"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

Recent trends support our forecast. Spot rates are flat into early March and, after a brief seasonal pickup throughout the month, will likely find a floor in April.

Meanwhile, the large and ongoing spot-contract gap will continue to drive downward pressure on contract rates that are up for negotiation throughout at least the year’s first half.

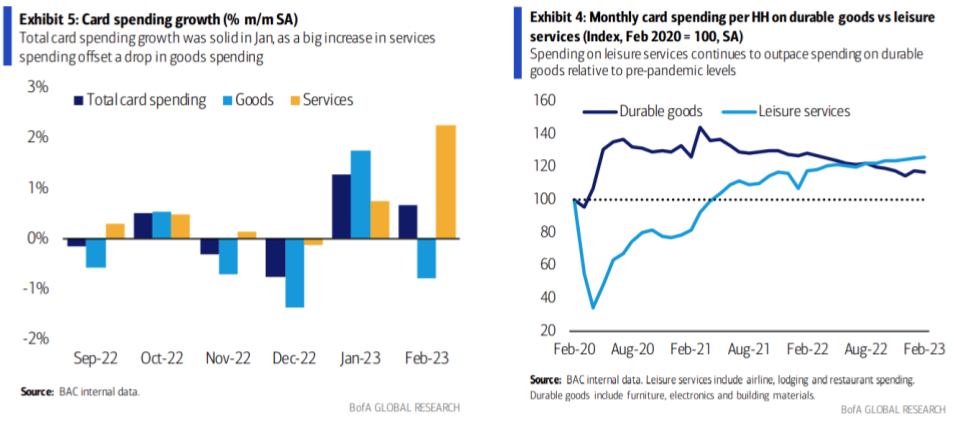

Finally, demand is faltering as capacity continues to normalize to new levels, which should ultimately facilitate longer-term equilibrium conditions until a significant enough demand disruption impacts the market.

"*" indicates required fields

Overall, demand remains healthy, but large allocations continue to move via primary contract carriers.

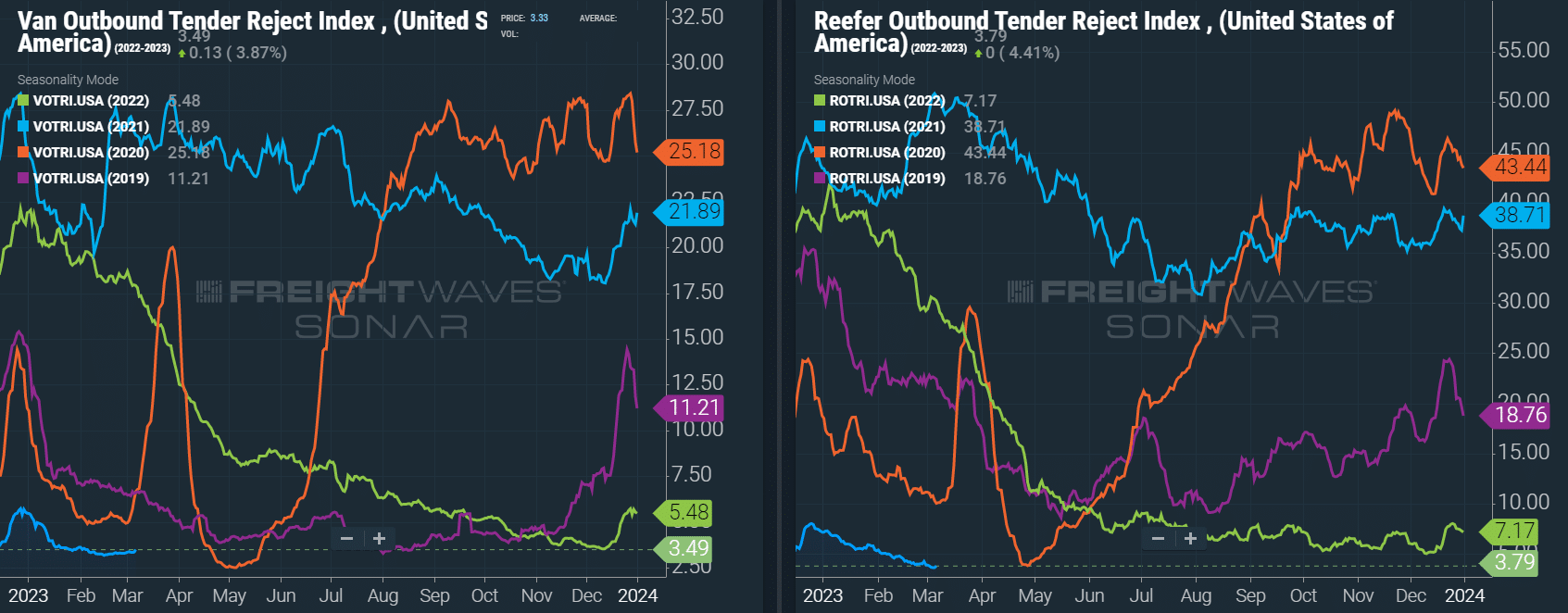

Tender rejection activity near 3.5% illustrates historically strong contract compliance and carriers’ appetite for accepting nearly all contract freight.

