"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

The freight market has stabilized after a volatile end to 2024, as lower demand and adequate capacity led to normal seasonal slowdowns in early February. Spot market activity increased in January, but truckload volumes remain below early 2024 levels, suggesting that the market recovery is still underway.

Supply appears tighter than at previous points in the cycle but not tight enough to support a sustained inflationary market flip. Dry van and reefer rates spiked in line with typical seasonal patterns throughout the holiday season but have fallen recently, reflecting normal slowdowns in the latter part of Q1.

Economic indicators point to a stable demand environment in 2025 due to consumer strength and a healthy labor market. However, unclear policies around tariffs and corporate tax cuts present upside and downside risks.

"*" indicates required fields

For-hire truckload volumes are down year-over-year, and capacity remains sufficient to mitigate any disruption risk.

What’s Happening: Volume remains down despite recent volatility.

Why It Matters: Capacity tightness is the leading cause of market disruptions.

The 2024 peak holiday season was more volatile than in recent years, but conditions have settled as of early February. Routing guide challenges and spot rate volatility increased on a year-over-year basis in late Q4, indicating the market’s ongoing recovery and growing risk of vulnerability as supply and demand come into balance. This sharp easing shows that typical seasonal patterns will continue to be the market narrative, with the next true test being summer peak demand surges beginning in mid-May.

The Sonar Contract Load Accepted Volume Index (CLAV) measures accepted load tenders moving under contractual agreements. It is similar to the Outbound Tender Volume Index (OTVI) but removes all rejected tenders. The latest reading illustrates slight year-over-year pullbacks, particularly in the back half of Q4 2024 and early 2025. Along with other demand trends, this points to a shift away from the for-hire contract market as investment in private fleet growth continues and routing guide challenges increase. These trends are largely responsible for the strong spot market activity during the 2024 holiday peak season.

Contract Load Accepted Volume, SONAR

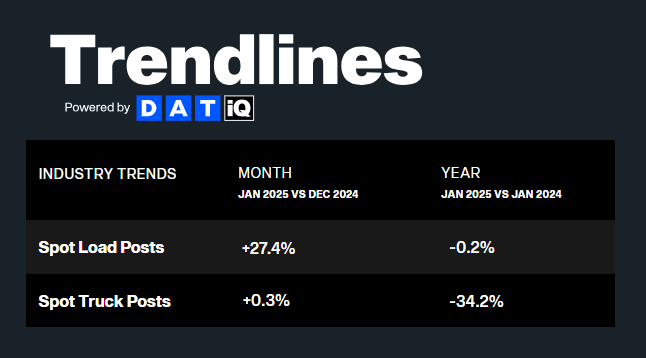

DAT reports that spot postings remained relatively flat year-over-year but increased over 27% from December to January, helping to offset contract volume declines. The year-over-year results showed significant improvement from January 2024, when spot postings were down nearly 40% from January 2023.

Truck postings tell a different story. They were relatively unchanged month-over-month but down significantly year-over-year, indicating that capacity reductions were the main driver of rate volatility during the 2024 holiday peak season.

The Cass Freight Index’s shipments component, which includes both spot and contract volume based on bill data, is a good indicator of demand health. The January reading shows significant sequential and annual declines of 5.4% and 8.2%, respectively, supporting the narrative that capacity tightening was the primary cause of recent market shakeups. Despite the supply pullback, volume declines may limit the market’s upside potential this year, especially if political policy significantly impacts global trade flows.

What’s Happening: Capacity is tightening.

Why It Matters: Tight supply makes the market more vulnerable to disruption.

After several volatile weeks, recent data indicates rapid market normalization as demand and capacity ease. We expect Q1 conditions to remain steady aside from the disruptions typical for this time of year, such as winter storms.

