"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

Recent trends support our forecast. Van and reefer spot rates are down in early April and, after a brief seasonal pickup, will likely find a floor this month or early next before summer peak season activity picks up in mid to late May.

Meanwhile, the large ongoing spot-contract gap will continue to drive downward pressure on contract rates that are up for negotiation throughout at least the year’s first half.

Finally, demand is faltering as capacity continues to normalize to new levels, which should ultimately facilitate longer-term equilibrium conditions until a significant enough demand disruption impacts the market.

"*" indicates required fields

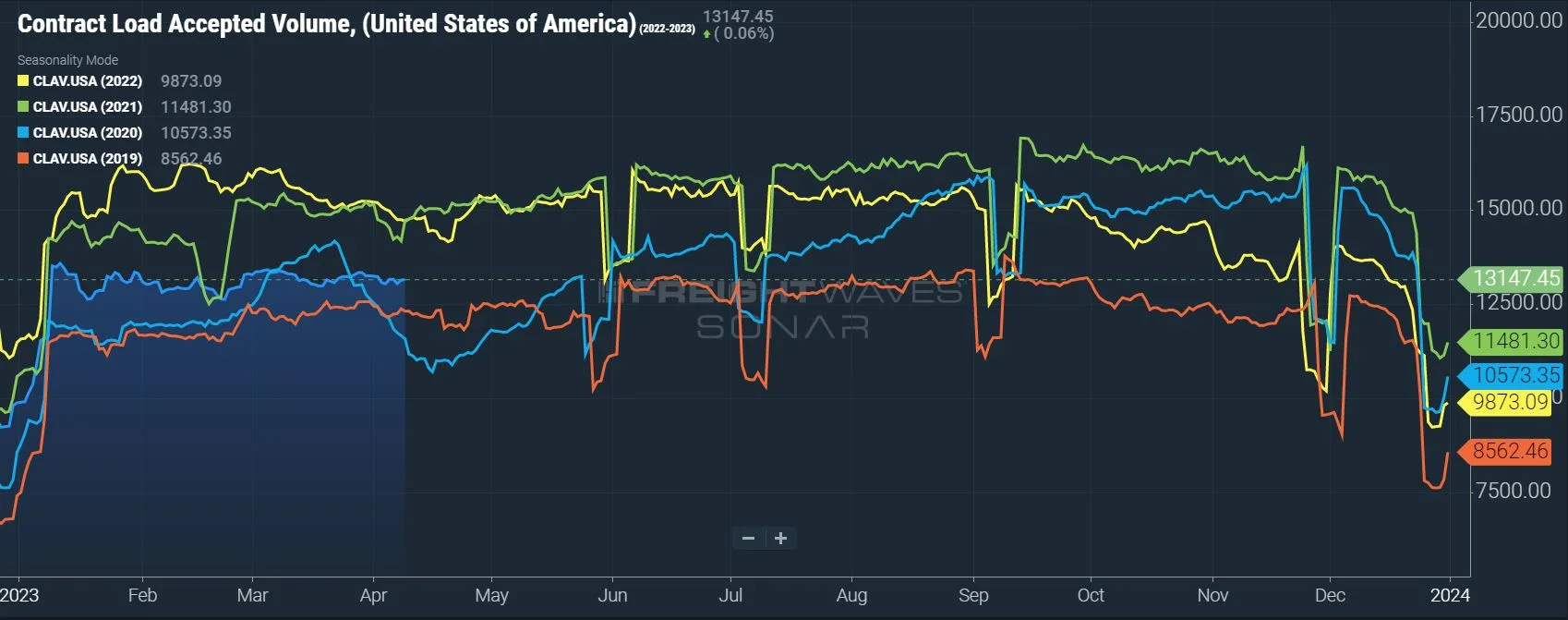

Demand remains healthy overall, but large allocations continue to move via primary contract carriers.

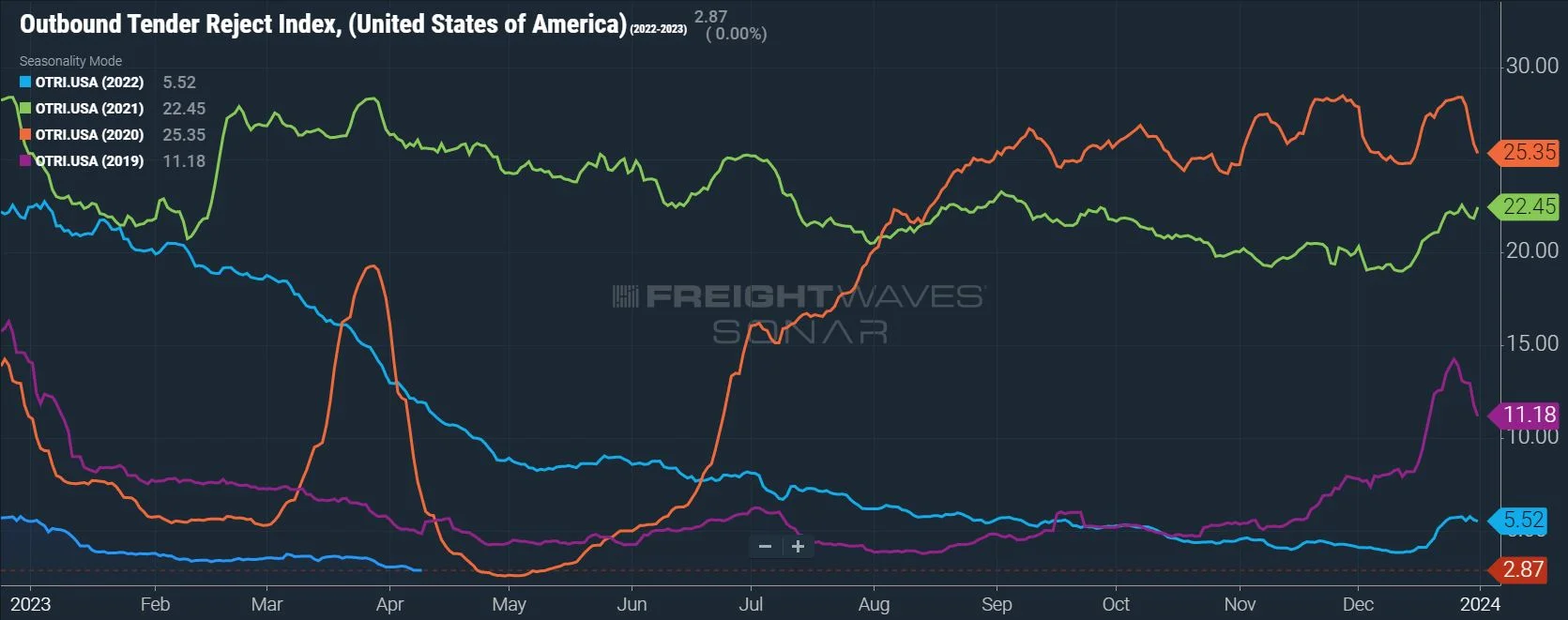

Tender rejection activity below 3% illustrates historically strong contract compliance and carriers’ appetite for accepting nearly all contract freight.

