"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

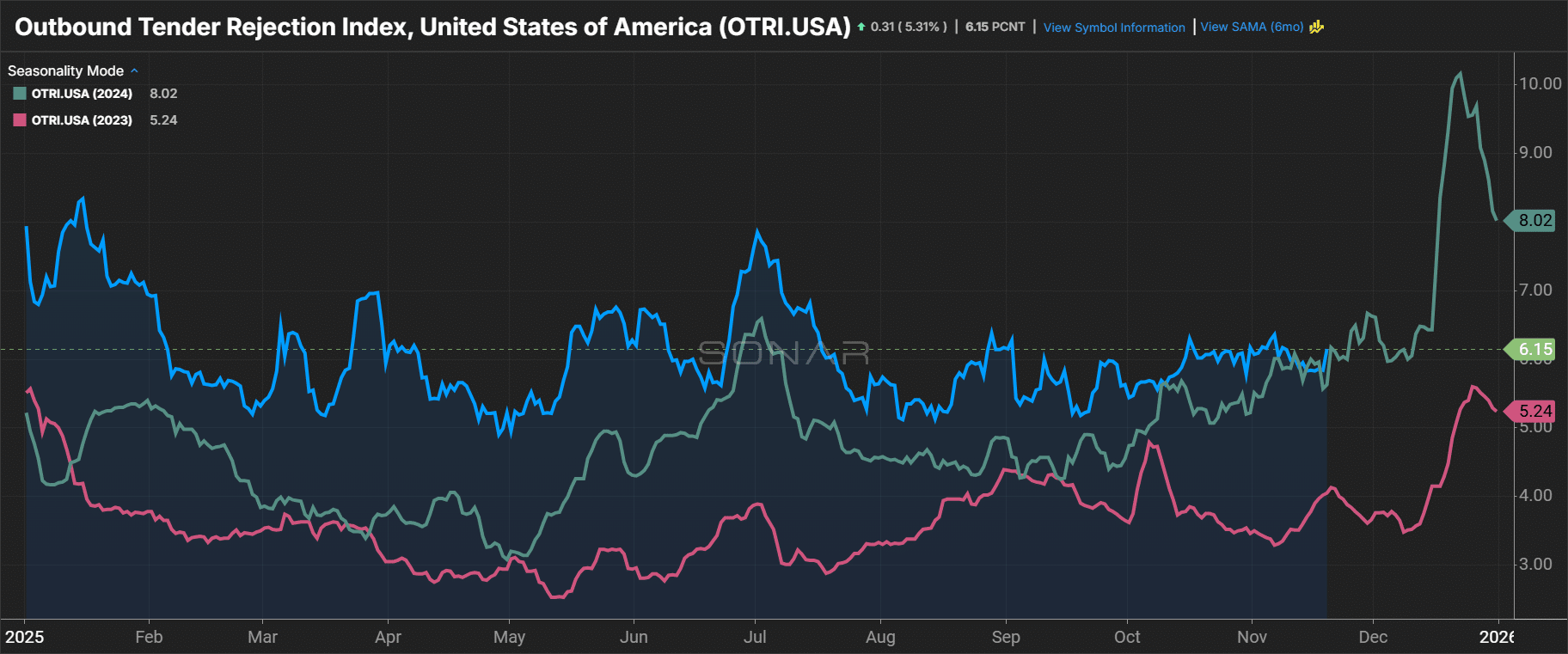

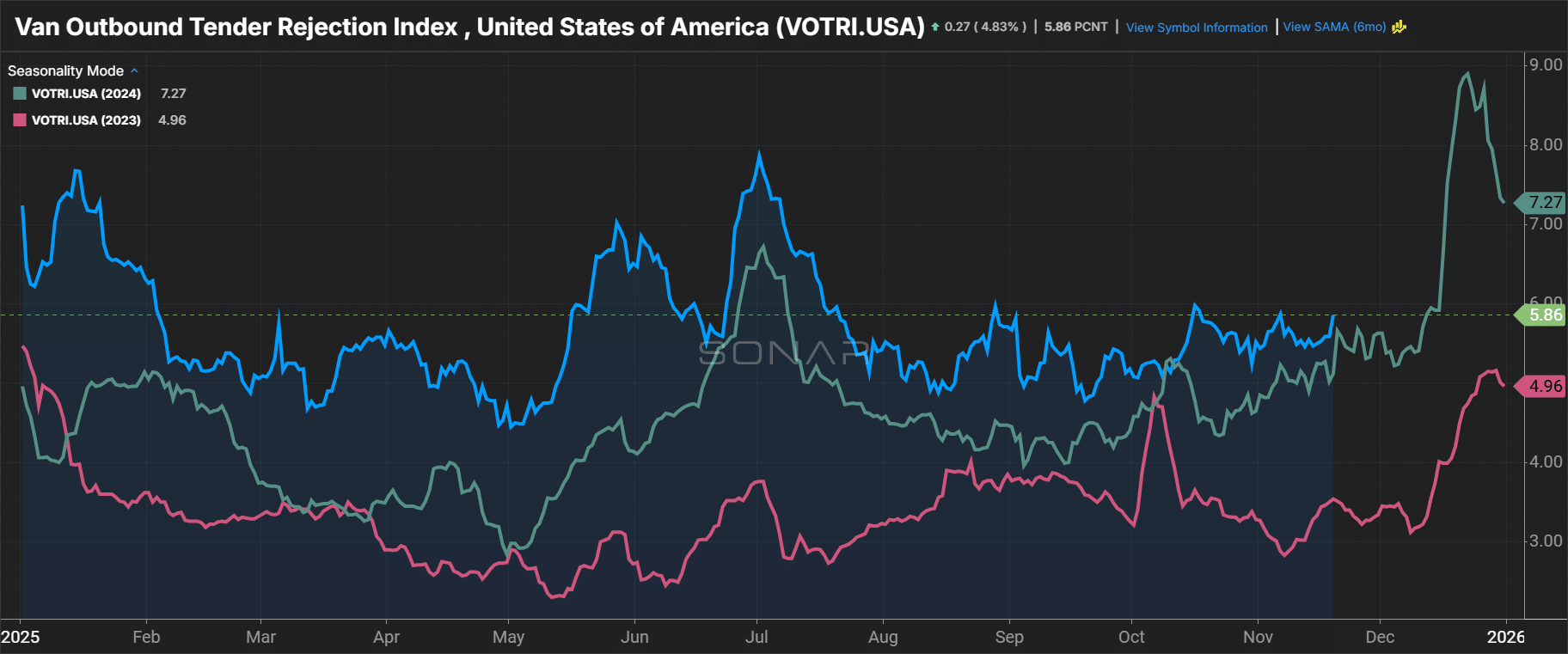

Volatility tied to Q3’s close and the late-September announcement of new non-domiciled CDL regulations has largely settled. Long-haul markets saw the greatest impact, though even that was muted.

With the U.S. Court of Appeals now pausing enforcement, near-term supply pressure should continue to ease. Combined with low demand and low rates, freight market conditions are unusually calm for this time of year.

