"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

April trends mirrored March, with steady demand and abundant capacity. Rates have mostly followed typical seasonal patterns, declining heading into the first half of May and rising during DOT Week.

Heightened year-over-year volatility indicates that the market is still finding equilibrium. Capacity exits will continue, and typical seasonality will take shape in specific regions as produce season wraps up and the “100 Days of Summer” begins.

Below are the key takeaways from this month’s Carrier Market Outlook:

Spot rates continue to set new cycle lows amid steady volume and abundant capacity.

Expect regional volatility as the produce season winds down.

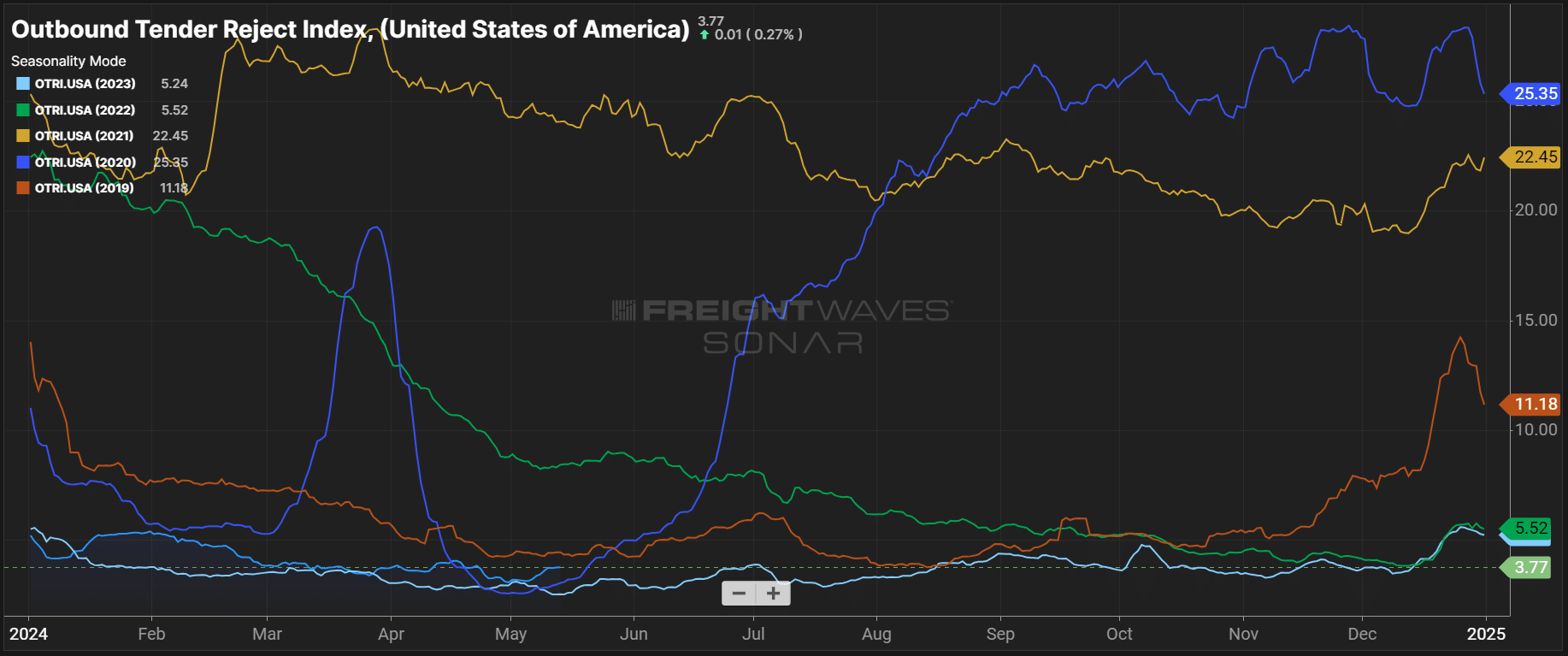

Tender rejections remain low but above 2023 levels, indicating the market is still soft but recovering.

Capacity continues to exit the market, albeit at a slower pace than in previous downcycles. Carriers with heavy spot market exposure continue to be hit hardest.

