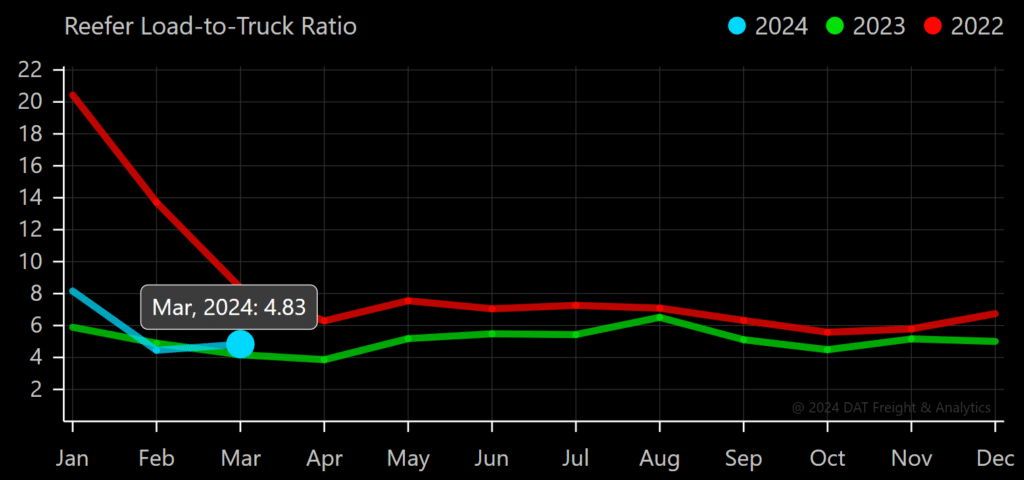

The DAT Load-to-Truck Ratio measures the total number of loads relative to the total number of trucks posted on their spot board. It rose slightly to 3.13 on the van side in March, just slightly above the same period in 2023. Reefer data revealed a similar trend, with the March ratio landing just north of the 2023 reading at 4.83.

What’s Happening: February trends continued in March and early April.

Why It Matters: The market is calm as the produce season begins.

