"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

2024 peak season trends clearly show that the market has moved past its lowest point. Rates and capacity challenges aligned closely with typical seasonal patterns, while economic and consumer indicators suggest a stable environment ahead. Our forecast for 2025 remains unchanged: The ongoing balancing of supply and demand, along with a narrowing spot-contract rate gap, is likely to heighten the risk of disruptions in 2025.

Key Takeaways:

Q4 demand trends aligned with typical seasonal expectations.

Trucking employment has increased, but the decline in long-haul trucking jobs points to an ongoing capacity reduction.

Tender rejections for dry van and reefer shipments are significantly higher than 2023 levels, reflecting a better supply-demand balance and increased vulnerability to market disruption.

Rates continued to follow seasonal trends as volatility increased during the peak holiday season. However, they will likely return to a lower baseline as seasonal demand softens throughout Q1.

Potential risks such as a second port strike and tariff increases in January could influence the market positively or negatively, depending on their outcomes.

Both the economy and consumer activity remain strong, signaling stable or upward demand trends as 2025 begins.

Tariffs have been top of mind for businesses in the freight market and beyond since President-elect Trump announced plans to impose a 25% tax on imports from Mexico and Canada, along with a 10% increase on imports from China, starting January 20.

Avery Vise’s commentary in the recently released FTR December 2024 Trucking Report offers a comprehensive analysis and insight into the potential impact of these changes. We’ve outlined key takeaways from that commentary below and will continue to provide updates in this report.

Short-Term Impacts: Trump’s social media announcements lack critical policy details, leaving many businesses unsure of how to respond.

Long-Term Implications: Though the long-term political and economic implications of raising tariffs are unclear, the trucking industry would likely face significant disruption if the increases remain in place for an extended period.

Preparing Amid Uncertainty: Businesses should consider several strategic actions to mitigate risk ahead of potential tariff increases.

The Reason For Raising Tariffs: This initiative is just one part of Trump’s pro-business policy agenda, which could positively impact the freight market.

Preparing For Port Strikes: East and Gulf port strikes will resume in mid-January if the sides can’t reach a deal. Here’s what we know:

What’s Happening: Shippers are experiencing the most significant routing guide challenges in over two years.

Why It Matters: Despite those challenges, there is no indication of a sustained market shift.

The Morgan Stanley Dry Van Freight Index measures relative supply; the higher the index, the tighter the market conditions. The black line with triangle markers on the chart provides a great view of what directional trends would be in line with normal seasonality based on historical data dating back to 2007.

Despite recent routing guide disruptions and rate volatility, as of mid-December, the latest reading showed no meaningful activity or demand increases and trends returning to the 10-year average amid seasonal cooling.

Morgan Stanley Dry Van Truckload Freight Index

The latest ACT for-hire Trucking Supply-Demand Balance Index shows conditions tightened in the most recent reading (October) as a result of increased freight volumes and decreased fleet capacity. ACT reports that one of the primary drivers of a longer equilibrium cycle is the expansion of private fleets, as increased capacity results in longer recovery times.

Class 8 tractor sales have continued to slow, a sign that the market will continue to rebalance in the coming months. As the broader economy grows, freight volumes should rise. As a result, the market will likely be tighter in 2025 than in 2024.

The Sonar Outbound Tender Reject Index (OTRI), which measures the rate at which carriers reject the freight they are contractually required to take, is trending well above where it was a year ago and fairly close to 2019 levels. Rejections during Thanksgiving were over 60% higher than last. Rejection rates prior to Christmas surpassed 10% for the first time since April 2022, before dropping back down to around 8%.

In the full history of the FreightWaves Sonar OTRI, the measure has only risen above 10% when a market disruption was in progress or conditions were primed for one with the right catalyst. For example, in 2019, rejection rates peaked at roughly 14% over Christmas week. A few months later, pandemic-related buying patterns sent the market on a multi-year bull run. While that was an extraordinary black swan event and one unlikely to occur again in the next few months, it does highlight that OTRI volatility leading up to the 2020 disruption indicated market vulnerability.