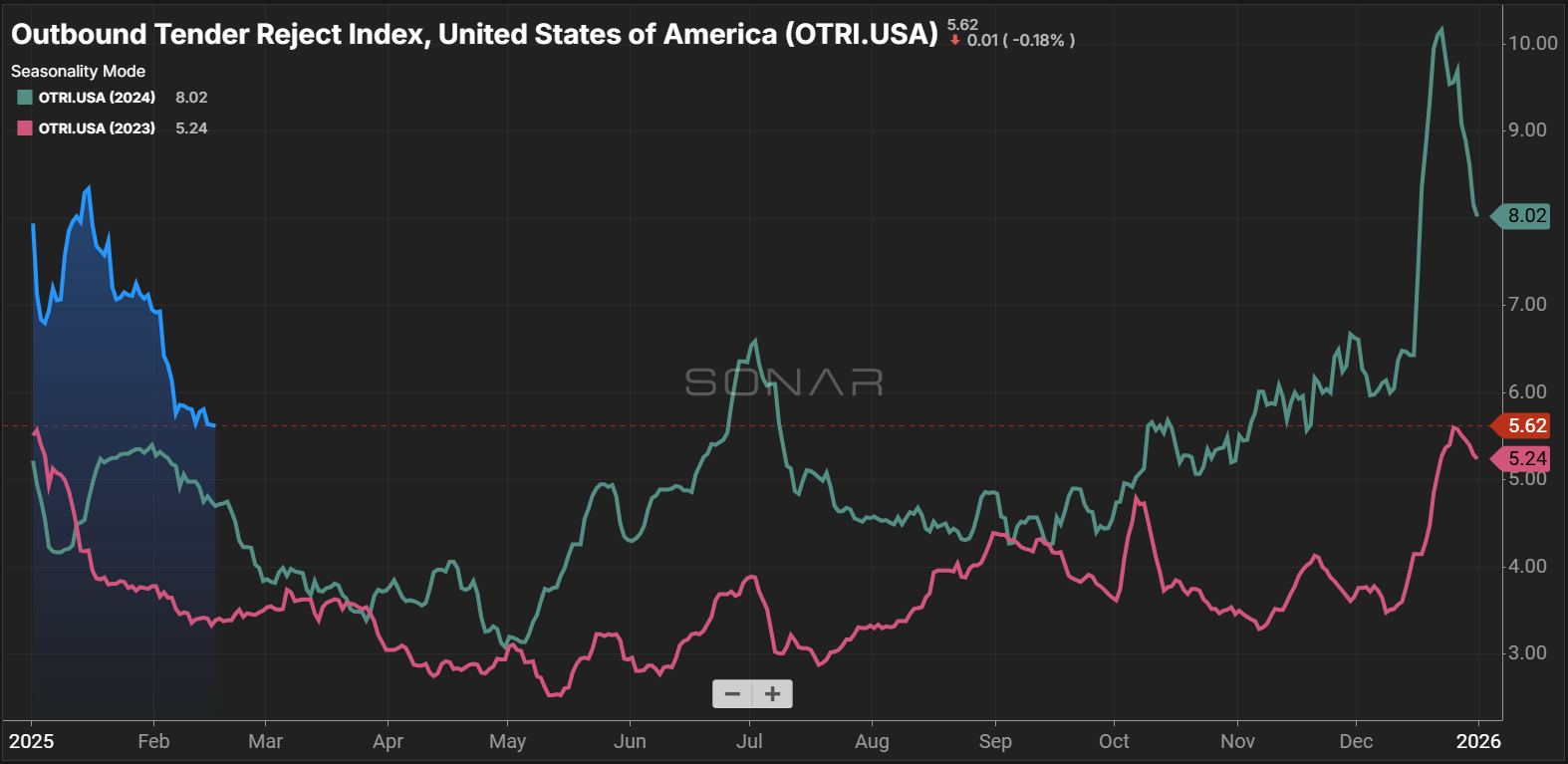

The Sonar Outbound Tender Reject Index (OTRI), which measures the rate at which carriers reject the freight they are contractually required to take, has declined significantly from the weather-induced peaks of mid-January. Rates are hovering in the upper 5% range—while slightly higher than the same period last year, this reading indicates strong routing guide compliance.

We expect rejection rates to fall further in March and April in line with seasonal expectations ahead of the 100 Days of Summer. However, the increased volatility during the 2024 peak season is a sign that the market is more vulnerable to disruption than at any point in the current cycle, even as demand declines.

Dry van tender rejection rates have declined significantly and now align closely with February 2024 levels. As the market continues to follow typical seasonality, we expect rates to remain near the floor through the rest of Q1 and into early Q2.

The reefer market remains far more volatile than the dry van market. At 13%, tender rejection rates are up 75% year-over-year. Winter weather remains a risk, but if current market conditions persist as temperatures rise, the 2025 produce and summer peak seasons could be significantly more active than in recent years.

Reefer Outbound Tender Reject Index, SONAR

The DAT Load-to-Truck Ratio (L/T), which compares the total number of loads to the total number of trucks posted on the DAT spot board, increased for dry van and reefer freight in January. The dry van L/T ratio climbed above 7, the highest point in the last two years. Similarly, the reefer L/T ratio surpassed 11, exceeding any point in 2023 and 2024. DAT’s load and truck posting metrics suggest this increase is driven almost entirely by a pullback in equipment postings, indicating carriers were much less reliant on posting equipment to find freight.

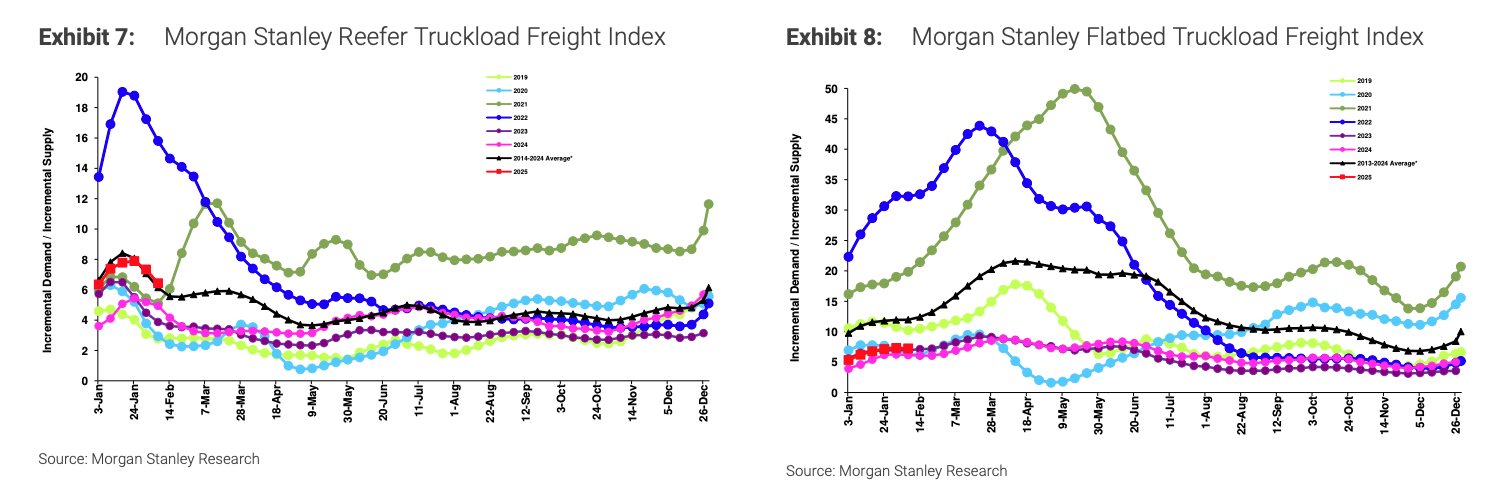

The Morgan Stanley Dry Van Freight Index is another measure of relative supply; the higher the index, the tighter the market conditions. The black line with triangle markers on the chart provides a great view of what directional trends would be in line with normal seasonality based on historical data dating back to 2007. Trends deviated from the 10-year average toward the end of 2024 and remained above 2024 levels and the 10-year average in early February 2025. However, the movement so far in 2025 has followed historical seasonal patterns very closely. If these trends continue, we expect further seasonal softening over the next few months.

Morgan Stanley Dry Van Truckload Freight Index

What’s Happening: Dry van and reefer rates have declined rapidly following holiday season increases.

Why it Matters: The market is following normal seasonality and we expect a quiet second half of Q1.

