"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

The freight market was business as usual in June and July. Stable conditions followed a short-lived period of volatility around the Fourth of July, as capacity remained more than sufficient to service demand. Thus, the market is firmly in equilibrium, with rates following normal seasonal patterns.

"*" indicates required fields

Demand continues to decline from May highs.

Capacity remains resilient despite challenging market conditions.

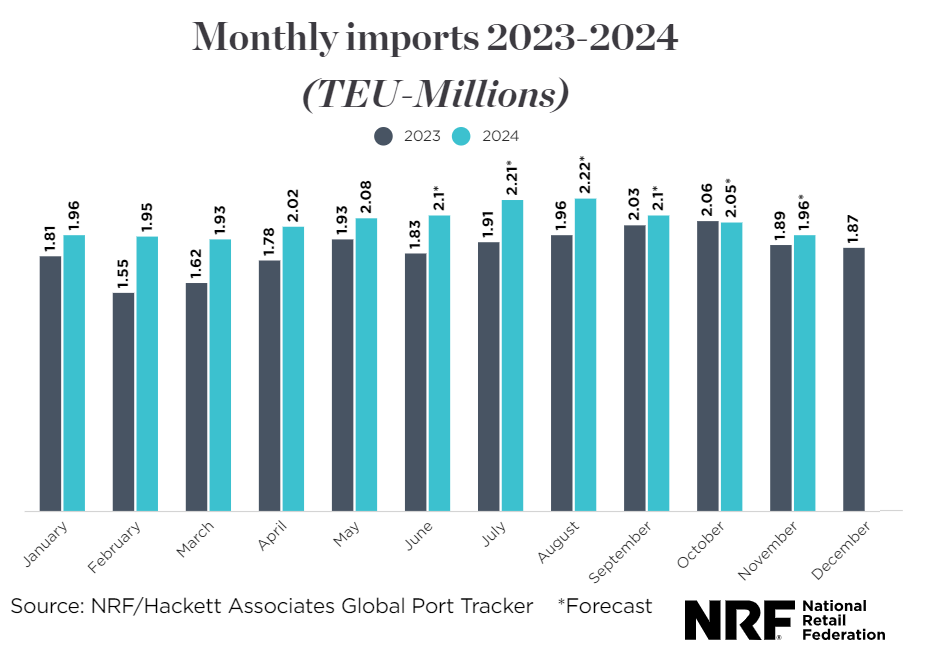

Import forecasts still look strong, with over two million TEUs expected each month through October 2024 (the highest levels since 2022).

Rates continue to follow typical seasonality, rising around the Fourth of July and normalizing shortly after.

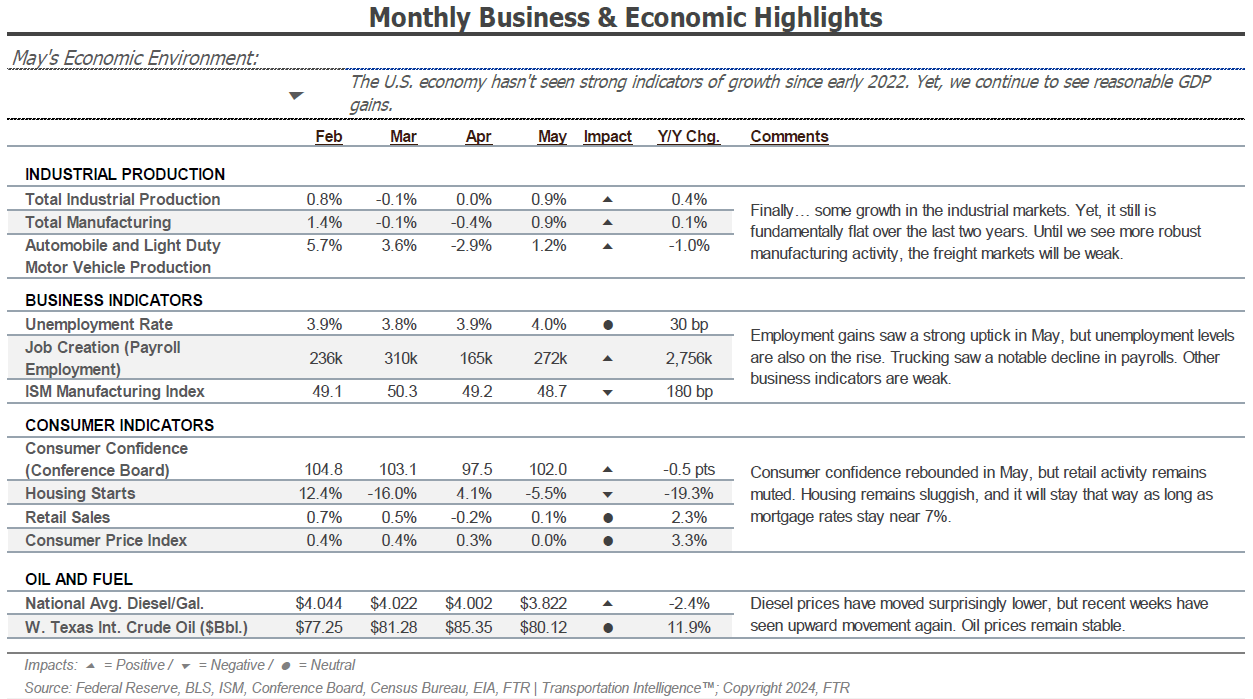

Industrial production, consumer spending and other key economic indicators remain steady and have yet to significantly impact freight demand.

CPI continues to cool, increasing the likelihood of a rate cut in 2024. Though a single cut is unlikely to significantly impact the freight market, it would be a welcome respite for consumers.

What’s Happening: Demand declined as expected.

Why It Matters: Softer demand could extend the equilibrium cycle.