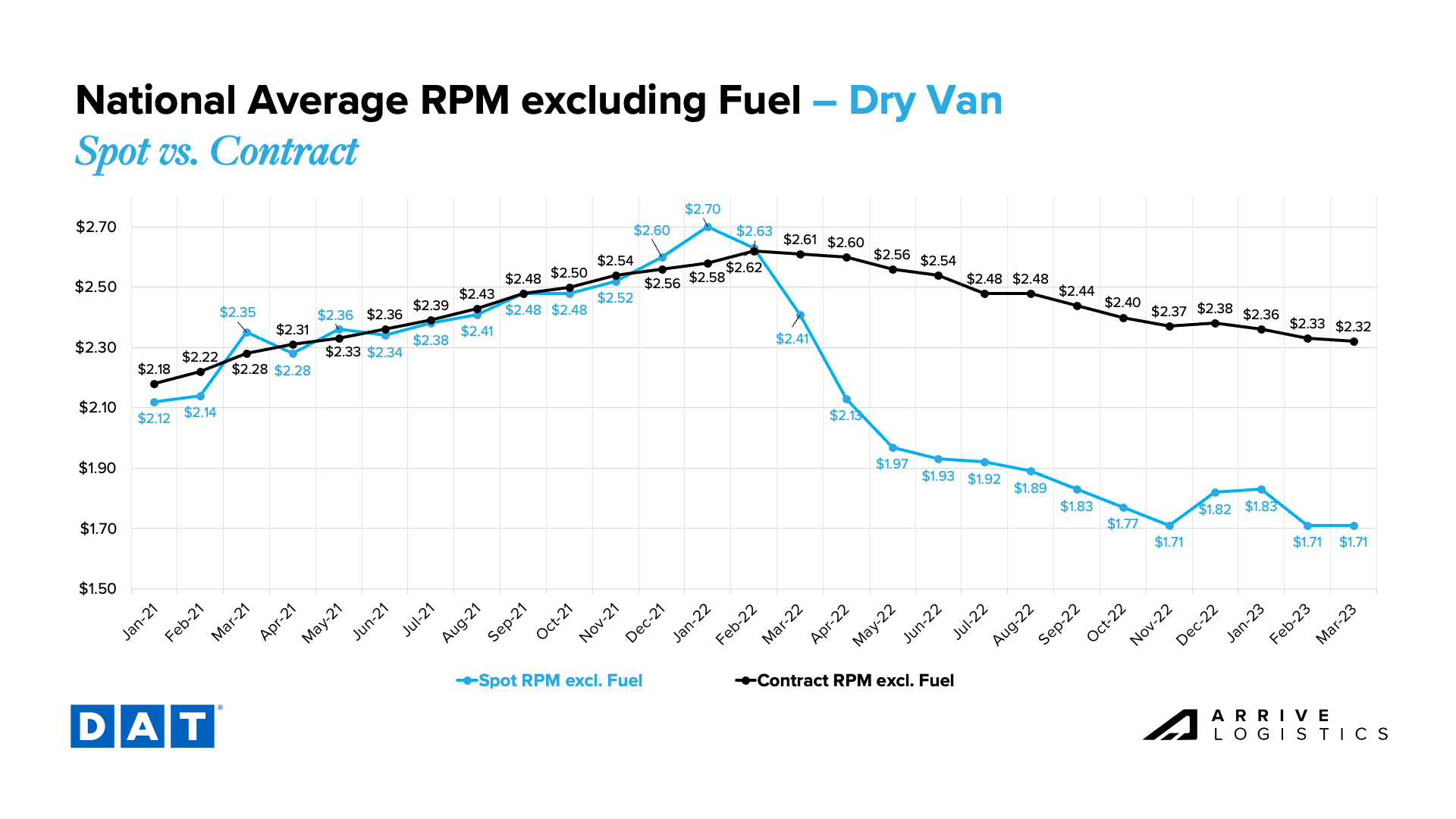

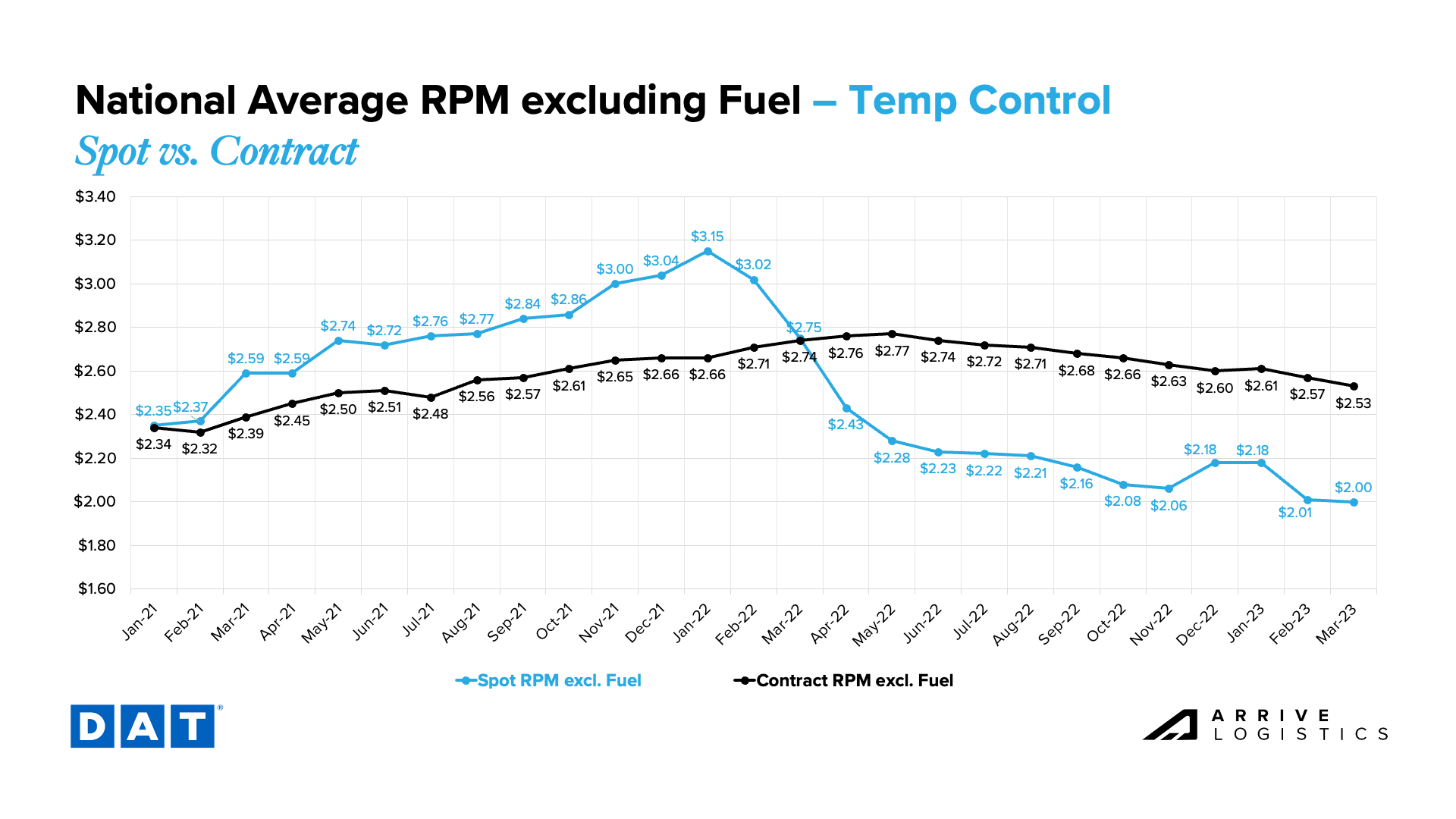

The gap between spot and contract rates for van and reefer equipment is currently $0.61 and $0.53 per mile, respectively, meaning downward contract rate pressure will persist.

Current spot rates are too low to support operating costs for most carriers and are driving large numbers of authority revocations among owner-operators with high spot market exposure.

Trucking employment experienced the most significant single-month job decline since the initial pandemic lockdowns; the number of drivers leaving the market is now outpacing owner-operators transitioning to company jobs.

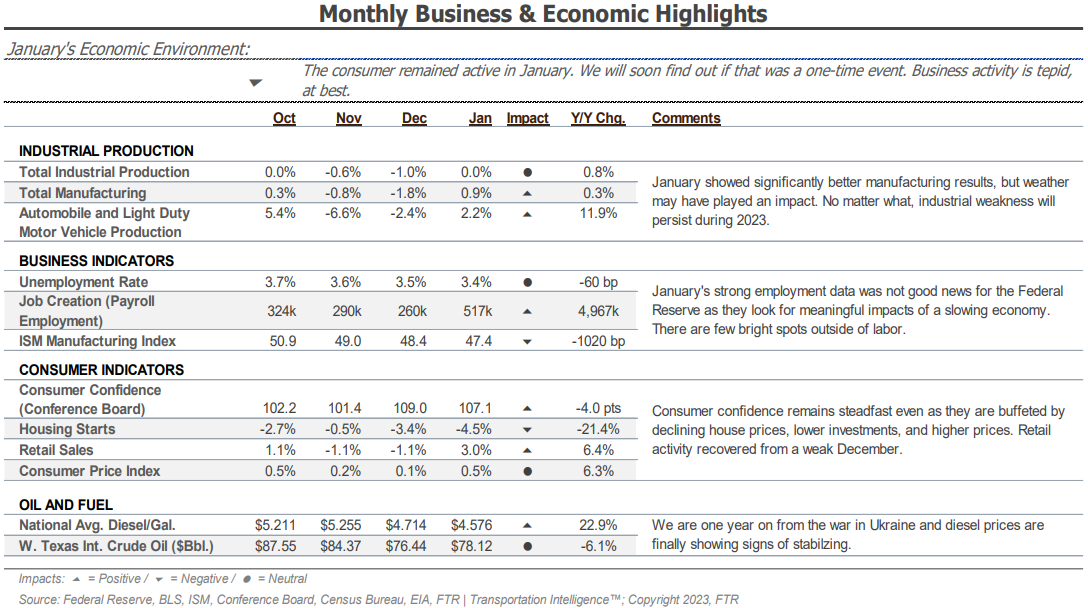

The manufacturing sector, which was expected to be a key driver of demand in 2023, contracted for the fourth straight month, increasing potential downside demand risk.

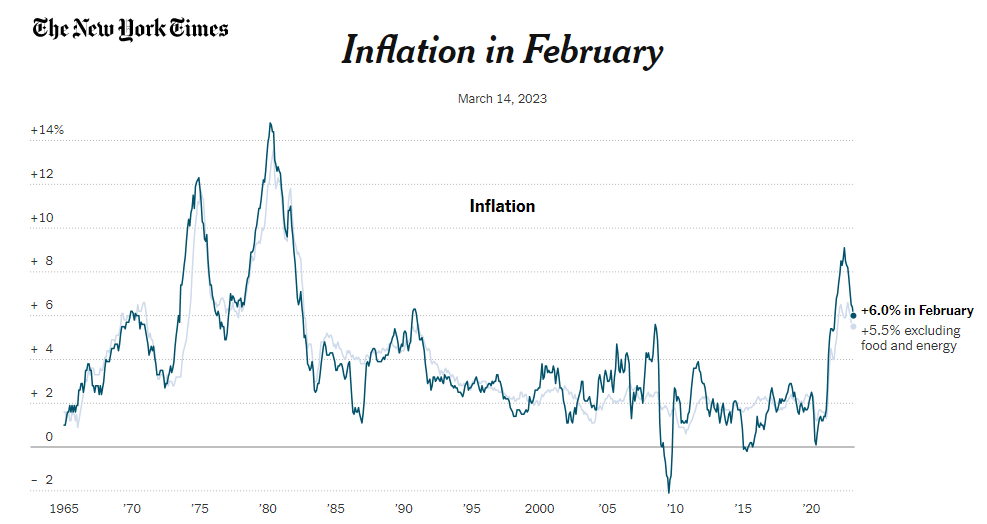

Consumer spending remains strong, but recent trends point to services spending as the key growth driver.

The National Retail Federation indicated retailers are holding off on ordering new inventories until the economic outlook clears up — an indication truckload demand and retail imports could see pullbacks in 2023.

Initial jobless claims and the unemployment rate remained relatively flat in early March, bolstering confidence in consumers’ ability to maintain spending and prevent rapid declines in truckload demand.

What’s Happening: Demand remains healthy relative to pre-pandemic norms, but it is showing signs of faltering.

Why It Matters: Dwindling demand could cause further challenges for carriers trying to keep trucks on the road.

February is typically the slowest month of the year for the freight market, and this one was no exception. Though overall demand remained healthy relative to pre-pandemic levels and trends were in line with normal seasonality, the market did show some early signs of faltering. Volumes are picking up in early March, and accepted tenders are currently up 1.4% from where they were at this time last month. However, it is still unclear whether this seasonal uptick will be strong enough to stave off further demand declines in the coming months.