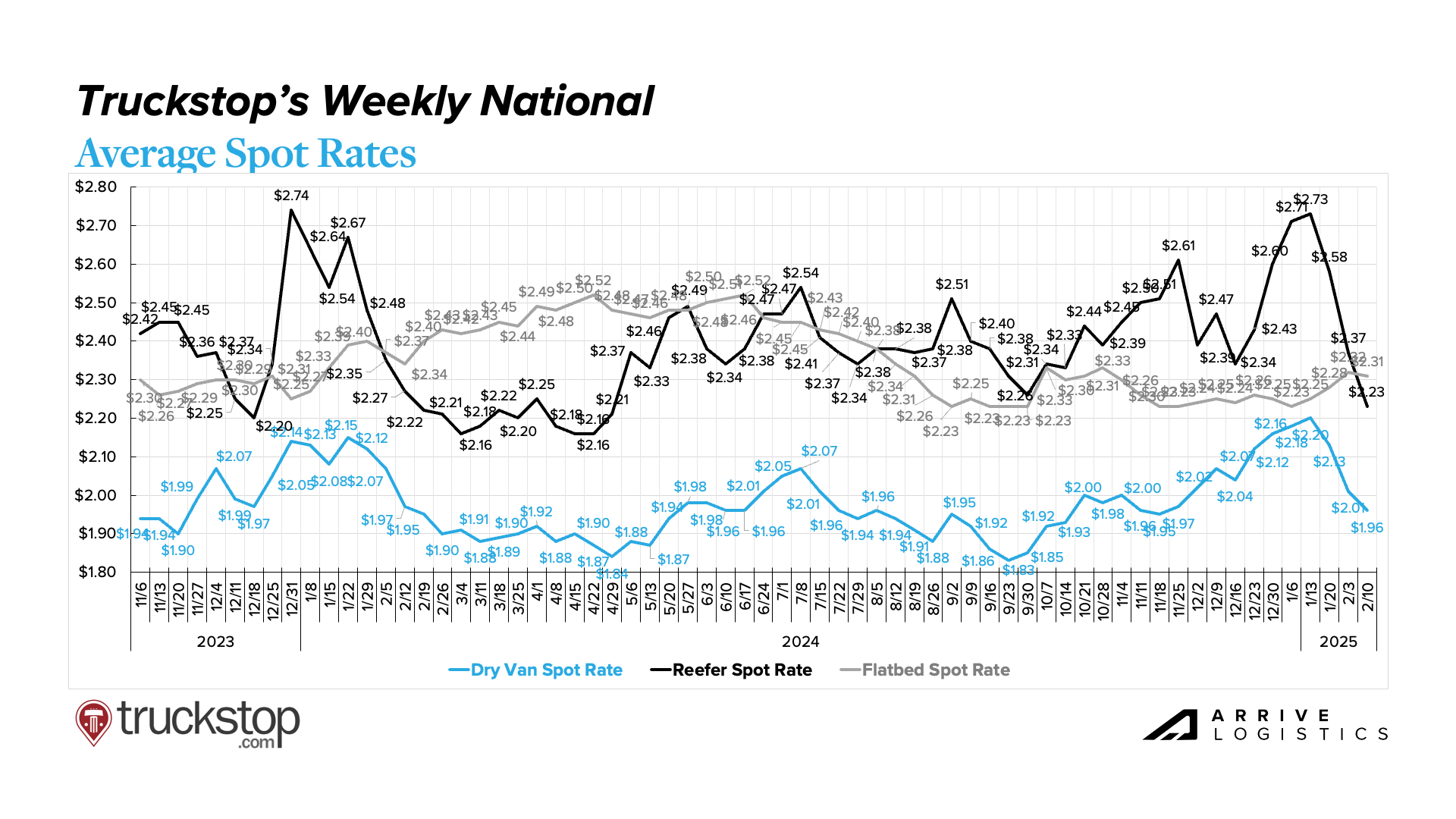

Truckstop’s weekly spot market rate data shows sharp seasonal declines for van and reefer in early February. Rates for both modes reached their 2024 peak amid a year-end demand surge. However, around mid-January, rates rapidly returned to pre-holiday averages. This pattern is normal and closely resembles the trend observed around the same time last year.

DAT data shows that all-in spot rates rose across all three transportation modes in January but declined in February, driven by elevated linehaul rates and a slight uptick in fuel prices. However, fuel prices remained flat in early February, and the all-in rate decline was primarily caused by falling spot linehaul rates, as reflected in the Truckstop Weekly rate chart.

DAT Monthly Rate Trends

Fuel prices fell for most of 2024 but rose in January and remained high in February. The February average is $3.66 per gallon, with a $0.40 dry van surcharge. Despite recent increases, prices are still lower than last year’s $4.04 per gallon average and $0.47 surcharge. Prices are expected to remain steady, but U.S. tariffs could create volatility.