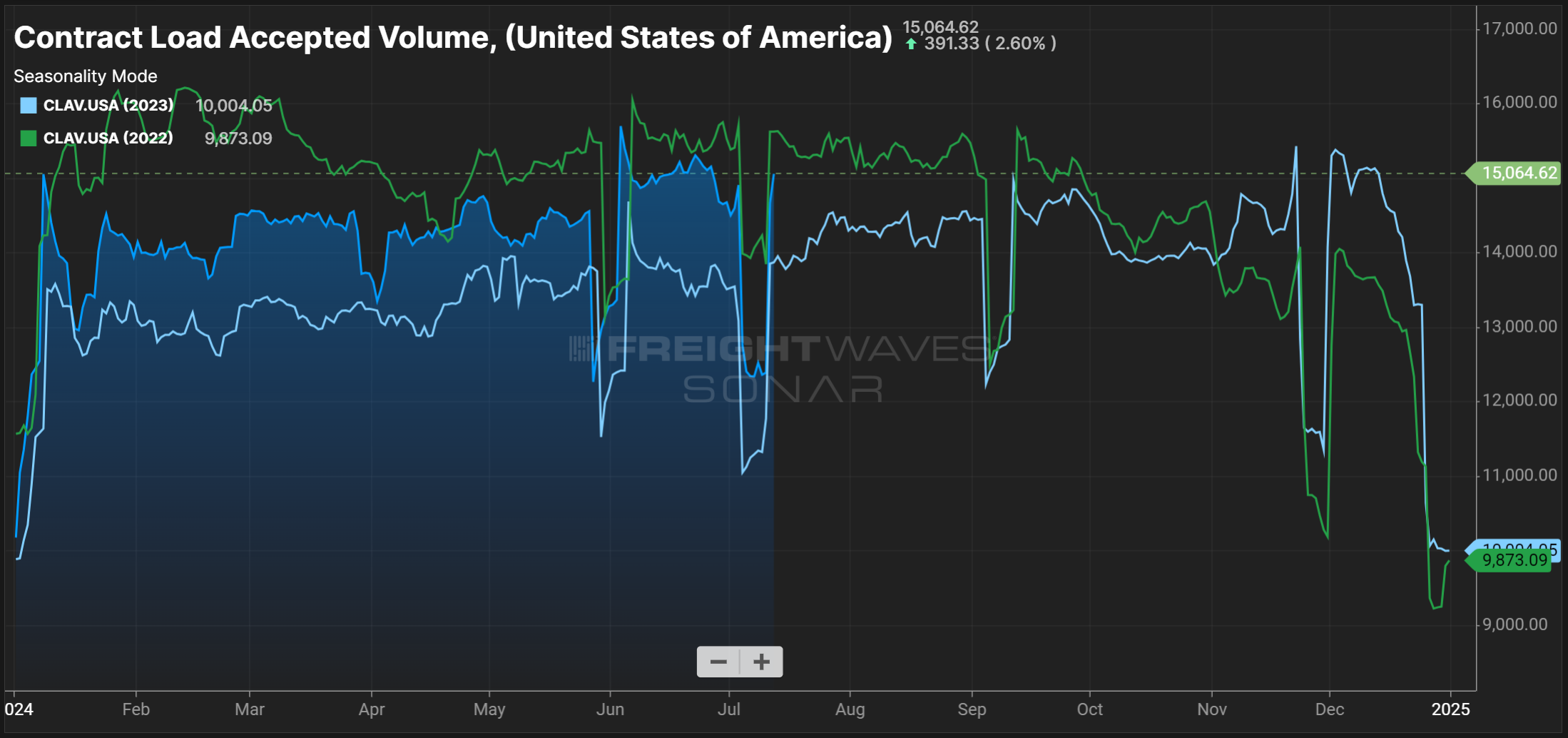

The Sonar Contract Load Accepted Volume Index (CLAV) measures accepted load tenders moving under contracted agreements. It is similar to the Outbound Tender Volume Index (OTVI) but removes all rejected tenders.

In Q2 and early Q3, the CLAV index showed relatively strong contract volumes compared to historical levels. Overall, volumes were up nearly 8.6% month-over-month in early July, largely driven by dry van freight, which increased 8.1%. Reefer volumes regressed slightly, declining 0.9% month-over-month.

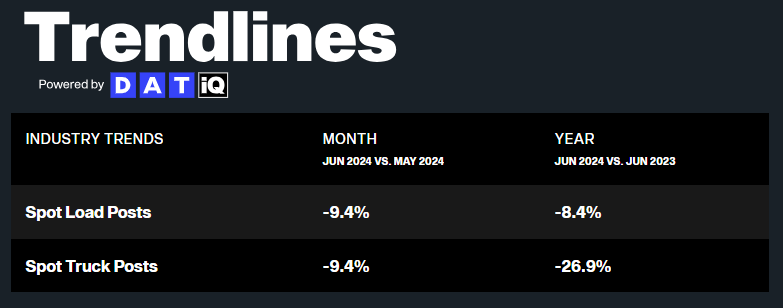

In June, DAT reported that spot load postings declined 9.4% month-over-month and 8.4% compared to June 2023. Such downward trends are normal for June. For example, in 2023, spot load postings declined by over 54% from June 2022. This year’s significant month-over-month decline likely resulted from spot load postings surging by 18% from April to May due to DOT Week and Memorial Day.

Spot truck postings declined sequentially, falling 9.4% from May and 26.9% from June 2023. This trend likely resulted from carriers posting fewer trucks and instead spending more time searching for loads.

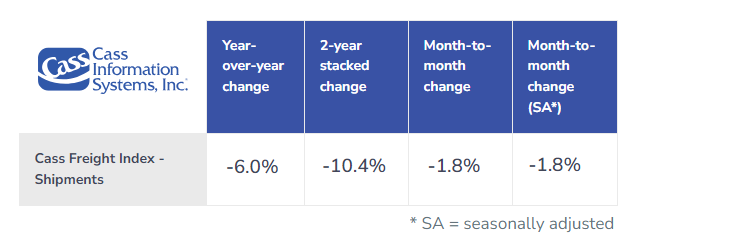

The Cass Freight Index shipments component is a good indicator of overall market health because it encompasses both spot and contract freight based on bill data. The June reading declined nearly 2% from May, likely normalizing following a period of elevated shipments around DOT Week and Memorial Day.

Shipments were also down 6% year-over-year, creating even more challenges for carriers as supply and demand move toward balance. Ultimately, the numbers indicate that the market is firmly in equilibrium, with no imminent signs of an inflationary flip.

What’s Happening: Carriers remain resilient despite tough market conditions.

Why It Matters: Strong supply protects the market from vulnerability.

Though obtaining precise capacity data remains challenging, recent trends indicate supply is flattening despite declining demand. Capacity showed resilience amid early summer volatility and after Hurricane Beryl, confirming the market is in equilibrium territory.