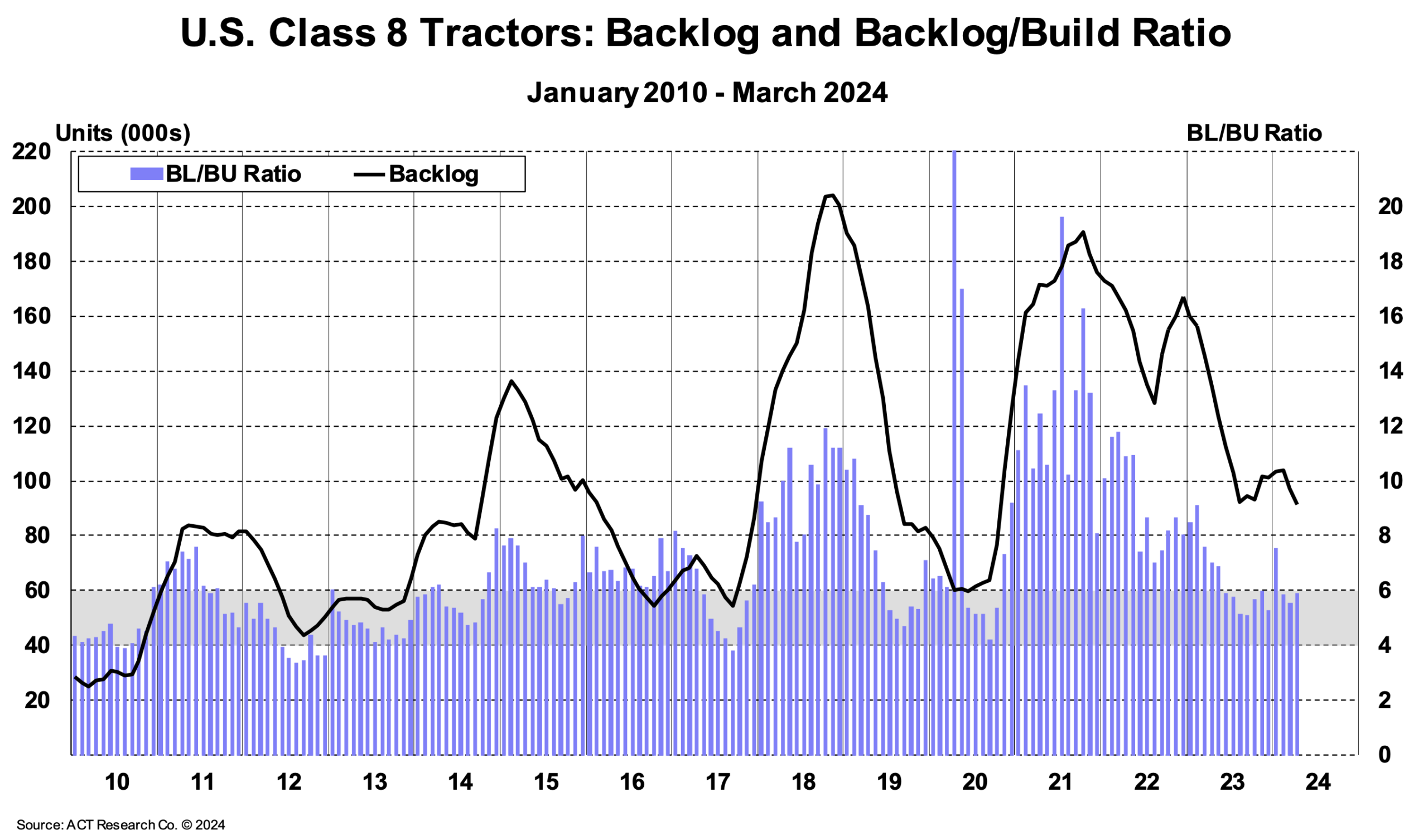

Backlogs continue to shrink as new Class 8 truck orders decline.

Fuel prices remain relatively steady but could rise as summer demand ramps up and tensions escalate in the Middle East.

A positive April inflation reading indicates that the Fed could still cut rates at some point this year. Lower interest rates should drive consumer spending and, as a result, increased truckload demand.

What’s Happening: Capacity is showing some volatility.

Why It Matters: Shifting capacity trends could increase rate volatility during the summer.

The Morgan Stanley Dry Van Freight Index is another measure of relative supply; the higher the index, the tighter the market conditions. The black line with triangle markers on the chart provides a great view of what directional trends would be in line with normal seasonality based on historical data dating back to 2007.

The most recent reading showed a small demand increase relative to supply in April. Though a slight deviation from seasonal expectations, this aligns with DAT spot posting data. As DOT Week concluded, the index remained in line with the historical averages for this time of year. Reefer data shows a similar deviation but is almost identical to 2023 from a year-over-year perspective.

The most recent (March) ACT Supply-Demand Index reading was 48.7, down from 53.5 in February, breaking a seven-month-streak of tightening conditions. Overall, rate movement in the for-hire market was similar, with spot rates hitting cycle lows. However, the market will likely continue to tighten through the 100 Days of Summer.

Though tracking total capacity is challenging, recent load-to-truck ratios and the April Outbound Tender Rejection Index reading indicate supply and demand are moving toward balance, leaving the market more vulnerable to seasonal pressures. Routing guides will see increased challenges due to the improved market balance but will remain intact overall and return to baseline after the Fourth of July.

The latest Sonar Outbound Tender Reject Index (OTRI), which measures the rate at which carriers reject freight they are contractually required to take, confirms that the market is more vulnerable to disruption than a year ago. Trends are approaching what they were in 2020, meaning the summer peak season could have a greater impact. However, recent rejection rate growth is unlikely to last beyond peak season due to the oversupplied market.

The DAT Load-to-Truck Ratio measures the total number of loads relative to the total number of trucks posted on its spot board. The April reading rose to 3.54 on the van side, slightly higher than April 2023 and in line with April 2022. Reefer load-to-truck ratios remained relatively flat month-over-month and slightly elevated year-over-year.

What’s Happening: The capacity surplus continues despite ongoing carrier exits.

Why It Matters: Ample capacity safeguards the market from disruption.

According to the latest revocations report, the for-hire carrier population has declined in 17 of 19 months. Though significant, the streak is still well short of The Great Recession, when the population fell in 28 of 30 months between October 2007 and March 2010. Despite the steady decline, there are 92,000 more active for-hire trucking firms today than before July 2020, when a massive wave of new carriers entered the market.

According to ACT Research, Class 8 Tractor sales have returned to replacement levels. While the for-hire market seems to have stopped adding capacity, private fleets still are. However, increasing cost pressures and low revenues continue to strain carriers’ financial health, indicating that new tractor orders may continue to decline this year. Ultimately, this trend would create tightness and drive rates up.