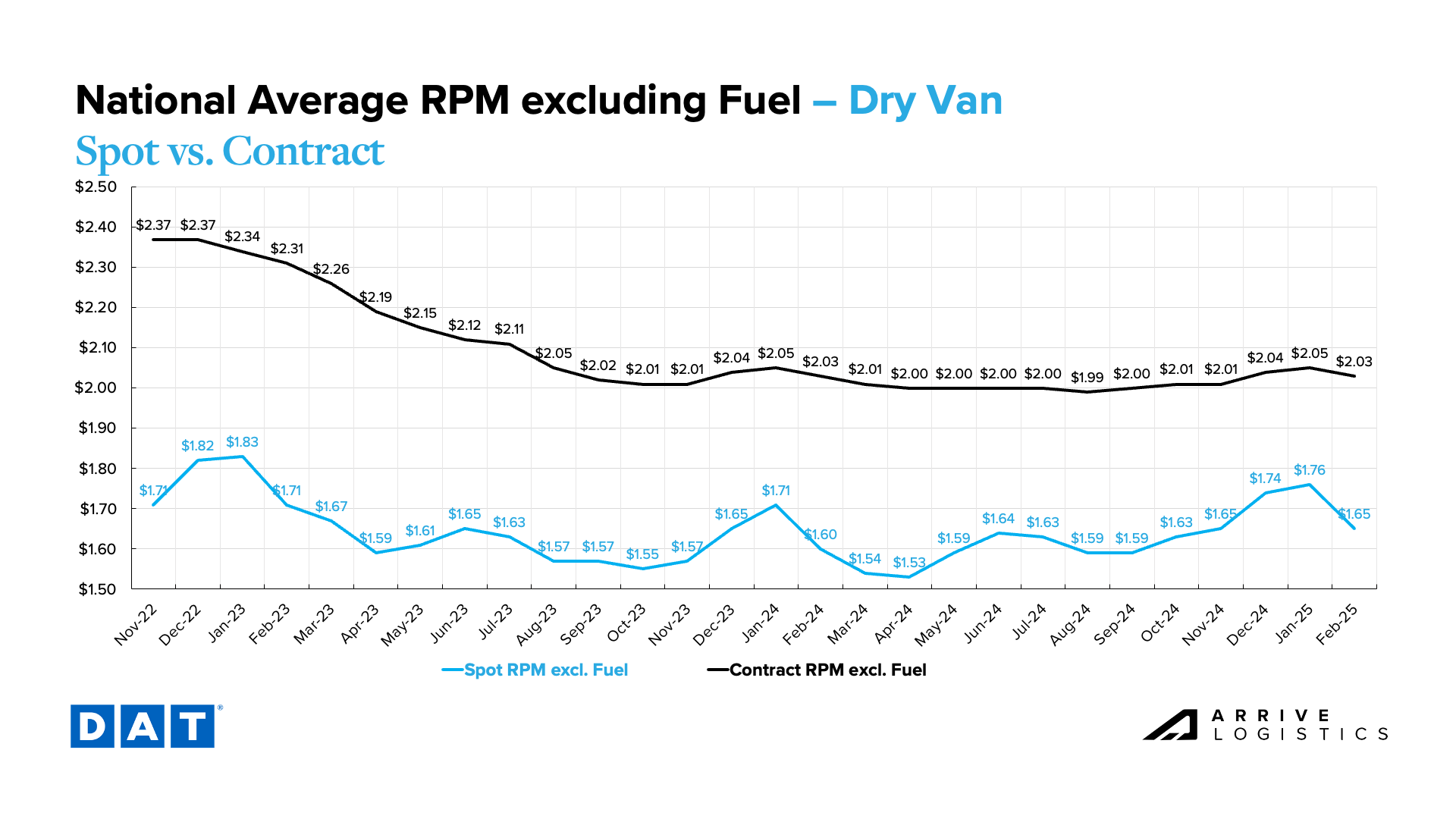

DAT dry van data shows linehaul spot rates increased during the 2024 holiday season. They remained elevated into the new year, with the $1.76 per mile average in January being the highest monthly average since January 2023. Contract rates also rose to $2.05 per mile, matching the previous high in January of last year. Rates have since normalized. The spot average is currently $1.68 per mile, excluding fuel, and further declines are likely through the end of the month.

After closing to a cycle low in January, cooling spot rates caused the spot-contract rate gap to expand again in February. This shift supports our view that a sustained inflationary flip is not imminent.

Reefer spot rates, excluding fuel, increased month-over-month from October 2024 to January 2025. They peaked at $2.11 per mile in January, the highest mark since January 2023, before declining rapidly in early February. Spot rates are currently $1.95 per mile, excluding fuel, mirroring a similar downward trajectory as a year ago. Barring a major disruption, we anticipate rates will follow trends similar to 2024 for the next few months, remaining near a floor until May. Contract rates remain stable despite recent spot rate volatility.

The flatbed market remains significantly more stable than van and reefer, with spot and contract linehaul rates sitting at $1.96 per mile and $2.56 per mile, respectively. The significant $0.60 per mile rate spread suggests the market is unlikely to experience any disruption in the near future. However, that could change as the building season drives increased activity in the spring.

What’s Happening: The Canadian freight market experienced volatility in Q4 2024 due to tightening capacity and strong holiday demand.

Why It Matters: Market conditions are expected to stabilize in early 2025, but uncertainty about tariffs may create additional volatility.

What’s Happening: Cross-border trade is at record levels, driven by nearshoring, proposed U.S. tariffs and seasonal produce demand.

Why It Matters: Capacity constraints and transportation costs may remain elevated beyond Q1 2025.

What’s Happening: Regional capacity remains tight in key markets, with severe weather and seasonal demand influencing conditions.

Why It Matters: Market conditions are expected to remain uneven through Q1, with weather disruptions and shifting produce seasons playing a key role.

East Coast

Midwest

South

West

Pacific Northwest (PNW)

What’s Happening: Flatbed demand is rising, while capacity constraints and weather disruptions are tightening the market.

Why It Matters: Spot rates may increase as carriers prioritize key customers and avoid winter weather regions.

What’s Happening: Carriers continue to exit the market.

Why It Matters: This makes the market more vulnerable to disruption.