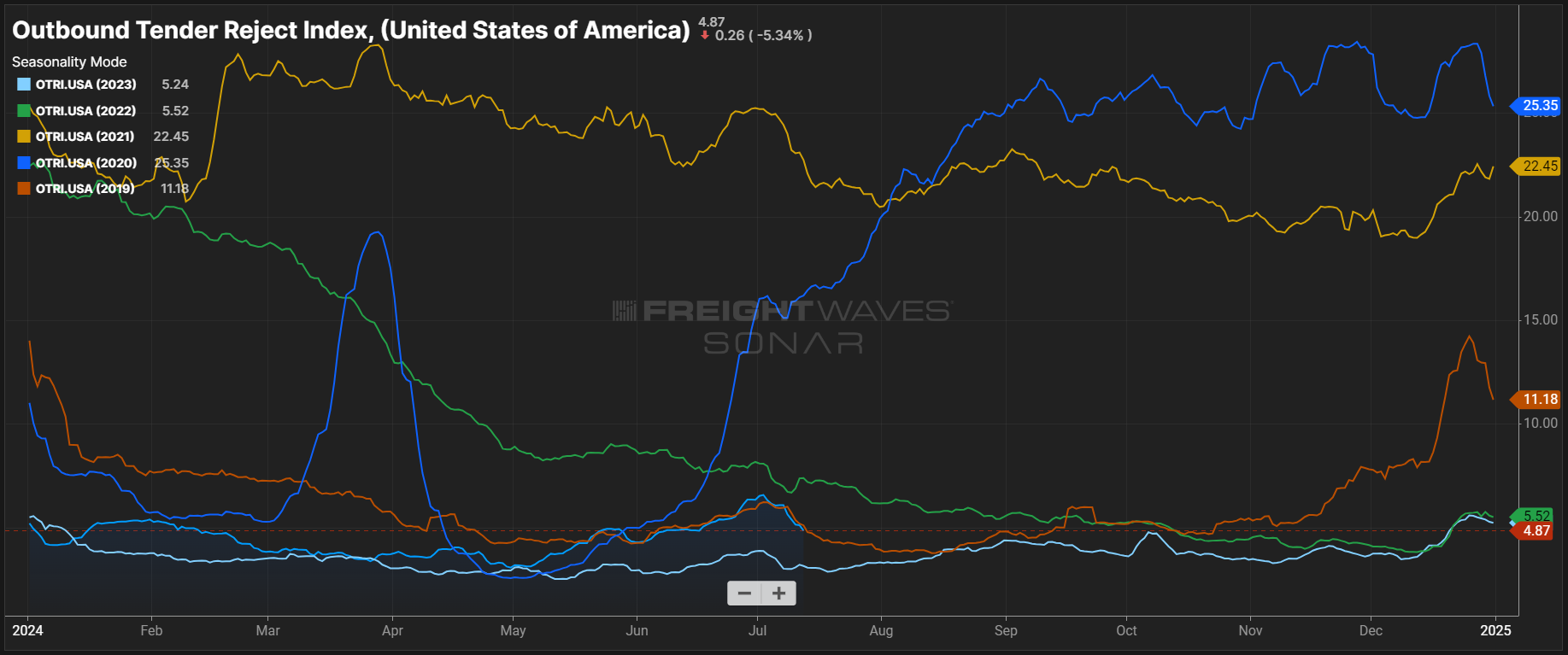

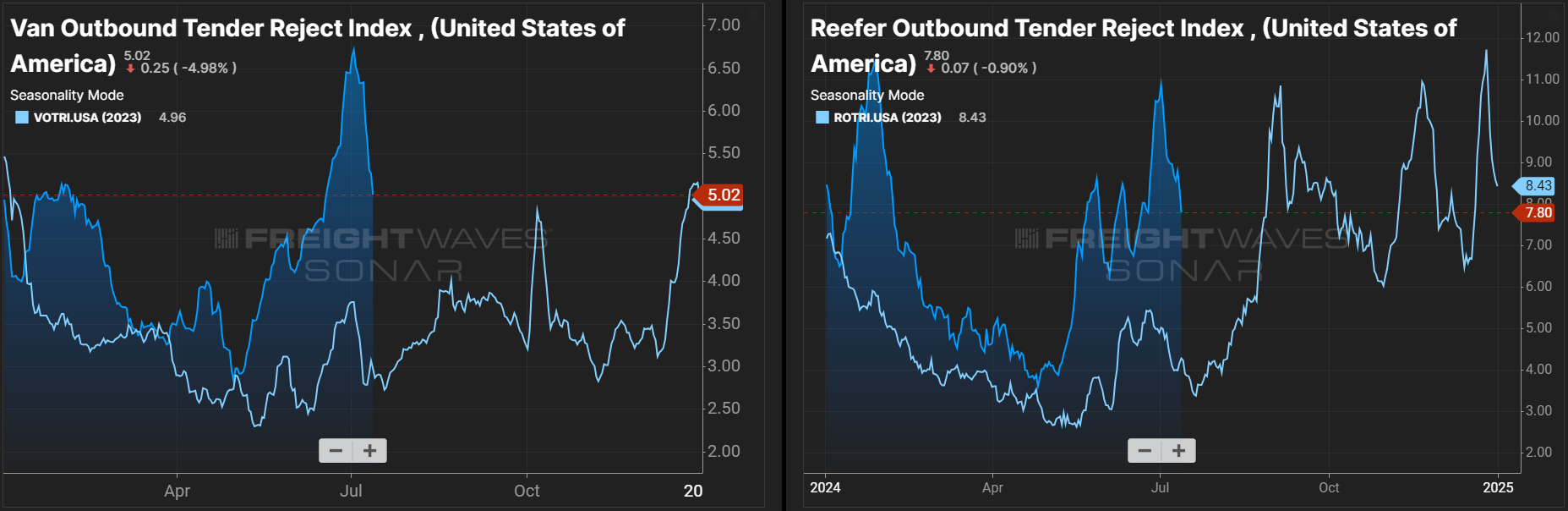

The Sonar Outbound Tender Reject Index (OTRI), which measures the rate at which carriers reject the freight they are contractually required to take, shows more volatility now than at this time last year. So far, 2024 rejection rates have closely followed 2019 trends. If current conditions hold through year-end, tender rejection rates could rise meaningfully through the Q4 peak season. Rising rejection rates are likely the result of poor trucking conditions and carrier attrition over the past year.

The DAT Load-to-Truck Ratio measures the total number of loads relative to the total number of trucks posted on its spot board. The June reading rose to 4.72, marking the fourth consecutive monthly increase and the second-highest reading since February 2022 (January 2024 was the first). The reefer load-to-truck ratio also rose month-over-month to 7.03, slightly above this time last year and almost exactly in line with June 2022.

The Morgan Stanley Dry Van Freight Index is another measure of relative supply; the higher the index, the tighter the market conditions. The black line with triangle markers on the chart provides a great view of what directional trends would be in line with normal seasonality based on historical data dating back to 2007.

The most recent reading in early July indicated trends are moving in line with the 10-year average, with some slight tightening in May that stabilized quickly. Based on historical trends, conditions will likely soften from late July to the end of August.

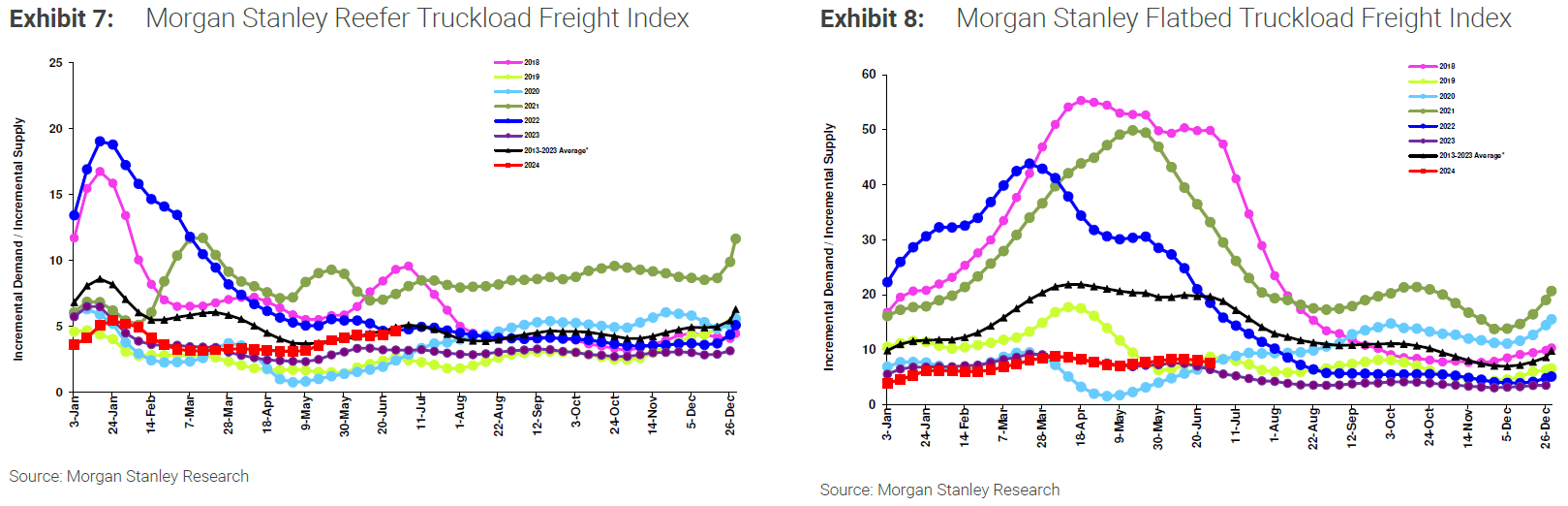

The reefer index remains close to the 10-year average. The flatbed index is slightly higher than in 2023 but is still well below the 10-year average.