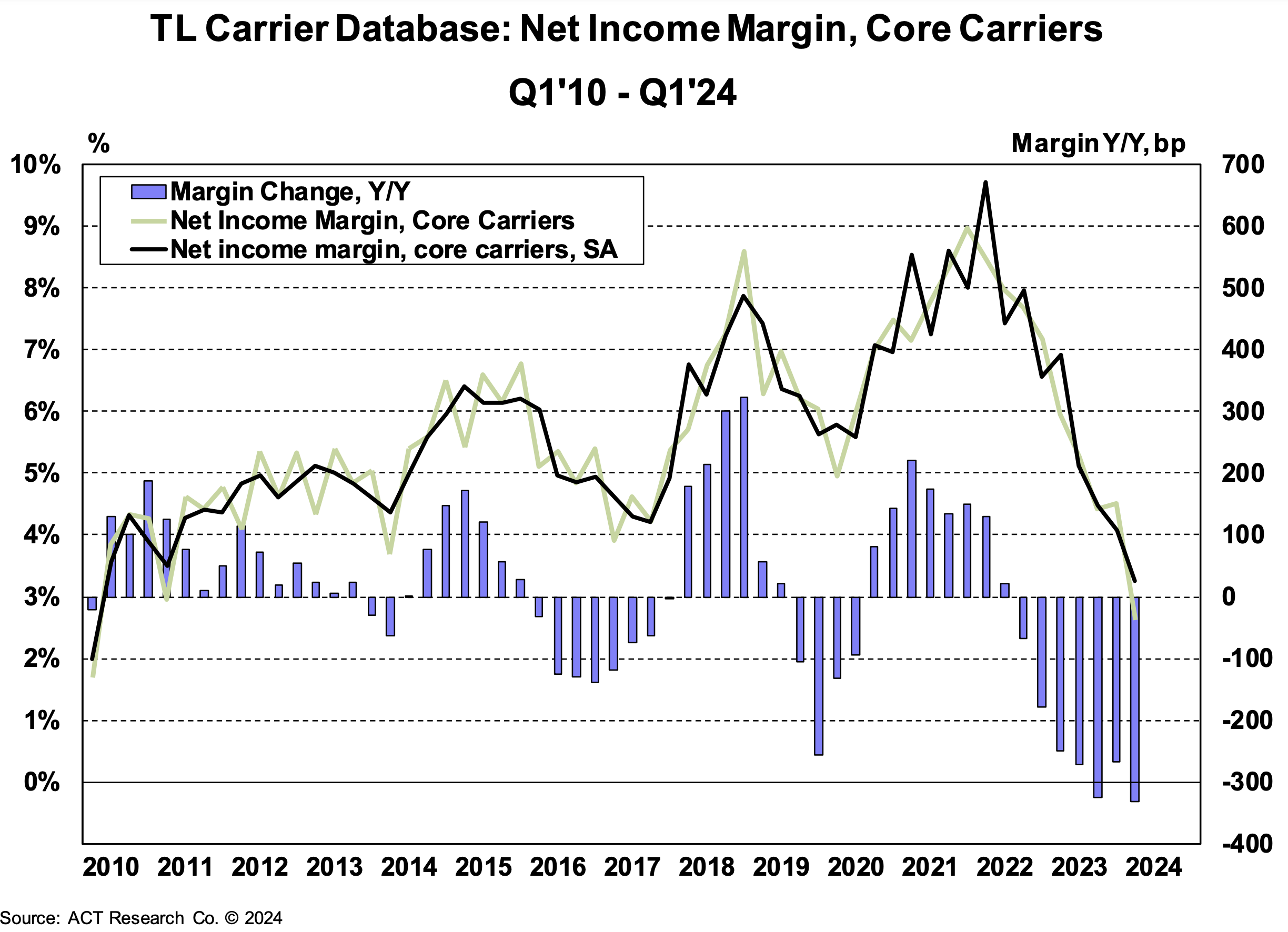

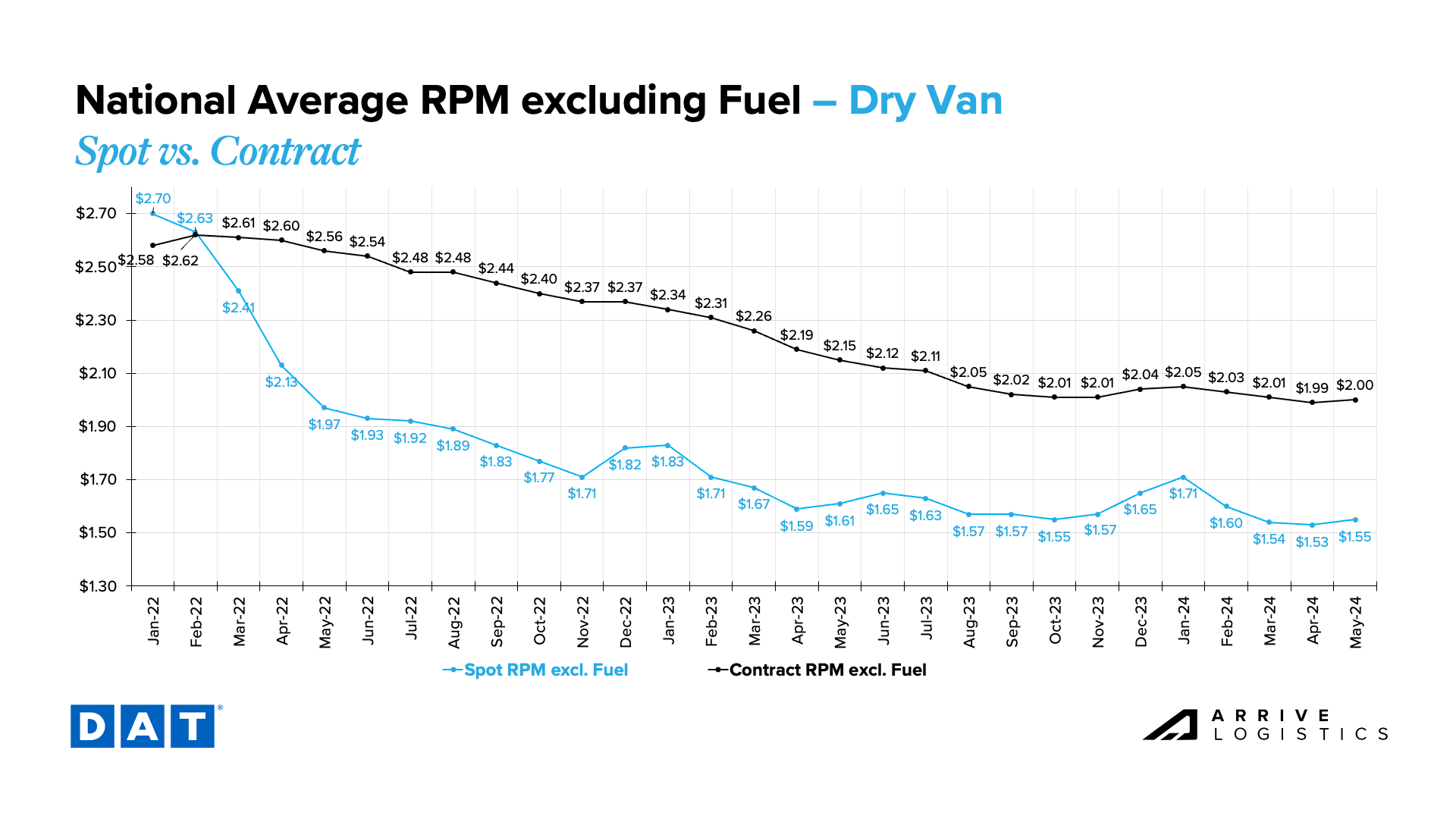

Carrier margins continued to sink in Q1 amid declining revenues and high operating costs. Net income margins for ACT’s ‘core carriers’ dropped to nearly 3% and had the largest year-over-year decline since at least 2010. With spot market rates almost 25% lower than contract, carriers with heavy spot exposure are feeling the greatest impact. Meanwhile, contract-driven fleets are still generating relatively strong revenues and private fleets continue to add capacity. As challenging conditions drive more carriers out of the market, rising rates amid shrinking supply will ultimately trigger inflationary conditions.

According to ACT Research, the preliminary Class 8 Backlog-to-Build ratio rose from 5.5 in March to 5.9 in April. After rising consistently towards the end of 2023 and into early 2024, the backlog has decreased for consecutive months, reaching 91,000 units, the lowest level in the last three and a half years.

