"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

Our short-term outlook calls for a relatively uneventful end to peak retail season. We expect strong contractual routing guide compliance and some volatility in the spot market between Christmas and New Year’s.

The outlook for rates in 2023 remains unchanged. Spot rates will likely bottom out in Q1 or Q2, and contract rates will continue getting downward pressure throughout the year. As demand wanes and capacity leaves the market, there will be increased vulnerability to severe weather and other disruptive events as the year progresses.

"*" indicates required fields

What’s Happening: Overall volumes saw negative year-over-year growth in November, but demand still shows signs of strength compared to historical levels.

Why It Matters: With a healthy amount of contract freight moving and ample capacity available to meet demand, shippers can expect strong routing guide compliance and high service levels from carriers in December.

November truckload demand reports varied from source to source, mainly because spot-focused index trends continued to show significant declines in activity while contract indices displayed more stability. Our takeaway from these opposing trends is consistent with last month’s report: Overall, demand remains healthy but continues to see large allocations moving via primary contract carriers.

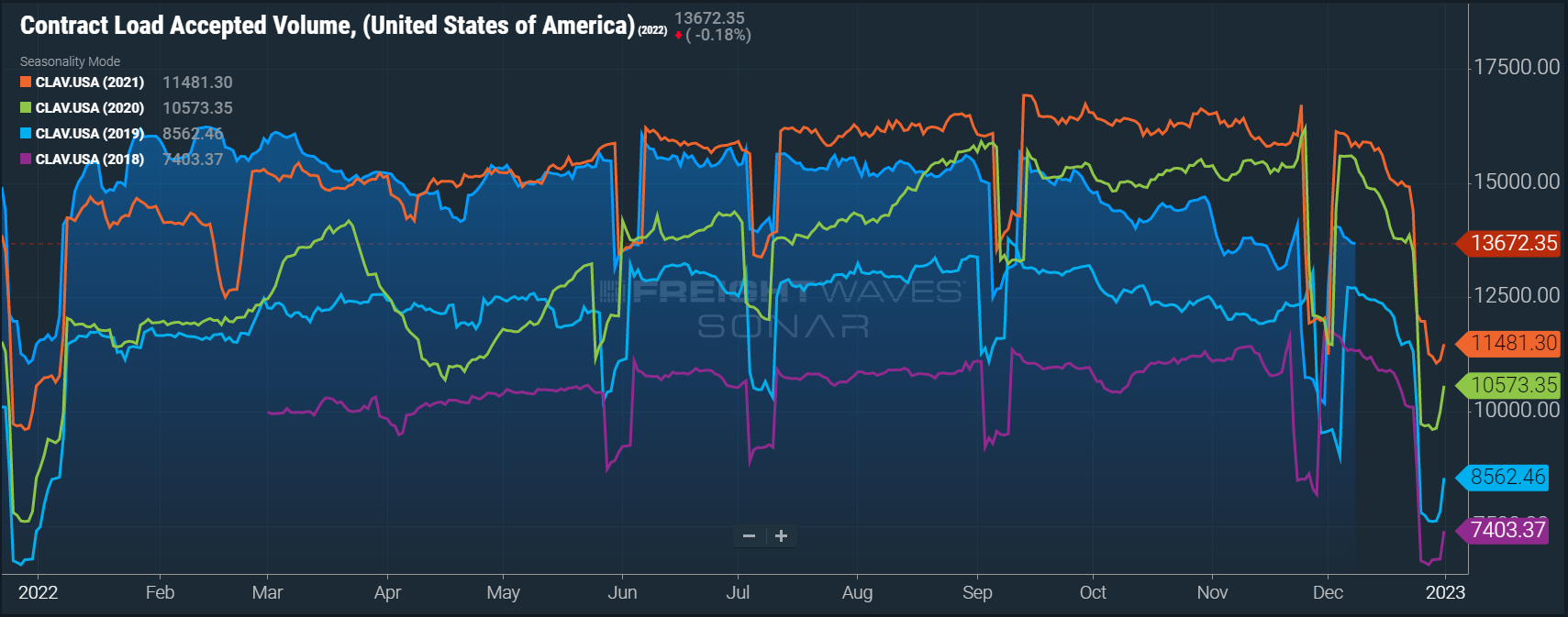

The FreightWaves SONAR Outbound Tender Volume Index (OTVI), which measures contract tender volumes across all modes, was down 26% year-over-year (1% month-over-month), or 12.8% when measuring accepted volumes after the significant decline in tender rejection rates.