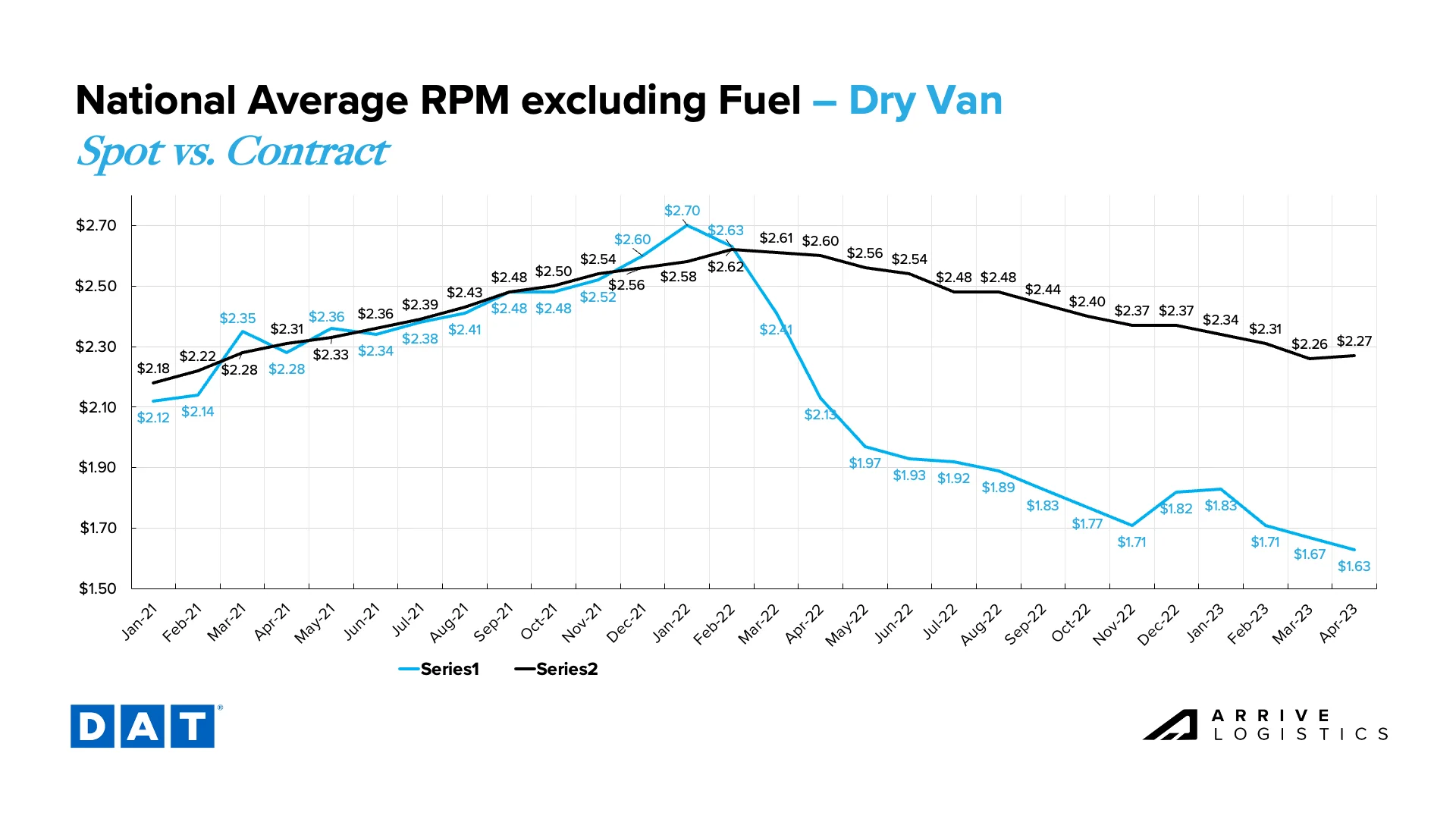

The gap between spot and contract rates for van and reefer equipment is currently $0.63 and $0.60 per mile, respectively, meaning downward contract rate pressure will persist.

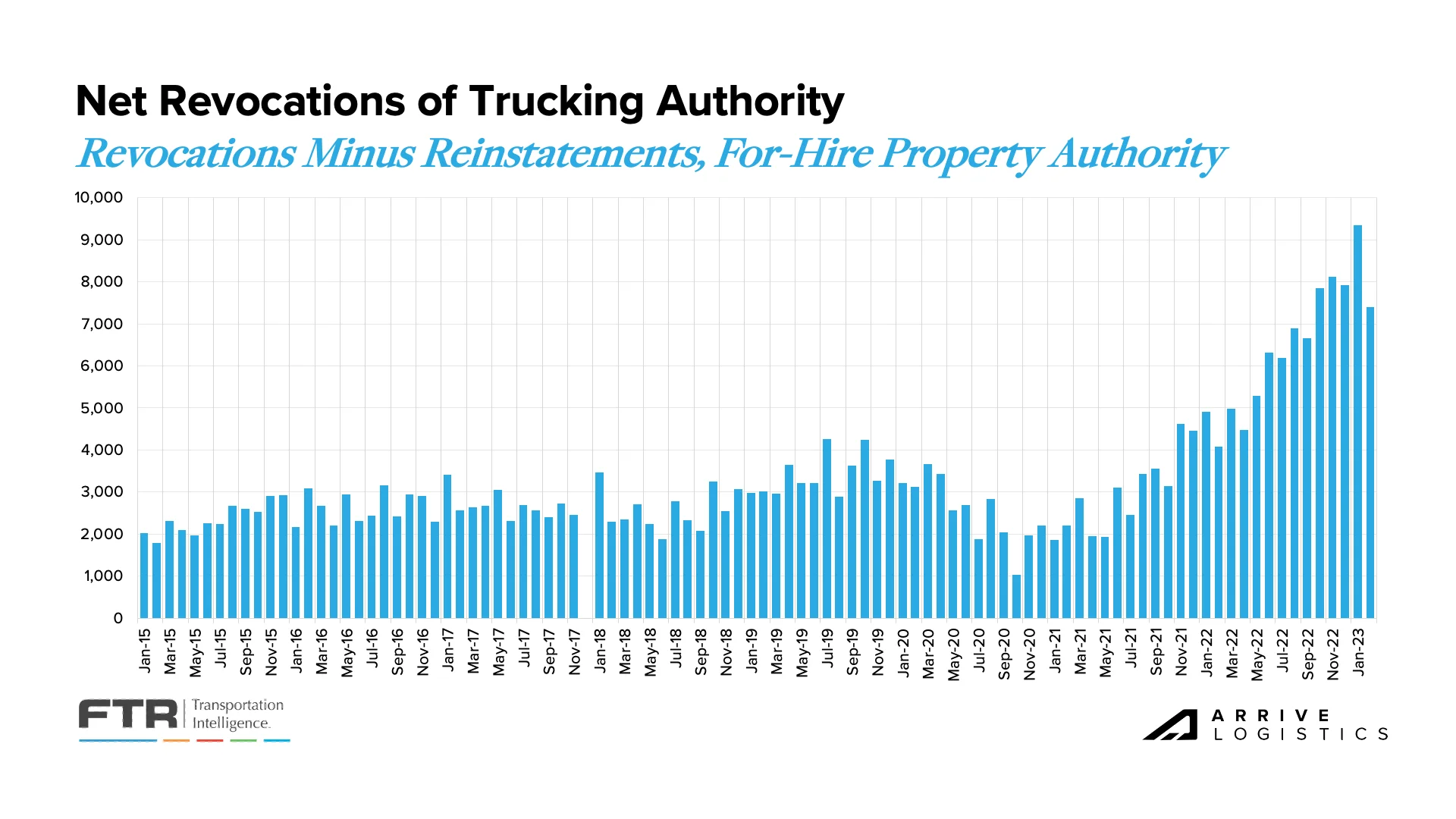

Current spot rates are too low to support operating costs for most carriers and are driving large numbers of authority revocations among owner-operators with high spot market exposure.

Trucking employment unexpectedly recovered in March following a sharp February decline, indicating carriers are seeing stronger demand than anticipated, particularly in the flatbed sector.

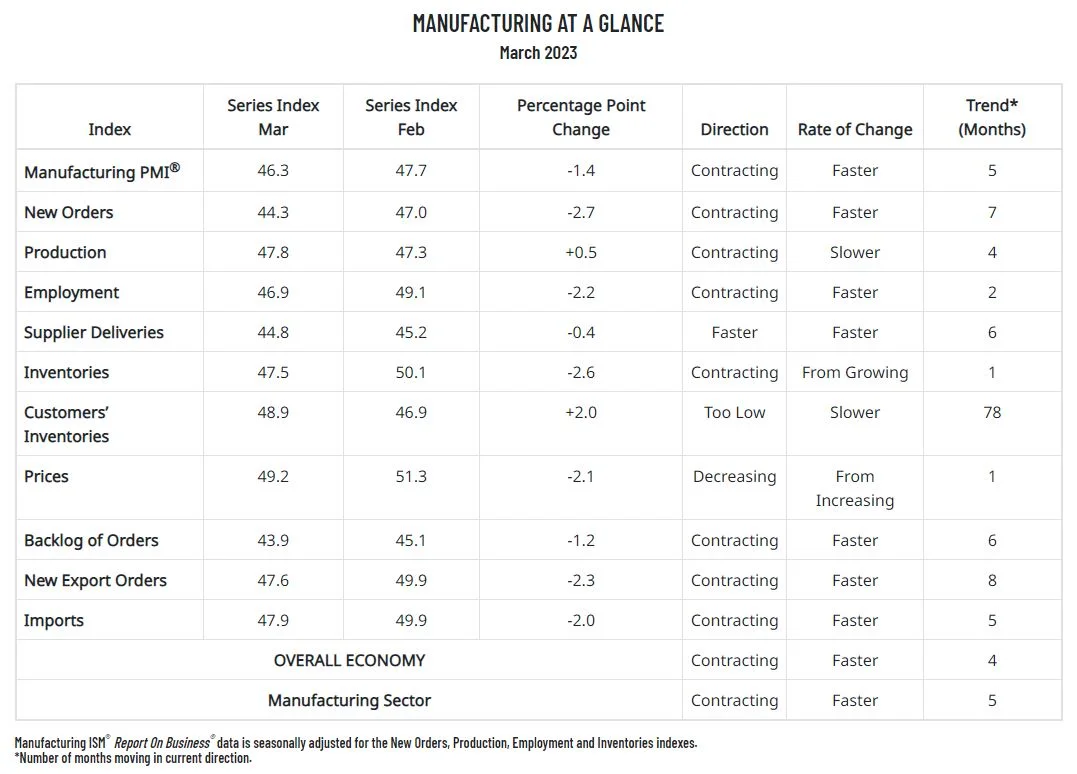

The manufacturing sector, which was expected to be a key driver of demand in 2023, contracted for the fifth straight month, increasing potential downside demand risk.

Consumer spending declined 1.5% on a seasonally adjusted basis in March, driven by pullbacks in spending on durable goods as services spending remained flat.

The National Retail Federation indicated retail imports are on the rise; they are likely to grow through the summer but remain close to pre-pandemic levels, a sharp decrease from the record volumes of 2022.

Initial jobless claims and the unemployment rate indicate the labor market remains relatively healthy in early April, bolstering confidence in consumers’ ability to maintain spending and prevent rapid truckload demand declines.