Morgan Stanley Dry Van Truckload Freight Index

What’s Happening: Rates are following typical seasonality.

Why it Matters: Rates will likely decline as August begins.

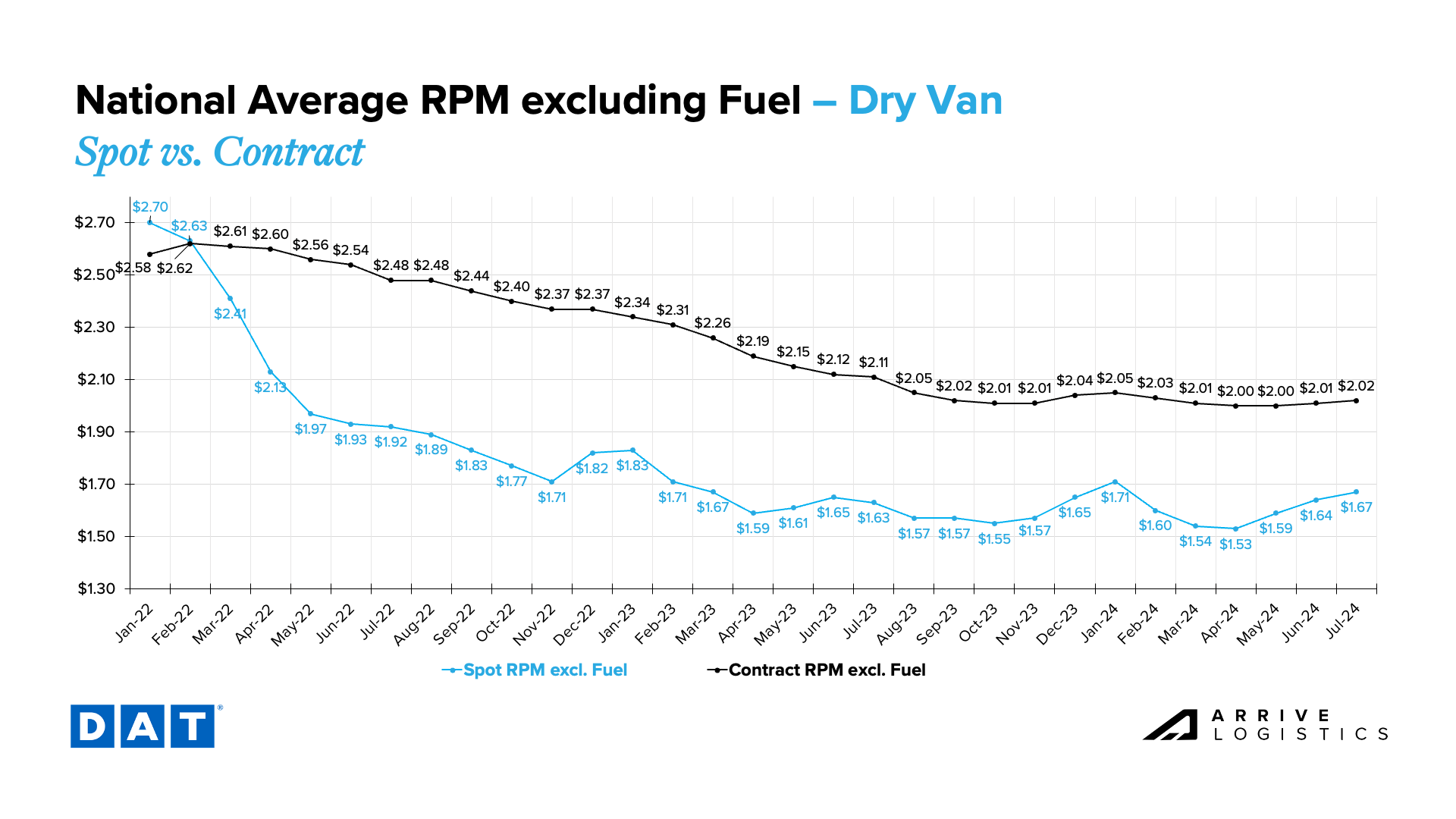

Rates followed typical patterns in June and July, increasing around the Fourth of July and normalizing shortly after. Save for any major disruptions, rates will likely return to their floor as August approaches and then fluctuate on a seasonal basis. The large spot-contract rate gap means the market is less vulnerable to major disruptions, such as Hurricane Beryl.

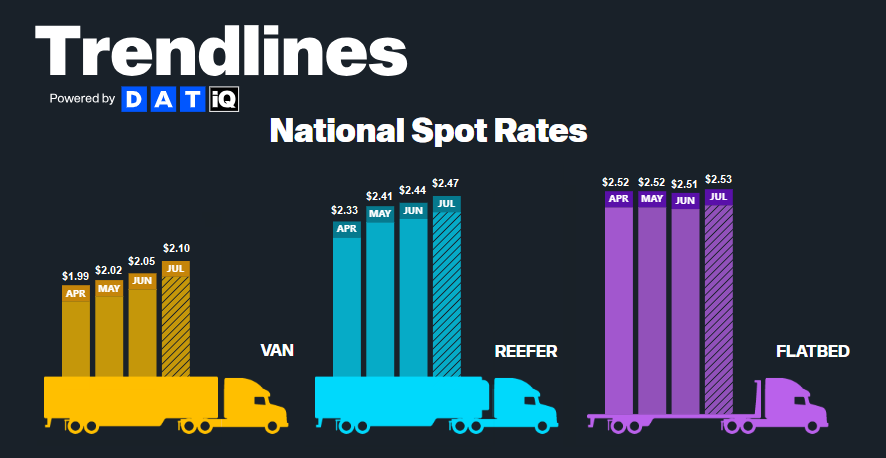

According to DAT, all-in spot rates across the three major modes have increased month-over-month in July. Dry van leads the way, with rates rising by $0.05 to $2.10 per mile. As the end of the month draws near, rates should fall closer to June averages.

All-in reefer and flatbed rates also increased but to a lesser degree than van. Ultimately, linehaul rates will likely normalize, but elevated summer fuel costs could lead all-in rates to flatline.

National diesel prices ticked up in early June and have continued to increase week over week. Prices look very similar to this time last year, a cause for concern among carriers that endured high fuel costs throughout last summer. Much of the 2023 fuel cost surge resulted from OPEC’s surprise production cuts, but prices throughout this summer will likely remain elevated even without such a catalyst.

DAT dry van linehaul rates continue to increase month-over-month, with mid-July averages of around $1.67 per mile. Contract rates remain steady, with mid-July averages at $2.02 per mile. This contract rate stability was unexpected and has led to a steady spot-contract spread, which, while consistent, remains historically elevated at $0.35 per mile. As a result, the market remains less vulnerable to demand disruptions despite increasing tender rejections.