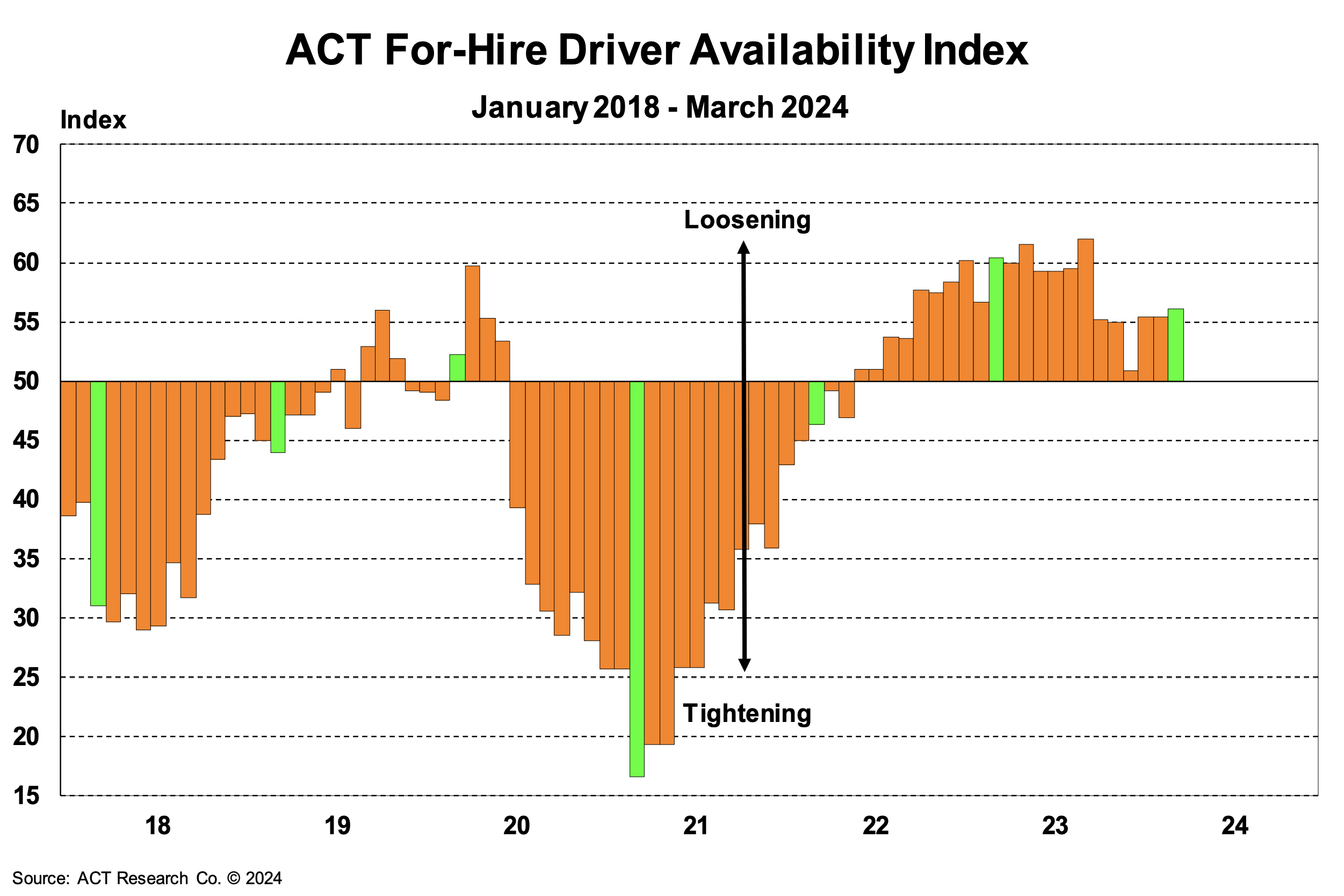

The latest (March) ACT Driver Availability Index reading was 56.0, up from 55.4 in February. This marginal increase indicates that driver availability remains strong, and there is no driver shortage. However, with rates low and wages decreasing, other sectors such as manufacturing and construction may start offering higher salaries, potentially drawing drivers away from the industry.

According to ACT, drivers continue to work past retirement age due to persistent inflation. If this trend is widespread, many drivers could retire simultaneously once inflation falls and interest rates are cut. This potential exodus could shock the market and lead to quicker-than-expected rate increases.

What’s Happening: Import forecasts for the next few months are encouraging.

Why It Matters: Consistently strong import volumes could drive increased truckload demand.