What’s Happening: The start of produce and construction season typically drives seasonal demand increases in March, but overall activity remained relatively stable this year.

Why It Matters: Shippers can expect minimal volatility risk given low demand and the surplus of capacity in the market.

Though trucking activity typically increases in March, all signs point to relatively stable demand month-over-month. A muted early produce season and single-family home construction slowdown are two likely culprits in driving accepted contractual tenders down 1.8% in early April from where they were a month ago.

The FreightWaves SONAR Outbound Tender Volume Index (OTVI), which measures contract tender volumes across all modes, was down 22% year-over-year, or 13% when measuring accepted volumes after the significant decline in tender rejection rates. The significant decline is still inconsistent with other sources. Though unconfirmed by FreightWaves, their data is likely skewed heavily toward retail freight, for which demand has slowed substantially since Q4 2021. If true, this would help explain the significant volume drop.

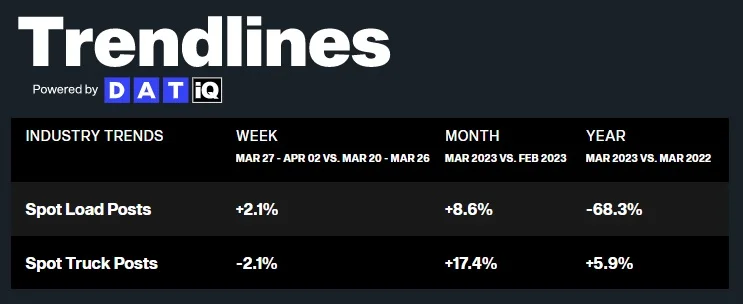

The contract versus spot market story stayed mostly consistent in March. Shippers still heavily favored contractual freight, but there was a meaningful pickup in spot activity. Though DAT data showed spot volumes were down nearly 70% year-over-year, the 8.6% month-over-month growth in March aligns with typical seasonality heading into the final month of the first quarter.

What’s Happening: Persistently soft conditions and an oversupply of capacity led to another month of historically low tender rejections in March.

Why It Matters: Shippers will continue to see ample supply and excellent service from carriers.

Despite the spot activity uptick, March made clear that capacity is and will likely continue to be abundant in the market in the coming months. Tender acceptance improved from already historically high levels, indicating carriers continue to show a strong interest in and ability to support current contractual freight demand.

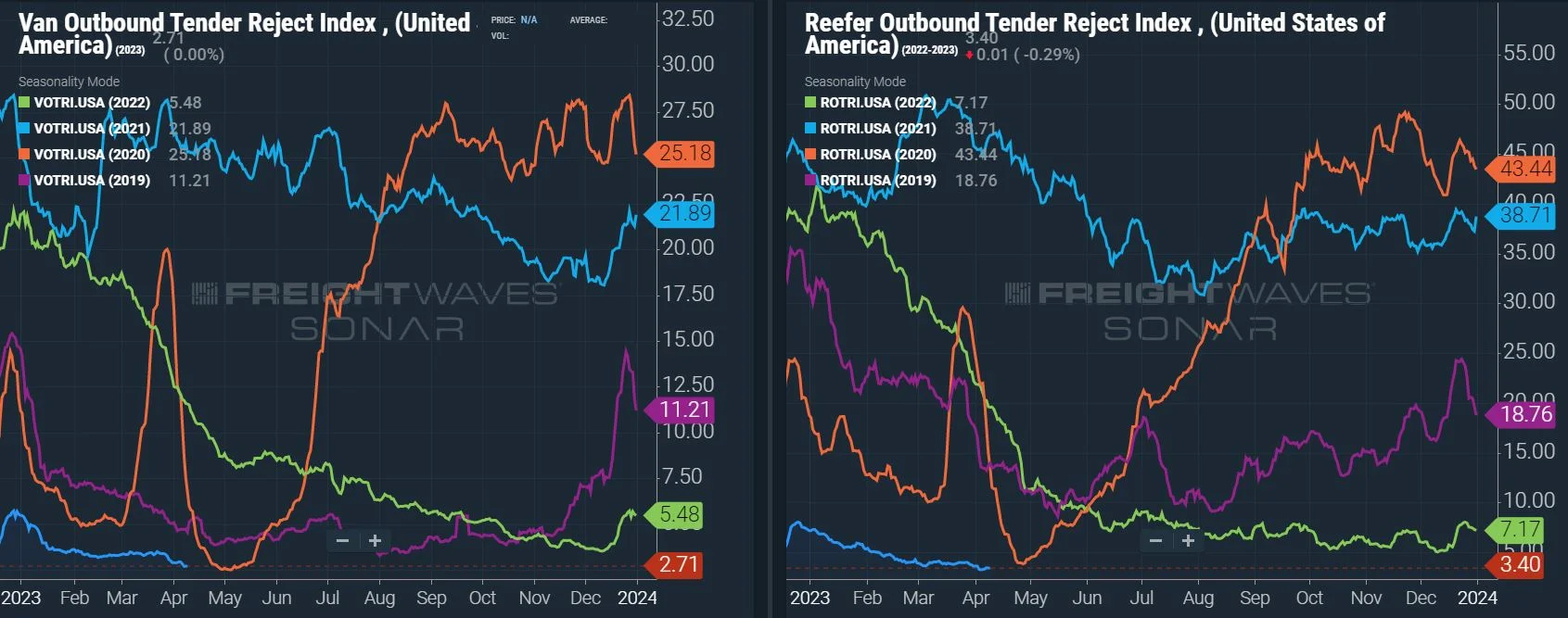

The Sonar Outbound Tender Reject Index (OTRI) measures the rate at which carriers reject the freight they are contractually required to take. The month-over-month rate remained relatively flat, decreasing from 3.5% in early March to 2.87% in early April, meaning good routing guide compliance on contractual freight continued for shippers. Meanwhile, reefer tender rejections aligned with van rejections, easing throughout the month.