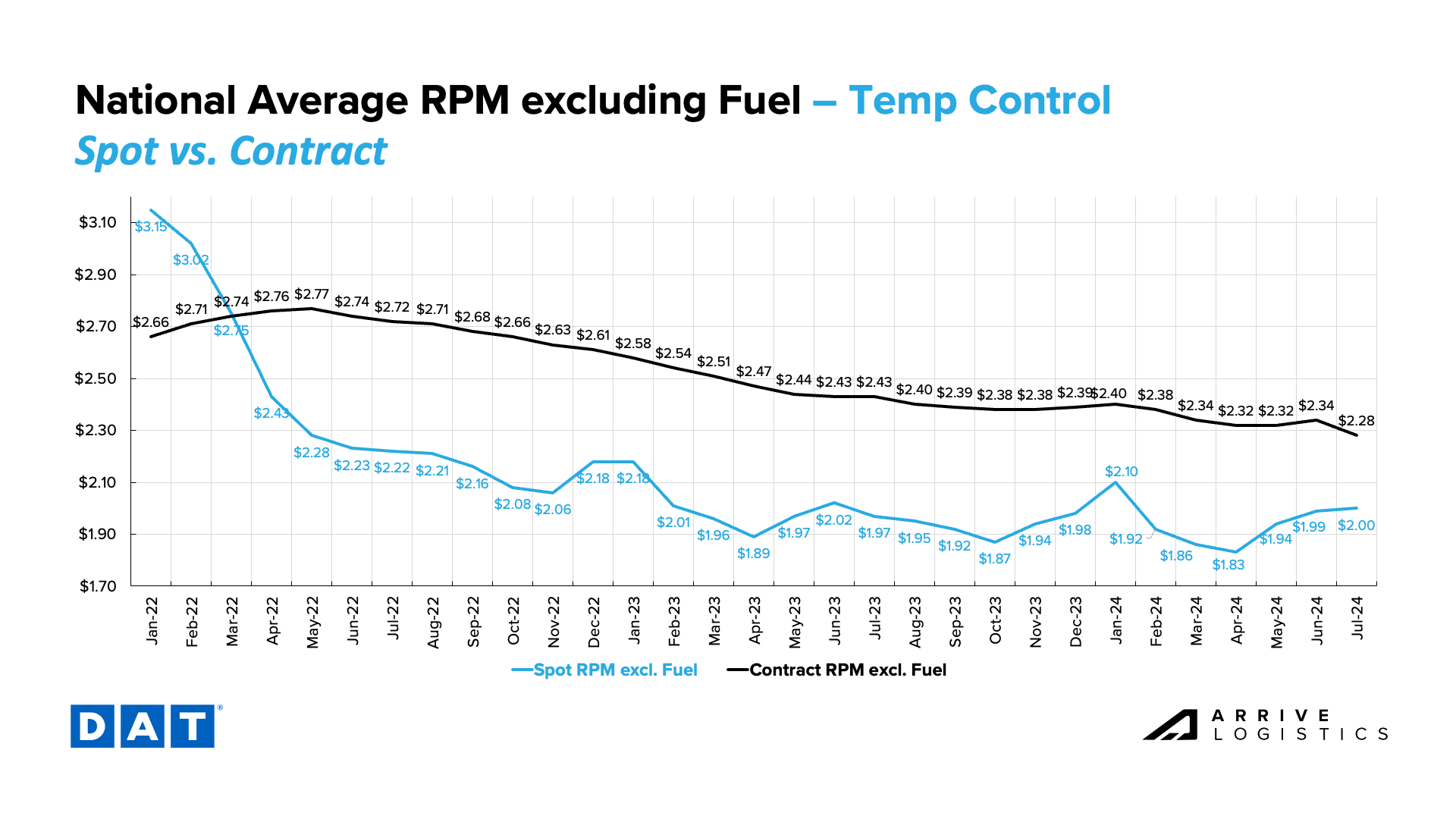

Recent volatility confirms that the temp controlled market recovery is further than dry van. Reefer linehaul rates approached $2.00 per mile in June and hit it in early July, marking the first time since January rates have reached this level. Contract rates have declined significantly in July but should soon normalize back to June levels.

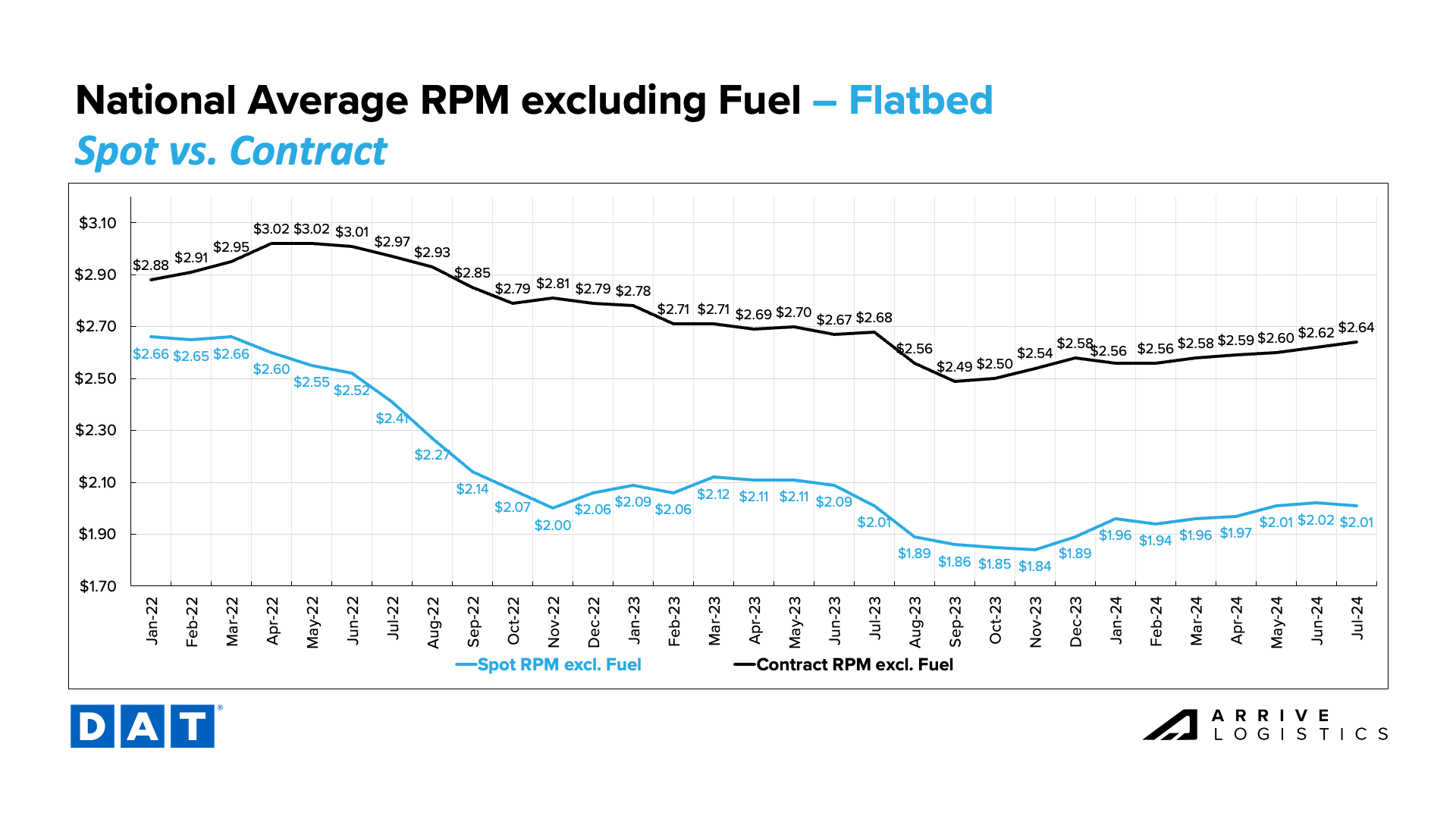

Flatbed spot rates remained steady at $2.01 per mile in early June, while contract rates continued to rise. If preliminary July numbers hold up, it would mark five consecutive months of contract rate increases. The flatbed spot-contract rate gap remains historically high at $0.63 per mile.