The National Retail Federation (NRF) import outlook remains positive for the summer and fall, forecasting over two million monthly TEUs. The most recent (March) import data showed U.S. ports handled around 1.93 million TEUs, down 1.4% from February but up 18.7% year-over-year.

While the large year-over-year increase is encouraging, it is important to note that Asian exports were slow in March 2023 due to the Lunar New Year. Nonetheless, the optimistic import forecast indicates retailers continue to order merchandise to meet strong consumer demand.

NRF Monthly Imports

According to DAT, spot market activity ticked up month-over-month and year-over-year in April, indicating a slight demand increase compared to the same period last year. Truck postings declined by nearly 19% amid ongoing capacity attrition and strong contract tender compliance.

What’s Happening: Market conditions look similar to last month.

Why It Matters: Rates held steady amid a surplus of capacity.

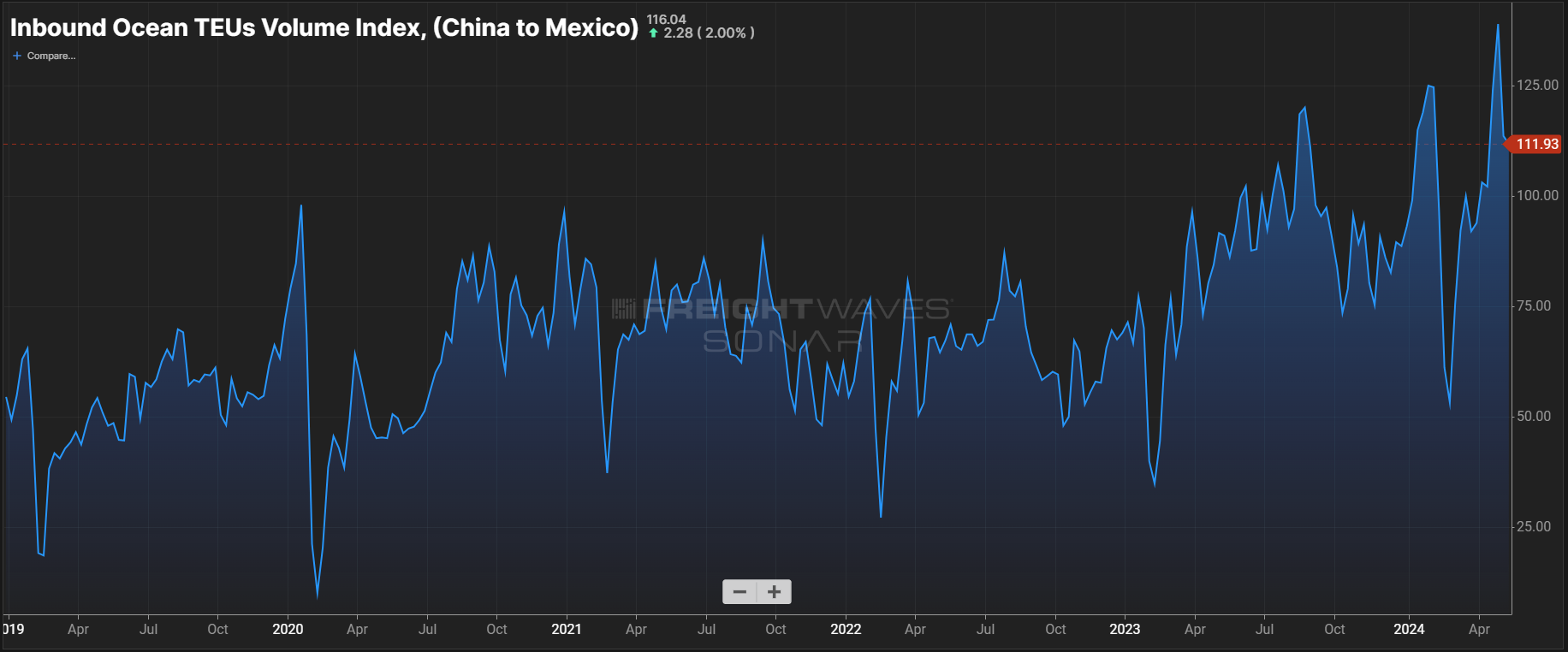

What’s Happening: Ongoing investment into Mexico is supporting increased freight demand.

Why It Matters: More production and manufacturing likely means greater demand for outbound Mexico freight.

What’s Happening: The LTL market is steady despite ongoing industry changes.

Why It Matters: LTL rates remain strong.

What’s Happening: Typical seasonality is expected as produce season continues.

Why It Matters: Regional volatility and rate increases are likely.

East Coast

Midwest

South Central

West

Pacific Northwest

What’s Happening: Flatbed demand remains strong.

Why It Matters: Rates are rising on the heels of increased demand.

What’s Happening: Rates are rising ahead of the 100 Days of Summer.

Why It Matters: Rising rates suggest increased volatility in the coming months.