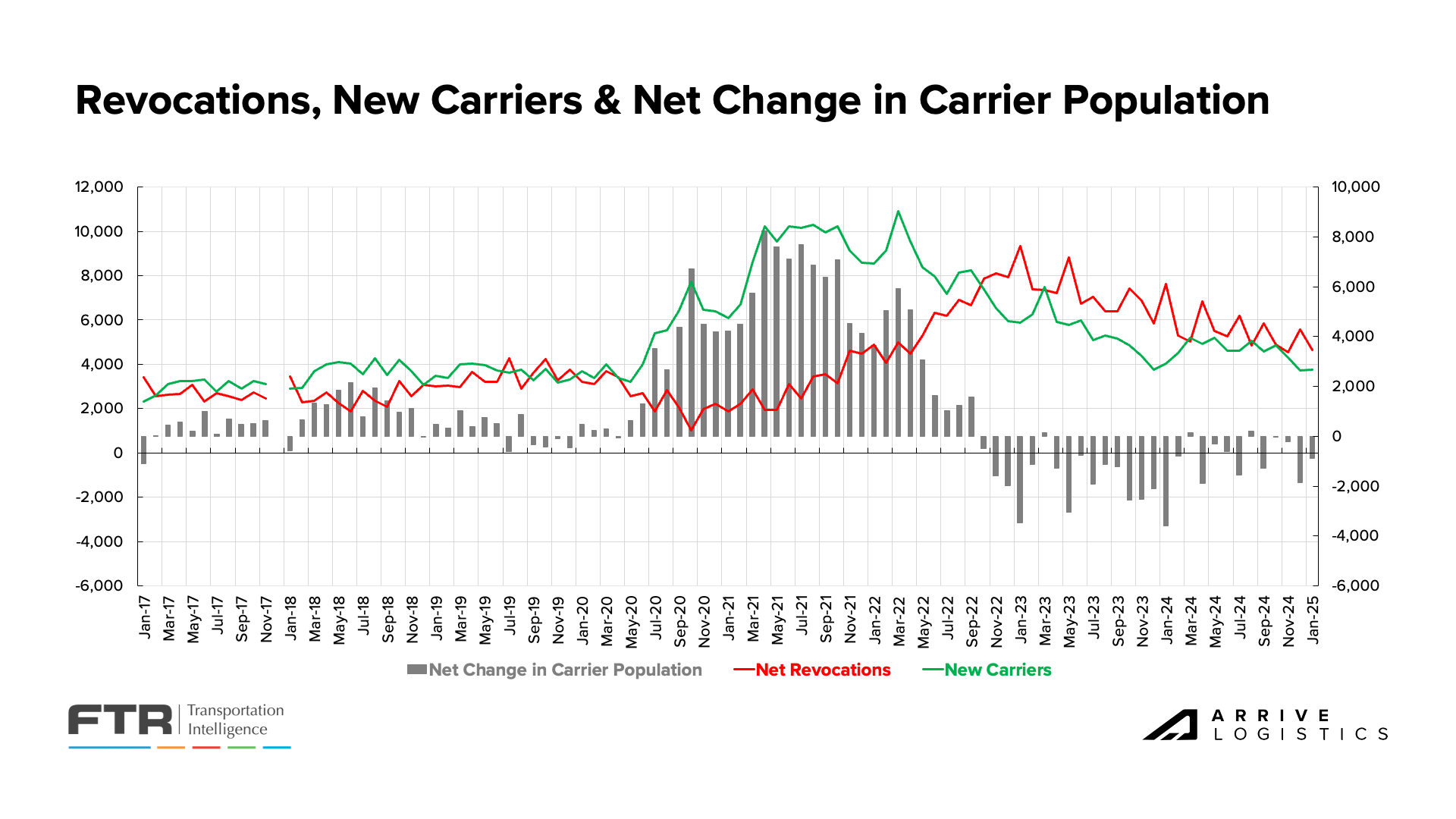

Challenging trucking conditions for carriers have resulted in high numbers of exits over the past few years. Year-over-year increases in load-to-truck ratios and tender rejection rates around the holidays make clear that these exits are creating more balanced market conditions.

While carrier population change trends do not tell the full story, they provide some insight into where supply levels are headed. Since the first carrier population decline during this cycle in October 2022, there has been a net loss of nearly 38,000 carriers, including 2,700 net revocations in the past two months—the highest number since January and February 2024 (nearly 4,400 net revocations). As the carrier pool continues to shrink, spot capacity will tighten, and market vulnerability will increase.

The driver market continues to support demand, as evidenced by the ACT Driver Availability Index rising 3.5 points to 56.3 in December, marking 31 consecutive months of stable or improving driver availability. Several factors contribute to sustained availability, including a 4%-5% market share shift to private fleets over the past two years and experienced owner-operators leaving the market to join larger carriers. .