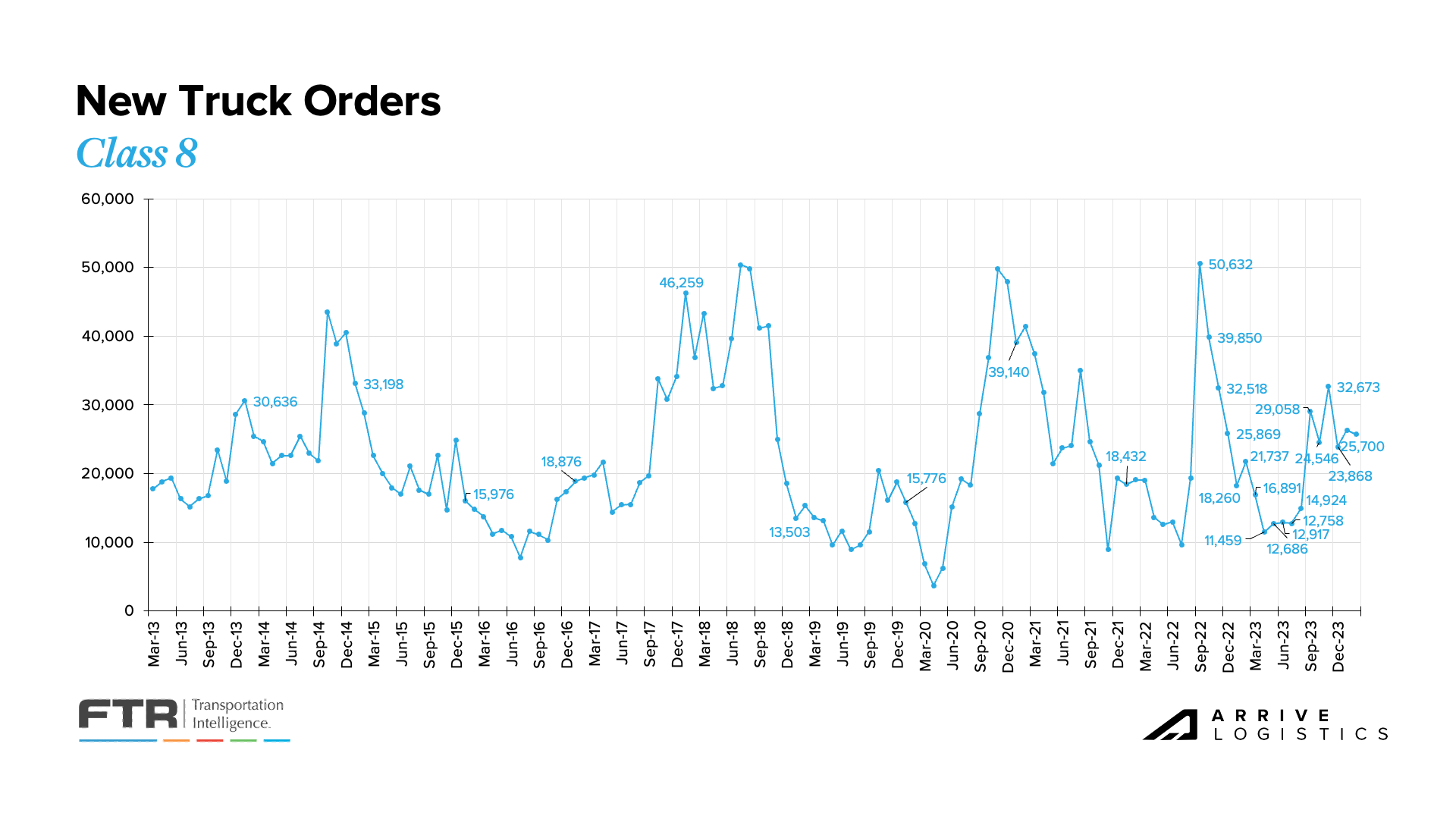

According to ACT Research, new Class 8 truck orders declined from over 17,000 in February to 10,000 in March. While this seems relatively significant, it aligns with typical seasonality. New truck production remains strong as backlogs continued to decline in March.