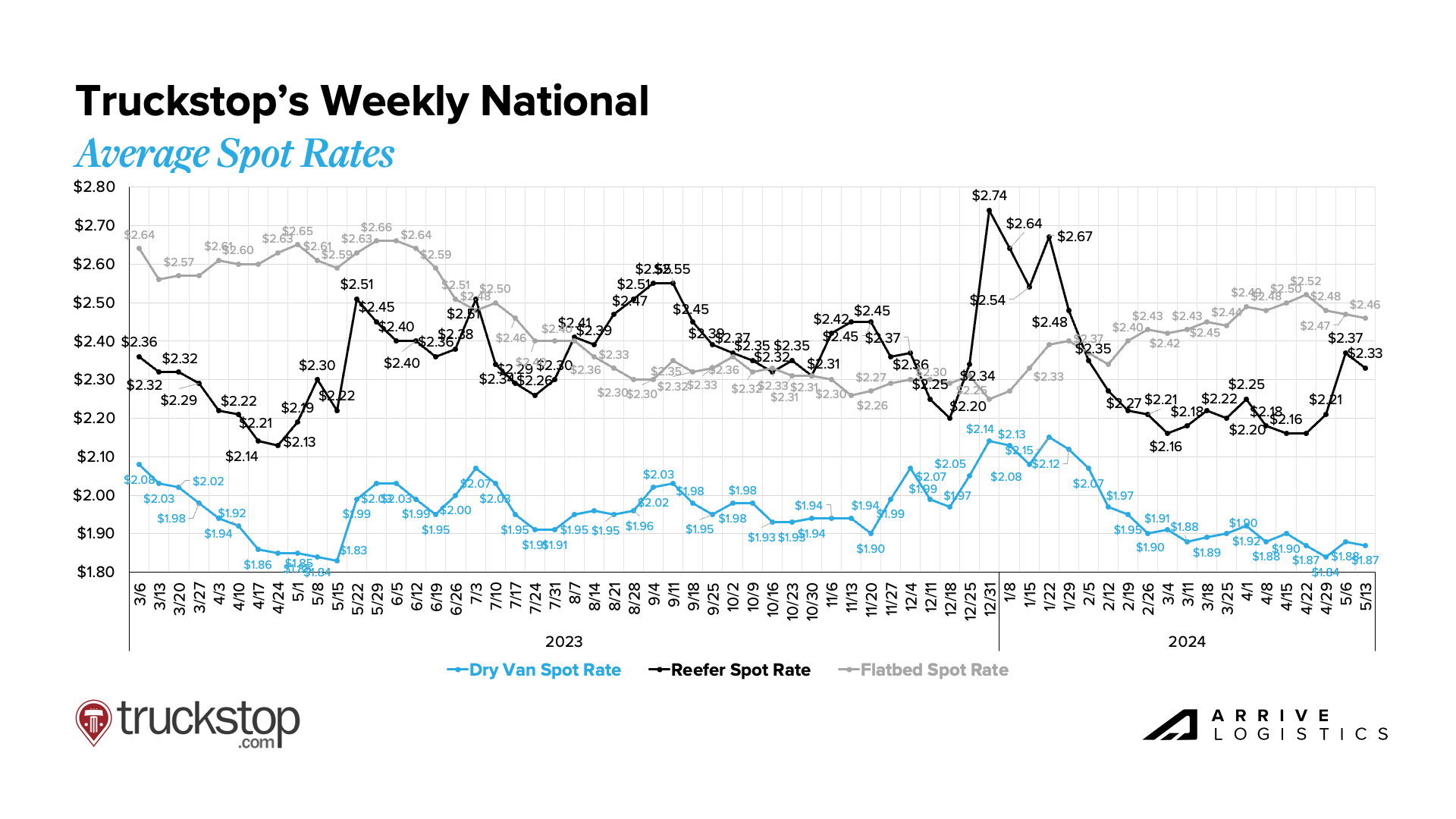

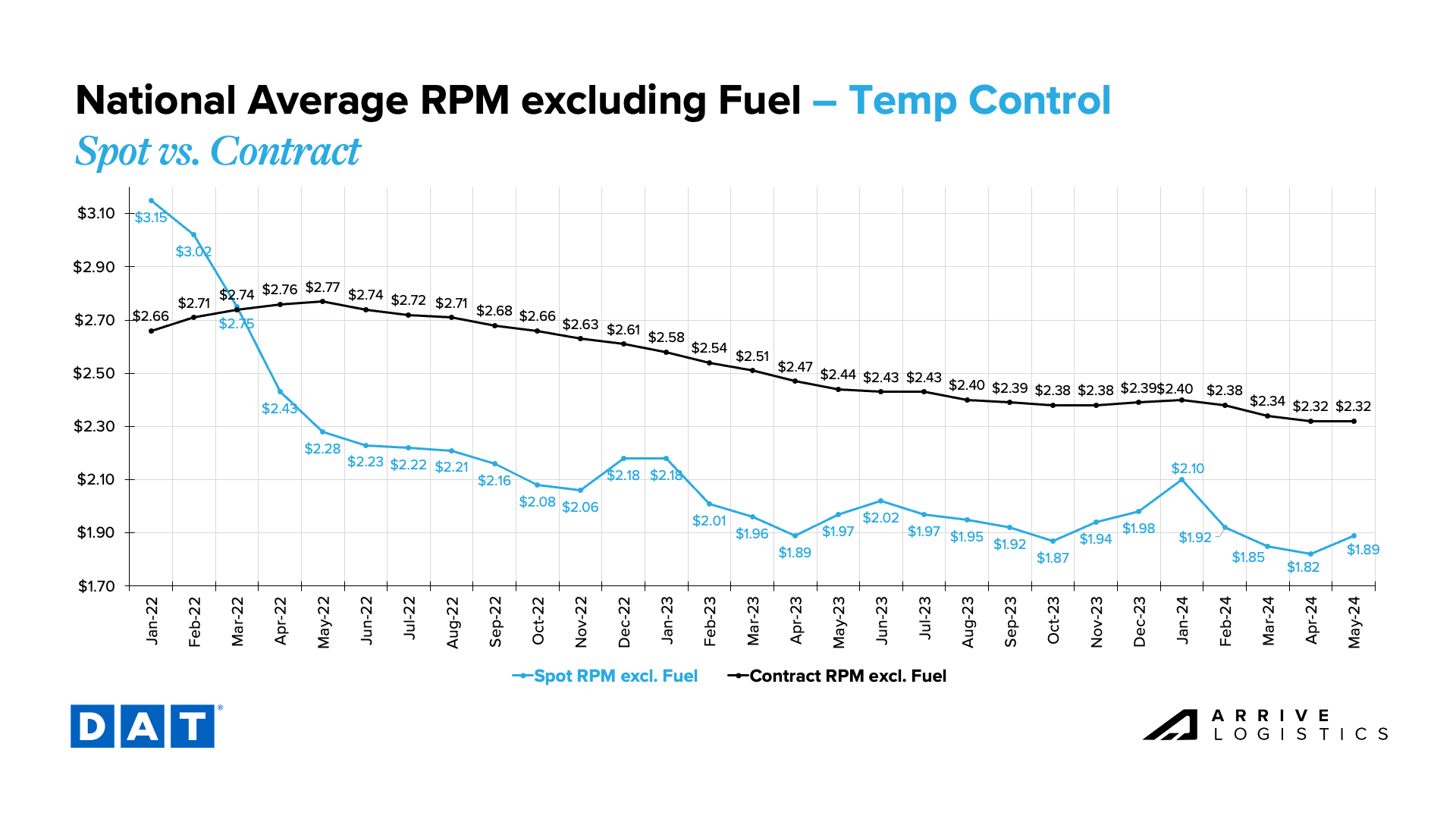

DOT Week spurred regional rate volatility, particularly for reefer capacity. It is unclear how high rates will rise from here, but based on 2023 trends, we anticipate a return to normal seasonality by July rather than a sustained disruption.