For Hire Driver Availability Index, ACT Research

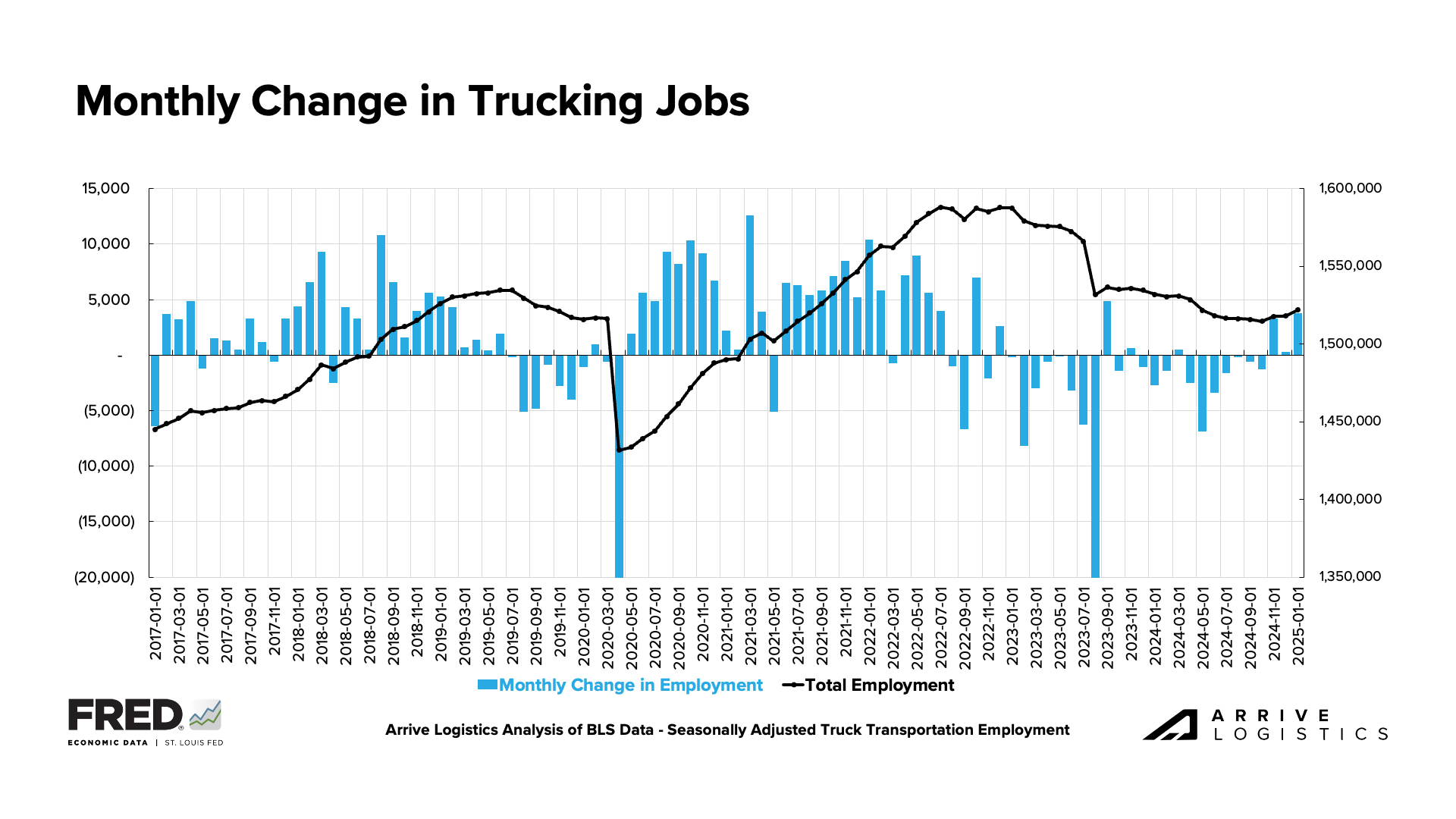

The January trucking jobs report revealed that 2024 started with 20,000 fewer jobs than previously reported and ended 27,800 jobs lower. This significant downward revision brings total trucking employment back to pre-pandemic levels, erasing gains from that high-rate era. This data doesn’t fully capture owner-operator capacity or private fleet capacity growth, so we do not believe overall supply has fallen to 2020 levels. However, the decline is significant and supports the narrative that capacity is, in fact, exiting the market.

On a positive note, though employment is down from its peak, there has been industry job growth in recent months. January saw a 3,800 job increase from December and 7,400 compared to October, likely driven by short-term disruptions like port strike threats, tariffs and peak retail season.

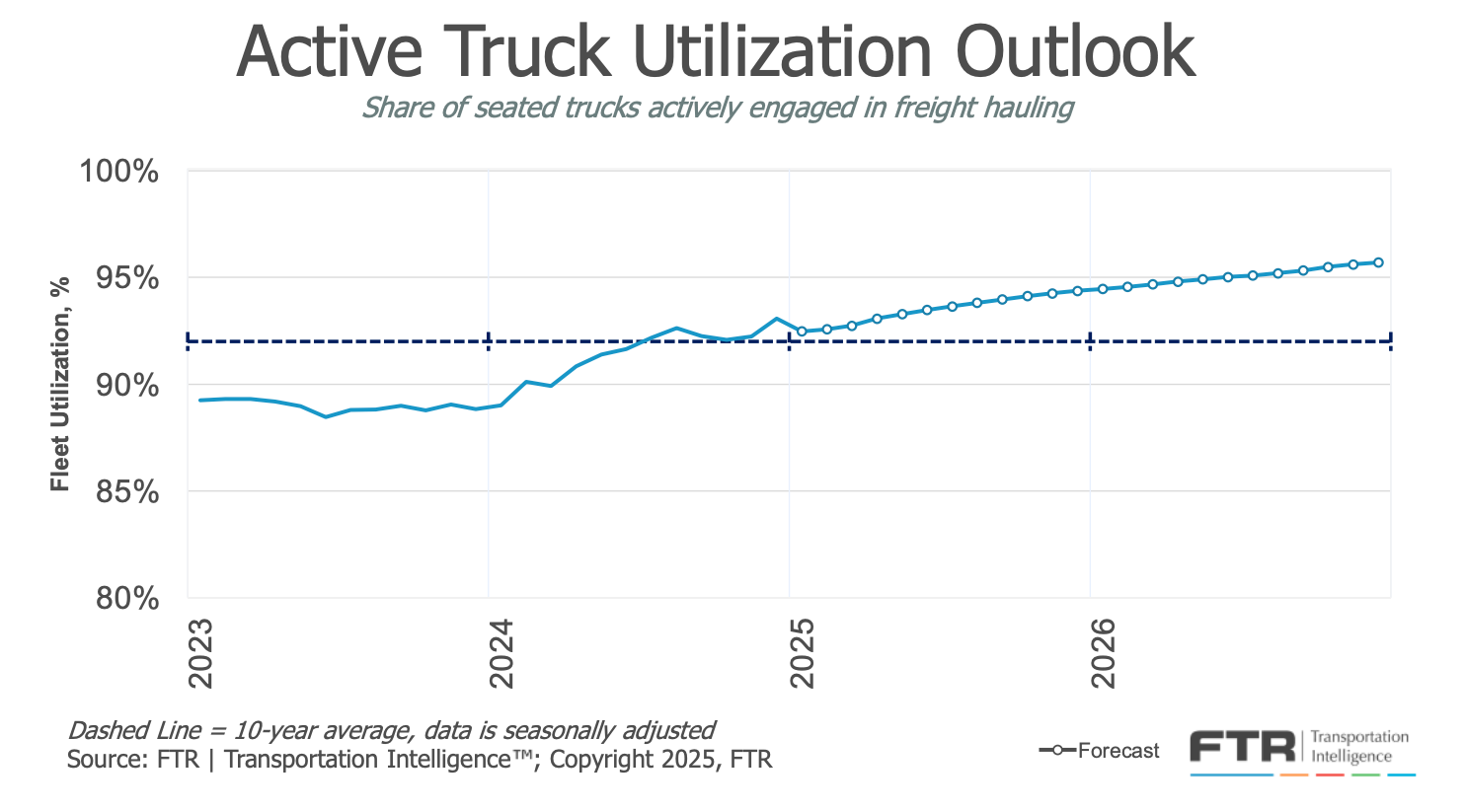

FTR’s most recent truck utilization forecast surpassed the 10-year average of 92%. Utilization is expected to approach 95% by the end of 2025, suggesting that fleet networks are tightening. As levels approach 100%, the risk of disruption and inflationary conditions increases due to a lack of additional capacity to support demand fluctuations.

What’s Happening: Imports have maintained momentum in the new year.

Why It Matters: Elevated imports create increased demand in the freight market.

Demand was steady through the holiday season and should remain consistent in the near term. However, there is uncertainty surrounding how proposed U.S. tariffs and corporate tax cuts would impact the 2025 truckload demand environment.