What’s Happening: Conditions are soft as the market awaits a decision on the rail strike.

Why It Matters: Rates remain low, but the potential strike could increase volatility.

What’s Happening: Demand is leveling out.

Why It Matters: Rates are stable aside from regional weather disruptions.

What’s Happening: The LTL market could soon experience more shake-ups.

Why It Matters: Given this is LTL’s slow season, any impact will likely be muted.

What’s Happening: Tightness is moving up the Atlantic Coast.

Why It Matters: Regional rates are rising as a result.

East Coast

Midwest

South Central

West

PNW

What’s Happening: Flatbed demand remains steady.

Why It Matters: Rates are following typical seasonality.

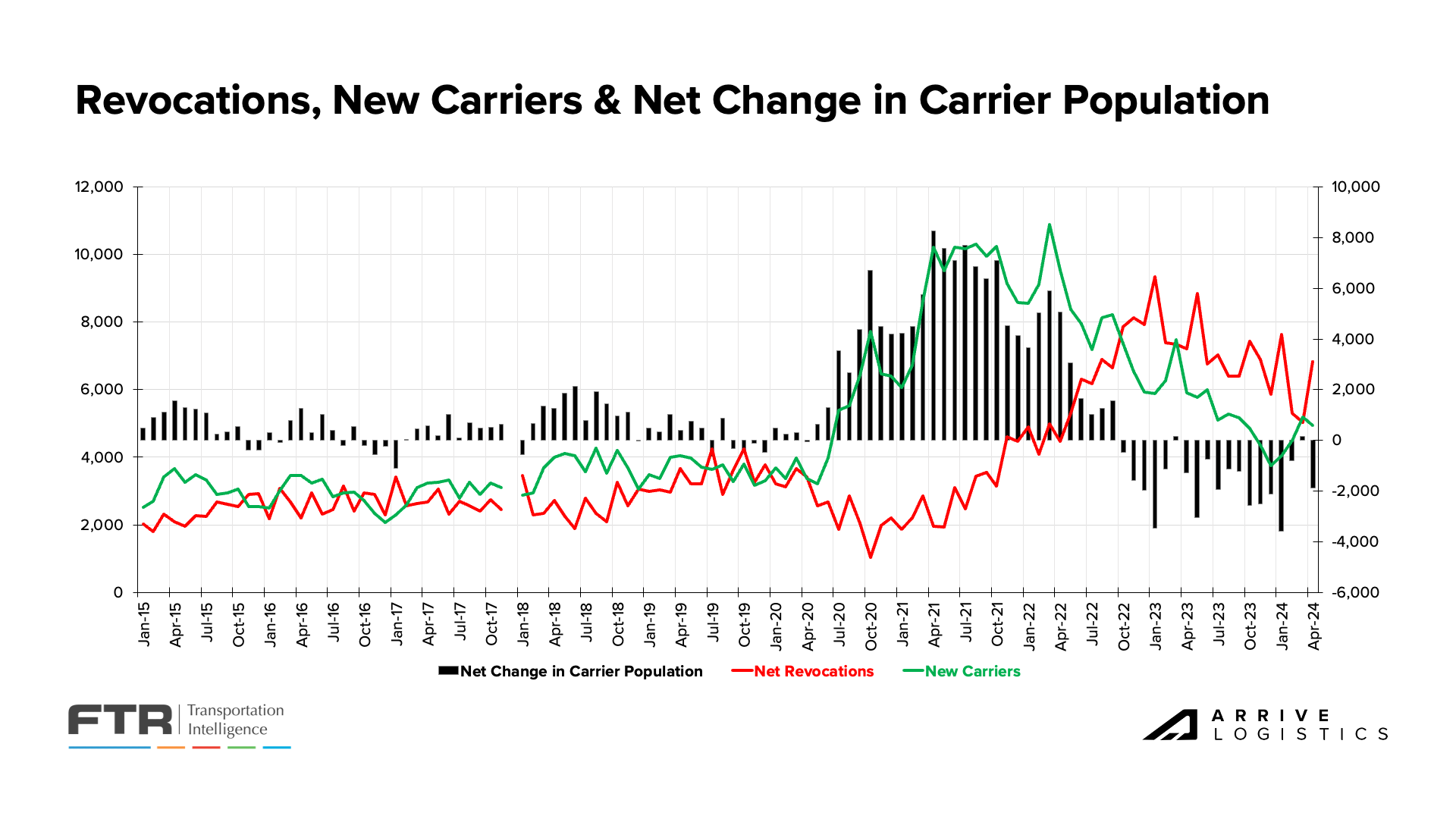

What’s Happening: More carriers are entering the market, but revocations are still negative.

Why It Matters: This trend could extend this market cycle phase.

The capacity market continues to show resilience amid challenging conditions. Net revocations have slowed, and new market entrants have increased for the second consecutive quarter. This trend amid declining carrier exits has slowed the carrier attrition rate. Current conditions reflect the equilibrium market and may remain the same in the near term. According to FTR, the high number of new carrier entrants paired with settling levels of revocations could indicate that the weakest capacity has already left the market.

Overall capacity levels remain elevated despite consistent net carrier population declines since late 2022. Avery Wise of FTR reports that there are still nearly 15% more for-hire carriers than in March 2020. While high, that number is down from its peak of 18% in July 2022. Despite the ongoing correction, it may be some time before a meaningful capacity crunch occurs.

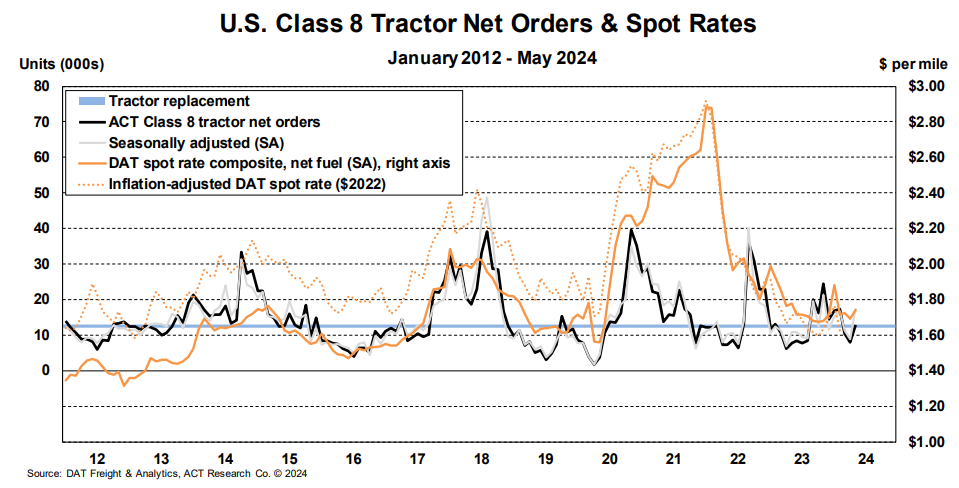

ACT Research reported 7,500 Class 8 truck orders in June, down from 11,000 in May. The decline is unsurprising as orders tend to soften during the summer. However, orders have fallen below replacement levels in four of the last five months, which could be a positive sign for those waiting for the capacity market to shrink.