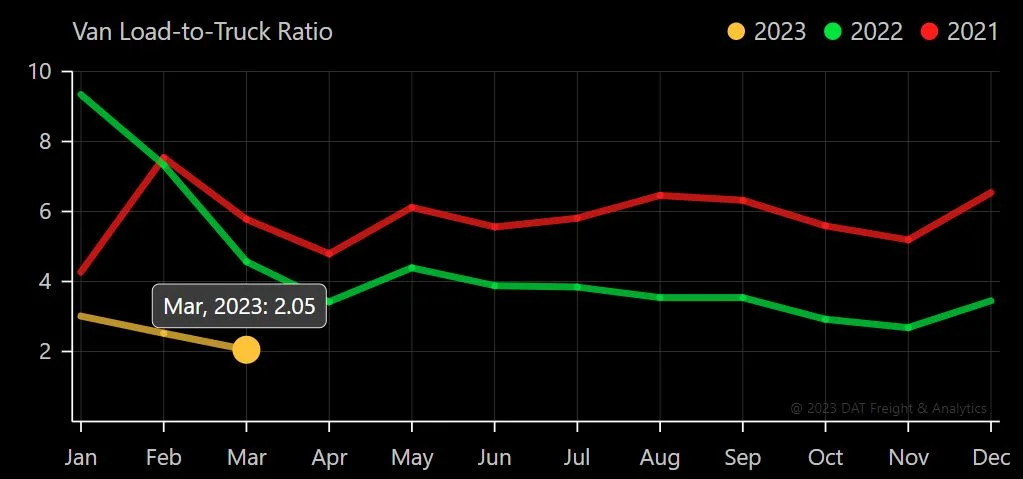

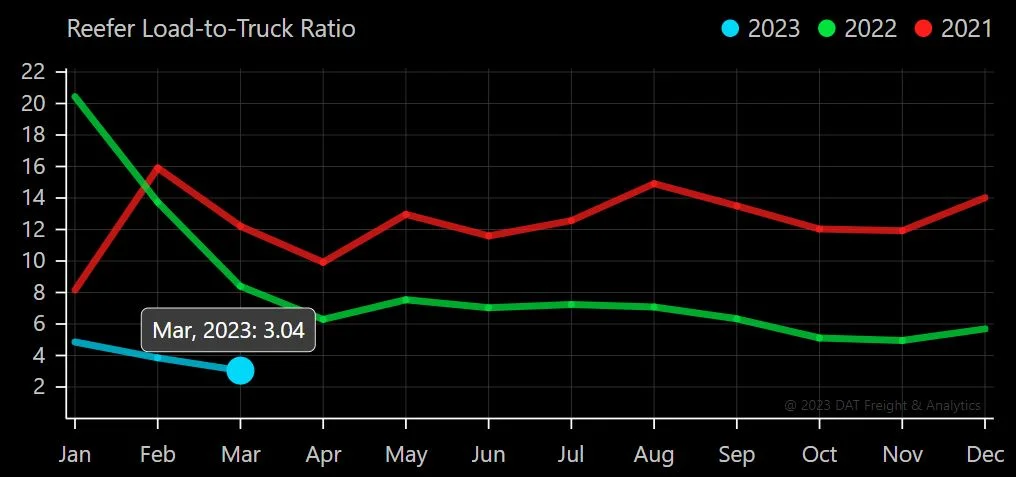

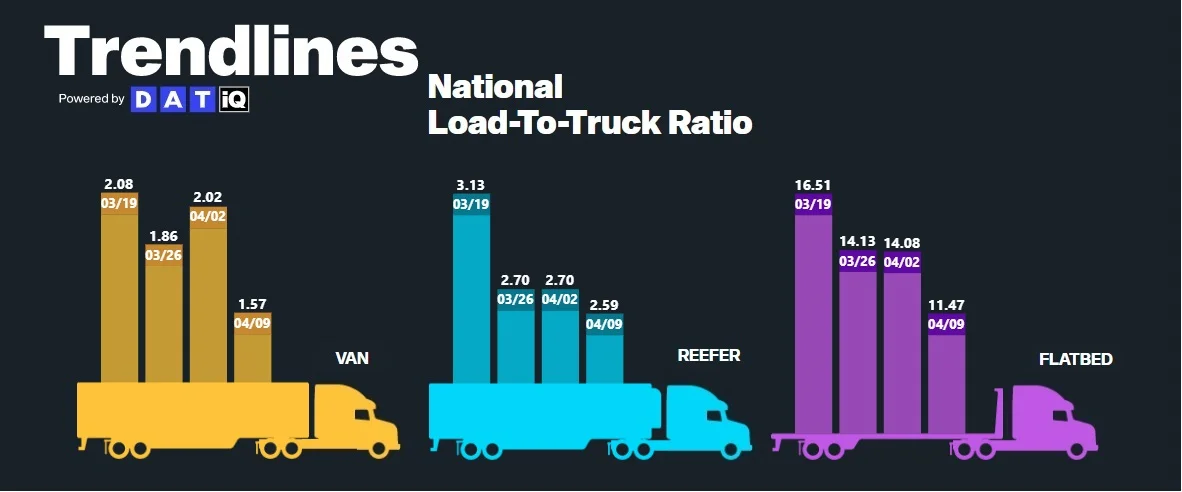

The DAT Load-to-Truck Ratio measures the total number of loads relative to the total number of trucks posted on their spot load board. March data was inconsistent with typical seasonal pressures: The Dry Van Load-to-Truck Ratio was down 18.8% month-over-month and 55% year-over-year, and the Reefer Load-to-Truck Ratio was down 21.1% month-over-month and 63.8% year-over-year.

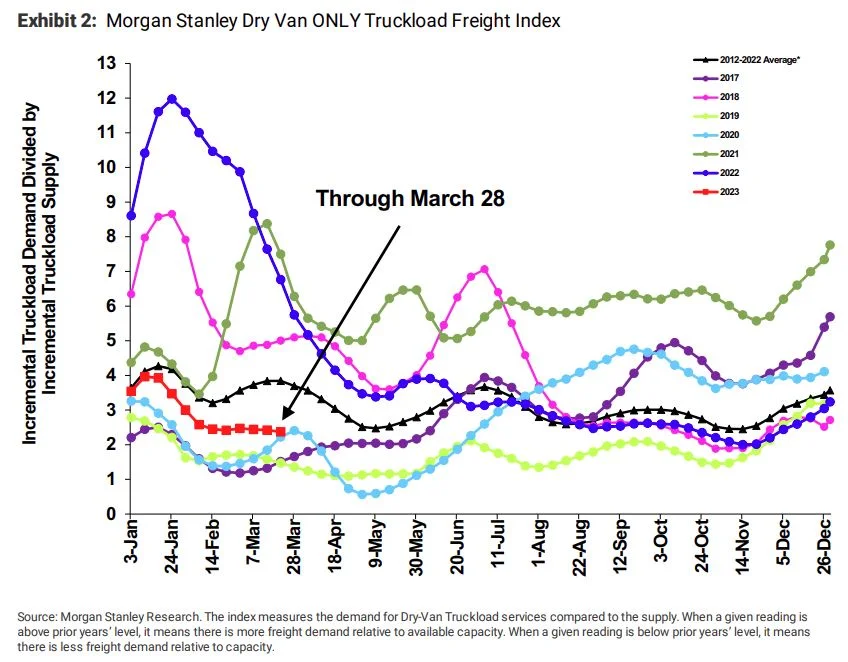

The Morgan Stanley Dry Van Freight Index is another measure of relative supply; the higher the index, the tighter the market conditions. The black line with triangle markers on the chart provides a great view of what directional trends would be in line with normal seasonality based on historical data dating back to 2007.

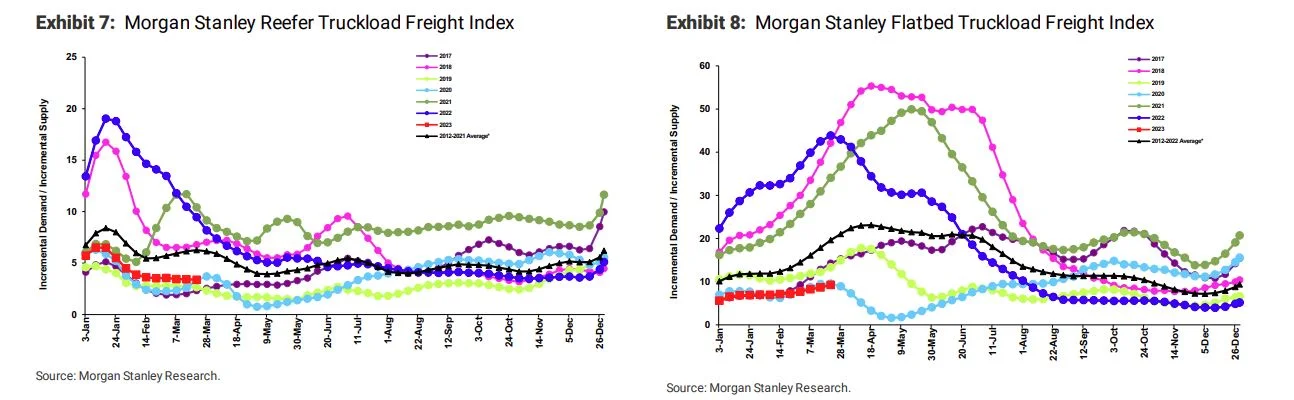

Similar to other truckload supply measures, normal seasonal trends typically indicate increasing tightness at this time. The data, however, illustrated flat to decreasing tightness as the month progressed; this mirrors tender rejection and load-to-truck data and provides further evidence that capacity is abundant relative to demand. Normal seasonality would lead us to believe that conditions could soften further in April before the summer peak season leads to some increased pressure in mid to late May.

What’s Happening: Dry van and reefer rates are down following a slow start to produce season, but flatbed rates are rising as construction season gets underway.

Why it Matters: The market remains soft overall, creating advantageous conditions for shippers.