Dry van tender rejections remain above 2023 and 2024 levels. They spiked in December in line with typical seasonal expectations, indicating that the market is more volatile than a year ago. Van rejections surpassed 8% ahead of the holiday week, offering additional proof that the market is more sensitive heading into 2025. During the second half of December 2023, we saw a sharp increase in tender rejections followed by a sharp reduction in mid to late January. We saw similar trends in 2024, but some risk remains with the looming threat of a mid-January port strike and the new administration taking office on January 20th.

The reefer market continues to illustrate similar year-over-year trends to the van market, indicating improved supply and demand balance. However, with rejections on track to pass 20%, the same risks exist for reefer as for van. Throughout the history of the reefer-specific metric, the 20% range has been the threshold indicating an active or imminent disruption. That said, typical seasonality will likely be the narrative for the reefer market until the right catalyst occurs.

The DAT Load-to-Truck Ratio (L/T) measures the total number of loads relative to the total number of trucks posted on its spot board. The van L/T increased sharply from November to December, passing 6 for the first time since February 2022. The ratio will likely fall entering early 2025, but the data continues to indicate that the market is more volatile than it has been in the last 24 months.

What’s Happening: Carrier exits have slowed somewhat.

Why It Matters: This is likely due to increased seasonal opportunities, and we expect exits to ramp up again in 2025.

Carriers continue to exit the market, but the pace has slowed. FTR noted in its most recent report that over the past four months, the average decline in the for-hire population has been just 327 carriers per month, compared to 1,755 per month throughout 2023. While recent disruptions, holiday rate increases and fuel price declines may offer many carriers a sense of stability, we anticipate further capacity reductions in 2025.

FTR’s Carrier Revocations, New Carriers & Net Change in Carrier Population

We continue to monitor the evolving role of private fleets as they increase their share of the for-hire market despite volume declines. With less freight available, for-hire carriers are negotiating rates aggressively to maintain volume and revenue, putting downward pressure on spot rates. If this trend persists, it could extend the current rate environment deeper into 2025.

According to the latest data from ACT Research on U.S. Class 8 tractors, the backlog-to-build (BL/BU) ratio increased from 6 months in October to 6.5 months in November. The overall backlog grew by over 10,000 units in November to around 75,000 units. ACT Research reports this growth was largely supported by lower build rates as manufacturers focus on vocational production rather than tractor production. With rates still low, more major near-term growth is unlikely.

Driver availability remains relatively soft. There is little evidence of a shortage, likely due to older drivers staying on the road longer to cover their high cost of living and the growing migrant population. Driver availability showed no apparent tightening as a result of the November drug and alcohol clearinghouse rule changes regarding drivers with prohibited status.

The November trucking jobs report indicated an increase of just 2,900 jobs on a seasonally adjusted basis. Although total jobs were up 3,700 over the previous four months, they were still down 1,400 year-over-year in November and more than 39,000 from the peak in July 2022. The long-haul sector continues to show job losses consistent with for-hire carrier data, a sign that optimism around recent green shoots isn’t necessarily driving an uptick in long-haul trucking employment.

What’s Happening: Trends are following typical seasonality.

Why It Matters: This should continue through the first half of 2025.

The key demand variables to watch are the potential port strike in mid-January and the tariff increases slated for late January. These events have the potential to create both upward and downward risks to volume. However, given the lingering uncertainty around both events, our outlook still calls for flat to slow demand growth in 2025.

The National Retail Federation estimated a 14.3% increase year-over-year in December, which would close the full year out 14.8% above 2023 levels. Elevated levels earlier in the year were expected due to the initial threat of a port strike in October, and they have continued as shippers have looked to lower risk heading into a potential disruption later in January.

DAT reported that November spot loadings were down nearly 26% from October and 7.0% from November 2023. The large month-over-month decrease likely correlates with the spot posting surge following Hurricanes Helene and Milton in October. Notably, postings during the first week of December were up 116% from the last week of November. While this uptick was largely due to fewer business days during Thanksgiving, it is still one of the largest we have seen.

What’s Happening: Volatility increased ahead of the holidays.

Why It Matters: Any disruptions will likely subside in Q1 2025.

What’s Happening: Increased holiday volume created border bottlenecks.

Why It Matters: This should subside in Q1.

What’s Happening: Regional tightening.

Why It Matters: Things should settle in Q1.

