"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

However, a recent government inquiry into the potential safety implications of a worker strike has put the likelihood of such action on hold for now. The inquiry has no set timeline, but past outcomes of similar situations indicate that a decision is months away. While allowing more time for the two sides to reach an agreement should mitigate the chances of a strike, it also forces rail customers to create contingency plans without any certainty as to when or even if they will need to use them.

Because CN and CPKC own 75% of all Canadian rail capacity, we can speculate on the impact of the deal falling through. First and foremost, it would likely limit the flow of certain goods and increase over-the-road truckload transportation demand. Freight from Canadian ports could also land on U.S. soil, leading to capacity crunches stateside.

Additionally, a single strike day will create at least another three to four days of disruption. This exponential effect could have a significant downstream impact on U.S. automakers, which rely heavily on inbound shipments from Canada that would almost certainly see significant slowdowns should the railways close.

Further, Canadian grain, potash and coal producers have commented anecdotally that the strike could disrupt their export operations. Jason Miller of Michigan State University recently completed a carload volume data analysis that revealed general containerized goods, metallic ores, chemicals, coal, grains and other petroleum products are the most heavily transported commodities. Of those, metallic ores face the greatest risk of disruption as they account for 74% of total CN and CPKC carloads.

Because Canada’s over-the-road freight market is oversupplied, most shippers should be able to find enough truckload capacity to cover impacted railway shipments in the event of a strike. However, rate increases would likely follow if the shutdown lasts long enough to drive sustained long-haul capacity demand.

While it is too soon to discern how the situation will play out, we hope the two sides can reach a deal in time to prevent the stoppage of this critical cog in the Canadian economy.

Following some short-lived volatility in Q1, the Canadian freight market has moderated substantially in the second quarter. Normalized volumes amid a surplus of capacity continue to put downward pressure on spot and contract rates, and strong consumer spending despite sticky inflation has the economy in flux. Carrier revenues are still low, and tightness will become increasingly likely as more businesses exit the market in the coming quarters.

Truckload demand is still weak as Q2 continues. Cross-border loads comprised approximately 64% of all Canadian truckloads in April, with intra-Canada freight accounting for 34%. Recent Loadlink data shows a 5% volume decline from February to March and a 23% year-over-year decline. It’s worth noting that consumer spending was high and retailers were actively restocking inventories in March 2023, which could help explain the year-over-year change.

Despite a lull in March, the Canadian freight market had a dynamic first quarter. Spot load postings increased by a record 47% month-over-month in January, driven by an unprecedented 110% rise in inbound cross-border volume — a figure surpassing typical seasonal trends for northbound freight. Although freight volumes decreased slightly in February and March, they still exceeded the averages observed in Q2 and Q3 of 2023.

Canadian maritime import trends have fluctuated in 2024, with slow periods in January and late February and significant inbound TEU increases in March and early February. Imports increased steadily during the back half of April and are now in line with 2021 import levels. Strong import volumes remain a bright spot for the Canadian market as demand remains down.

Freight volumes have declined year-over-year for nineteen consecutive months. However, month-over-month volumes increased by 47% in January, resulting in the highest spot volume levels in the past ten months.

In turn, load-to-truck ratios rose from 0.27 to 0.38. While higher load-to-truck ratios indicate tightening, levels are still relatively low and confirm the soft and oversupplied state of the market. As long as this continues, rates will remain steady and be less vulnerable to demand fluctuations.

Canadian trade remained relatively stable in Q1, and the month-over-month total trade increase of 5% in February was the highest dollar amount since January 2023.

The United States remains Canada’s number one trade partner, representing nearly 70% of total trade in February. The European Union and China are the next largest, contributing 6.6% and 5.8%, respectively. As trade volumes rise, freight and truckload services demand will likely increase.