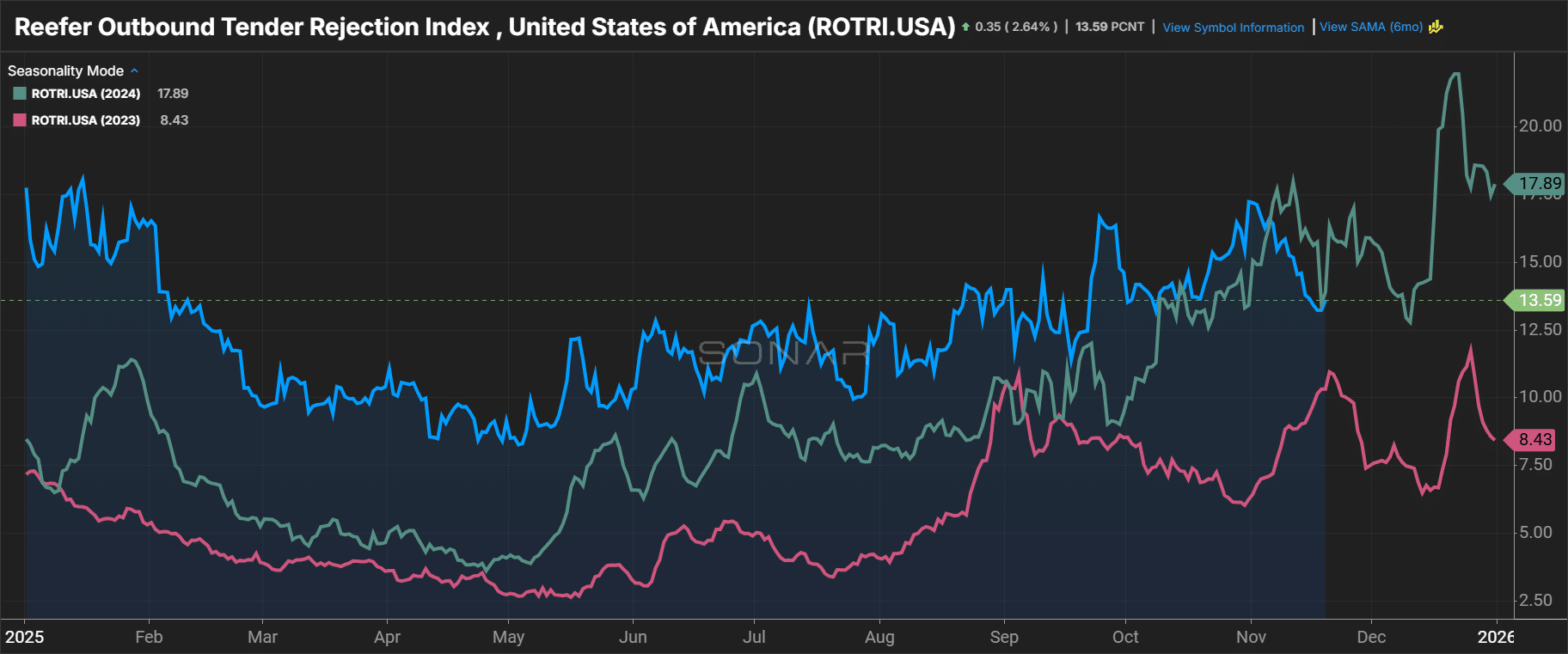

Reefer rejection rates followed normal seasonal patterns through October before falling in early November, with only pockets of tightness driven by seasonal food shipments and freeze-protect demand. With continued softness across other major modal markets, current capacity should easily cover short-term holiday or weather-related disruptions.

Longer-term conditions are less certain, as equipment orders remain below replacement levels and ongoing regulatory uncertainty could create downside risk.

Import volumes remain soft due to the summer pull-forward surge that left shippers well-stocked long before typical peak season preparation began. With retail forecasts now pointing to declining volumes through year-end and manufacturing still contracting, meaningful near-term demand growth looks unlikely.