This year-over-year contract volume decline is inconsistent with other sources, however. As we reported last month, some experts believe that the SONAR tender data has a higher proportion of retail freight than the overall market. This is unconfirmed by FreightWaves, but given retail demand has slowed substantially since Q4 2021, it would help explain the significant drop in tender volumes in recent months.

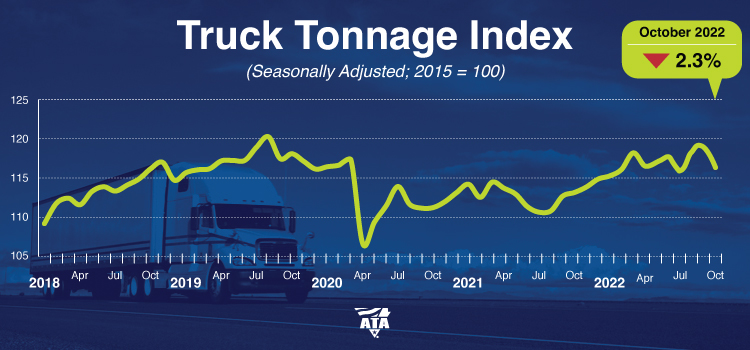

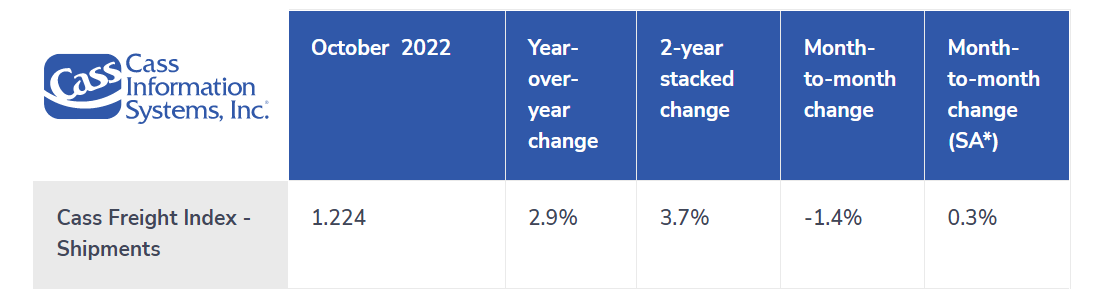

With retail down, industrials and manufacturing are most likely responsible for driving volumes. The ATA report indicated year-over-year volumes were down 2.3% in October after rising 5.5% year-over-year in September, and the Cass report showed volumes were up 2.9% year-over-year in October.

Contract is still leading the way as spot volumes continue to suffer as shippers experience ongoing strong routing guide compliance. DAT data shows year-over-year spot volumes declined 64% in November, indicating particularly slow retail peak season demand compared to what we typically see in the back half of the month.

What’s Happening: Capacity remains plentiful and continues to show further softening at a time when we typically see significant seasonal tightness.

Why It Matters: Most lanes should remain relatively volatility free through the end of the year.

Despite the Thanksgiving surge and the holiday season being in full swing, supply conditions remained stable in November. Because Thanksgiving trends are typically a good indicator of how things will unfold as we approach Christmas and New Year’s Eve, shippers should see strong routing guide performance hold steady through year-end.