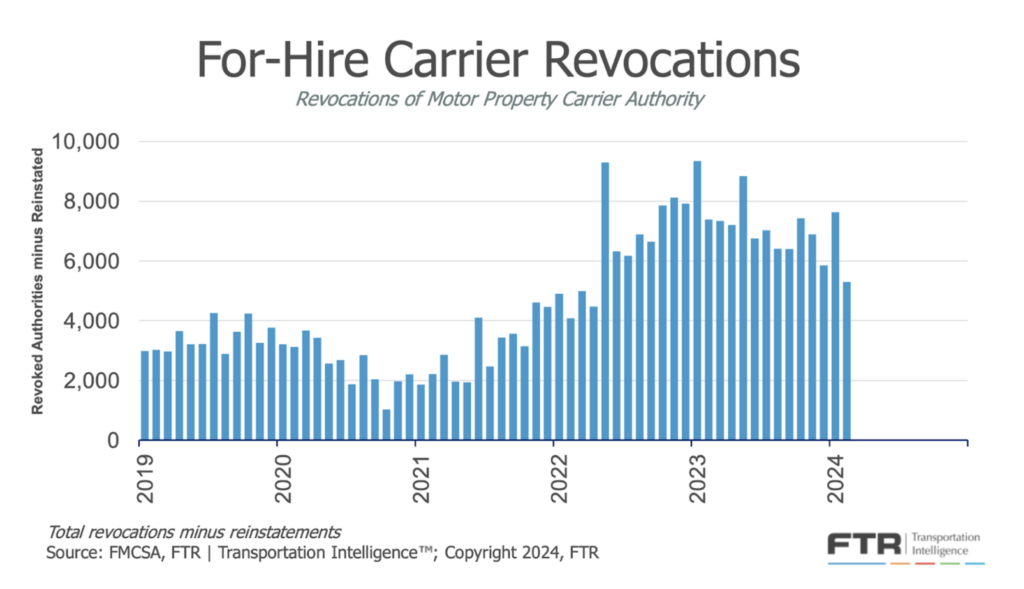

According to the latest report (February), net revocations fell to nearly 5,300 in February, marking the lowest number since April 2022. Though somewhat surprising as rates continue to reach new cycle lows, the volatility in December and January likely helped carriers keep their wheels turning. The number of new carrier entrants also increased in February, meaning the overall population decreased by just 800 carriers.

FTR reported 26,000 new orders in January — an increase of 10.3% month-over-month and more than 44% year-over-year — indicating that some carriers are trying to maintain or expand their fleets.

February order estimates were around 25,700, a 2.4% month-over-month decrease but an 18.2% year-over-year increase. This trend likely points to the financial strength of larger carriers and private fleets’ ongoing investment in growth.

While order levels were above the historical average, they did align with seasonal trends. Because freight demand is healthy overall, larger fleets are adding capacity to insource volume back from smaller for-hire fleets and owner-operators.