Truckstop’s Weekly National Average Spot Rates provide a detailed view of week-to-week movements and a real-time look into the current environment. Rates for all three equipment types are strikingly similar to this time last year, with van and reefer falling within just a few cents of 2023 levels. Given the year-over-year similarity of tender rejection and volume levels, rates will likely tick up this month, decline slightly in early June, and rise again around the Fourth of July and end of Q2. From there, rates should return to baseline levels as seasonal demand subsides.

National diesel prices started to decline again in early May, with the average falling below $4.00 per gallon for the first time since January. Declining fuel costs benefit carriers facing financial pressure due to increased operating costs and low revenue. However, prices could increase again as summer demand ramps up and tensions in the Middle East escalate.

DAT data shows dry van spot rates increased by $0.02 per mile to $1.55 per mile in May, excluding fuel. Contract rates also rose by $0.01 per mile to $2.00 per mile. While national data shows minimal rate movement overall, there is still volatility on a lane-by-lane basis, such as on outbound freight in the Southeast. On the contrary, inbound Southeast rates have decreased as carriers look to capitalize on opportunities in the region.

Reefer linehaul spot rates increased by $0.07 per mile to $1.89 per mile in May, aligning with typical seasonal trends for this time of year. Contract rates were flat at $2.32 per mile, excluding fuel. Like dry van, some lanes were more volatile than others; rates out of California and other parts of the West Coast are rising, while inbound rates for the same region declined.

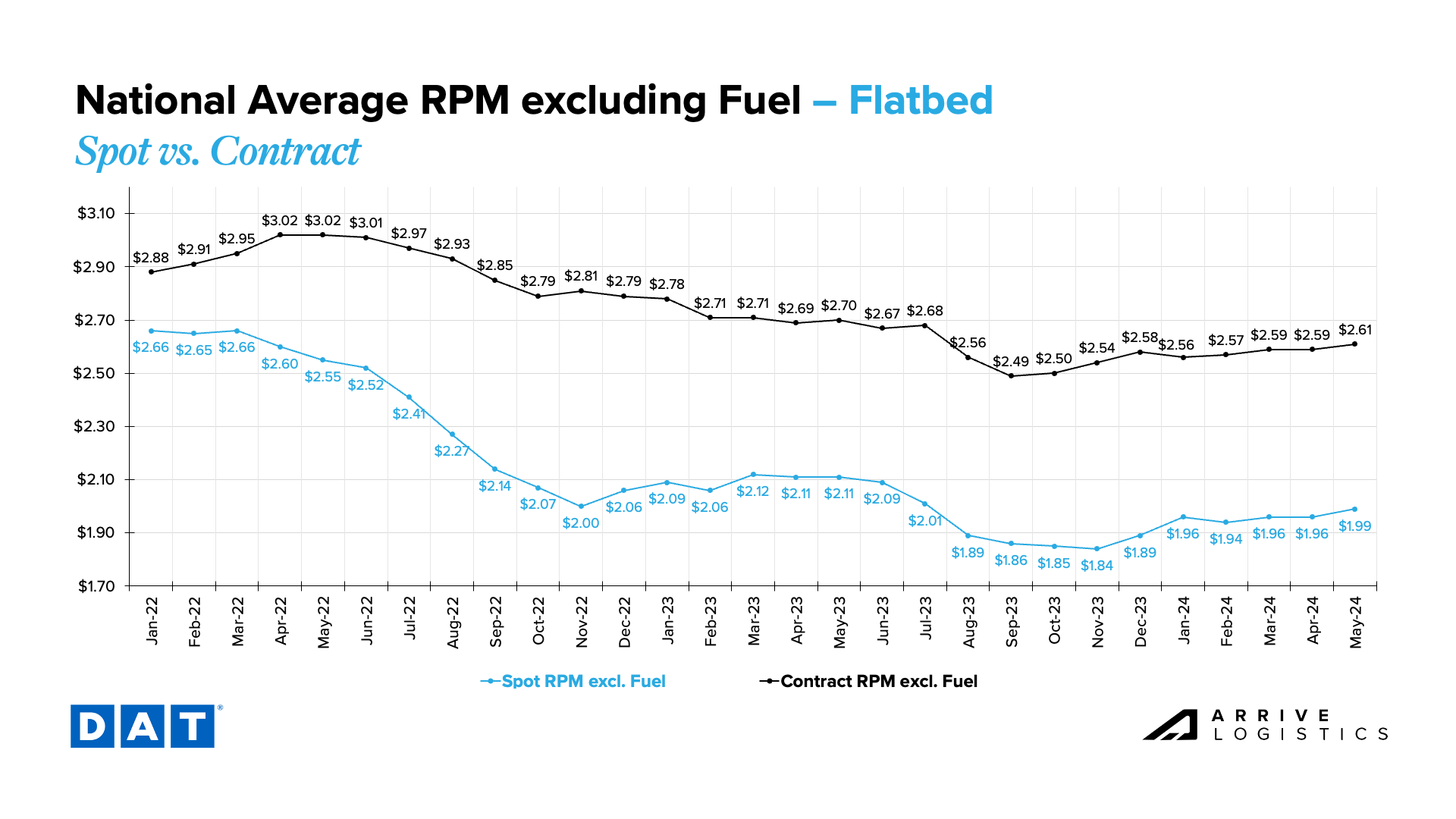

During the first half of May, flatbed spot and contract rates rose by $0.03 per mile and $0.02 per mile, respectively, driven by increased project-related freight demand for heavy equipment and commodities like steel. The gap between spot and contract rates remains large.