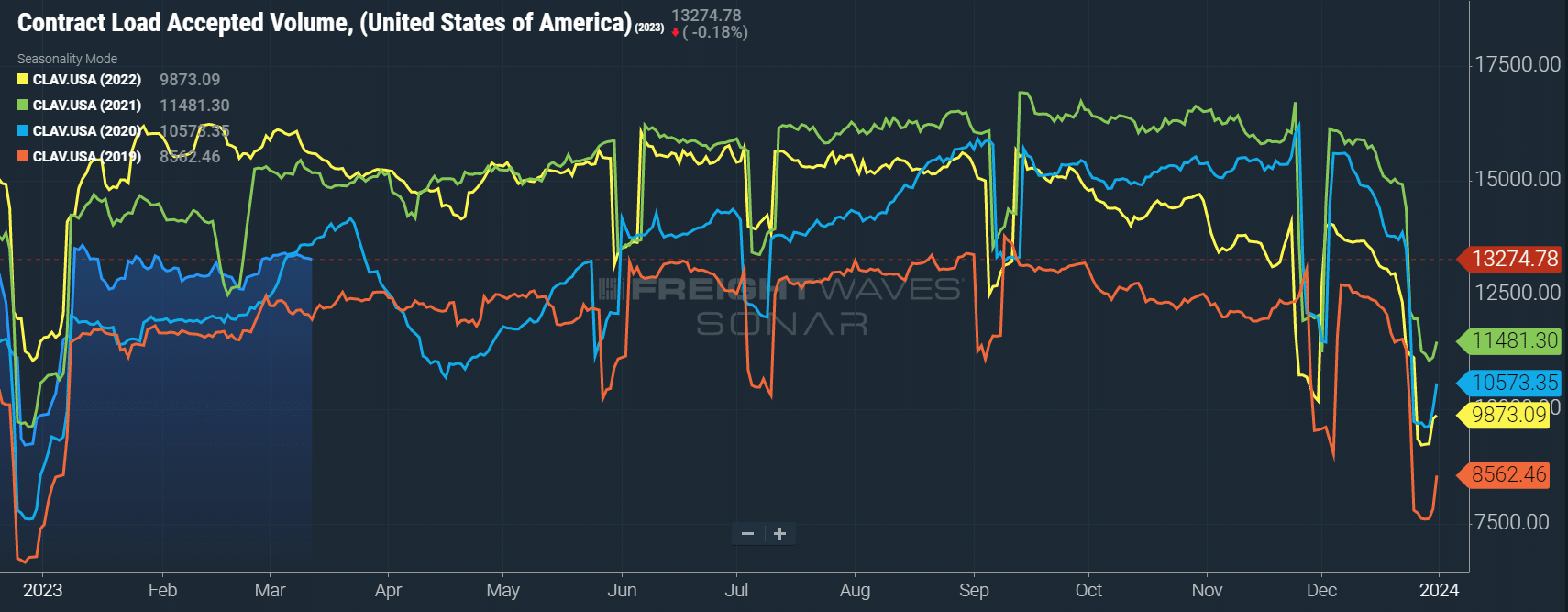

The FreightWaves SONAR Outbound Tender Volume Index (OTVI), which measures contract tender volumes across all modes, was down 30% year-over-year, or 17% when measuring accepted volumes after the significant decline in tender rejection rates. The significant decline is still inconsistent with other sources. Though unconfirmed by FreightWaves, it is likely that their data is heavily skewed toward retail freight, for which demand has slowed substantially since Q4 2021. If true, this would help explain the significant drop in volumes.

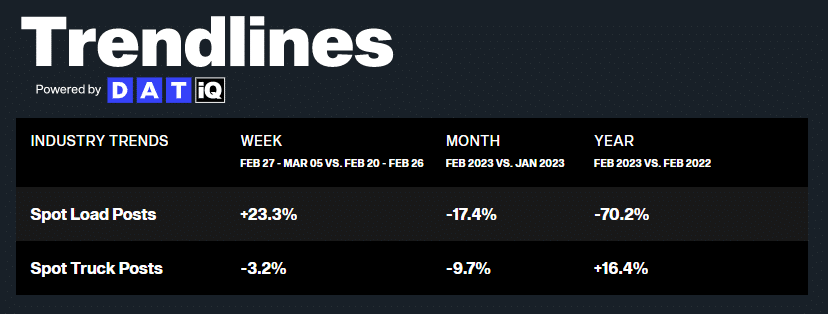

The February contract versus spot market story stayed consistent with January, as shippers still heavily favored contractual freight. DAT data showed spot volumes were down 70% year-over-year and 17% month-over-month in February, a sign of easing seasonal pressure at the end of January.

What’s Happening: Tender rejection rates remain historically low as carriers and brokerages prioritize service to protect contract volumes.

Why It Matters: Shippers can count on finding ample capacity in the market as carriers and brokers brace themselves against broader economic uncertainty.

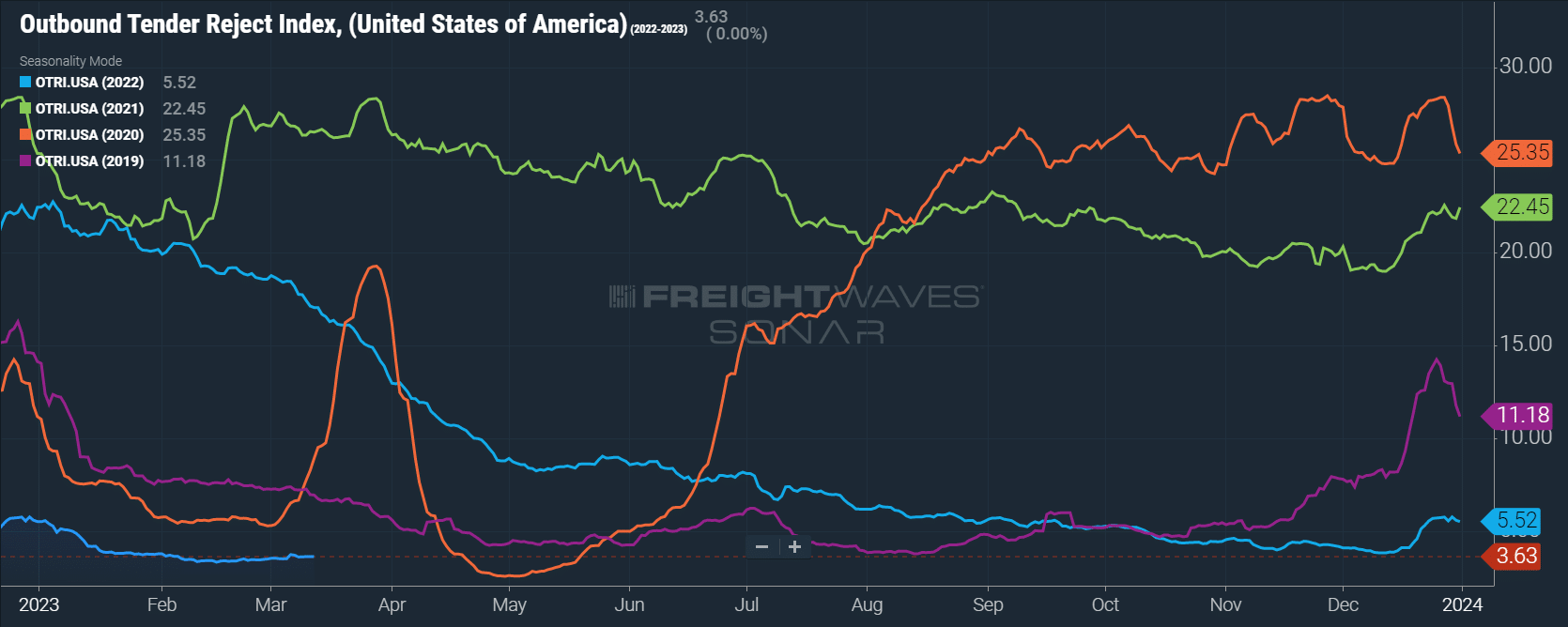

February provided further proof that capacity is and will likely continue to be abundant in the market for at least the short term. Aside from a nominal uptick last month, tender rejections remain historically low for this time of year, indicating that carriers are still willing and able to support current demand.

The Sonar Outbound Tender Reject Index (OTRI) measures the rate at which carriers reject the freight they are contractually required to take. The rate remained relatively flat month-to-month, increasing from 3.47% in early February to 3.52% in early March. This indicates that shippers are still seeing good routing guide compliance on contractual freight. Meanwhile, reefer tender rejections aligned with van rejections, easing throughout the month.