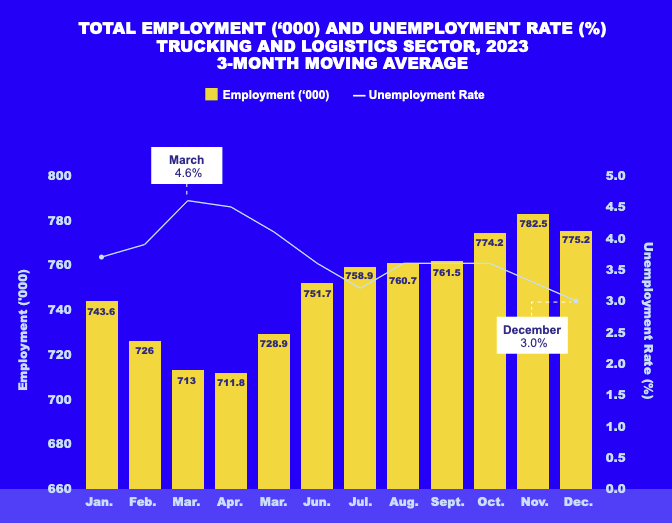

Despite fluctuating freight volumes, trucking and logistics sector unemployment declined steadily in Q4 2023, reaching the lowest rate of the year (3.0%) in December. Driver unemployment was slightly higher at 3.5%, but this was still a significant improvement from the 6.5% reading in April 2023. As persistently low rates and revenues drive more carriers out of the market, drivers may look for opportunities outside of the industry.