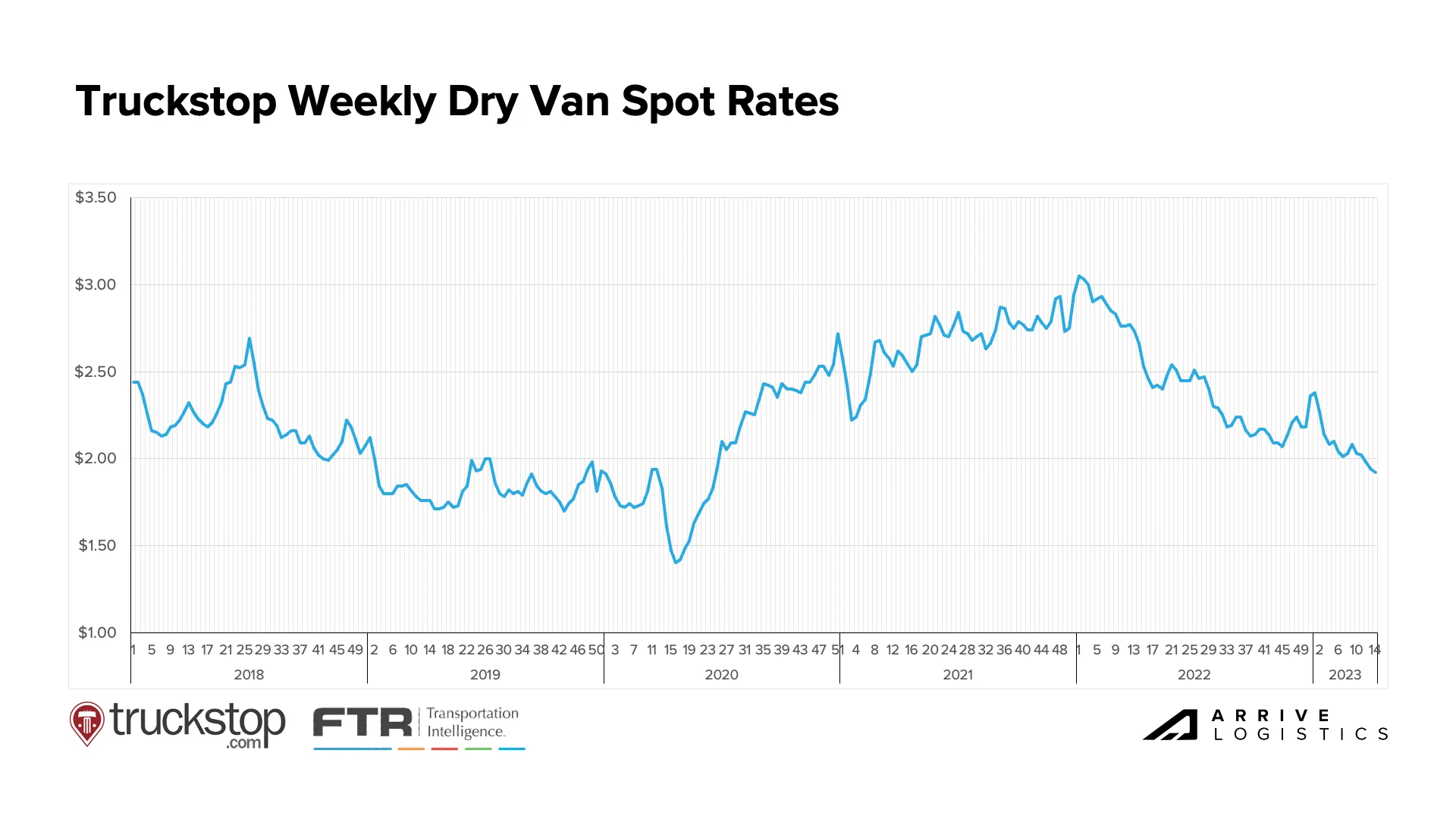

Spot rates tend to move in line with load-to-truck ratios and other relative truckload supply measures, so it is no surprise to see downward trends for van and reefer spot rates throughout March. According to Truckstop and FTR, Weekly Dry Van Spot Rates have fallen for five straight and 10 of the last 13 weeks since the beginning of the year. With normal seasonality pointing to even softer conditions ahead in April, some room is likely left before spot rates bottom out. Shippers are still in a great position to lock in low contract rates as we approach the floor.

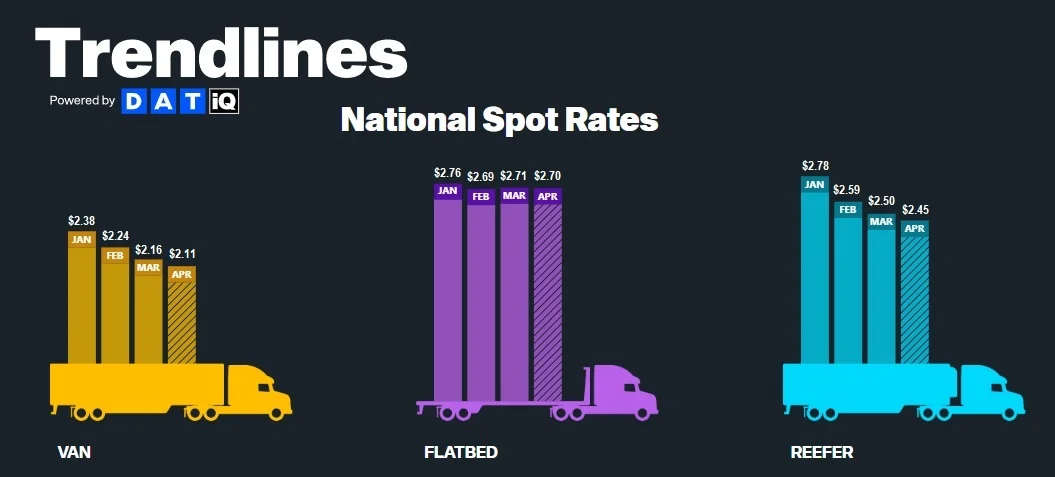

According to DAT, all-in spot rates, including linehaul and fuel costs, are down across all three equipment types. As of April 9th, van and reefer equipment rates have fallen by $0.05 from March, while flatbed rates are down just $0.01 per mile.

Early April linehaul data shows van and reefer spot rates trending downward while flatbed spot rates are rising. Reefer contract rates are the only equipment type seeing increases so far month to date, as both van and flatbed contract rates show relatively flat growth on a month-over-month basis.

The van rate spread increased month-over-month to $0.63 between spot and contract. As a result, downward pressure on contract rates should continue for the foreseeable future, even if the market experiences some seasonal pressures in the back half of the second quarter.

All-in dry van spot rates are down 23.8% year-over-year, while linehaul spot rates are down 23.5%. All-in dry van contract rates are down 15.4% year-over-year, and linehaul contract rates are down 13.1%.

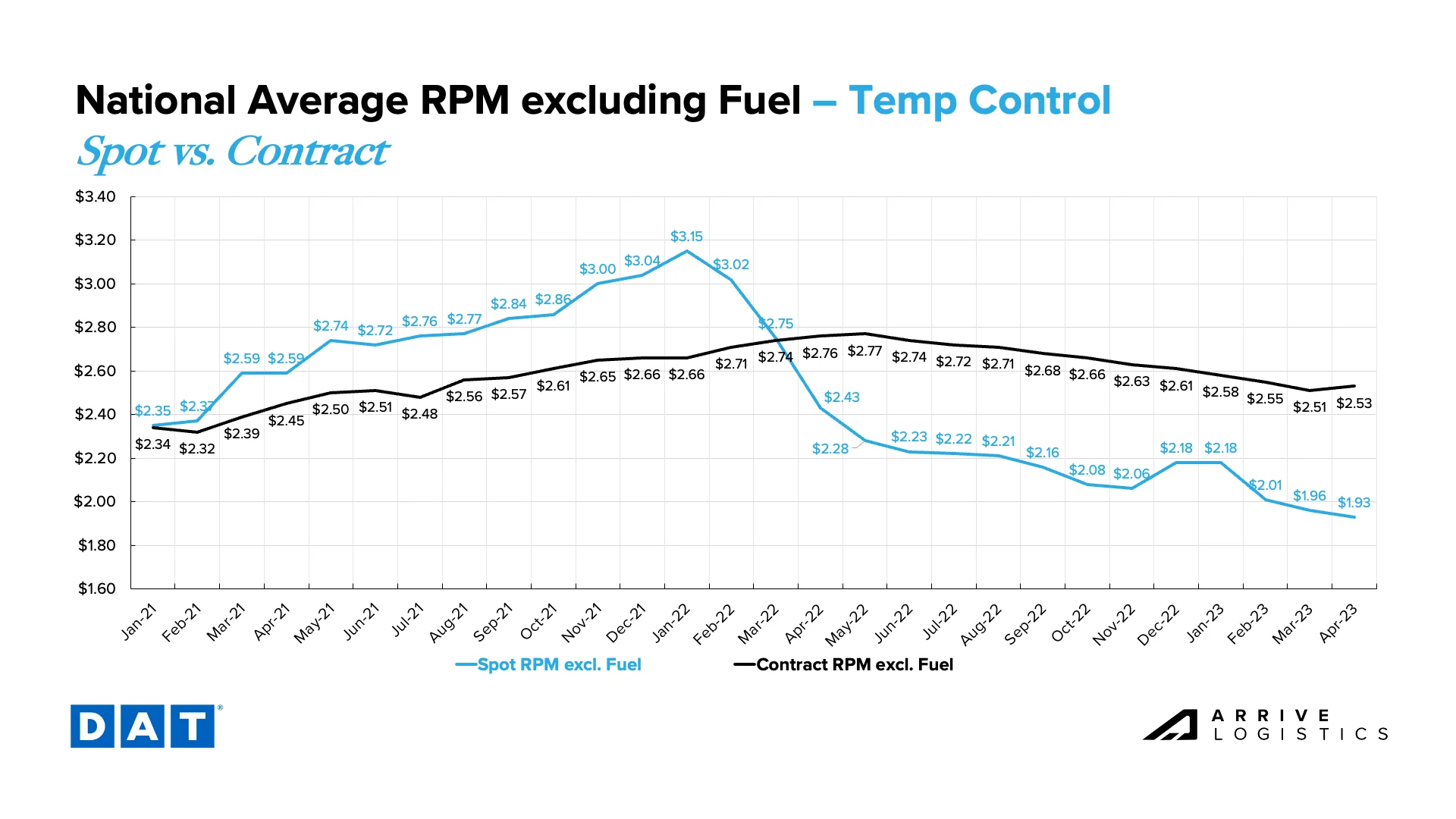

Reefer spot linehaul rates are following the same pattern as van rates early in the month, while contract rates are showing their first potential increase in nearly a year. It will be a surprise if those contract increases are realized, as spot rates hitting their floor is typically a prerequisite to a shift in the directional trend of contract rates — especially with the reefer spot-to-contract rate spread of $0.60 per mile. We believe increased demand ahead of Easter is driving this trend, and by the end of the month, contract rates will show a decline from March.

Down 8.3% year-over-year, the current reefer contract rate is $2.53 per mile, excluding fuel, while the current reefer spot rate is down 20.6% year-over-year to $1.93 per mile, excluding fuel. This is a significant decline but slightly less dramatic than the 29% plummet in March, indicating we have likely passed peak year-over-year deflationary pressures.