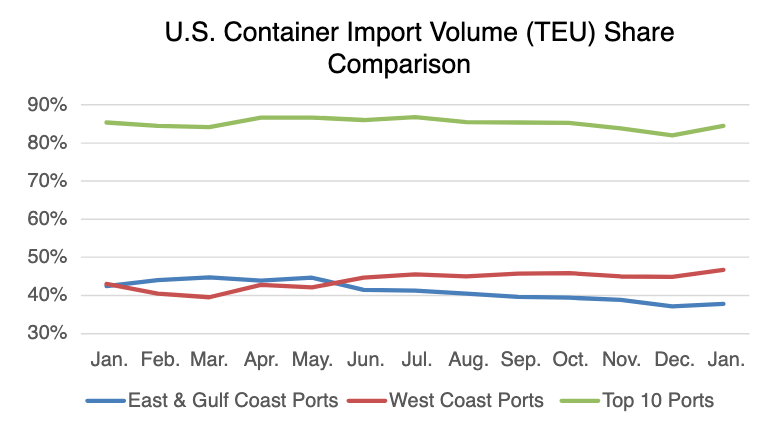

The National Retail Federation (NRF) reports that imports consistently increased month-over-month in 2024. 2.14 million TEUs were imported in December, a slight decrease from November but nearly a 15% increase from December 2023. Import strength is likely due to shippers pulling freight forward to avoid the impact of the potential strike at East and Gulf Coast ports.

Imports for the first six months of 2025 are expected to remain steady. However, if additional tariffs are placed on North American, Asian and European goods, import volumes could be negatively affected.

Both Descartes and the NRF recently published data showing elevated import volumes throughout 2024, with July and September levels exceeding previous records. The Descartes data also indicates that January 2025 import volumes surpassed the previous record set in January 2022. This increase was likely due to shippers rushing imports to the U.S. to avoid potential tariff increases and the East and Gulf Coast port strike. If true, we can anticipate imports to decline slightly in the coming months.

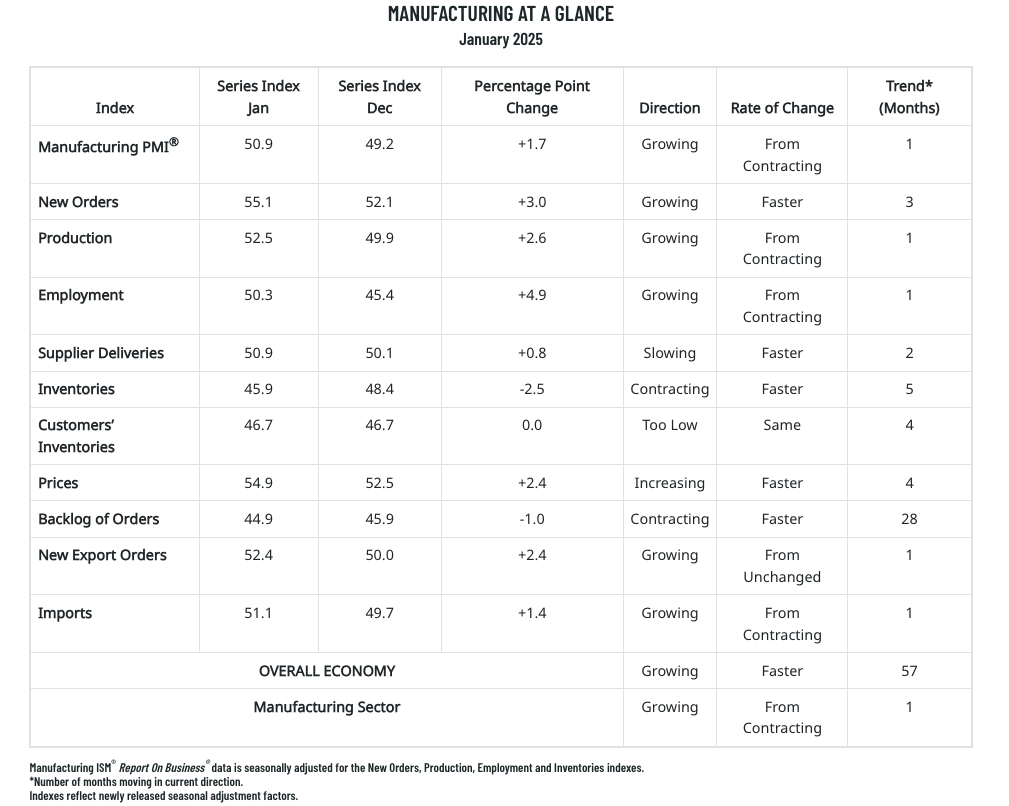

The Manufacturing PMI rose to 50.9 in January, up 1.7 percentage points from December’s reading of 49.2 and marking the sector’s first expansion in nine months. The ISM notes that a reading above 42.5 indicates overall economic expansion, and January was the 57th consecutive month above that threshold. If interest rates decline and spending increases, manufacturing demand could strengthen and sustain growth in the sector throughout 2025.

Economic indicators for freight-related industries are showing promising signs of stabilization. Industrial production has moved into positive territory, and total manufacturing increased slightly. The labor market continues to demonstrate resilience, with unemployment decreasing and strong job creation. Retail sales have shown consistent improvement in recent months, although annual comparisons remain weaker. Additionally, declining mortgage rates have bolstered housing activity for the third consecutive month. However, with uncertainty surrounding future interest rate cuts, the degree to which manufacturing and housing will drive freight demand in the first half of 2025 is still unclear.