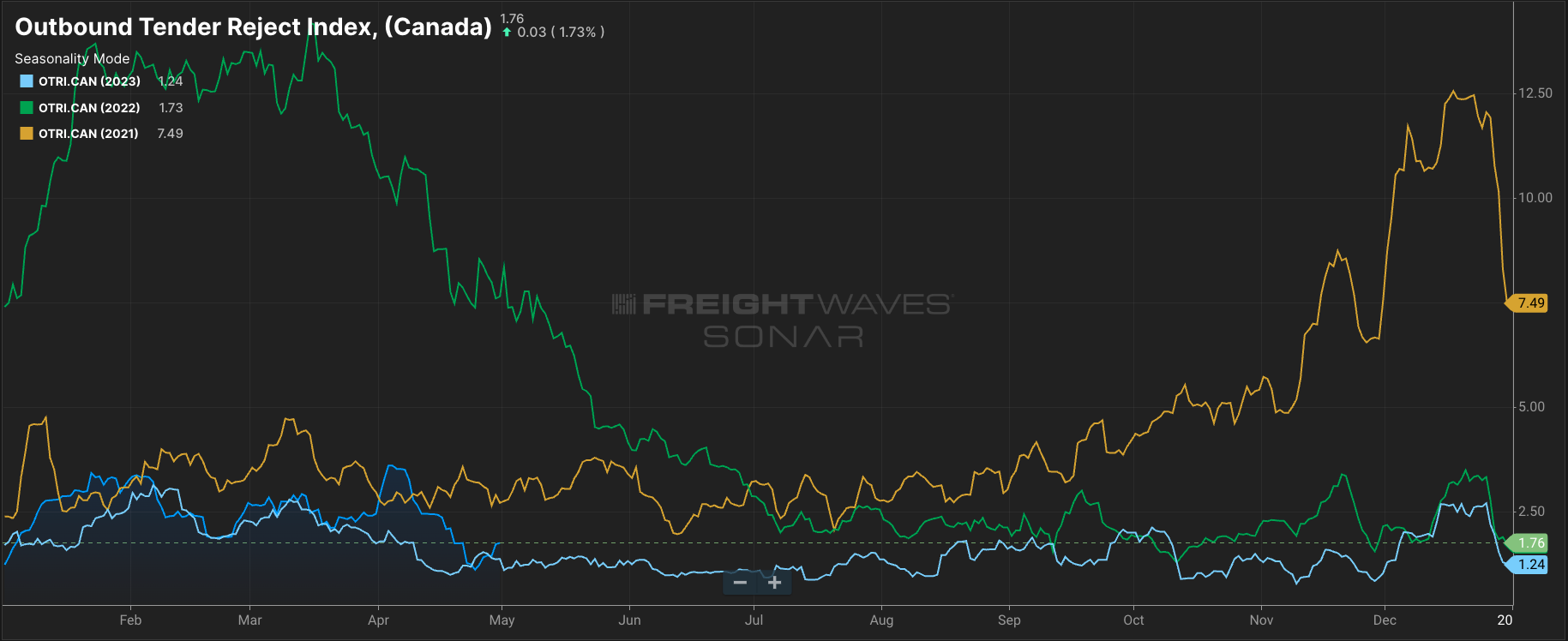

The Sonar Outbound Tender Reject Rate Index (OTRI), which measures the rate at which carriers reject freight they are contractually required to take, hovered just under 2% as May began. That number is well below historical averages, indicating the market remains oversupplied and carriers continue to service contract freight over spot freight. However, the OTRI increased slightly year-over-year, evidence the downcycle has progressed over the last 12 months.

Rejection rates reached nearly 4% in early April, likely due to drivers and dispatchers taking time off for Easter. Van and reefer rejection rates were below 1%, further emphasizing soft market conditions.

Fuel prices were volatile in 2023, hitting historic highs early in the year, rapidly declining when summer started and surging again after OPEC’s unexpected announcement about production cuts.

Prices have been more stable thus far in 2024, with flat monthly averages aside from short-lived spikes in February and April. Shippers and carriers welcome this stability because operating costs fall and rates become more manageable with limited fuel volatility. However, with ongoing tensions in the Middle East posing a constant potential threat to maritime shipments and crude oil production, there remains a possibility of fuel price increases this year.

The Consumer Price Index (CPI) fell to 2.8% in March, excluding fuel. Despite cooling inflation, the rate remains above the 2% target, so cuts in the near term are unlikely. In April, the Bank of Canada announced it would hold rates at 5.0% for the 10th consecutive month since July 2023. The next meeting will take place this June.

The factors fueling inflation continue to change. When inflation started rising at the onset of the COVID-19 pandemic, the primary drivers were high goods and manufacturing costs. Next, it was the service sector. Today, it’s shelter costs, specifically high mortgage rates and rent costs, as shelter demand increases on the heels of population growth.

Consumer demand is steady overall. However, discretionary goods spending decreased significantly year-over-year, which could negatively impact freight volumes and demand.

Conversely, spending on essentials and discretionary services increased by 4.3% and 5.1% year-over-year, respectively. Strong travel demand helped bolster services spending. The Royal Bank of Canada estimates that hotel spending in March increased by nearly 3% year-over-year, and spending on food services and drinking establishments is up nearly 1.4% year-over-year.

Despite ongoing economic uncertainty and high inflation, the Canadian GDP remained strong and reached an all-time high in Q4 2023. This positive trend has continued thus far in 2024. The GDP in February was $2.218 trillion (CAD), up 0.2% from January and up 0.8% year-over-year, partly due to rapidly increasing population and strengthening consumer spending. However, these factors have also created a softer labor environment and rising unemployment.

The Canadian Dollar (CAD) has steadily weakened compared to the U.S. Dollar (USD) for most of 2024. Around New Year’s Eve, the exchange rate was roughly $0.76 CAD to $1.00 USD. However, as of early May, it has dropped to less than $0.73 CAD to $1.00 USD. A weak exchange rate can negatively impact Canadian shippers and carriers that receive compensation in USD but pay for most domestic expenses in Canadian dollars.

Just over one month into Q2, the Canadian freight market continues to show softness following some short-lived volatility at the start of the year. Trade and import trends have been strong despite economic uncertainty, and the capacity surplus wages on as resilient carriers persevere against persistently low rates.

As summer begins, volumes will likely tick up based on typical seasonality. However, the impact on rates will likely be minimal as there is plenty of capacity to service demand.

With that, our outlook for the rest of 2024 remains the same: Rates will likely hold steady overall and fluctuate in line with typical seasonality.

The Arrive Canada Market Update, created by Arrive Insights, is a report that analyzes data from multiple sources, including but not limited to Statistics Canada, BMO Bank, Loadlink Technologies, American Trucking Associations, and Mordor Intelligence, from the past month as well as year-over-year. Please note that all dollar amounts are in CAD. We know market data is vital in making real-time business decisions. At Arrive Logistics, we are committed to giving you the data and insights you need to better manage your freight.