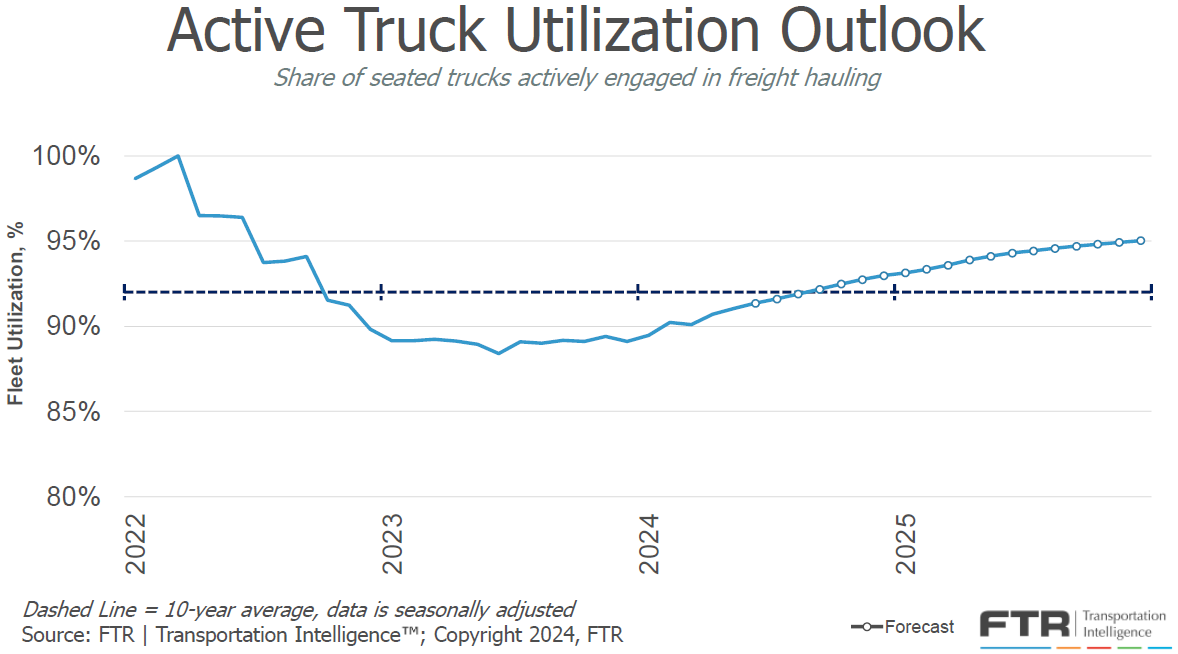

FTR revised its truck utilization forecast downward due to a weaker freight outlook. However, it is clear that utilization bottomed out in mid-2023 and has consistently ticked up since. Active utilization was 91% in May 2024, one percentage point below the 10-year average, and will likely approach 93% by the start of 2025 — another sign that the market is moving toward balance.

What’s Happening: Import volumes will likely remain elevated through Q3 2024.

Why It Matters: Elevated imports could drive increased freight demand and rates.

Overall, the volume outlook remains positive. The National Retail Federation (NRF) still expects over two million TEUs monthly until November. U.S. ports handled 2.08 million TEUs in May, an increase of 7.7% year over year and 3% month-over-month. The NRF’s forecast also calls for 4.43 million TEUs to move through U.S. ports in July and August, which would be an 18.4% year-over-year increase.

Increased imports indicate that retailers are restocking inventories in anticipation of strong holiday consumer demand. While this data is encouraging, we caution that retail orders are not always a true indicator of future retail spending. If retail executives overorder, it could create inventory stockpiles similar to those of the post-COVID era, which would have a deflationary impact on the freight market.

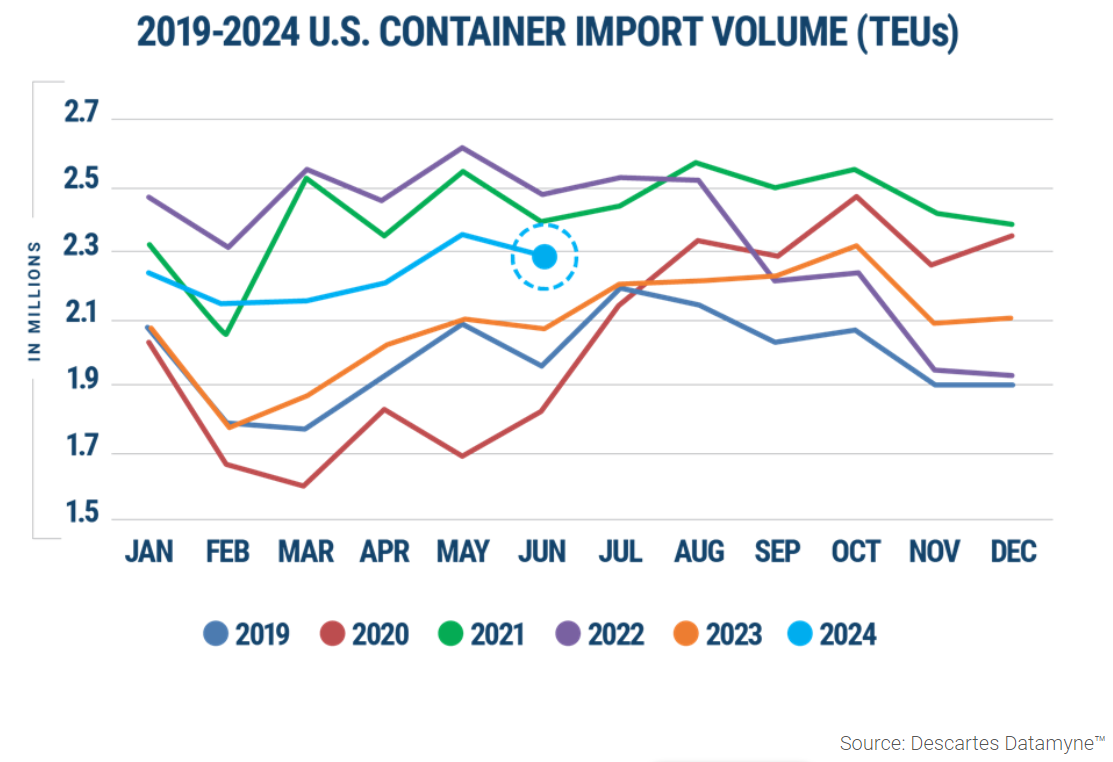

Descartes’ June import data deviated slightly from the NRF’s projections, showing a 2% decrease from May. However, volumes were still up over 10% year-over-year, indicating a strong import market.