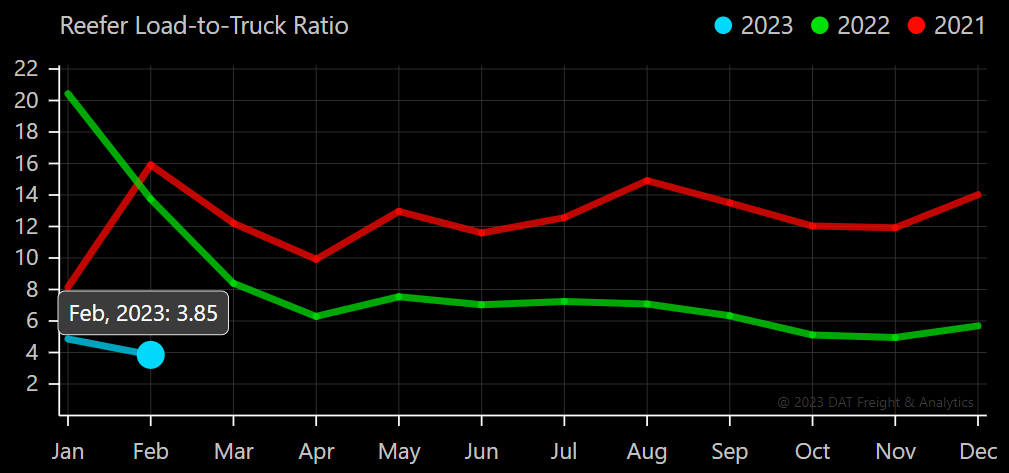

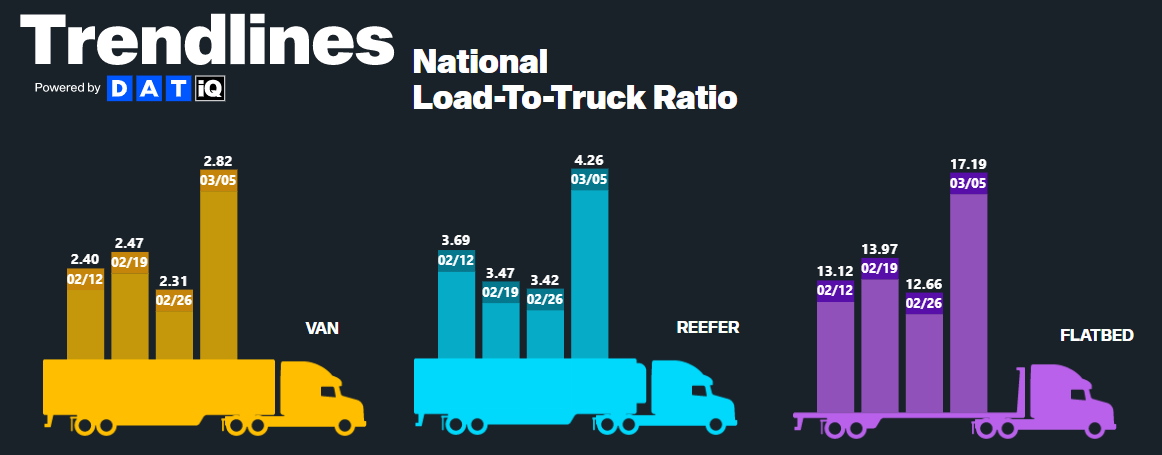

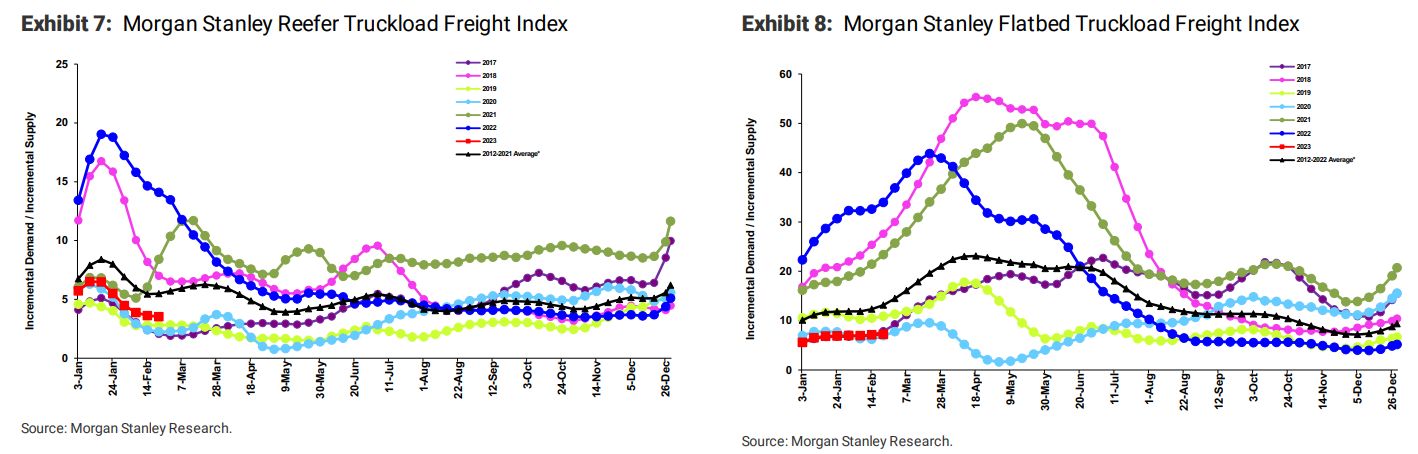

The DAT Load-to-Truck Ratio measures the total number of loads relative to the total number of trucks posted on their spot load board. February data was consistent with typical seasonal easing: The Dry Van Load-to-Truck Ratio was down 16% month-over-month and 65% year-over-year, and the Reefer Load-to-Truck Ratio was down 20% month-over-month and 72% year-over-year.

Figure 6: DAT Van Load-to-Truck Ratio

Weekly Load to Truck Ratio trends across all modes showed a spot load increase in the last week of February due to the overlap of a short-lived activity surge and widespread winter weather.

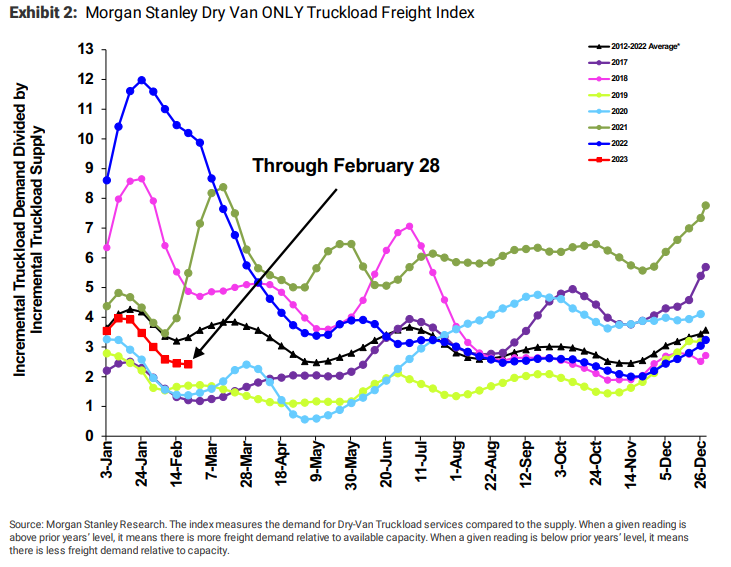

The Morgan Stanley Dry Van Freight Index is another measure of relative supply; the higher the index, the tighter the market conditions. The black line with triangle markers on the chart provides a great view of what directional trends would be in line with normal seasonality based on historical data dating back to 2007.

While the data continues to show underperformance relative to normal seasonality, a recent plateau signals we are still seeing movements in line with expectations. Nonetheless, some tightening is expected with the early produce season in March, but it is unlikely to significantly disrupt shipper tender acceptance.

What’s Happening: Aside from a slight end-of-month uptick, rates are following normal seasonal patterns.

Why it Matters: Shippers still have time to lock in contract capacity at lower rates.

As with Load-to-Truck Ratio trends, rates spiked briefly near the end of the month due to widespread winter weather and a resulting brief spot demand surge. However, February rates remained mostly in line with normal seasonal patterns. Spot rates don’t appear to have fully bottomed out just yet, so shippers are still in a great position to lock in low contract rates before we reach the floor.

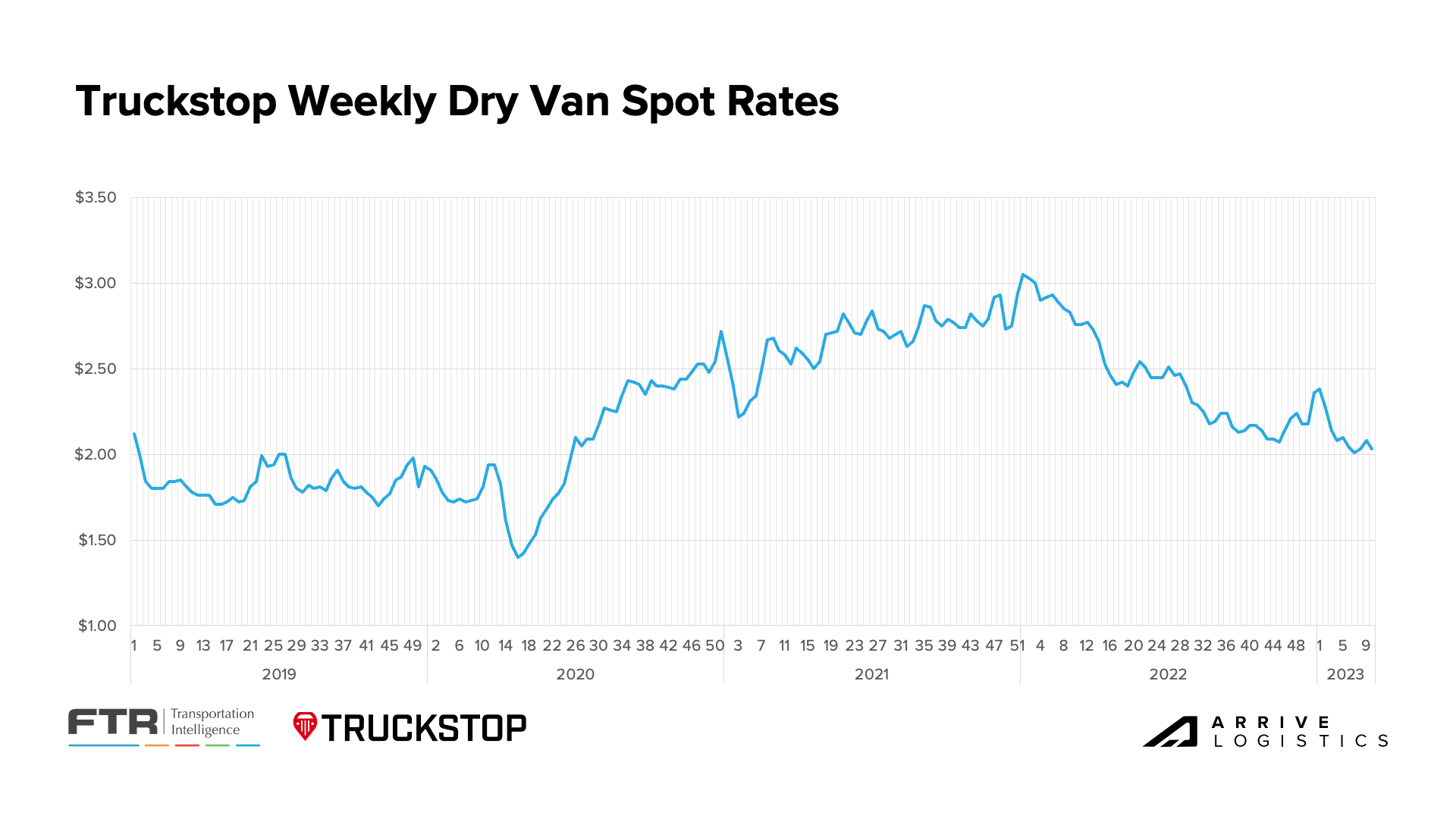

Looking at the Weekly Dry Van Spot Rates chart, rates briefly found a floor in recent weeks but have since trended back up. A similar situation occurred in 2019 when capacity conditions and other market pressures were much like today. At that time, rates continued to trend down into April after the March uptick, and we expect to see the same scenario play out this year.