East Coast

Midwest

South

The rest of the South is quiet, as expected for this time of year.

West

Pacific Northwest (PNW)

What’s Happening: Rates increased meaningfully during the holidays.

Why It Matters: This is normal seasonality, and we expect rates to settle in early Q1.

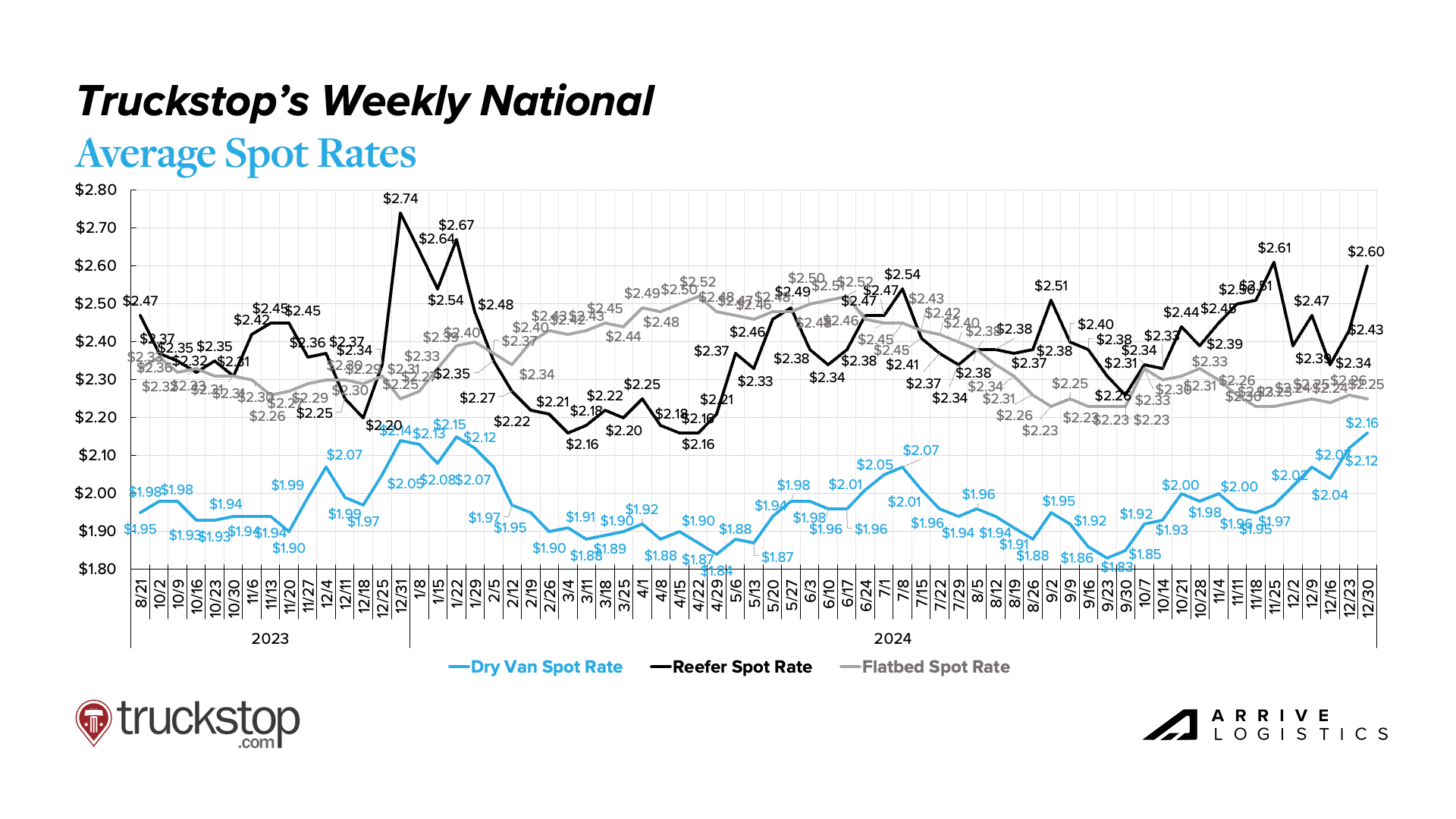

According to weekly spot market data provided by Truckstop, which we believe provides the best view of week-to-week seasonal volatility, rates moved as expected throughout November and December. Typical seasonal patterns call for localized peaks around both holiday weeks, followed by a return to the floor in late January and early February. While risks related to external factors such as winter weather, a possible port strike and the new administration could complicate the exact timing, we still expect a rate pullback in early Q1.