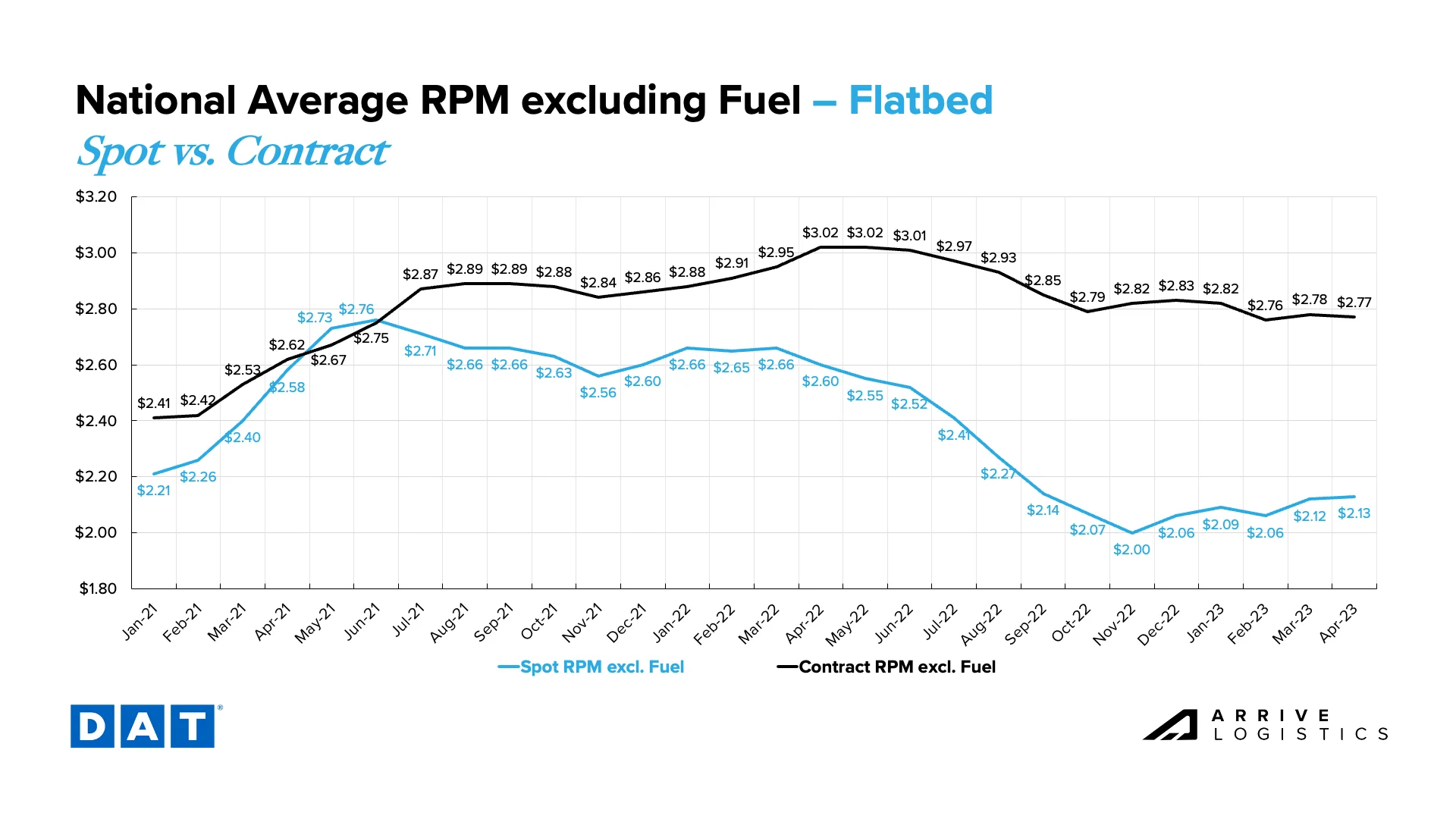

Thanks partly to the return of warm weather and the onset of construction season in the South, spot flatbed rates had another meaningful month-over-month increase, while contract rates took a step back from a slight pickup in March. Spot rates landed at $2.13 and contract at $2.77, excluding fuel.

What’s Happening: Volume woes continue for LTL carriers.

Why It Matters: Ongoing low volumes will create an increasingly challenging landscape for LTL carriers.

What’s Happening: Rates are increasing as Mexico’s produce season ramps up.

Why It Matters: Dry van carriers capable of transporting certain produce are becoming available as they aim to capitalize on high rates.

General Cross-Border Mexico Market Update: We’re seeing more requests for refrigerated and frozen capacity now that produce season is underway. More requests mean temperature-controlled rates will increase as capacity gets tighter. Given that some produce travels on dry vans, capacity with these carriers is becoming more readily available as they try to capitalize on the strong rates.

Market Specific Updates:

Canada Update:

What’s Happening: Current market pressures indicate further capacity normalization is likely.

Why It Matters: The market will be oversupplied with capacity until normalization is fully realized.

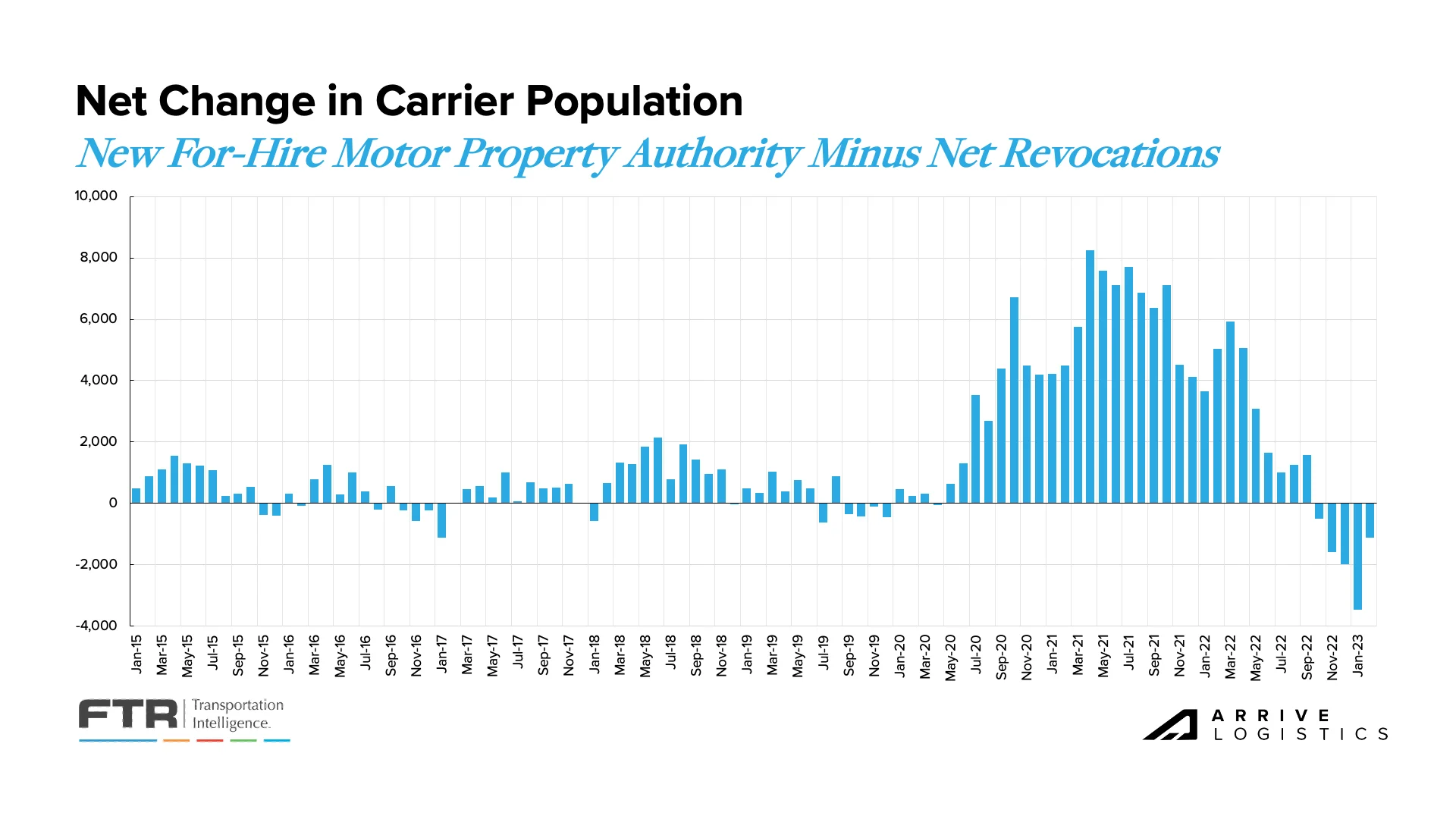

Easing demand will likely lead to a persistent oversupply of capacity in the market, resulting in ongoing capacity normalization. Carriers in the spot market are still facing poor conditions; FTR has yet to release data for March as of April 9th, but we anticipate revocations of trucking authority will remain at or near historically high levels. Some revocations may be owner-operators taking company jobs with larger asset carriers, while others are carriers opting out of the market altogether.