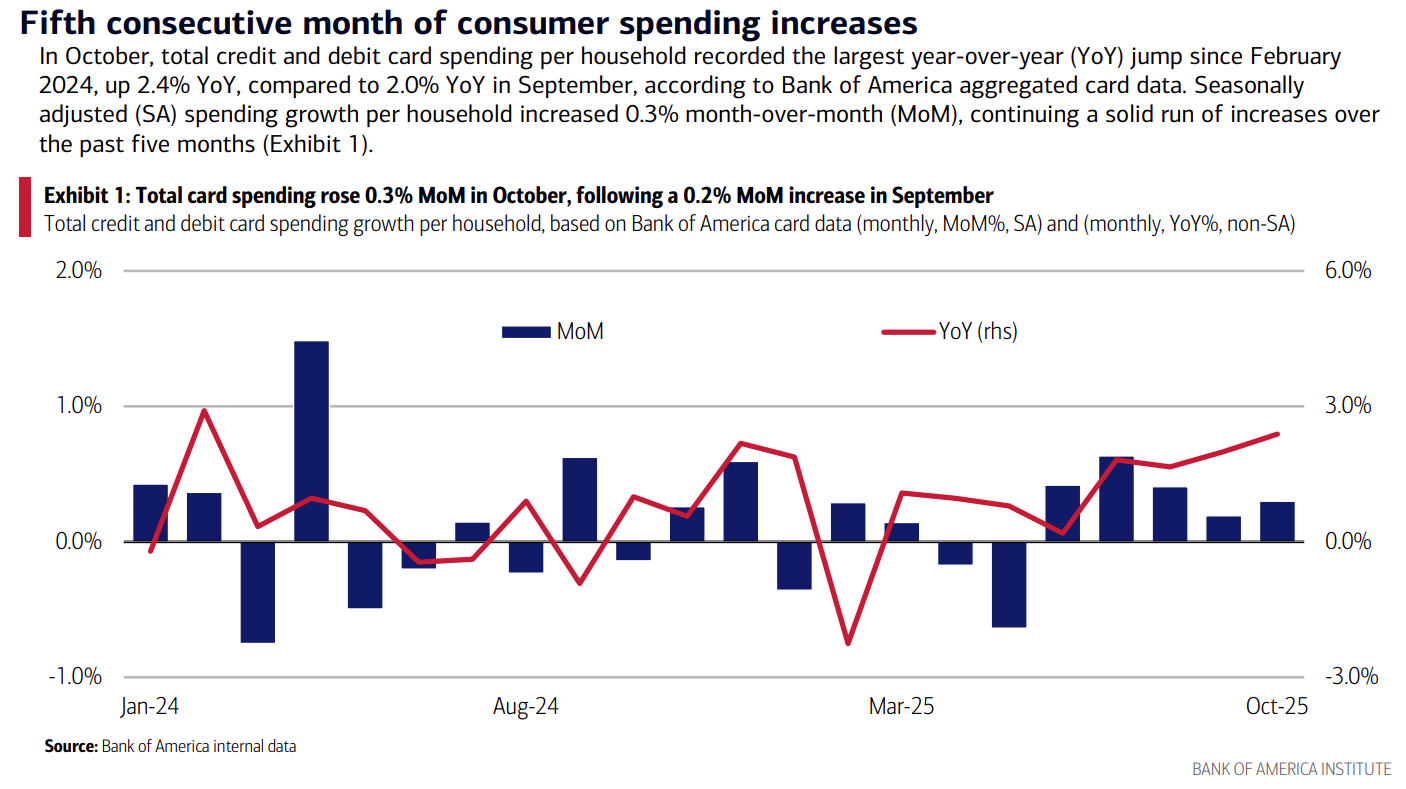

The government shutdown disrupted economic and labor market data availability this month, but Bank of America card data shows consumers are still spending despite inflation and interest rate uncertainty.

While indicators point to a muted peak season overall, some tightness and rate increases will still materialize. Reefer should see the most significant disruption as food shipments pick up through November and December, but dry van equipment remains susceptible to demand spikes and severe weather events, especially as drivers take time off for the holidays. Even so, strong supply levels should limit the duration of any disruptions.

Read on for a full breakdown of demand, supply, rates and economic conditions this month.