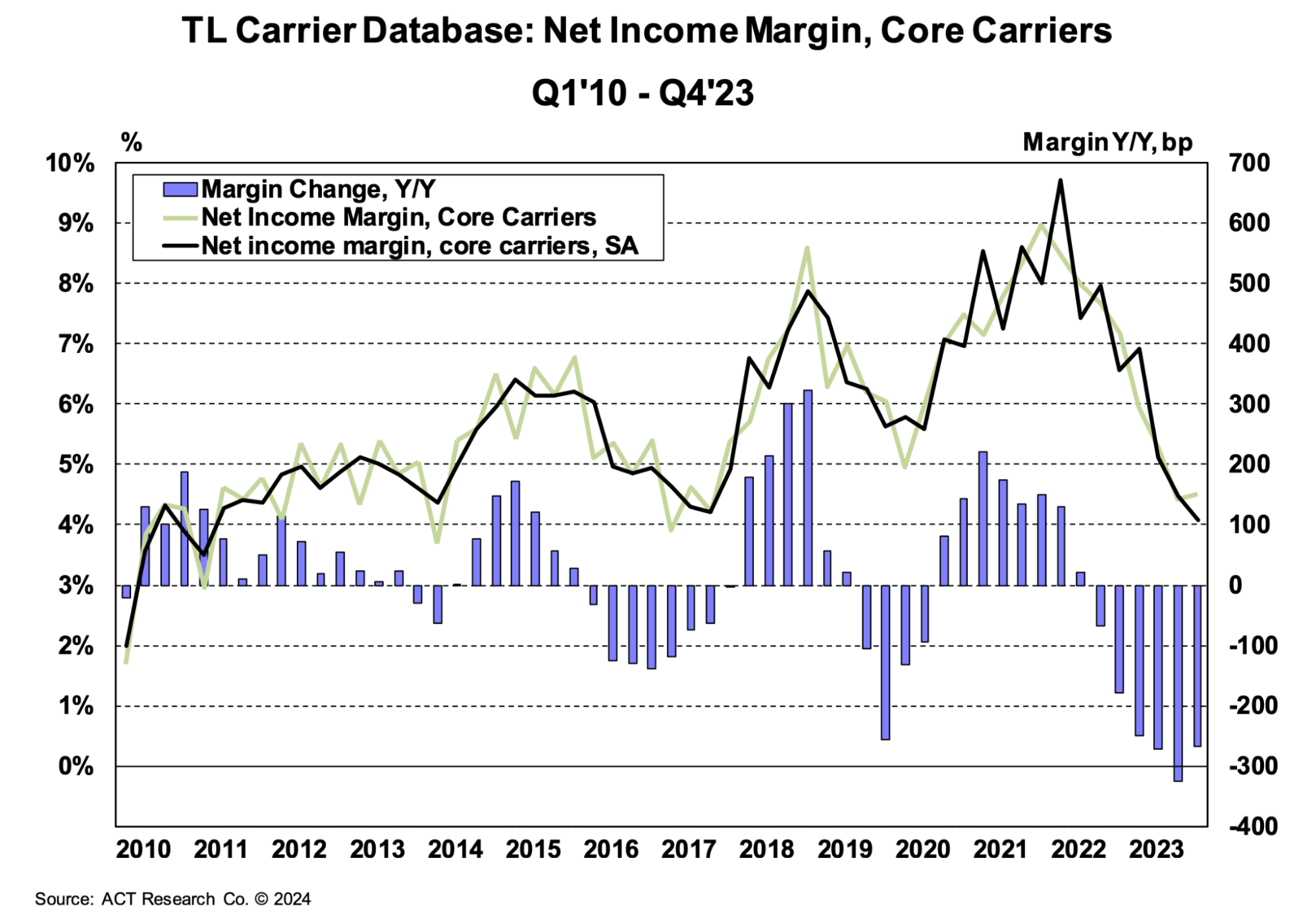

Carrier margins continue to shrink due to falling revenues and high operating expenses. ACT’s “Core Carrier” set shows year-over-year declines for six consecutive quarters. Net margins did rise quarter-over-quarter in Q4 2023 but were still down 2.7% year-over-year. As rates become more volatile in the back half of 2024 and into 2025, the pressure on carriers should ease.

According to ACT Research, the Class 8 backlog-to-build ratio declined from 5.8 months in February to 5.5 in March. Though backlogs shrank for most of last year, they rose by over 10,000 units to nearly 105,000 from October 2023 to March 2024. However, they dropped again by 7,000 units in March 2024, leaving the backlog at around 97,000.

The latest (February) ACT Driver Availability Index reading was flat. Volumes remain relatively low, and ACT projects seasonal declines in Q2. As low rates persist, market conditions will likely apply downward pressure on availability as drivers seek more lucrative opportunities, potentially outside the trucking industry.

What’s Happening: Market conditions held steady in March.

Why It Matters: Low demand today could indicate a muted peak summer season.

In January, the National Retail Federation (NRF) reported flat imports month-over-month at 1.96 million TEUs. However, this marked a 25% year-over-year increase — the largest projected for at least the first half of the year. Additionally, the NRF predicts that over two million TEUs will soon be imported in one month for the first time since last fall.

The Francis Scott Key Bridge collapse continues to have regional impacts. Shipments have been rerouted to nearby ports such as Newark, NY and Norfolk, VA. The Port of Baltimore handled roughly 48,000 TEUs in January. Despite the bridge collapse and Houthi attacks in the Red Sea, the maritime supply chain remains relatively stable and resilient.

Figure 16: NRF Monthly Imports

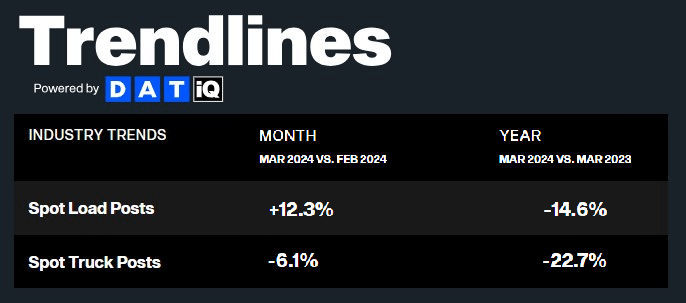

Conditions in March remained relatively quiet without any major disruptions. Spot load postings increased by 12.3% month-over-month but were down nearly 15% year-over-year. Meanwhile, month-over-month truck postings dropped by 6.1%. These results reflect soft demand conditions.

What’s Happening: Cross-border Canada freight slowed in March.

Why It Matters: Rates remained steady amid a surplus of capacity.