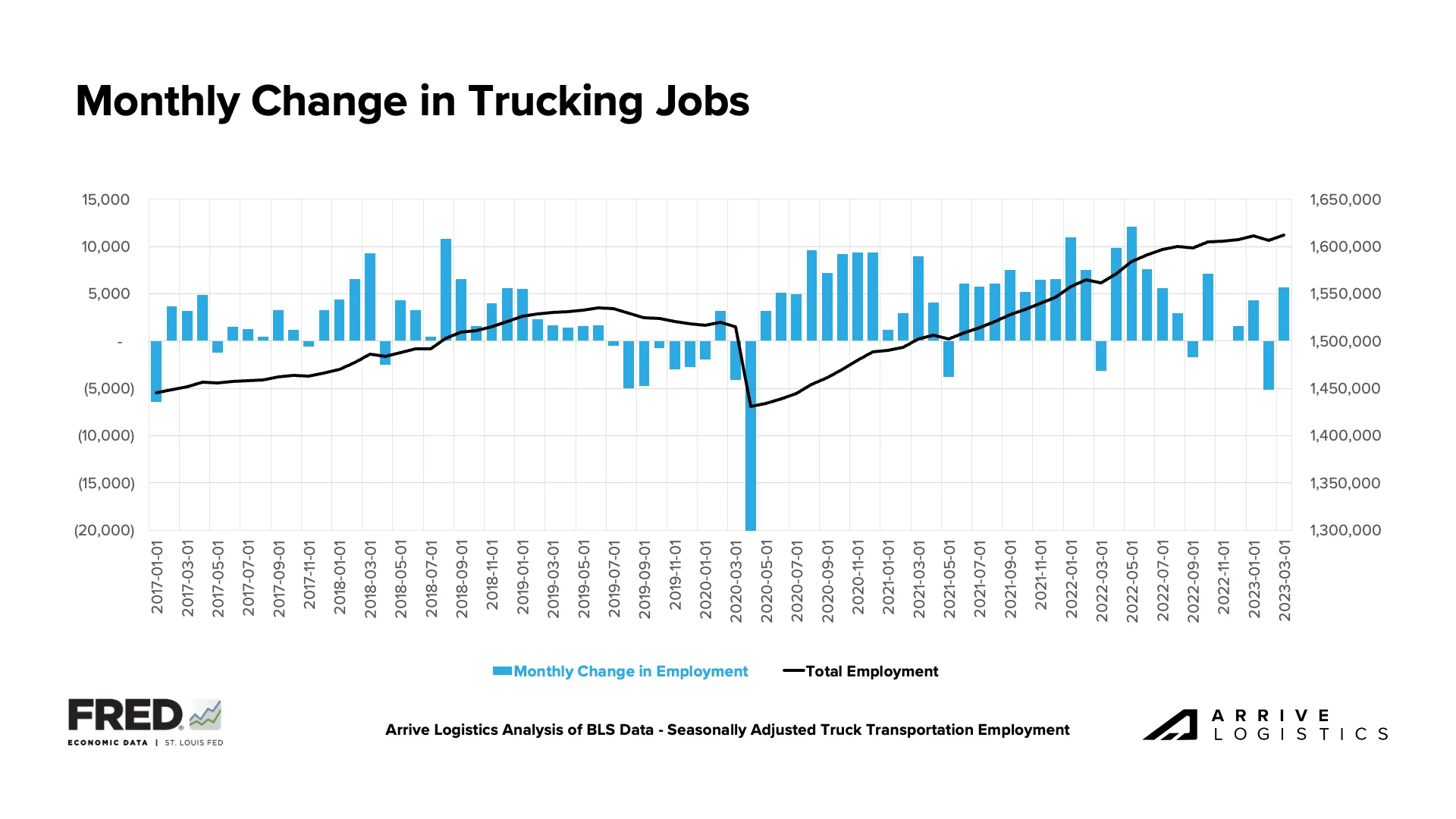

In February, the trucking industry saw the largest employment drop since the pandemic lockdowns in May 2020. However, in March, a sudden hiring surge more than made up for the February losses — this was unexpected since many thought that job growth had peaked and the February results would lead to a capacity correction. During the past year, many of the new jobs created were taken by owner-operators moving to company jobs, but most of that movement is likely over. So, we hypothesize that the March hiring surge resulted from carriers anticipating reduced volumes but instead experiencing stable or increased volumes. These businesses may have cut staff earlier in the year to prepare for reduced demand or ramped up hiring to meet customer needs. The Cass Shipments Index, ATA Freight Tonnage Index, and several others suggest a more stable demand environment will materialize this year.

Another data set that is not yet available for March but remains critical to the narrative is the Net Change in Carrier Population. Over the past five months, revocations have outpaced the number of net new carriers entering the market, reducing the total number of carriers. As with revocation data, we expect to see the net change in carrier population remain negative, although the increase in jobs in March creates some uncertainty. Regardless of March results, the longer-term outlook is a further reduction in active carriers in the months ahead. Large carrier increases over the prior market cycle have contributed significantly to current conditions, and downward rate trends have historically resulted in capacity normalization.

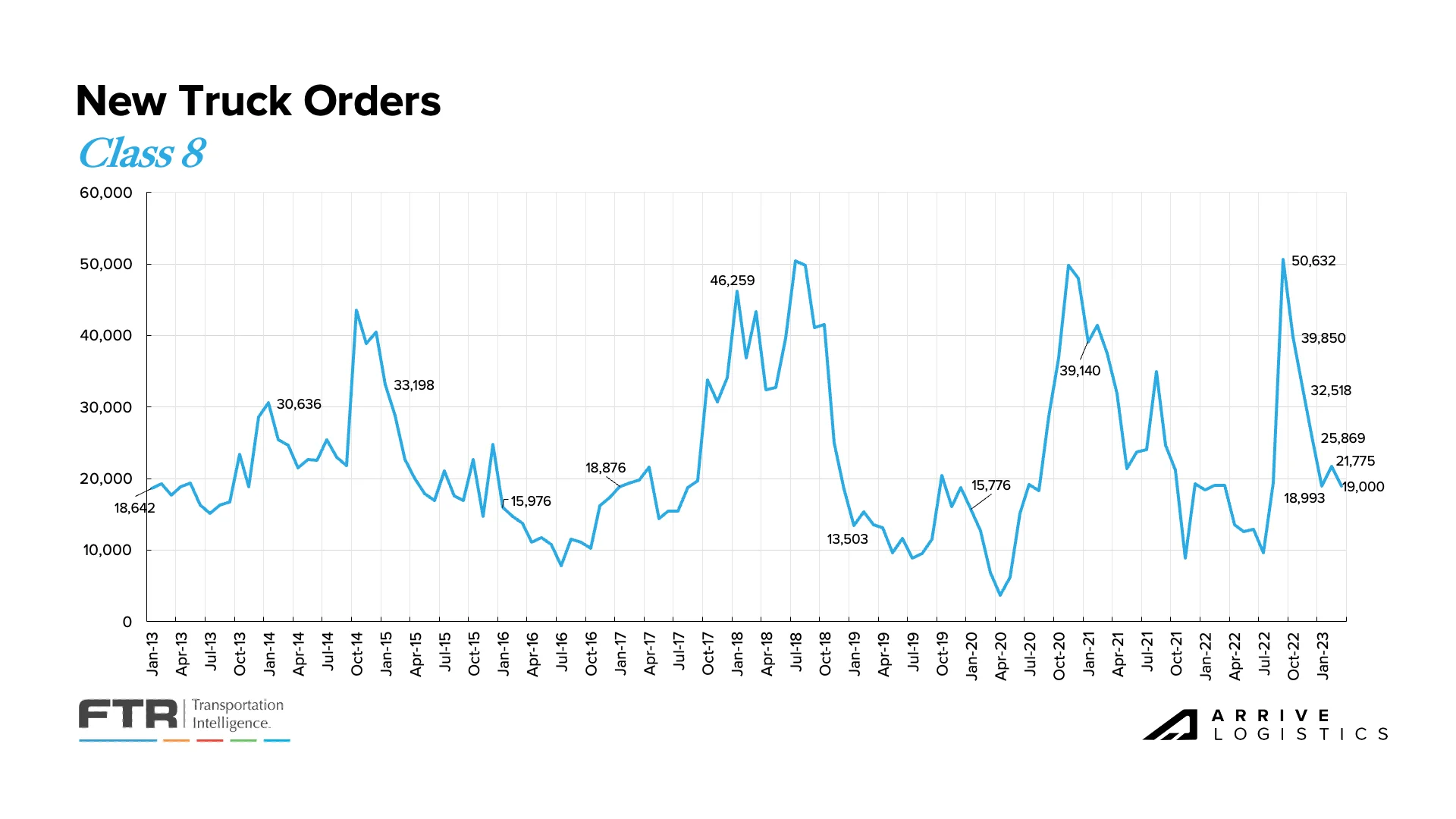

In March, FTR reported that new Class 8 truck orders fell for the fifth time in the last six months to 19,000 units. New orders have remained below but near build levels for the past few months, indicating that backlogs will likely decline but remain high. With production slots mostly filled through the remainder of the year, long lead times for new equipment will likely continue. FTR noted that given the economic uncertainty ahead, solid equipment order trends are a sign that demand has not collapsed and fleets still have access to capital.

What’s Happening: Construction is helping drive volumes, particularly in the flatbed market.

Why It Matters: At least in the short term, this section is helping prevent a truckload demand crash.