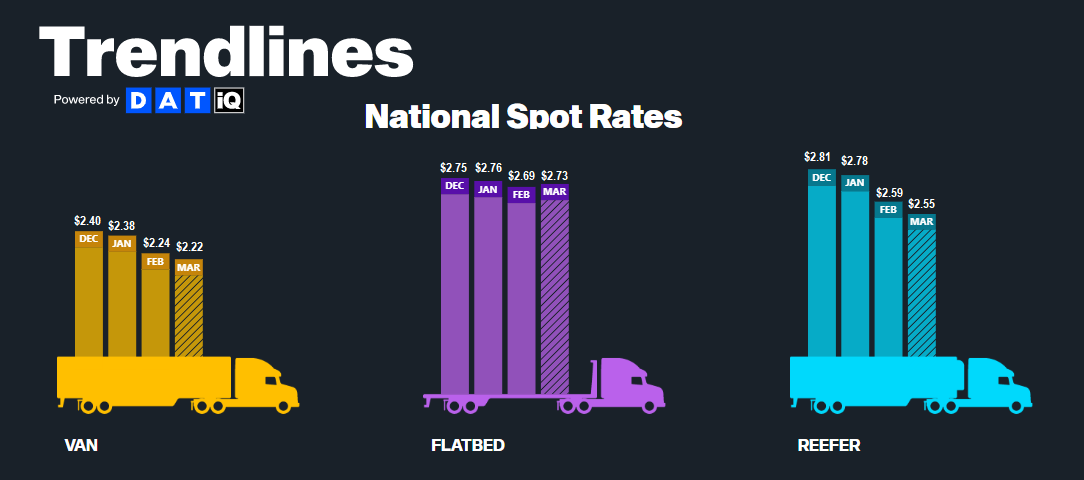

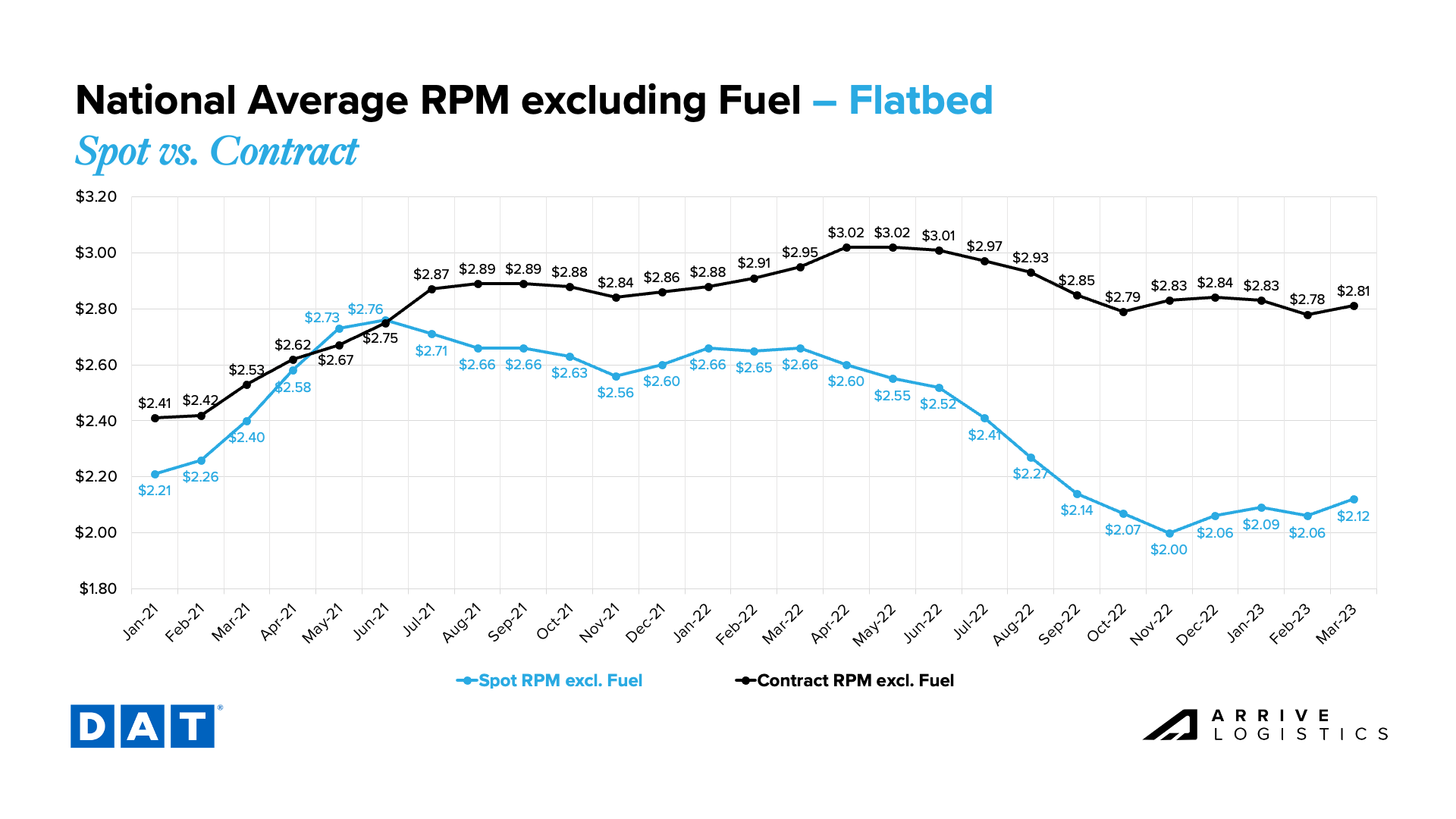

According to DAT, all-in spot rates, including linehaul and fuel costs, are down across dry van and reefer equipment types but are up for flatbed equipment. As of March 10th, van and reefer equipment have fallen by $0.02 and $0.04, respectively, compared to an increase of $0.04 for flatbed.

Early March linehaul data shows spot rates stabilizing and contract rates continuing their downward trend of the past year for van and reefer equipment, while flatbed spot and contract rates are on the rise.

The van rate spread is holding relatively steady at $0.61 between spot and contract rates. As a result, downward pressure on contract rates should continue for the foreseeable future, even if the market experiences some seasonal pressures in the back half of the second quarter.

All-in spot rates are down 27% year-over-year, and linehaul spot rates are down 29%. All-in contract rates are down 13% year-over-year, and linehaul contract rates are down 11.1%.

Reefer spot and contract linehaul rates are following the same pattern as van rates early in the month. Down 7.7% year-over-year, the current reefer contract rate is $2.53 per mile, excluding fuel, while the current reefer spot rate is down 27% year-over-year to $2.00 per mile, excluding fuel. This is still a significant decline, but slightly less dramatic than the 33% plummet in February.

Thanks in part to the return of warm weather and the onset of construction season in the south, spot and contract flatbed rates both had meaningful month-over-month increases. Spot rates landed at $2.12 and contract at $2.81.

What’s Happening: LTL carriers are still seeing low volumes.

Why It Matters: Strong pricing offers some relief, but more pullbacks in manufacturing or other major sectors could be a persistent pain point.

What’s Happening: Mexico’s produce season is driving some tightness.

Why It Matters: This trend will continue as the season ramps up.

General Cross-Border Mexico Market Update: As the produce season continues to ramp up, the market is tightening slightly in the Bajio. The continued nearshoring trend will result in a wider gap between northbound and southbound volume.

Market Specific Updates:

General Cross-Border Canada Update: A healthy balance of capacity is moving into and out of the Greater Toronto Area (GTA) as the market remains stable. Our Canadian carrier base continues to grow as our team does, and new carriers are entering the mix regularly.

Market-Specific Updates:

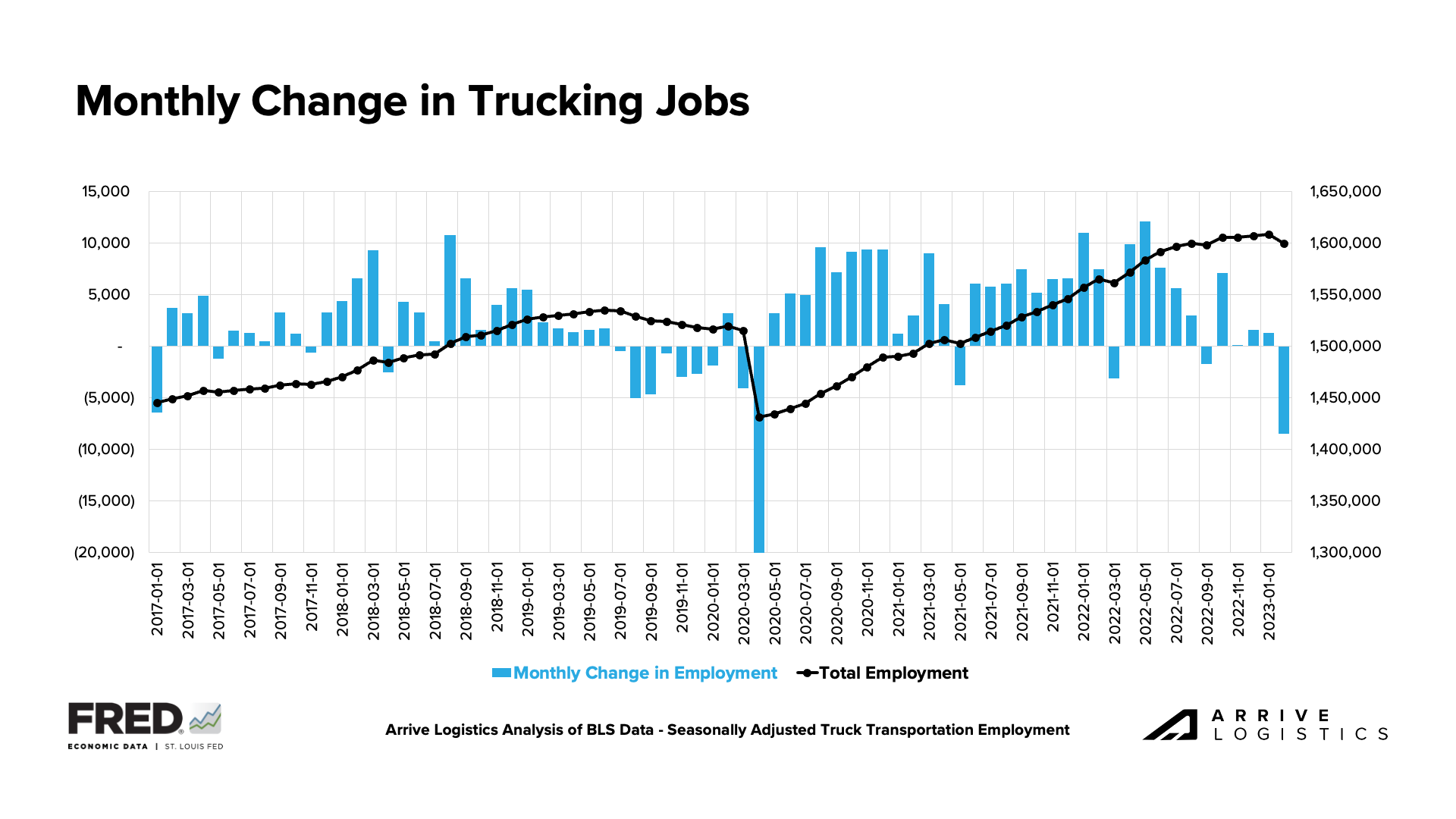

What’s Happening: Carriers are right-sizing their fleets as shippers adjust volume awards to the downside, leading to the largest decline in trucking employment since May 2020.

Why It Matters: This trend could continue for some time and indicates that capacity will continue to decline until demand stabilizes. At that point, the market could become vulnerable to disruption due to shrinking capacity.

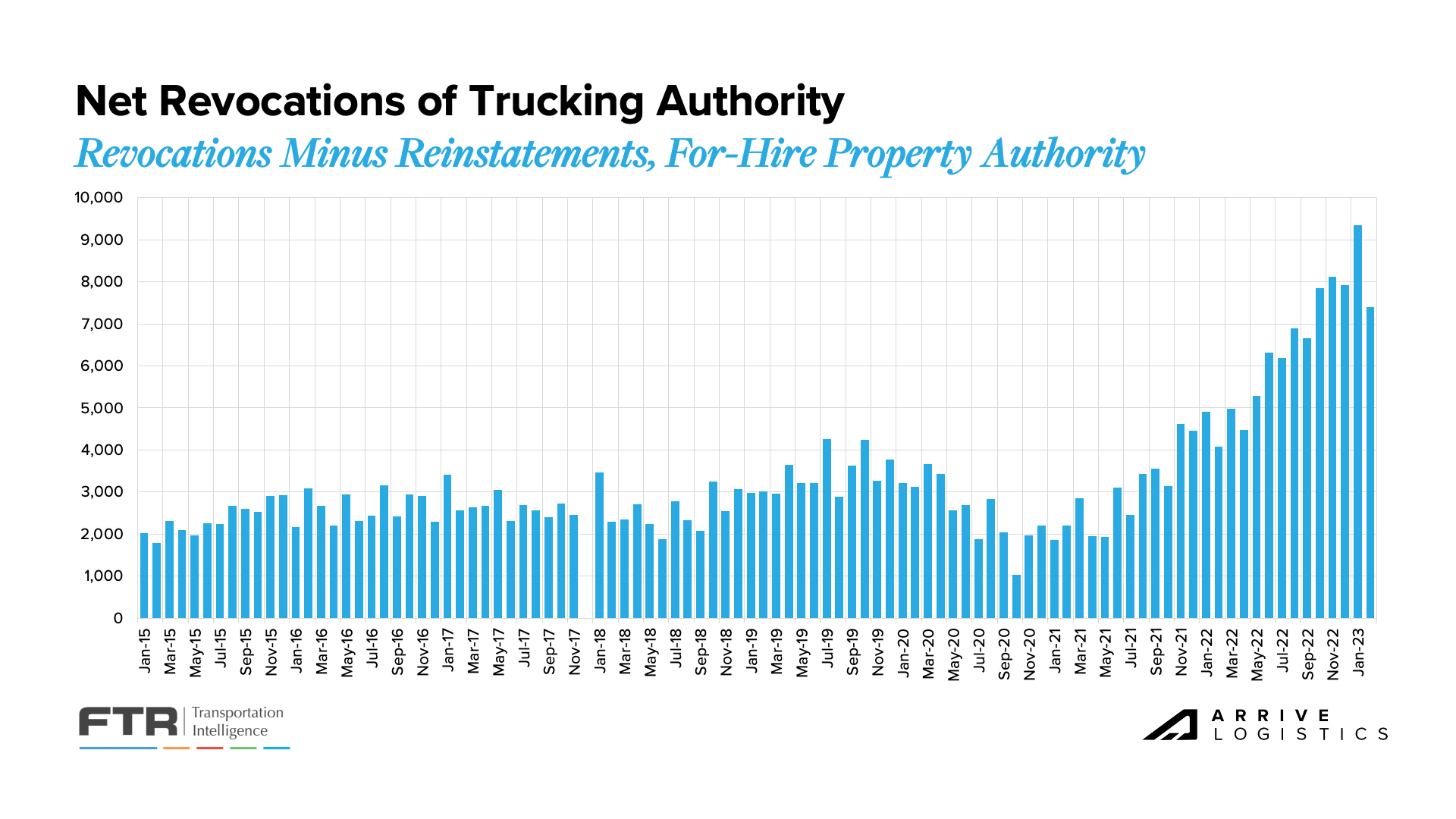

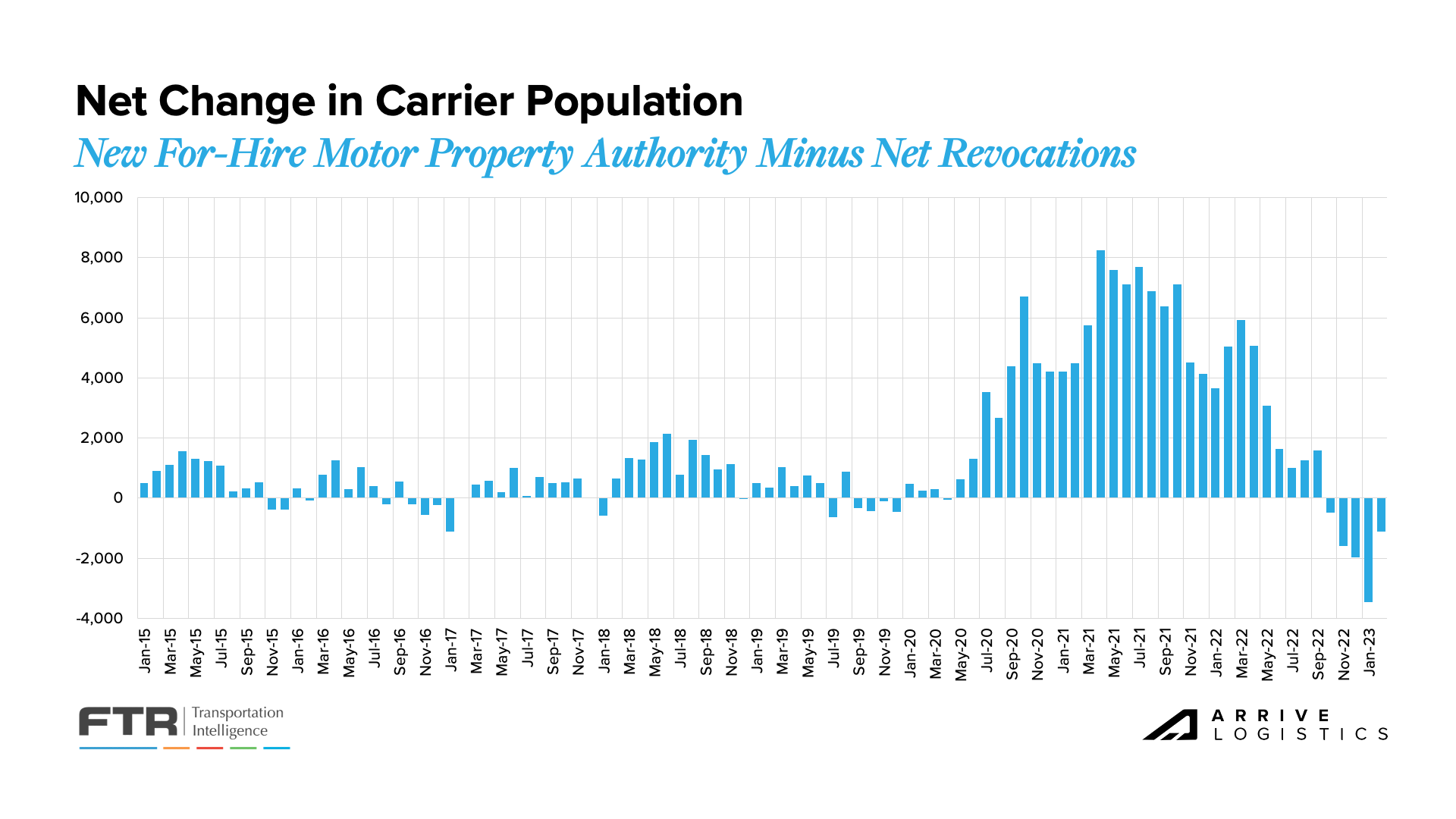

Decreasing demand is expected to continue causing oversupply in the market, resulting in ongoing capacity normalization. Carriers in the spot market are still facing poor conditions, and revocations of trucking authority remain at historically high levels, despite a slight pullback from January. Some revocations may be owner-operators taking company jobs, while others are carriers opting out of the market altogether.