What’s Happening: Increased cargo theft is creating tightness in Central Mexico.

Why It Matters: Rates are rising on inbound and outbound shipments.

What’s Happening: The LTL market continues to absorb Yellow’s freight.

Why It Matters: “Difficult” freight can impact operating costs.

What’s Happening: Typical seasonality is expected as produce season continues.

Why It Matters: Regional volatility and rate increases are likely.

East Coast

Midwest

South Central

West

Pacific Northwest

What’s Happening: Seasonal demand is increasing nationwide.

Why It Matters: Rates are rising on the heels of increased demand.

What’s Happening: Rates continue to fall to new cycle lows.

Why It Matters: Declining carrier revenues could drive more capacity out of the market.

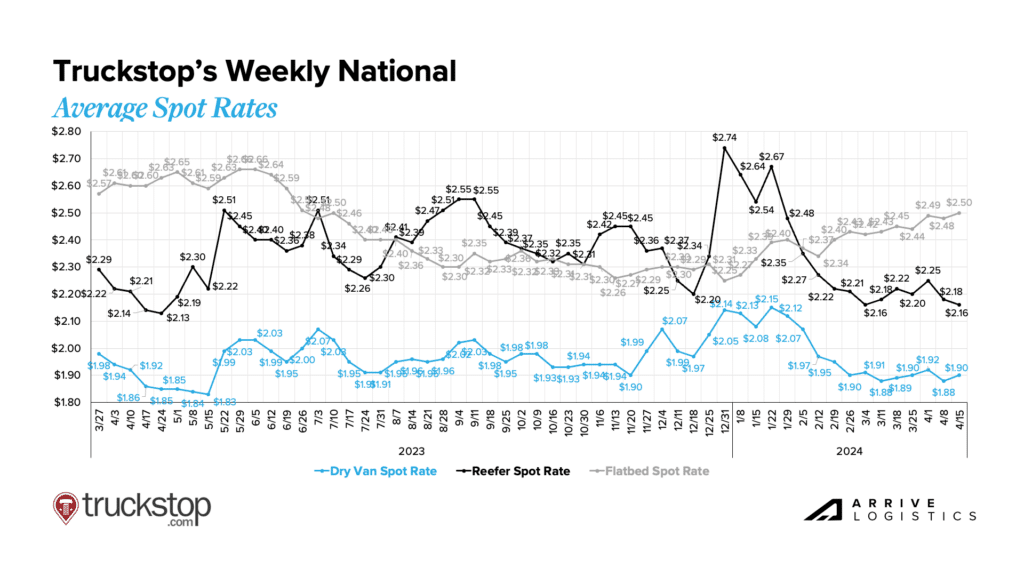

Truckstop’s Weekly National Average Spot Rates provide a detailed view of week-to-week movements and a real-time look into the current environment. Recent readings show that dry van and reefer spot rates are nearing new cycle lows. Dry van spot rates fell to $1.88 per mile, matching the cycle low set in mid-March, and reefer rates were $2.18 per mile, just $0.02 higher than the cycle low reported in early March. Flatbed rates continue to trend upward as construction season gets underway.

National diesel prices have leveled out over the past two months, with relatively minimal weekly fluctuation. The average price through the first half of April is $4.02 per gallon, matching the March average. Fuel surcharges have remained relatively steady, but with tensions mounting in the Middle East, there remains a chance for increases in the upcoming months.

DAT data shows dry van spot rates are down year-over-year and well below January 2024 highs. In March, spot rates set a new cycle low of $1.54 per mile, excluding fuel. Early April data shows similar numbers, with the national spot average increasing by $0.01 per mile. National contract rates for dry van have slowly declined as spot rates apply downward pressure. If early April averages remain flat throughout the month, contract rates could reach $2.00 per mile, excluding fuel, a new cycle low.

