"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

Several Canadian freight market trends progressed as expected last year, most notably the continuation of the downcycle. Truckload demand was down compared to 2022, resulting in low volumes and linehaul rates. The economy is strong, but businesses and consumers are playing it safe as inflation exceeds the 2% target and interest rates remain elevated. The market is still oversupplied, and trucking employment is healthy. The fourth quarter of 2023 showed signs of volatility, indicating that the freight market should continue moving toward equilibrium in 2024.

Overall, demand remains soft as 2024 begins. LoadLink reports that December freight volumes were down 14% month-over-month and 34% year-over-year. Of all the truckloads moved in Canada last month, nearly two-thirds of the volume was intra-Canada, while 36% was cross-border.

Much of the decline can be attributed to shippers closing for the holidays, resulting in less freight moving on the roads. Although total volume declined, the load-to-truck ratio jumped from 3.0 in November to 3.68 in December, a sign that some capacity went offline during parts of December as drivers and operators returned home for the holidays. Most drivers are back on the roads now, and truck postings have likely increased month-over-month in January.

The December volume decline affected all directions of transport. Outbound Canada loads into the U.S. were down 18% month-over-month and 30% year-over-year; inbound Canada loads were down 6% month-over-month and 42% year-over-year; and intra-Canada loads were down 16% month-over-month and 30% year-over-year. These results highlight the delicate demand environment created by more conservative consumer spending amid high inflation and interest rates.

For most of the year, Canadian maritime imports trended below 2021 and 2022 levels but finished strong with year-over-year growth in December. Imports slowed during the first half of January but have since rebounded and are trending above where they were at this time last year. We expect import volumes to closely mirror early 2023 for at least the near term as consumers play it safe and retailers restock with some caution.

Recent LoadLink and BMO data from October 2023 show that year-over-year spot freight volumes have declined for 16 consecutive months, roughly as long as the current freight downcycle. However, it is important to note that the rate of decline has started to slow, indicating that spot freight volumes are stabilizing overall. As stabilization continues and more capacity exits due to the challenging rate environment, the market will reach equilibrium, and rates will begin to experience upward pressure.

Despite volume declines, truck crossings in and out of Ontario showed year-over-year growth for nine months in 2023. However, there was a drop in December due to shippers and carriers closing for the holidays and Canada-based drivers avoiding the U.S. for fear of weather and other disruptions that might keep them from getting home. Additionally, many of Canada’s South-Asian driver population take extended vacations to visit home around this time. As a result, the year-over-year change during December was relatively flat, falling by just over 1%. Nonetheless, the U.S.-Ontario border crossing remained the highest volume region between the two countries and grew despite the UAW strike during the second half of the year.

Canadian trade has been holding steady month over month. The U.S. remains Canada’s largest partner, accounting for over 70% of total trade (exports and imports) in November 2023 alone. The European Union and China follow the U.S., accounting for 6.8% and 6.0% of total trade, respectively. Canadian trade growth has increased over the past decade. Bringing in more products annually ultimately bodes well for future demand, as more imports mean more freight that needs to move over the road or via rail.

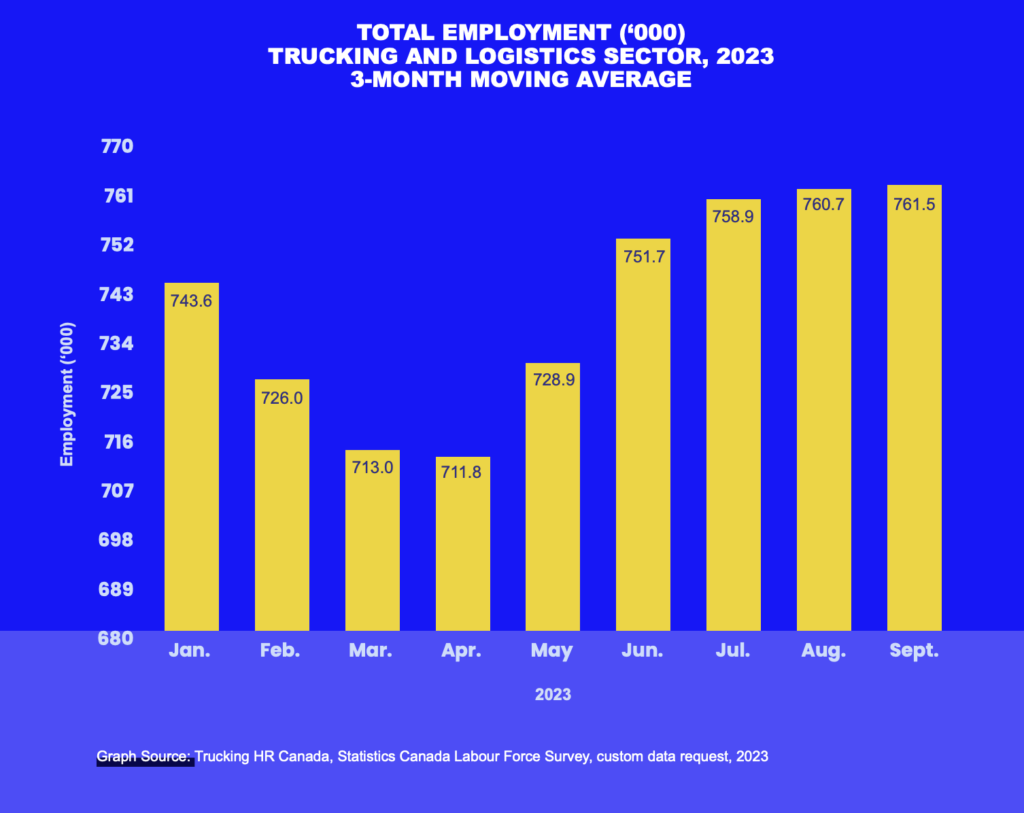

Despite fluctuating freight volumes, trucking and logistics sector employment showed consistent month-over-month growth heading into Q4 last year. Nearly 50,000 jobs were added from April to September, bringing the total above 761,000 by the end of this period. During that stretch, the unemployment rate also fell from its March 2023 high of 4.3% to 3.2% in September. Though these trends typically bode well for the logistics sector, in today’s over-supplied market, more employment growth will likely extend the current downcycle.