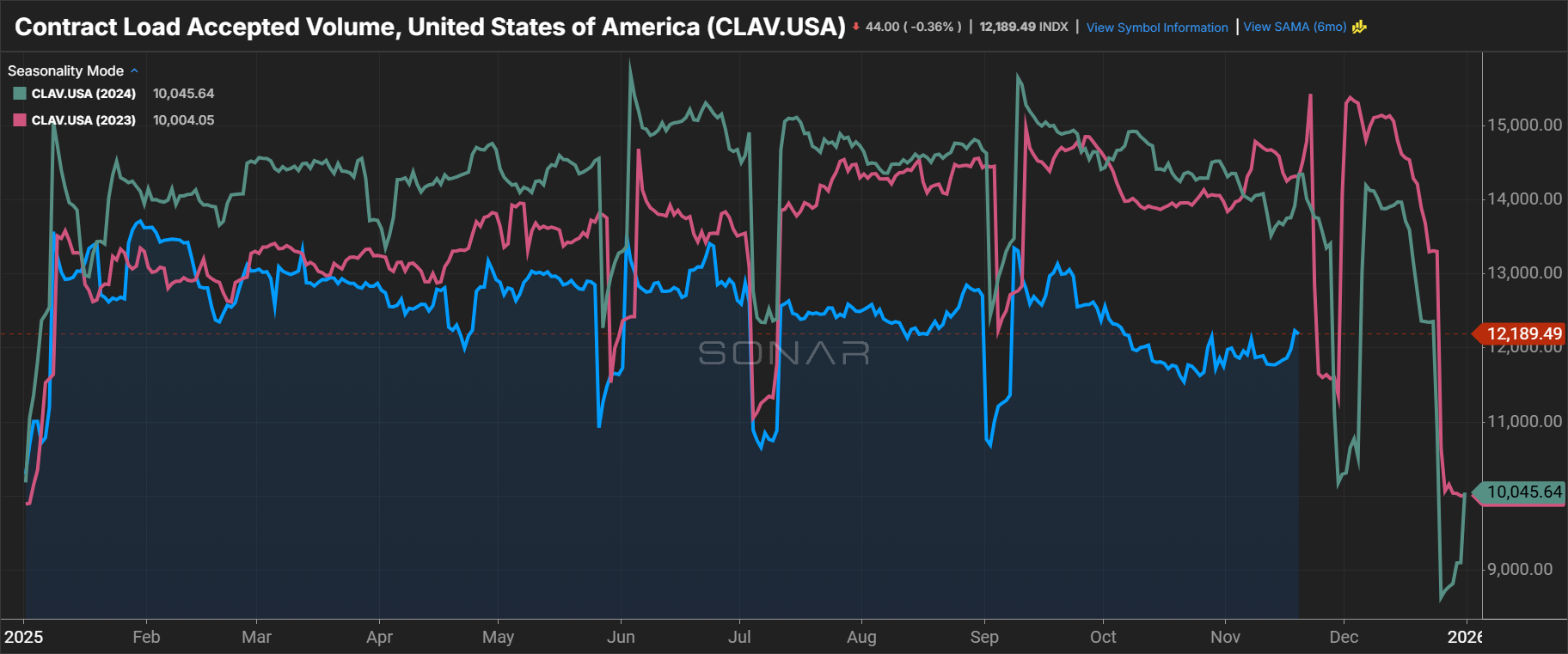

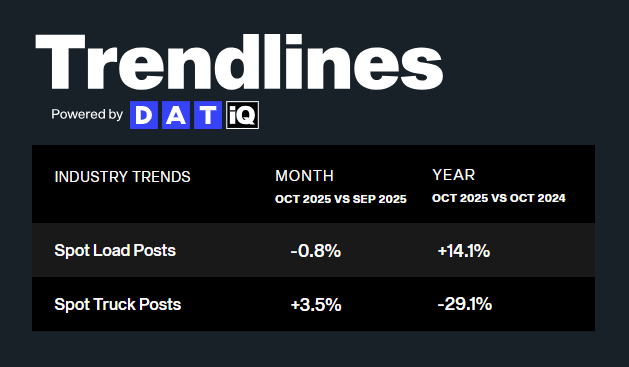

After early October’s short-lived volatility subsided, truckload demand weakness has held steady through mid-November. Contract volumes flattened after mid-month, and DAT showed a slight month-over-month dip in spot load posts, though year-over-year activity remained positive. Import-driven freight was soft for this time of year due to reduced peak-season ordering following earlier pull-forward efforts, and ongoing manufacturing contraction continued to weigh on volumes.

Volumes will likely remain soft through year-end, with volatility limited to typical seasonal patterns. That includes reefer tightness as holiday food demand rises, short weather-related bumps and van disruptions tied to annual capacity shutdowns in late December. Continued manufacturing contraction and a weak investment environment amid persistent tariff uncertainty remain the primary near-term downside risks to future volumes.

As October volatility subsided, capacity has remained in balance through mid-November, with tender acceptance holding steady across most major markets. Reefer markets tightened on seasonal food and freeze-protect lanes, but the impact was limited to regions that typically see pressure this time of year.

Despite low volumes, low rates and ongoing regulatory uncertainty, the capacity market is still oversupplied for now. Severe winter weather and drivers taking time off around the holidays are the primary near-term supply risks through year-end, but if equipment orders remain below replacement levels and CDL enforcement begins again, capacity could see challenges once demand turns upward.