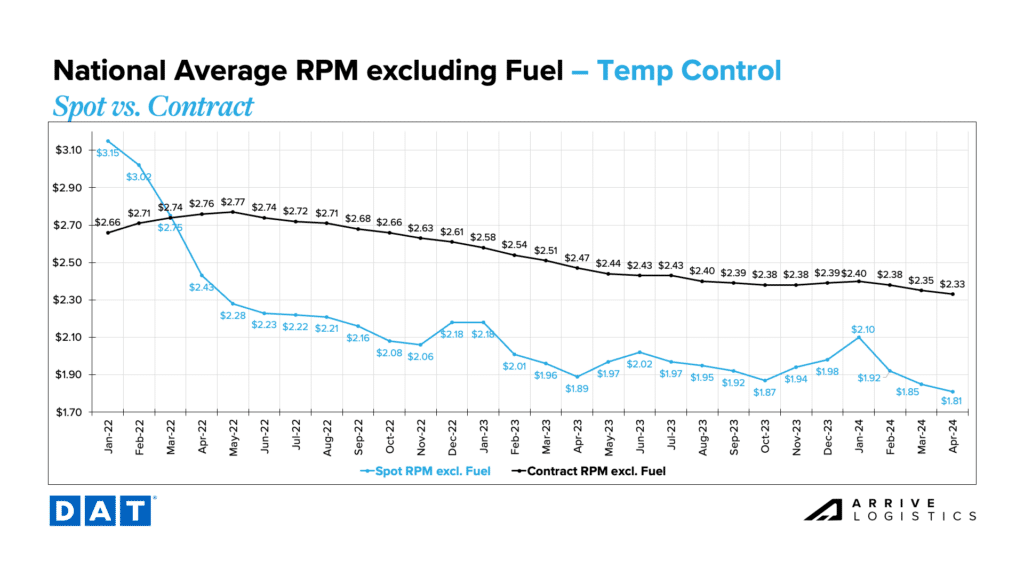

Reefer rates continue to trend down. If early April data holds true for the rest of the month, spot and contract rates could reach new cycle lows. Spot rates currently sit at $1.81 per mile, excluding fuel; that’s $0.04 per mile below the prior cycle low of $1.85 per mile set in March. Reefer contract rates have declined by $0.02 per mile to $2.33 per mile in April, excluding fuel. The spot-contract gap also increased to $0.52 per mile.

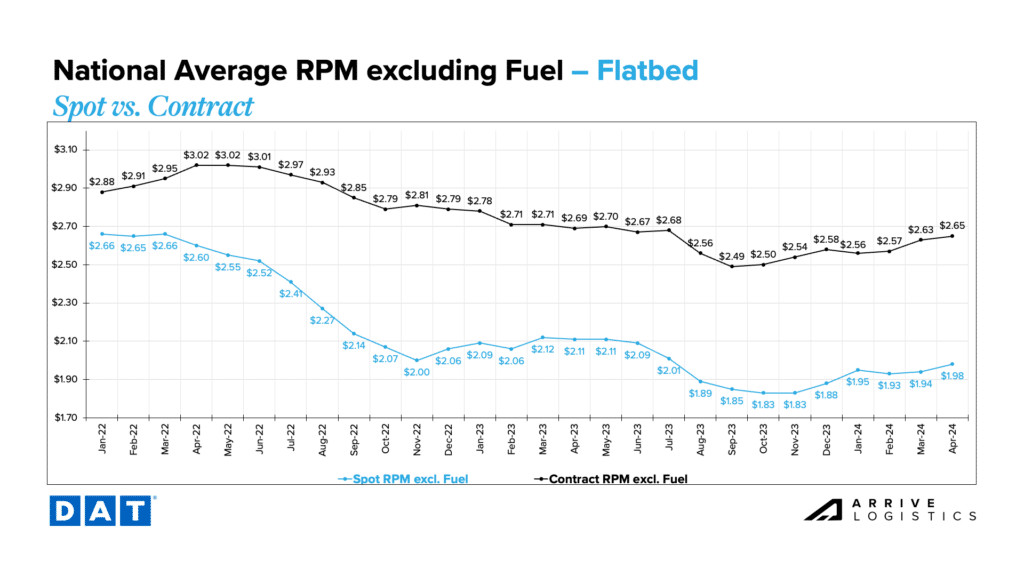

Flatbed rates rose to $1.98 per mile in early April, excluding fuel, the highest since mid-summer 2023. Contract rates also rose to $2.65 per mile, excluding fuel, also the highest since mid-summer last year.