National diesel prices continue to tick down, with the December average sitting at $3.49 per gallon. Low fuel prices continue to benefit carriers navigating higher operating costs amid low revenues. The long-term fuel cost outlook remains favorable for carriers, as the EIA predicts that global oil production will rise by over 1.6 million barrels a day in 2025, including a projected increase of U.S. production from 13.2 million barrels a day to 13.5 million barrels a day. While it is impossible to predict future fuel prices, additional supply should help keep them low.

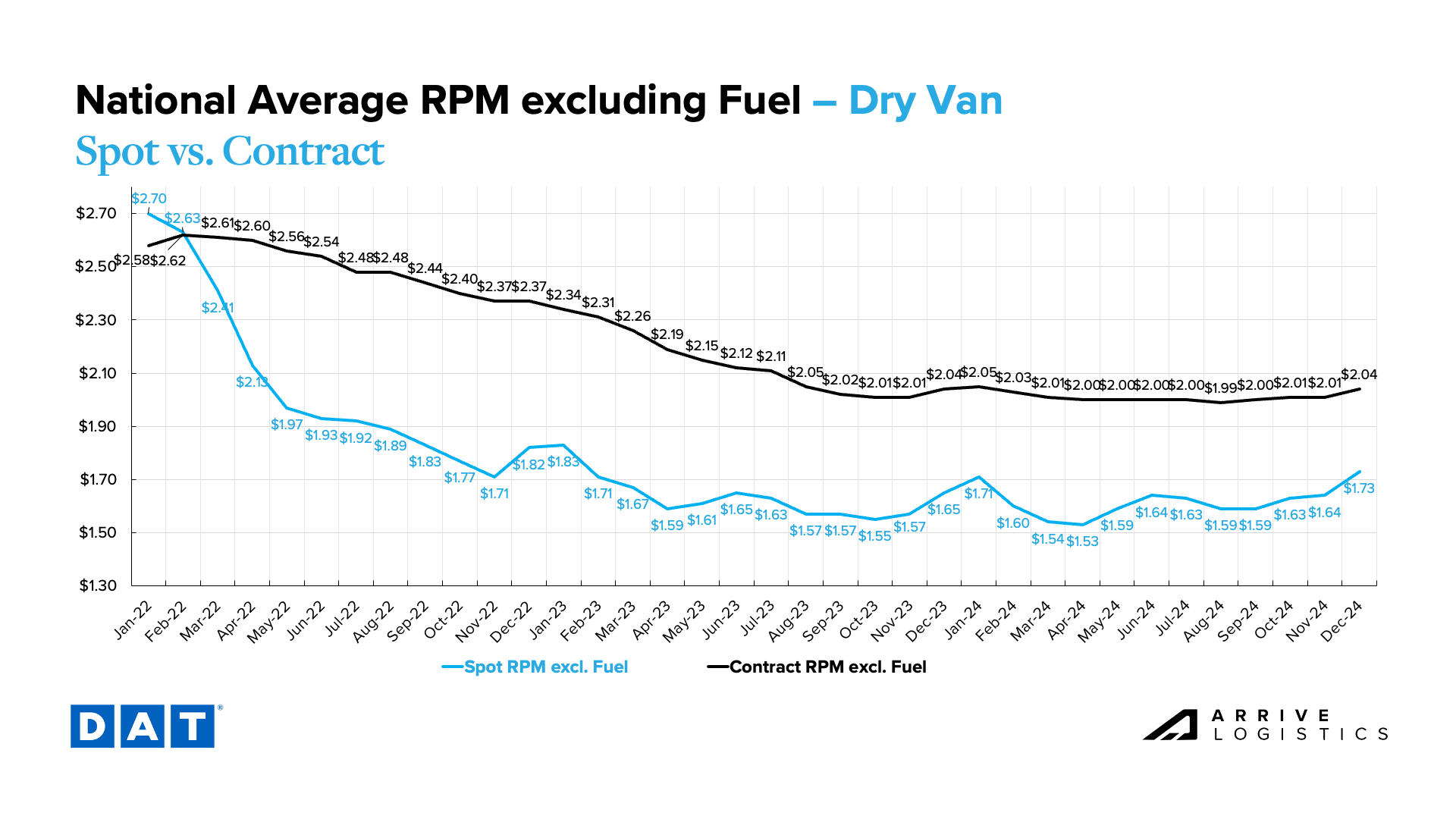

DAT dry van data showed the seasonal rate volatility we would expect around the holiday season. At $1.73 per mile, excluding fuel, spot rates rose over 4% year-over-year in December, while contract rates returned to flat year-over-year. These rates are expected to decline during Q1.

The spot-contract rate gap remains large at $0.31 per mile, making any sustained disruption at this time unlikely. However, this is half the cycle high of $0.66 seen in November 2022, where linehaul spot rates were also $1.71 per mile, excluding fuel. As the gap closes further, the risk of normal seasonal patterns or other external catalysts creating sustained disruption to shipper routing guides increases.

Reefer markets were volatile in November and December, with spot rates, excluding fuel, jumping up to $2.05 per mile from $1.97 per mile in October. Contract rates also increased slightly to $2.32 per mile but remained relatively stable overall.

Early December trends showed a slight pullback in spot rates. However, as challenges increased around the holidays, rates jumped up meaningfully.

The spot-contract rate gap is currently $0.27 per mile, a slight decrease from the cycle low of $0.28 per mile this November and down significantly from the cycle high of $0.58 per mile in October 2022, when spot linehaul rates were at $2.08 per mile, excluding fuel. As a result, the reefer market remains more susceptible to disruption than the dry van market.

DAT Temp Control National Average RPM Spot vs. Contract

Flatbed spot rates rose slightly in December but remained relatively steady. Contract rates show a large uptick, but that is typical as tender rejections increase at this time of year. Ultimately, the flatbed market continues to follow a more stable pattern than dry van and reefer. The spot-contract rate gap remains historically elevated, with no major disruptions likely in the near term.