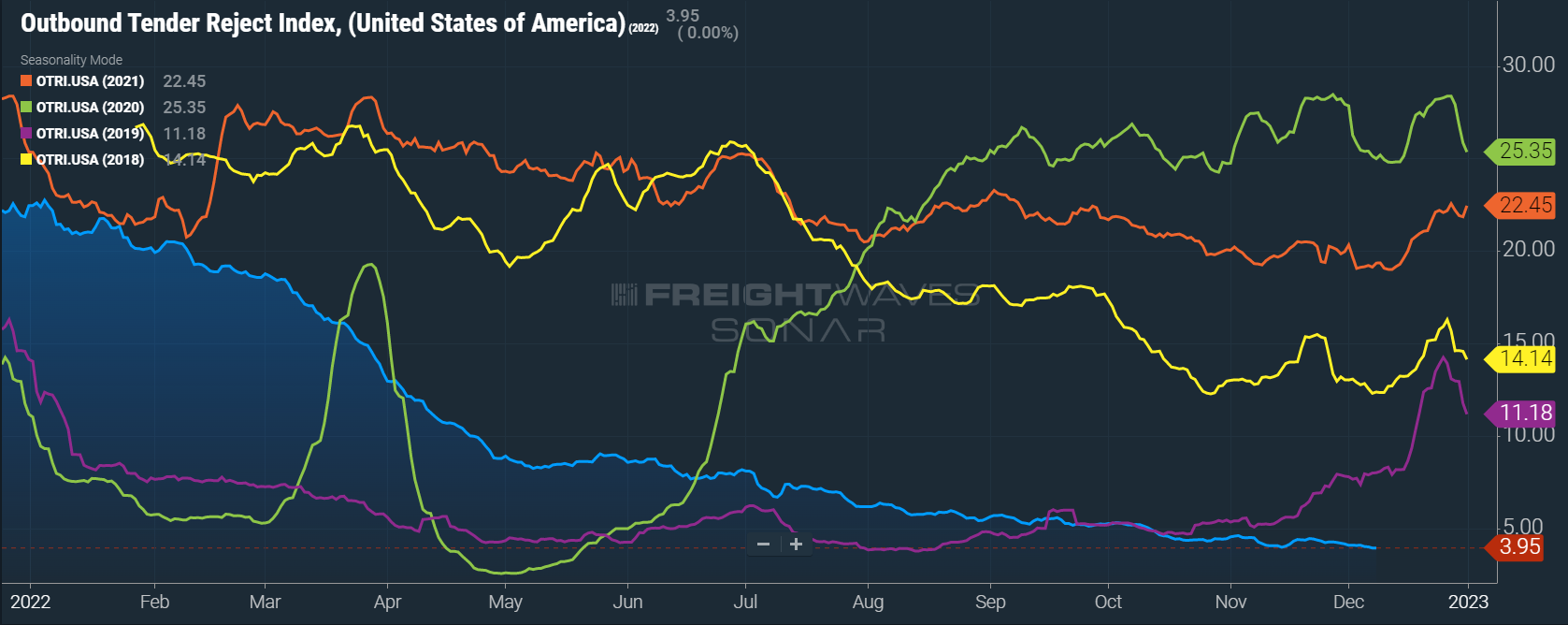

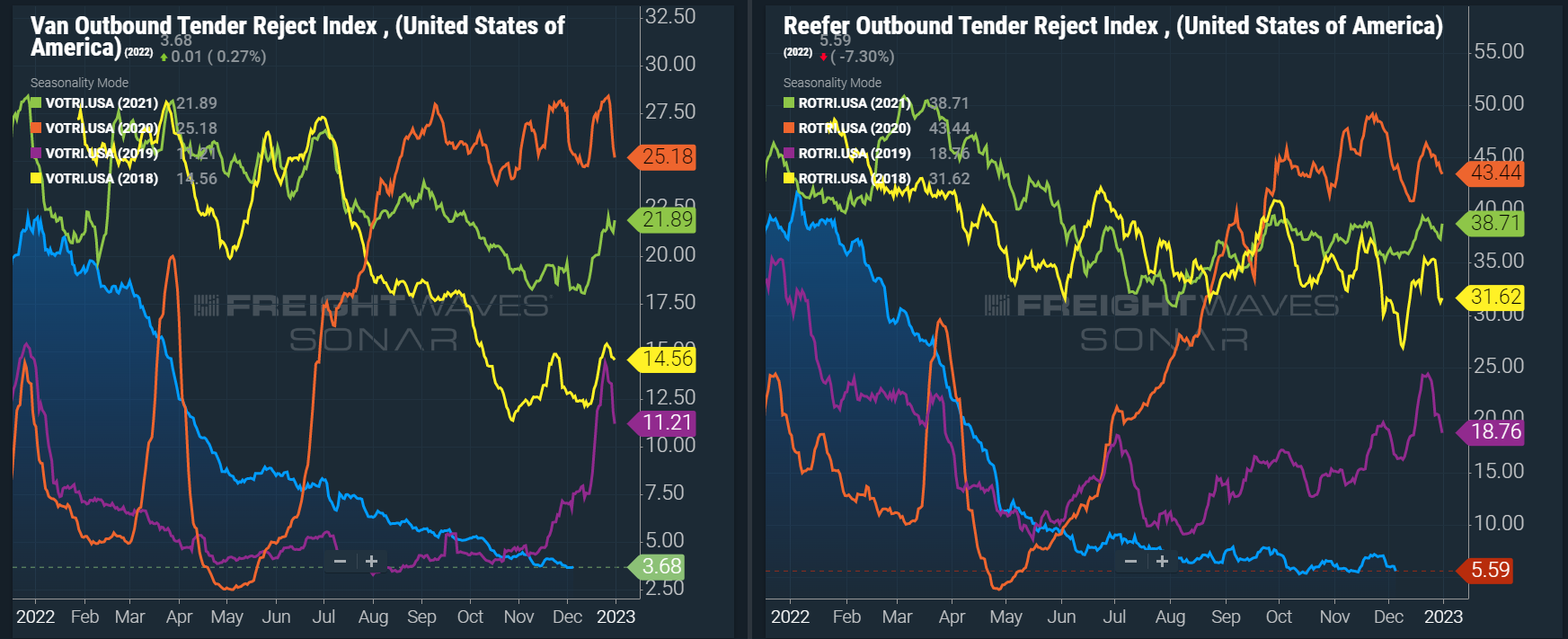

The Sonar Outbound Tender Reject Index (OTRI) measures the rate at which carriers reject the freight they are contractually required to take. The rate remained relatively stable this month, dropping from 4.19% in early November to 3.95% in early December, further indicating that shippers are still seeing good routing guide compliance on contractual freight.

Reefer tender rejections moved more than van tender rejections around Thanksgiving. Though we did see some of the usual food-related demand surge patterns, they were minimal compared to years past. This leads us to believe that even if spot activity and volatility increase before year-end, rejections will remain low as carriers continue delivering high service levels to protect volume heading into next year.