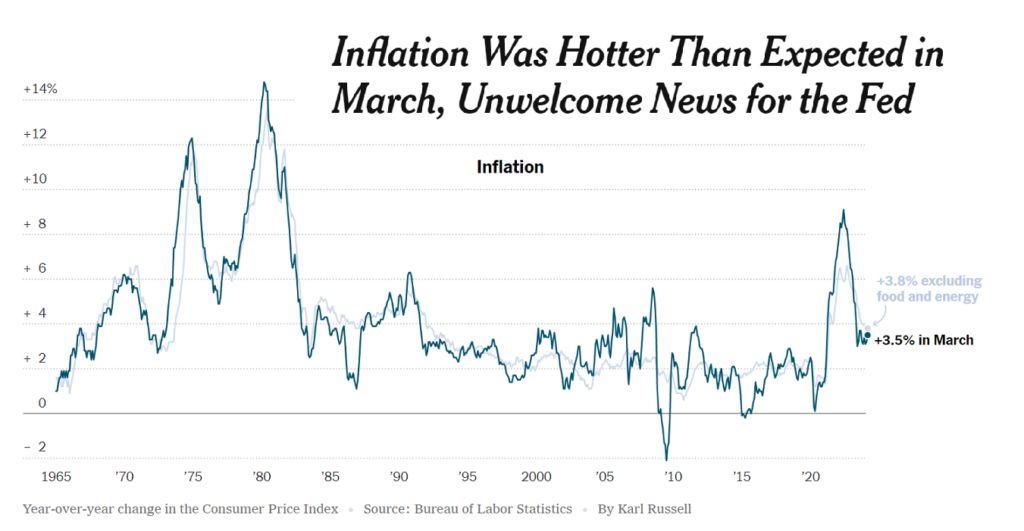

What’s Happening: Inflation remains sticky.

Why It Matters: Interest rates could stay elevated for an extended period.

CPI data rose from 3.2% in February to 3.5% in March. Inflation, excluding food and energy, remained at 3.8%. The Fed appears less keen to make cuts in the near term, and there is now a remote chance they won’t cut rates this year, which would mean a significant consumer spending increase is unlikely. Once inflation and interest rates cool, consumer spending should improve and help drive freight demand.

Bank of America data showed March card spending increased by 0.3% year-over-year, likely driven by the timing of Easter. However, when removing seasonal factors, March spending declined by 0.7% year-over-year. Despite the slight spending slowdown, consumers remain optimistic thanks to a strong labor market and wages reaching the highest level since early 2023.

Market conditions remained loose in March and April, with rates reaching new cycle lows amid flat demand and a surplus of capacity.

As we move deeper into the produce season and toward the 100 Days of Summer, expect limited volatility in line with typical seasonality. High operating expenses and declining revenues are still making it challenging for carriers to stay afloat. As exits continue, rising rates and tighter conditions should steer the market toward equilibrium.

Ultimately, our outlook for the remainder of 2024 remains the same: Mostly loose conditions with some tightness based on typical seasonality.

The Arrive Carrier Market Outlook, created by Arrive Insights™, is a report that analyzes data from multiple sources, including but not limited to FreightWaves SONAR, DAT, FTR Transportation Intelligence, Morgan Stanley Research, Bank of America Internal Data, ACT Research, Journal of Commerce, Stephens Research, National Retail Federation and FRED Economic Data from the past month as well as year-over-year. We know market data is vital in making real-time business decisions. At Arrive Logistics, we are committed to giving you the data and insights you need to better manage your freight.