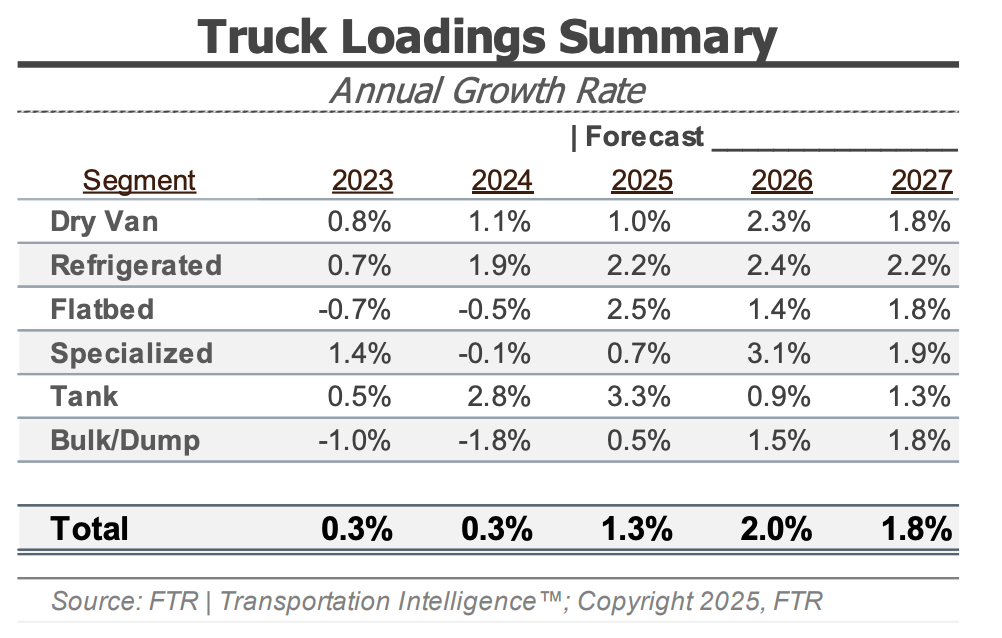

After a large downward revision last month, the FTR 2025 truck loadings forecast now calls for 1.3% growth. The shift was primarily driven by a positive outlook for building materials, with tank and bulk loadings expected to grow by 3.3% and 0.5%, respectively. Both dry van and reefer had downward revisions and are now expected to grow by 1% and 2.2%, respectively.

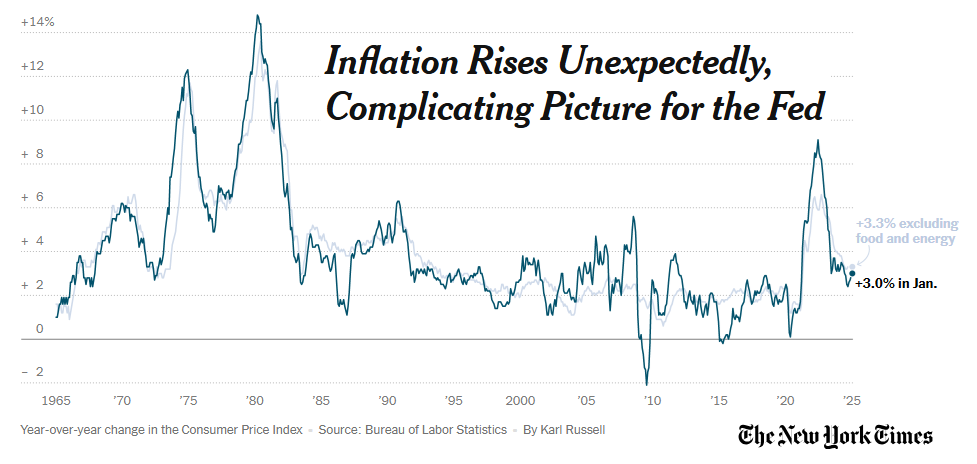

What’s Happening: Inflation ticked up slightly in January.

Why It Matters: Higher inflation is a sign that consumers might still see elevated prices.

Inflation ticked up to 3.0% in January due to increased food and energy prices. Core inflation, excluding food and energy, remained at 3.5%. While this raises speculation about potential interest rate cuts in 2025, the robust labor market and stubborn core inflation suggest that the Fed may keep interest rates higher for an extended period, presenting a downside risk to freight demand.

Bank of America credit card data reveals that household spending rose 1.9% year-over-year in January, following a 2.2% increase in December. Seasonally adjusted spending dipped 0.4% month-over-month, but the three-month annualized rate (SAAR) climbed 2.8%. Because services spending outpaced goods, the freight market is unlikely to benefit much.

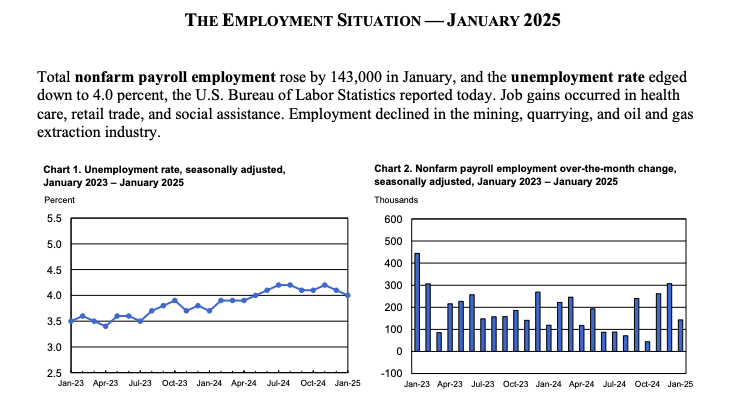

The January job market showed continued strength as payroll expanded and unemployment fell to 4.0%. Retail and other key service sectors are hiring to support increasing consumer demand. However, declines in the energy and mining sectors could indicate weakening industrial demand. Sustained hiring could help maintain household spending, but a tight labor market may make the Federal Reserve cautious about additional interest rate cuts.

Market conditions have stabilized following early-year volatility, with tender rejections declining and spot market activity normalizing. Despite more balanced market conditions and even some slight year-over-year spot rate inflation, these trends indicate that typical seasonal rate patterns will likely be the main narrative throughout 2025.

Volumes remain flat to down as capacity continues to contract, reinforcing the idea that supply, not demand, is driving volatility. While demand trends could move in either direction, it is clear that a low spot rate environment should continue to force capacity exits in the near term, which would increase market vulnerability as the year goes on, particularly if demand levels remain stable or grow.

The spot-contract rate gap has closed on a year-over-year basis but remains wide enough to prevent any sustained disruption, meaning an inflationary flip is unlikely unless a black swan event occurs.

The Arrive Monthly Market Update, created by Arrive InsightsTM, is a report that analyzes data from multiple sources, including but not limited to FreightWaves SONAR, DAT, FTR Transportation Intelligence, ACT Research, Morgan Stanley Research, Bank of America Internal Data, Journal of Commerce, Stephens Research, National Retail Federation and FRED Economic Data from the past month as well as year-over-year. We understand market data is vital in making real-time business decisions. At Arrive Logistics, we are committed to giving you the data and insights you need to better manage your freight.