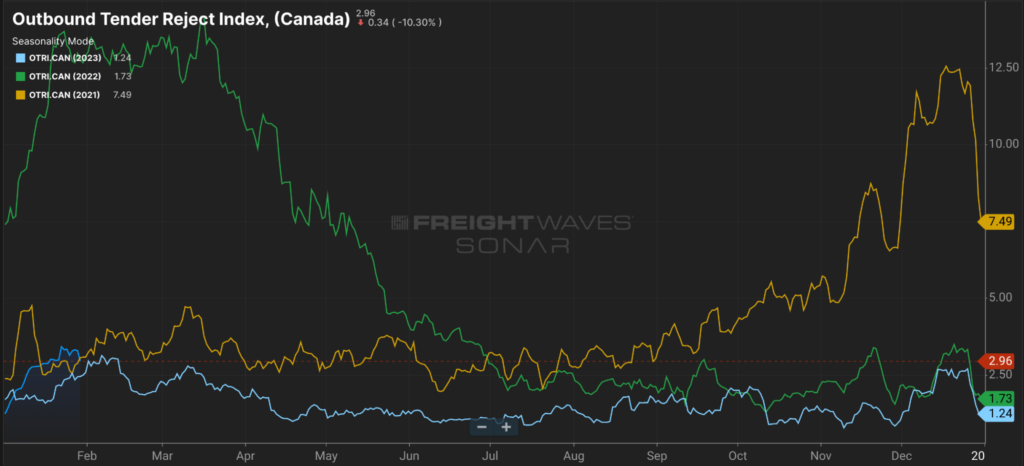

The Sonar Outbound Tender Reject Rate Index (OTRI), which measures the rate at which carriers reject freight they are contractually required to take, ended 2023 at around 1.24% — this is well below historical norms and indicates oversupply continues.

Rejection rates during the first half of 2023 trended significantly lower than in 2022 but ended the year following a similar seasonal pattern. January levels started to rise and ticked above both 2021 and 2023 numbers due to a spike in van rejections, which peaked at 2.5%. As spot rates continue to rise, carriers will likely reject contractual freight to pursue more profitable spot market opportunities.

2023 was one of the most volatile years on record for diesel prices. The national cost per liter started near record highs following sharp increases during the second half of 2022. Prices steadily declined during the first half of 2023, hitting bottom at the end of June before rapidly climbing again, then leveling out for about six weeks and declining once again toward the year’s end. The late summer price surge was largely driven by OPEC cutting production by 100,000 barrels per day, along with record-high temperatures in North America that limited the operating efficiencies of several refineries.

All of this volatility has made it difficult for carriers to predict bottom-line revenue and profitability, especially with linehaul rates down. Carriers benefit from lower operating costs when fuel prices drop, but when they rise, so do overall costs. Although prices seem to have steadied in recent weeks, monitoring key influences such as geopolitical tensions and significant weather events is crucial. For example, if the ongoing Middle East conflict escalates, it would likely trigger another diesel price increase.

The Consumer Price Index (CPI) continues to show inflation pulling back from the 2022 peak, but it remains well above the Federal Bank’s goal of 2%. As inflation levels out, it is becoming increasingly likely that the Fed will start to cut interest rates at some point this year. Lower borrowing costs will ultimately drive increased spending activity and, in turn, freight demand.

Despite ongoing economic uncertainty and high inflation, the Canadian GDP is steady. In fact, aside from a 1% downtick from Q2 to Q3, it remains close to the all-time high. One driver is Canada’s rising population, which grew by over one million during the first nine months of 2023. The population then increased by another 400,000 people in Q3 (equal to 1.1% of the overall population), the largest percentage growth of any single quarter since Q2 1957. Ultimately, all signs point to a relatively stable economy despite elevated inflation.

The Canadian dollar (CAD) was weaker than the U.S. dollar (USD) for most of the second half of 2023 before rebounding in November and December to nearly $0.76 CAD and $1.00 USD, respectively. However, over the past few weeks, the CAD pulled back again and is hovering around $0.75 CAD per $1.00 USD as of this writing. Despite this volatility, there is currently no direct impact on the financial health of shippers and carriers.

Overall, the Canadian freight market looks steady aside from temporary pockets of increased volatility. Trade remains strong, and disinflation trends point toward economic recovery. Conditions in 2023 were soft compared to the post-pandemic freight market, and similar trends are likely to continue in early 2024. As we move through the winter, large snow and freeze storms will inevitably cause delays and regional tightness. However, with low rejection rates and an oversupplied capacity market, major disruptions during this quarter remain unlikely.

The Arrive Canada Market Update, created by Arrive Insights, is a report that analyzes data from multiple sources, including but not limited to Statistics Canada, BMO Bank, Loadlink Technologies, American Trucking Associations, and Mordor Intelligence, from the past month as well as year-over-year. Please note that all dollar amounts are in CAD. We know market data is vital in making real-time business decisions. At Arrive Logistics, we are committed to giving you the data and insights you need to better manage your freight.