We continue to note retail imports and manufacturing trends due to their meaningful share of domestic freight demand. Recent data continues to signal a faltering outlook for both sectors. The manufacturing sector posted its fifth consecutive month of contraction, and imports have fallen well off the record-setting levels seen a year ago. Although they are expected to climb through the summer, they will remain more in line with pre-pandemic norms. According to the National Retail Federation (NRF), the main priority at the moment is resolving labor negotiations at the West Coast ports and avoiding any more self-inflicted supply chain challenges than we’ve in the past three years. Although a strike is not considered imminent, the risk for one appears to be growing.

Figure 21: Monthly Retail Imports 2022-2023

The ISM manufacturing report indicated more easing backlogs as new orders contracted for the seventh consecutive month amid slowing production. The new orders index contracted at a faster rate, falling to 44.3%, raising even more uncertainty about future backlogs and, therefore, truckload demand. Manufacturing was expected to be one of the main volume drivers in 2023, and if contraction persists, demand will likely fall further than previously forecasted. However, there is still significant pent-up demand in the sector that should enable healthy volumes in the near term.

One sector illustrating relative strength is the construction industry. The Wall Street Journal is reporting that a building boom in industrial plants, infrastructure and other nonresidential projects is offsetting home construction in the U.S. Spending on these areas is nearly 17% higher than last year.

Contrary to manufacturing, the backlog for nonresidential projects in the U.S. under contract but not yet started in February was more than a month longer than the same month last year. There is some caution that these trends could shift as economic concerns and labor and material shortages pose risks to contractors taking on new projects. However, these trends are likely key drivers preventing a truckload demand crash in the short term, particularly for flatbed equipment.

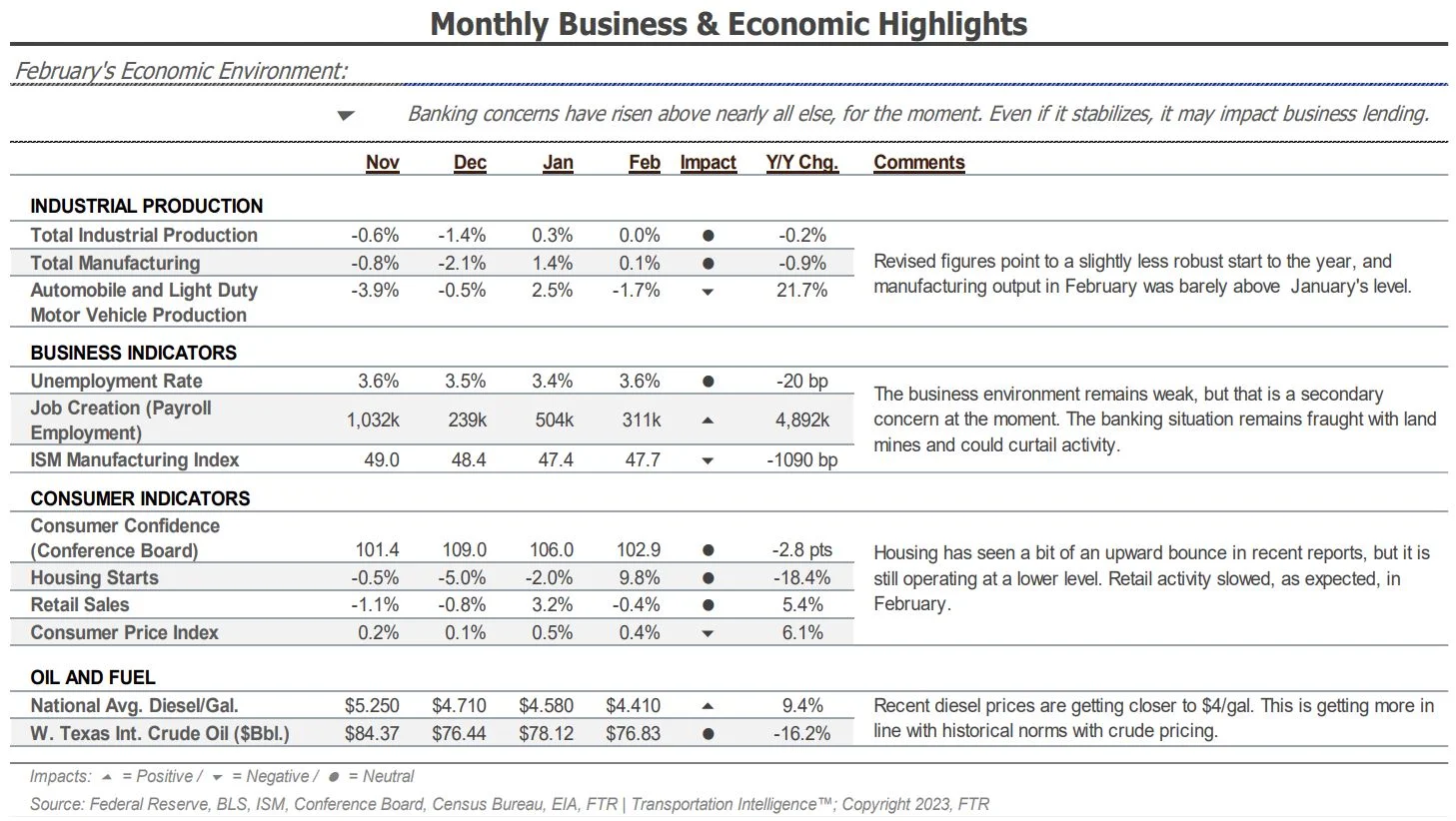

FTR’s latest truck loadings showed a 1.5% year-over-year increase for 2022, down from 1.7% last month after more revisions to previously reported loading data. The 2023 forecast has also been revised downward, showing a 1.6% decline versus the 1.4% decline reported in the last update. However, the dry van loadings forecast for 2023 improved based on stronger automotive loadings and a smaller decline in food loadings. FTR also noted that a more positive outlook for construction and industrial commodities loadings significantly improved the flatbed loadings forecast. However, it remains negative at 2.9% below where it was in 2022.

What’s Happening: Initial jobless claims have increased slightly in recent months but still remain close to 2022 and even pre-pandemic levels.

Why It Matters: A robust labor market signals confidence in consumers’ ability to sustain current spending, which should prevent a sudden drop in truckload demand.

April CPI data showed inflation slowed in March, falling from 6.0% to 5.0% year-over-year growth (5.6% when excluding food and energy). While the top-line inflation decline seems meaningful, the core inflation index is up from 5.5% in February — the first increase since September. Rising shelter costs continue to be a key driver of inflation data, accounting for about a third of the CPI index. When excluding housing and looking at core services, prices are up 3.4% from a year ago. The Fed is targeting 2% inflation and is therefore likely to continue taking action with its next opportunity to raise rates. Speculators are indicating another rate hike of 25 basis points is the most likely scenario.

Figure 25: NYT’s Inflation in March

Bank of America’s card data revealed consumer spending per household increased by just 0.1% year-over-year in March, down from 2.7% in February and 5.1% year-over-year growth in January. The 1.5% month-over-month decline in March on a seasonally adjusted basis was driven by particularly weak spending on gas, furniture, home improvement and department stores. However, airline spending continued to grow significantly.

Figure 26: Bank of America Monthly Card Spending

Services spending held strong overall compared to durable goods, which experienced a significant decrease in March as leisure services spending remained relatively flat. Because durable goods tend to move on trucks, spending declines have a larger impact on truckload demand.

Figure 27: Bank of America Monthly Card Spending on Durable Goods vs. Leisure Services

Initial jobless claims have increased slightly in recent months, but current levels remain close to last year and even pre-pandemic levels. The unemployment rate remains dead even with February 2020 and is down significantly from a year ago, a sign that the labor market is strong despite recent reports of layoffs. This robust labor market signals confidence in consumers’ ability to sustain current spending levels and avoid a sudden drop in truckload demand.

The freight market showed mixed signals in March, depending on the equipment type in question. Van and reefer conditions eased further throughout the month, bucking typical seasonal trends and indicating capacity is still sufficient to support demand. Stable demand also contributed to historically strong contract routing guide compliance for this time of year for both modes. The flatbed market, however, showed strength, likely propelled by increased demand associated with increased spending on large-scale construction projects. The overall truckload demand outlook remains a concern, and capacity normalization is still just beginning to materialize. Rate conditions continue to worsen for dry van and reefer carriers and may be below profitable levels for those with high spot exposure.

Our 2023 rate forecast remains mostly unchanged, with some increased downside risk due to economic uncertainty. However, spot rates have fallen even further below current operating costs for carriers, leaving little room for further decline. We expect spot rates will find their floor relatively quickly — likely by April or early May — and remain stable throughout the year with seasonal fluctuations. The unprecedented spot-contract gap will also continue to put deflationary pressure on contract rates.

As this all unfolds throughout the year, the market will become increasingly vulnerable to disruptive events as capacity continues to normalize. However, recent short-lived periods of volatility suggest that the market is still oversupplied with capacity and unlikely to experience any long-term disruptions through the remainder of 2023.

The Arrive Monthly Market Update, created by Arrive Insights, is a report that analyzes data from multiple sources, including but not limited to FreightWaves SONAR, DAT, FTR Transportation Intelligence, Morgan Stanley Research, Bank of America Internal Data, Journal of Commerce, Stephens Research, National Retail Federation and FRED Economic Data from the past month as well as year-over-year. We know market data is vital in making real-time business decisions. At Arrive Logistics, we are committed to giving you the data and insights you need to better manage your freight.