What’s Happening: Inflation is cooling slightly.

Why It Matters: If inflation data continues this positive trend, interest rates could fall.

April CPI data cooled to 3.4% from 3.5% in March, which may indicate interest rate cuts are still possible this year, but it is far from certain. Volatile energy costs like gasoline were the primary inflation drivers, while the cost of vehicles and some food items offset those increases. Housing inflation remained flat in April, which may concern policymakers who expected a better result.

Overall, the data is trending in the right direction. More positive readings could lead to interest rate cuts and drive freight demand. However, any near-term cuts are unlikely and could point to broader economic challenges. For now, the best-case scenario is sustained economic strength that allows for adjustment to higher interest rates and recovery in slow sectors.

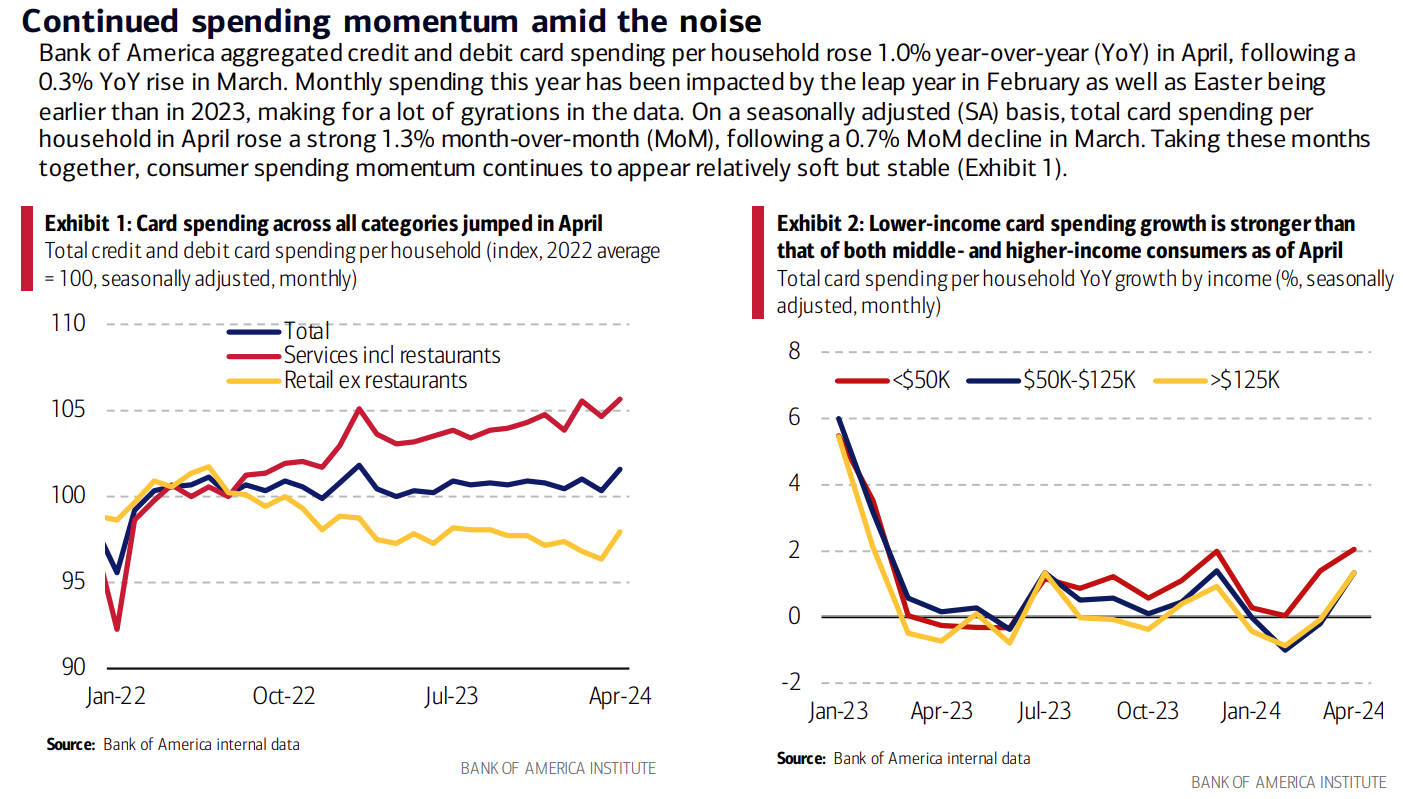

Bank of America card data showed a 1% year-over-year increase, with spending rising in the service and retail sectors, which should support a strong freight environment. Lower-income households’ after-tax wages and salaries increased, leading the growth rate to outpace middle and upper-tier income households. While encouraging, the cooling labor market could soon present new challenges, such as reduced spending on non-essential goods.

Market conditions in April followed typical seasonality, as relatively stable demand coupled with abundant capacity sent spot rates plummeting to a new cycle low in April.

In May, conditions moved in line with typical seasonality as well, with rates across all modes ticking up prior to DOT Week. As the produce season winds down and the 100 Days of Summer begins, we expect rates to remain above April lows. Regionalized volatility will continue similar to last year, but will be muted compared to 2021 and 2022.

Our overall outlook for the remainder of 2024 remains the same, with increased volatility compared to the first few months of 2024. As capacity continues to exit the market, vulnerability will increase and demand fluctuations will result in upward rate movement.

The Arrive Carrier Market Outlook, created by Arrive Insights™, is a report that analyzes data from multiple sources, including but not limited to FreightWaves SONAR, DAT, FTR Transportation Intelligence, Morgan Stanley Research, Bank of America Internal Data, ACT Research, Journal of Commerce, Stephens Research, National Retail Federation and FRED Economic Data from the past month as well as year-over-year. We know market data is vital in making real-time business decisions. At Arrive Logistics, we are committed to giving you the data and insights you need to better manage your freight.