What’s Happening: Inflation ticked up in November.

Why It Matters: The Fed may pause rate cuts.

Inflation remains above the target rate and ticked up to 2.7% in November. The Fed made another quarter percent cut during its December meeting and will revisit additional rate cut plans in January. With inflation remaining sticky, the Fed may pause rate cuts at the beginning of the year. In any case, no meaningful implications of rate cuts will materialize in the freight market until late 2025.

Recent Bank of America credit card data shows that consumers remain resilient. There were no signs of weakness in November or during the holiday shopping season, and spending levels should stay relatively stable in the near term as long as the labor market and wages continue to display strength.

As expected, typical seasonal trends dominated the 2024 peak holiday season and will continue to do so in Q1 2025. Higher tender rejection rates and increased spot activity following recent disruptions suggest the market is more balanced than it was a year ago. We are closely monitoring emerging holiday season trends to gauge how sensitive conditions might be to sustained disruptions in 2025.

Demand stability appears likely, particularly as shippers accelerate imports amid concerns over a potential second port strike and upcoming tariff increases. However, we believe supply remains sufficient to maintain routing guide compliance beyond the peak season. As the new administration’s policies take shape, we expect greater clarity on how they might impact transportation markets, with key areas of focus including tariffs, immigration, labor, industry regulation and environmental policies

With the right catalysts, a market shift is possible, but we are not yet prepared to predict widespread disruption in the near term. For now, we are watching for additional signs of vulnerability or any significant events that could abruptly affect demand or supply.

The Arrive Carrier Market Outlook, created by Arrive Insights™, is a report that analyzes data from multiple sources, including but not limited to FreightWaves SONAR, DAT, FTR Transportation Intelligence, Morgan Stanley Research, Bank of America Internal Data, ACT Research, Journal of Commerce, Stephens Research, National Retail Federation and FRED Economic Data from the past month as well as year-over-year. We know market data is vital in making real-time business decisions. At Arrive Logistics, we are committed to giving you the data and insights you need to better manage your freight.