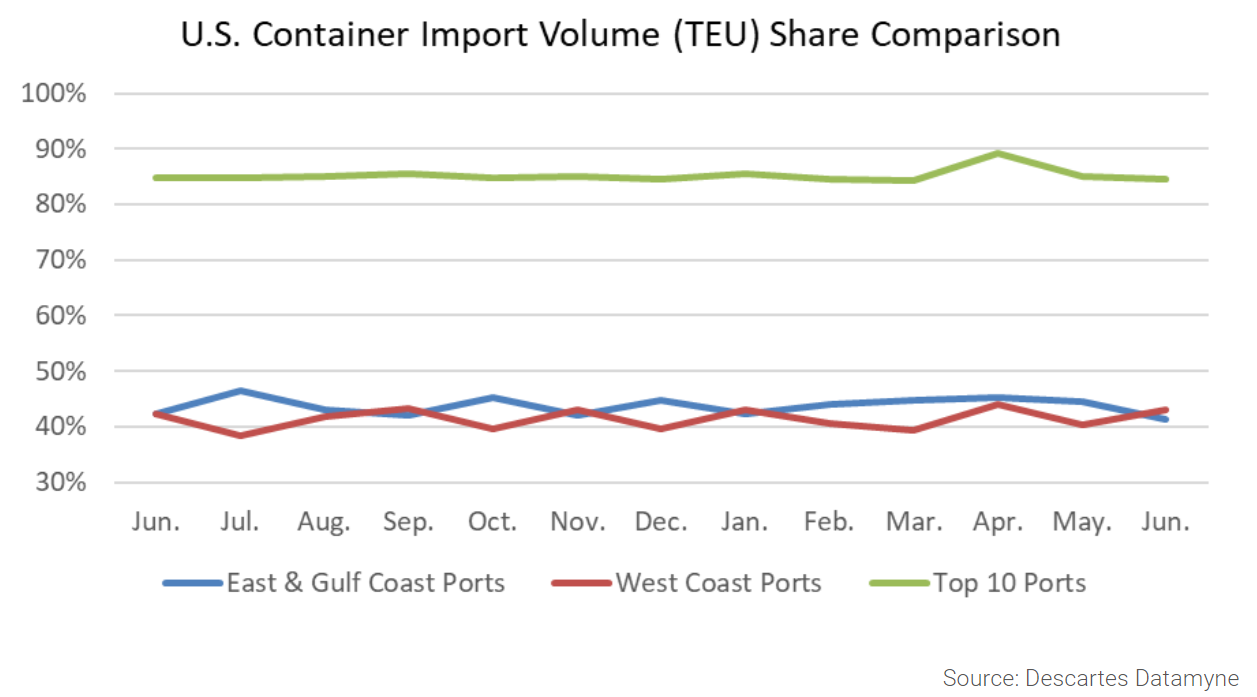

Chinese import volumes were up 13.8% year-over-year, which is unsurprising as retailers restock inventories and shippers work to import goods before tariffs increase starting in August. This trend might also explain why West Coast ports handled more volume than East and Gulf Coast ports for the first time since January 2024.

Overall, consumer health indicators still look relatively strong. Industrial production and manufacturing increased by 0.9% month-over-month, but the sector remains relatively flat year-over-year. Housing starts declined 5% month-over-month and nearly 20% from May of last year and will likely remain low amid high mortgage rates. Thus, truckload demand remains flat, but we will continue to monitor these industries as key drivers of freight demand fluctuations.

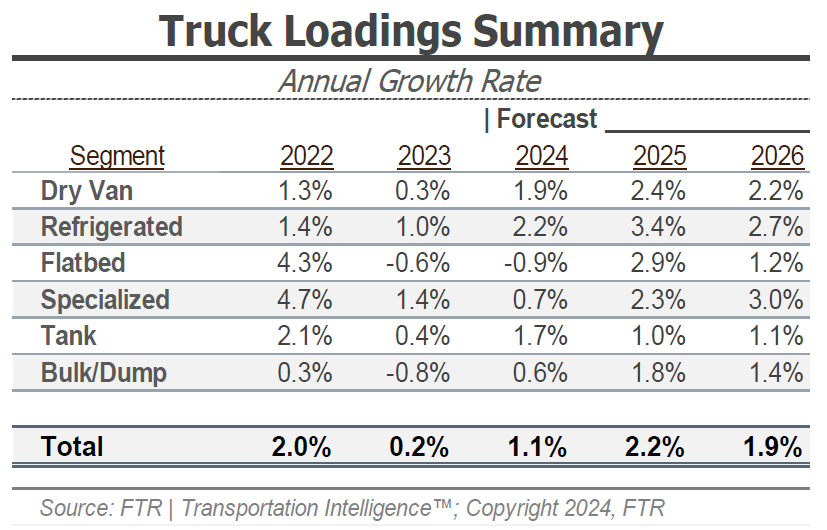

FTR’s latest truck loadings forecast calls for a 1.1% year-over-year increase by the end of 2024, a downward revision from last month’s 1.8% projection. The 2025 forecast was revised from 2.4% last month to 2.2%, largely driven by an updated bulk and dump loadings forecast that calls for 0.6% growth by year-end, down from the 3.6% projected last month. The remaining modes were relatively steady despite slight downward revisions. These changes reflect a market that is likely to be slow for most of the year.

What’s Happening: Inflation fell to 3.0%.

Why It Matters: Cooling inflation could lead to a late-year interest rate cut.

Inflation fell from 3.3% in May to 3.0% in June. While this is good news for customers, more than one rate cut this year is still unlikely, and the true impact of cooling inflation won’t take effect until 2025. Rate cuts would likely jump-start economic activity and spending as borrowing costs decline. However, because rate cuts may come with other less positive economic data that could offset any gains, we caution against making this a trend of focus.

Bank of America reports that credit and debit card spending decreased by 0.5% year-over-year in June. This was also the first month-over-month spending decline since January 2024. However, strong spending in April supported a 0.3% increase in Q2, indicating a positive trend overall. Services sector spending also increased in June, so a meaningful demand decline is unlikely in the near term.

The freight market is firmly in equilibrium, with seasonality driving typical rate volatility. June and July unfolded as expected, with some increased volatility around the Fourth of July, followed by rapid normalization. Thus, the summer peak season remains relatively muted but it is clear the supply-demand balance has progressed since last year.

Overall, our outlook remains the same. Quiet conditions will likely last through July and August with some regional volatility. Localized disruptions around coastal markets are possible as Hurricane season continues. However, barring a major storm, any impact will likely be contained and short-lived.

The persistently wide spot-contract spread should keep the market safe from disruptions. As this stage of the market cycle continues, it should lead to conditions for sustained routing guide disruption in 2025.

The Arrive Monthly Market Update, created by Arrive InsightsTM, is a report that analyzes data from multiple sources, including but not limited to FreightWaves SONAR, DAT, FTR Transportation Intelligence, ACT Research, Morgan Stanley Research, Bank of America Internal Data, Journal of Commerce, Stephens Research, National Retail Federation and FRED Economic Data from the past month as well as year-over-year. We understand market data is vital in making real-time business decisions. At Arrive Logistics, we are committed to giving you the data and insights you need to better manage your freight.