In February, the trucking industry experienced the largest decline in employment since the May 2020 pandemic lockdowns. This decline indicates that the number of drivers leaving the market is now surpassing the total number of owner-operators taking company jobs, which we believed was the main reason for the increase in employment for the better part of the past year. It is also representative of what we anticipate moving forward. The expectation is that shippers, many of whom have revised their volume forecasts down from pandemic levels, will be distributing smaller contract awards coming out of the Q1 RFP season. Carriers impacted by smaller awards will be forced to right-size their fleets.

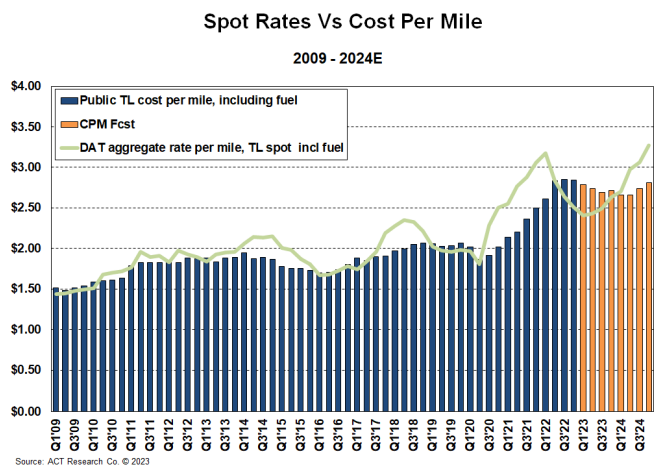

Q4 cost data of publicly traded carriers showed spot rates continue to trend below operating costs per mile, which may be causing more carriers with high spot exposure to close their businesses. Historically, capacity normalizes, and spot rates rise quickly when this occurs, but the gap could remain stickier than in past cycles if demand continues to fall.

A key trend we’re watching is that for five consecutive months, the number of revocations has outpaced the number of net new carriers entering the market, leading to a reduction in total carriers. Although the number is lower than in January, it remains historically significant. Observing this trend alongside the latest trucking employment data reveals that current capacity levels are normalizing to meet demand by taking drivers and, in some cases, carriers off the road.

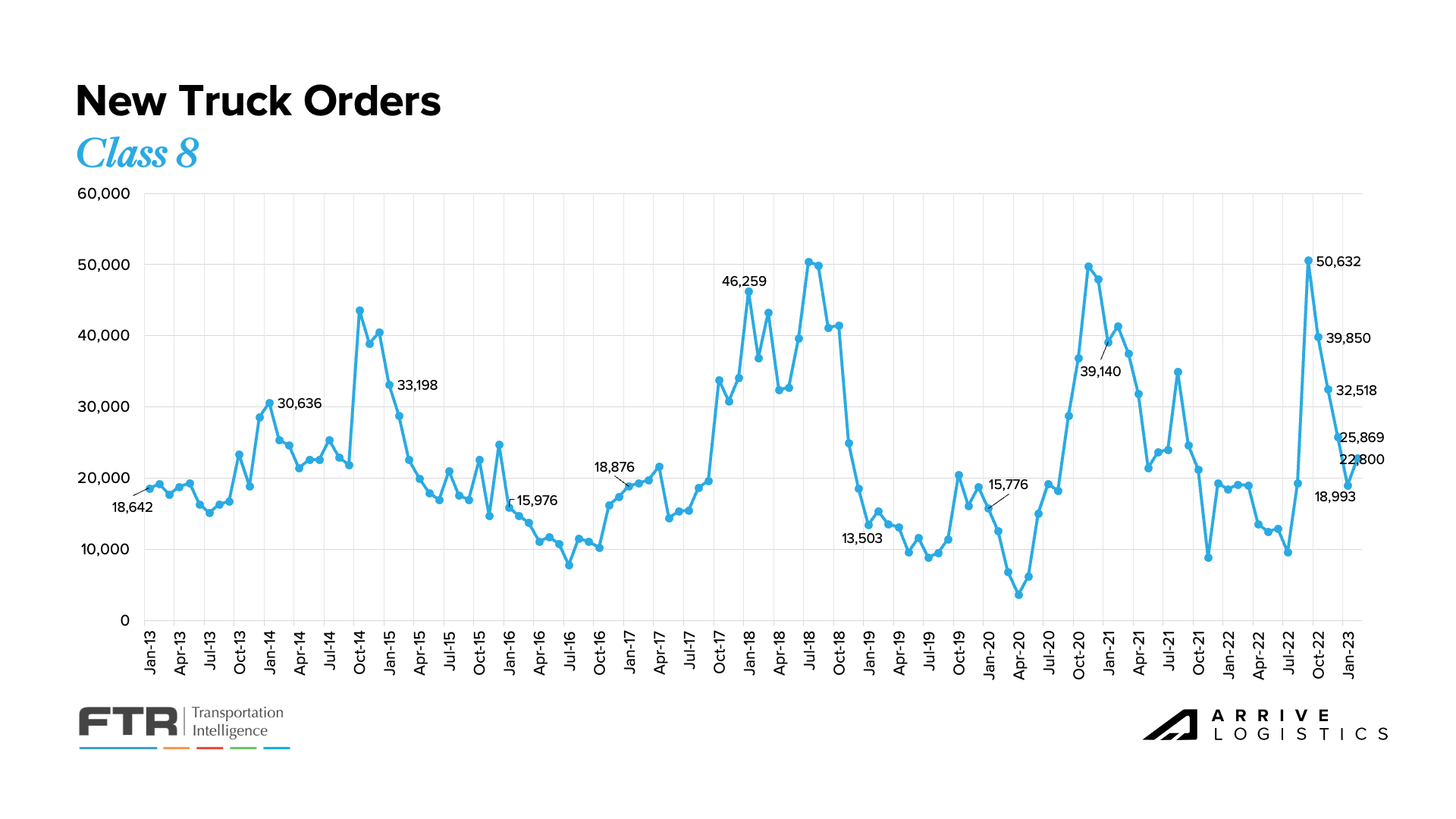

In February, FTR reported that new Class 8 truck orders rose for the first time in five months to 22,800, and orders stabilizing in the low 20,000 range is a good sign for the industry. Although new orders are likely below build levels, backlogs are expected to decline but remain high, and production slots are filled through Q3 of this year. In fact, the average time from order to delivery decreased from 9.6 to 8.26 months.

What’s Happening: Shipper volume estimates continue to be revised to the downside amid economic uncertainty.

Why It Matters: Without demand stability, the market could see equilibrium-like conditions for some time. And because vulnerability to disruption only comes when supply and demand are in balance, it will be some time before we see a significant shake-up.

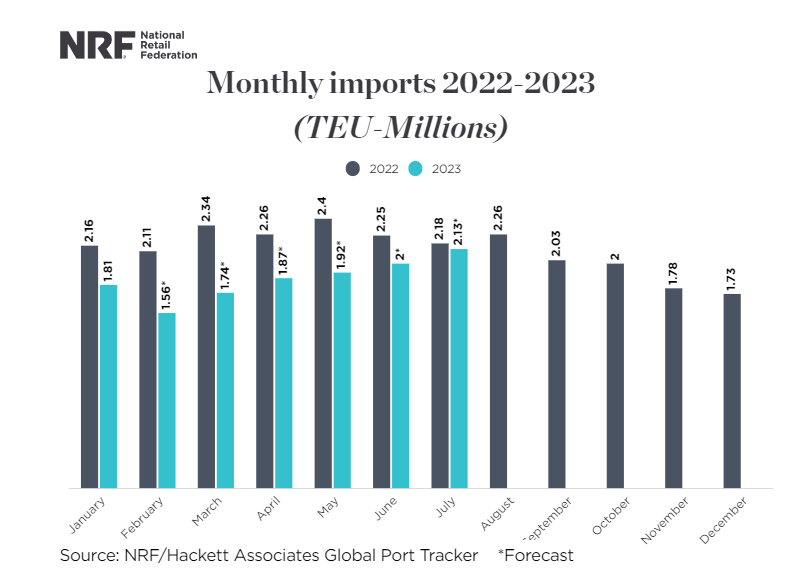

Indicators for future freight demand are bleak for 2023 as volume forecasts continue to be revised downward. Two major concerns are the manufacturing and retail sectors. The manufacturing sector posted its fourth consecutive month of contraction, and imports, a significant contributor to overall truckload demand, are estimated to have fallen to their lowest levels since May 2020, when many factories and stores were closed due to pandemic-related lockdowns. Projections suggest import levels will remain low but begin to recover as retailers work through inventories built up due to over-ordering in prior years. According to the NRF, retailers are importing less merchandise as they work to keep inventories in line with consumer demand.