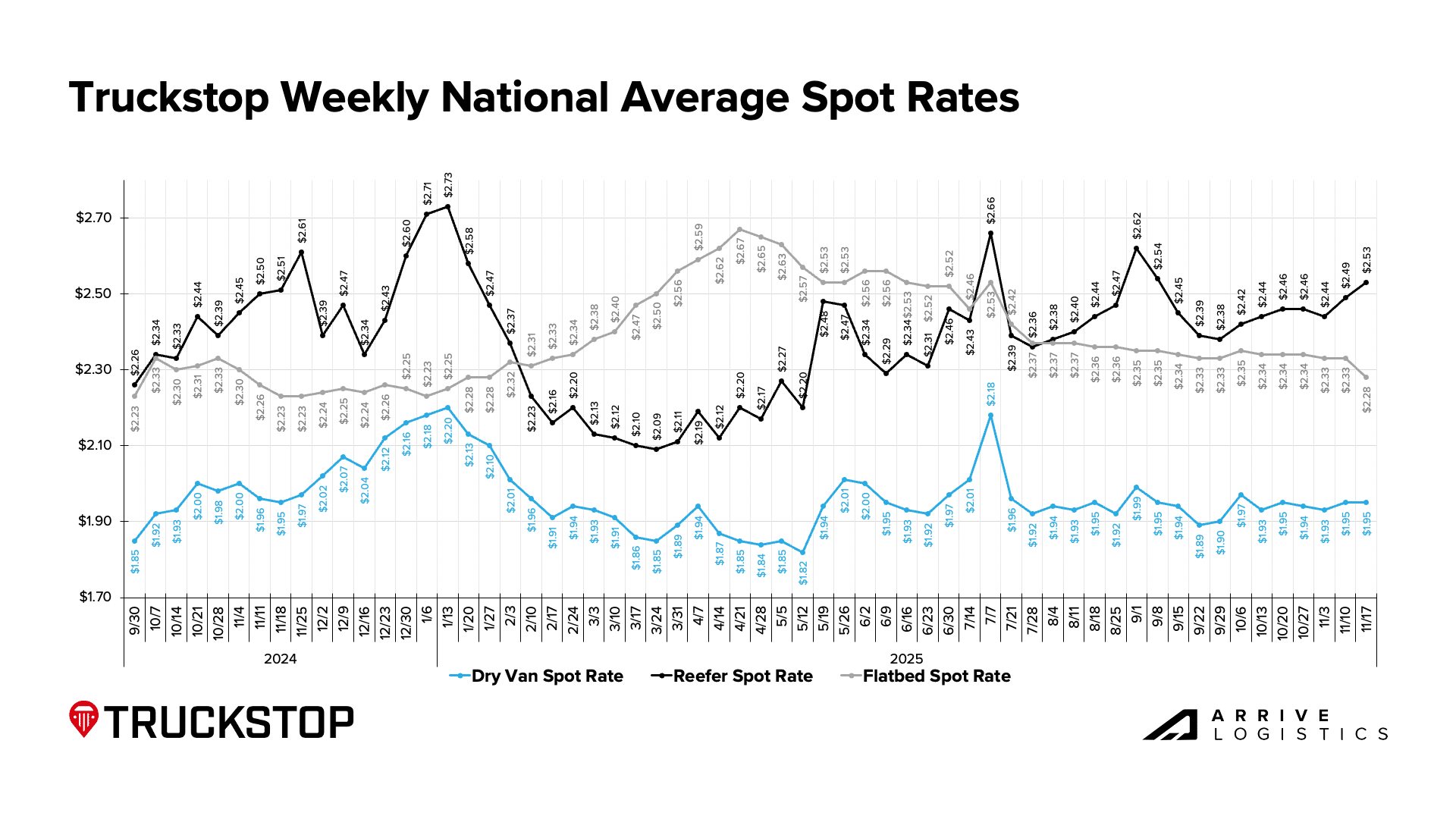

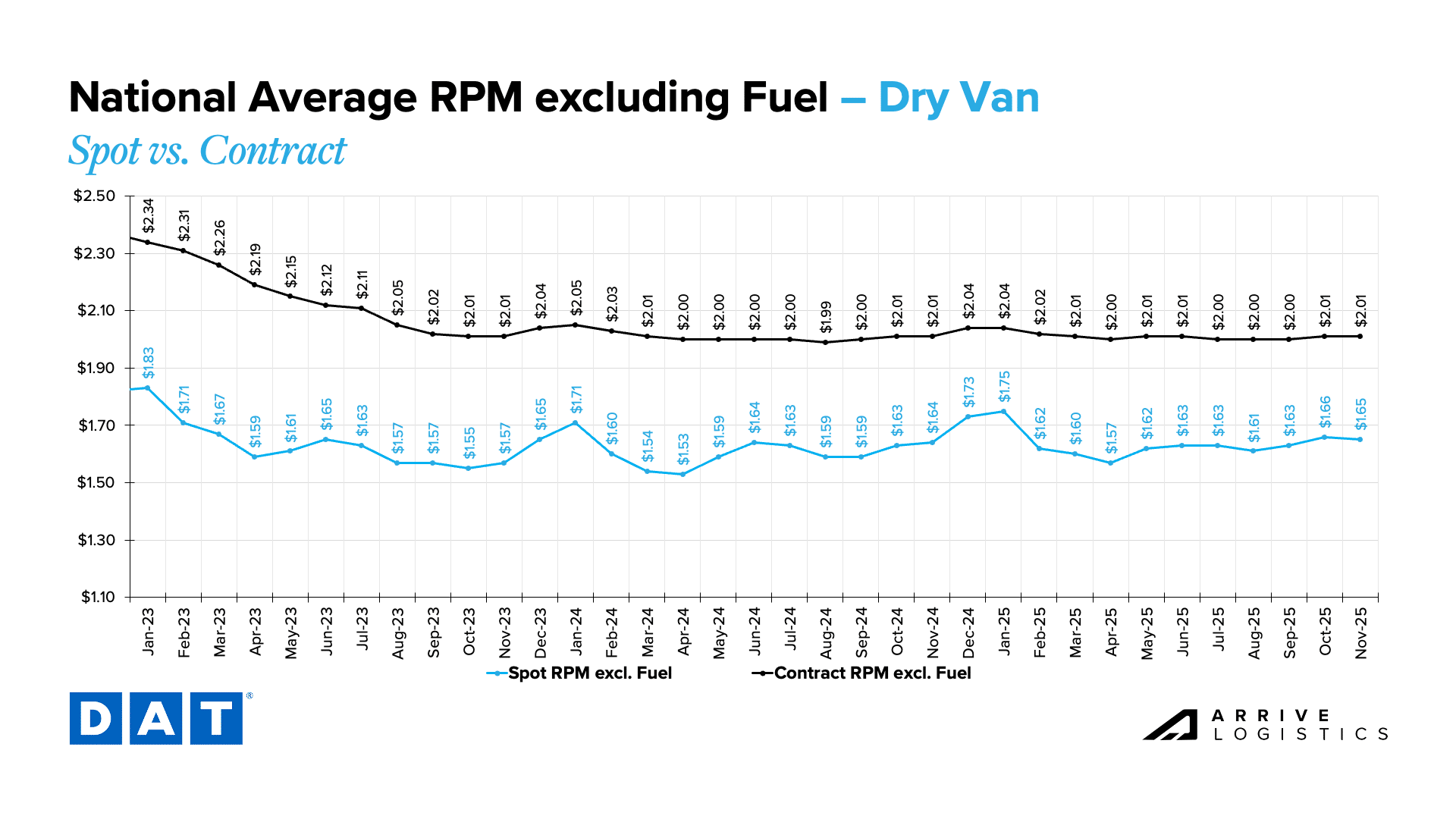

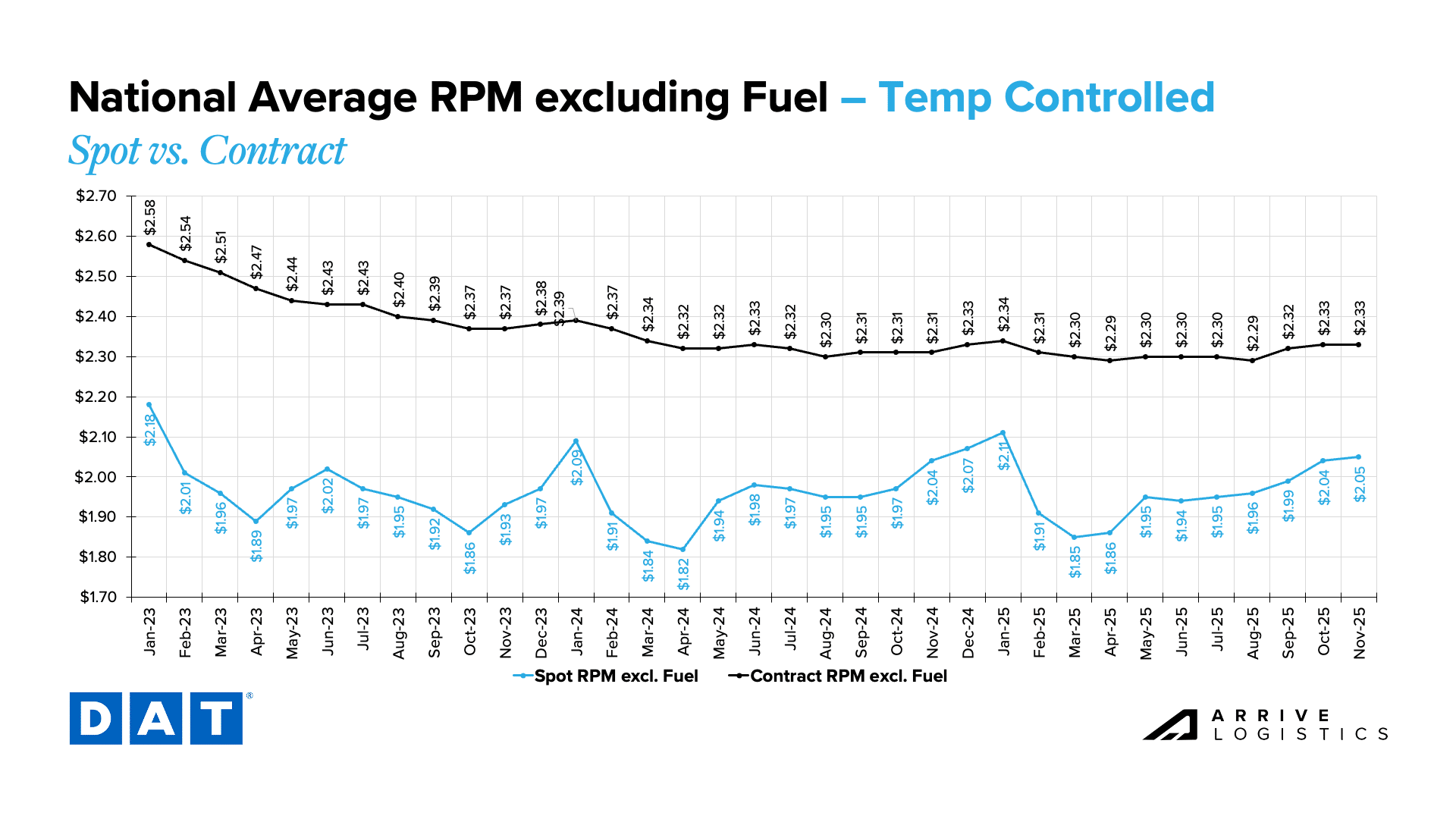

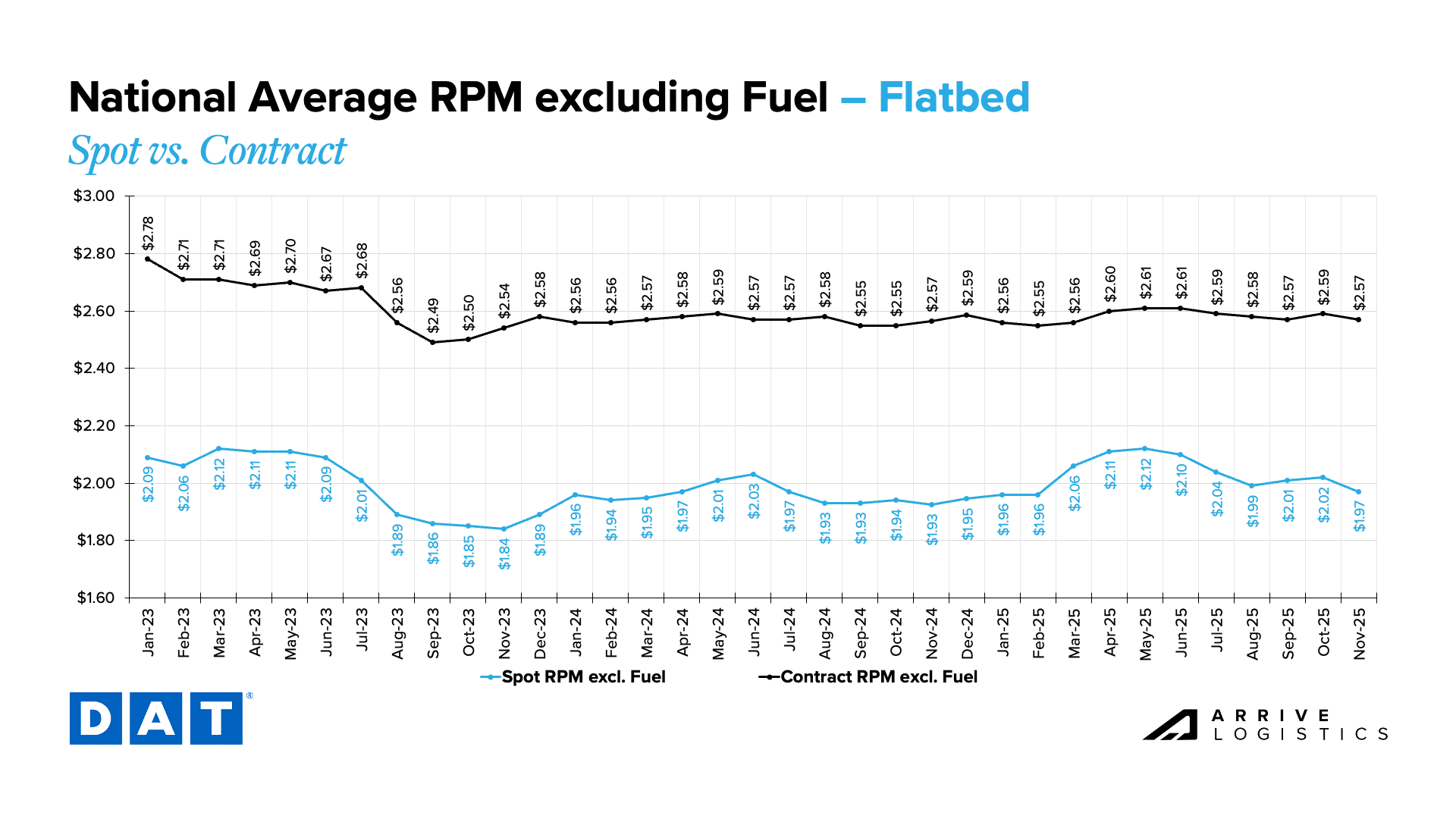

Van rates did not move meaningfully from mid-October through mid-November. Reefer showed modest month-over-month and year-over-year gains, but the strength was tied mostly to seasonal food shipments and freeze-protect demand rather than a sustained shift.

Rates are expected to follow typical seasonal patterns through year-end, with any volatility likely to be short-lived and driven by severe weather or seasonal demand. Beyond the holidays, a meaningful rate recovery is unlikely until long-term supply challenges materialize alongside a sharp volume increase.

The government shutdown interrupted normal economic reporting, leaving gaps in CPI, labor and other macro indicators at the time of writing. However, Bank of America card data showed a fifth consecutive month of rising consumer spending in October, with per-household spending up month-over-month and year-over-year.

Consumer spending should continue to support near-term freight demand, but it is unlikely to drive a sustained rebound until meaningful inflation and interest rate improvements materialize. This is especially true as widespread uncertainty around how these factors will influence the economy is expected to weigh more heavily on consumers and businesses as they consider larger discretionary purchases.

Get this free report delivered straight to your inbox every month.