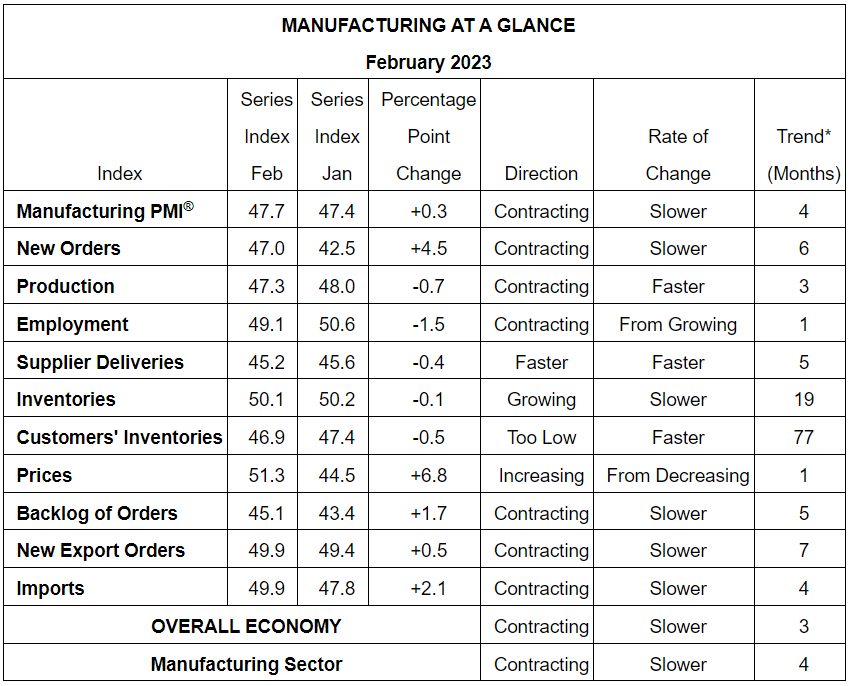

The ISM manufacturing report indicated continued easing backlogs as new orders contracted for the sixth consecutive month amid slowing production. Although the new orders index improved to 47% in manufacturing, further contraction raises more uncertainty about future backlogs and, therefore, truckload demand. Manufacturing was expected to be one of the main volume drivers in 2023, and if contraction persists, demand will likely fall further than previously forecasted. However, there is still significant pent-up demand in the sector that should enable healthy volumes in the near term.

FTR’s latest truck loadings showed a 1.7% year-over-year increase for 2022, an estimated 2.0% decline after downward revisions to previously reported loading data. The 2023 forecast has been revised downward substantially, showing a 1.4% decline from the 0.2% decline reported in the last update. In the latest forecast, weaker outlooks for food and packaged goods and automotive cut the dry van loadings forecast to a 1.3% decline from a previously reported flat outlook for 2023.

What’s Happening: Though economic and consumer data was largely in line with last month, slight declines in inflation and consumer goods spending were observed.

Why It Matters: Though recent headlines are showing increased risks to the downside, it is too early to tell whether current uncertainty will have a meaningful impact on truckload demand.

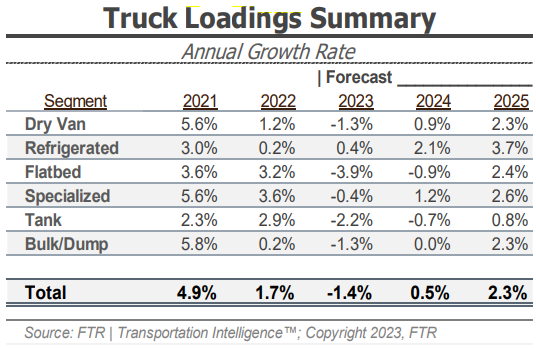

Largely in line with expectations, early March CPI data showed inflation slowed in February, falling from 6.4% to 6.0% year-over-year growth (5.5% when excluding food and energy). Rising shelter costs continue to be a key driver of the inflation data, as they account for about a third of the CPI index. When excluding housing and looking at core services, prices are up 3.7% from a year ago. With the Fed targeting inflation of 2%, this means that the Fed is still likely to continue taking action with their next opportunity to raise rates. Speculators are indicating another rate hike of 25 basis points is the most likely scenario.

While this data continues to point to light at the end of the tunnel and some improvement in overall inflation, there are other signs of economic uncertainty to consider. The recent failure of Silicon Valley Bank, although potentially an isolated incident, has sent shockwaves throughout the financial world and left many uneasy about the times ahead. Events like this can have an impact on consumer behaviors and we will be watching closely in the weeks and months ahead to see what potential impact it may have on freight demand.

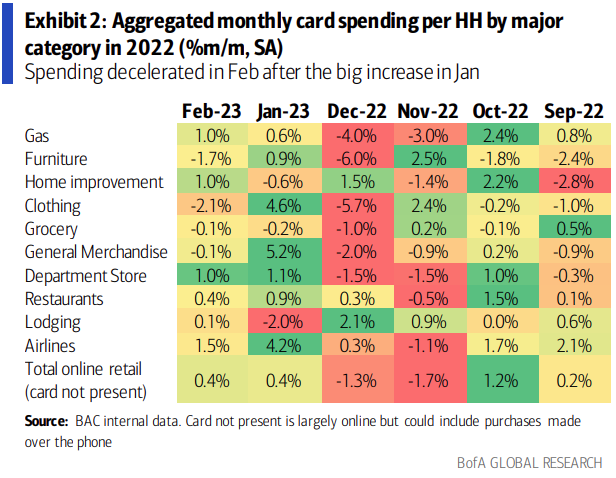

Bank of America’s card data revealed that consumer spending increased by 2.7% YoY in February, down from 5.1% YoY growth in January. This was expected, as a favorable seasonal adjustment and a few one-off factors boosted January’s growth. BofA observed that services spending experienced a significant increase, offsetting a decline in goods spending. This trend aligns with the strength seen in services spending relative to pre-pandemic levels.

When analyzing monthly spending trends by category, clothing and furniture saw weak spending, whereas airlines, gas, and restaurants showed strength.

Furthermore, BofA reported that the lowest-income bracket’s spending is still strong, surpassing that of higher-income households year-over-year. BofA theorizes that a tight labor market for blue-collar workers has offset inflation’s cost-of-living increase and that consumer spending will likely continue until the labor market cools off.

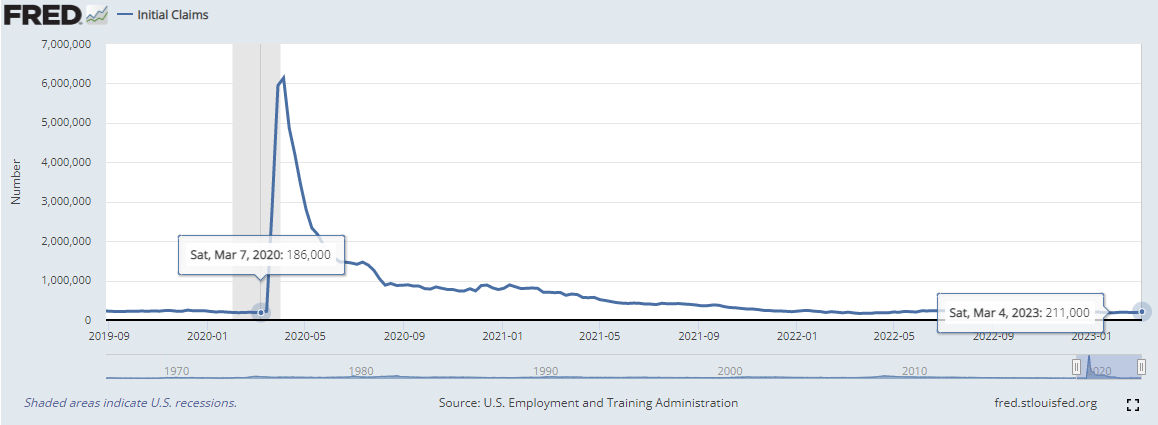

Although initial jobless claims increased slightly in early March, they remain close to last year and even pre-pandemic levels. The unemployment rate remains nearly flat compared to January 2020, a sign that the labor market is strong despite recent reports of layoffs. This robust labor market signals confidence in consumers’ ability to sustain current spending levels and avoid a sudden drop in truckload demand.

Freight market conditions softened throughout February in line with normal seasonal patterns, indicating capacity is still sufficient to support demand. Easing demand also contributed to historically strong contract routing guide compliance for this time of year. However, the demand outlook remains a concern and capacity normalization has just begun. We anticipate reductions in shipper volume expectations to lead to further reductions in fleet employment as carriers work to right-size their fleets.

Our 2023 rate forecast remains mostly unchanged, with some downside risk due to economic uncertainty. However, spot rates have already fallen significantly below current operating costs, leaving little room for further decline. We expect spot rates to find their floor relatively quickly — likely in the next 45-60 days — and remain stable throughout the year with seasonal fluctuations. The unprecedented gap between spot and contract rates will continue to put deflationary pressure on contract rates.

The market will become increasingly vulnerable to disruptive events as capacity continues to normalize throughout the year. However, recent short-lived periods of volatility suggest that the market is still oversupplied with capacity and unlikely to experience any long-term disruptions until at least late Q3.

The Arrive Monthly Market Update, created by Arrive Insights, is a report that analyzes data from multiple sources, including but not limited to FreightWaves SONAR, DAT, FTR Transportation Intelligence, Morgan Stanley Research, Bank of America Internal Data, Journal of Commerce, Stephens Research, National Retail Federation and FRED Economic Data from the past month as well as year-over-year. We know market data is vital in making real-time business decisions. At Arrive Logistics, we are committed to giving you the data and insights you need to better manage your freight.