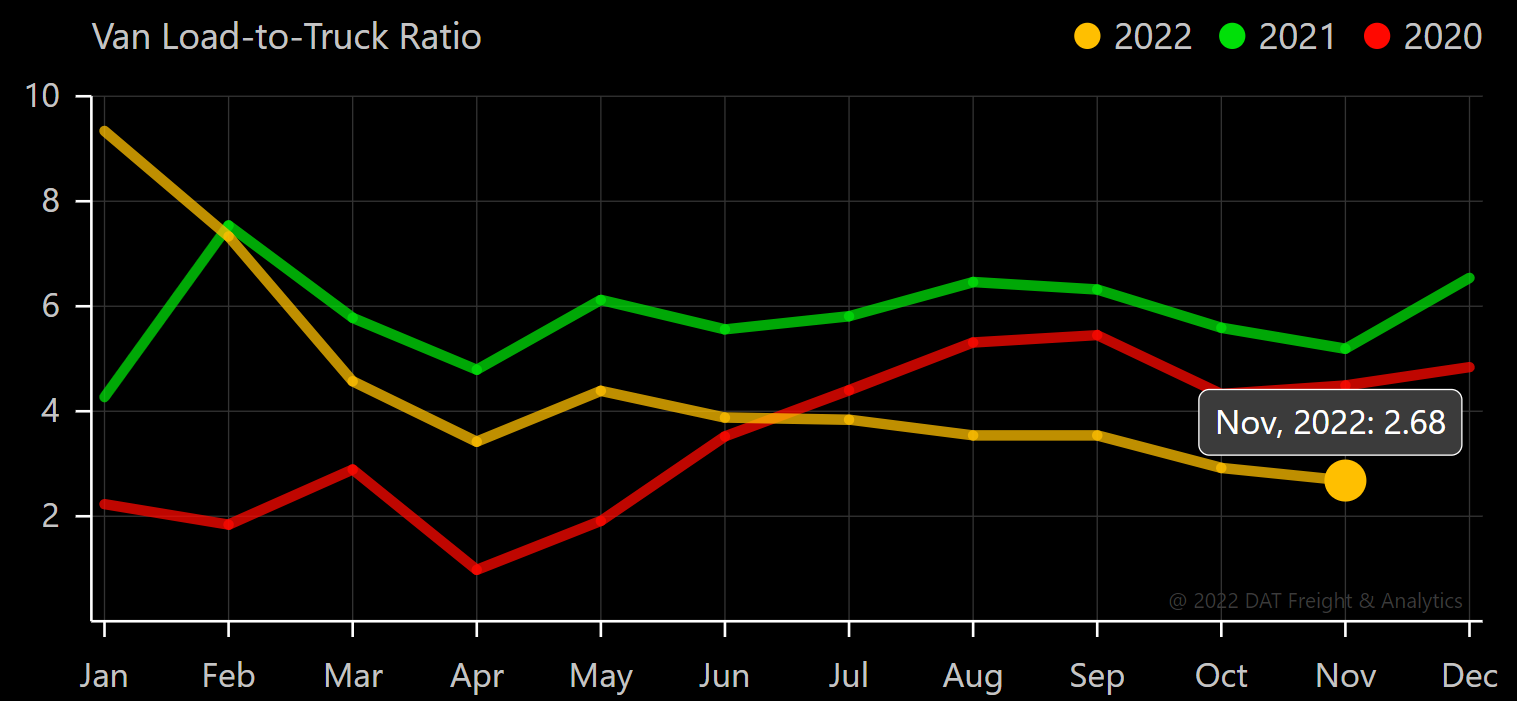

The DAT Load to Truck Ratio measures the total number of loads compared to the total number of trucks posted on their spot load board. In November, the Dry Van Load to Truck Ratio was down 21.6% month-over-month and 56% year-over-year, ranges that are typical of equilibrium market conditions. Likewise, the November Reefer Load to Truck Ratio was down 11.5% month-over-month and 62% year-over-year.

Weekly Load to Truck Ratio trends showed a slight increase in spot tightness during the week of Thanksgiving, but soft conditions returned across all modes the following week.

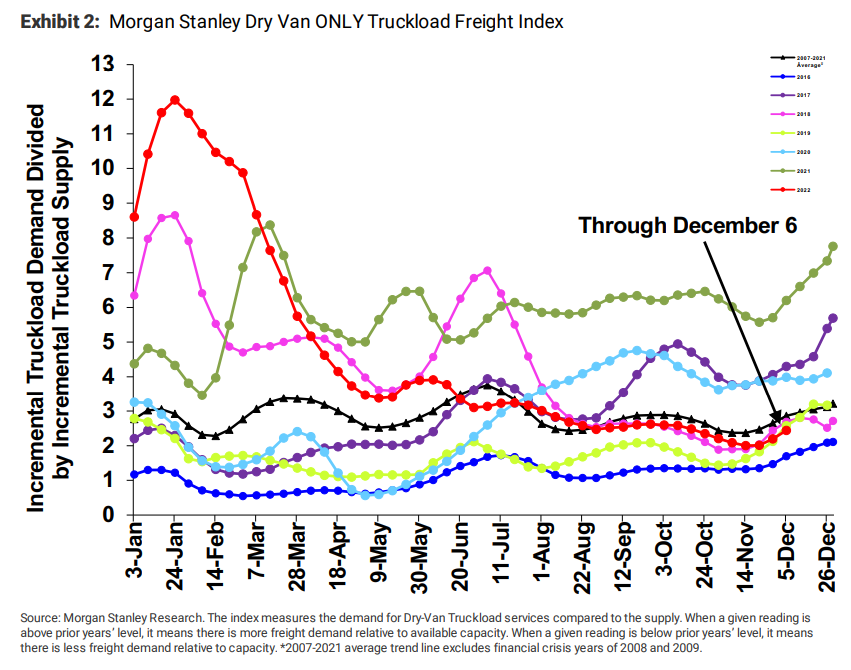

The Morgan Stanley Dry Van Freight Index is another measure of relative supply; the higher the index, the tighter the market conditions. The black line with triangle markers on the chart provides a great view of what directional trends would be in line with normal seasonality based on historical data dating back to 2007. Because all prior years saw increased tightness from mid-November through the end of the year, we would typically expect to see a similar trend now.

However, recent data helps illustrate that oversupplied conditions are driving declining market rate trends. While we have seen an uptick in line with normal seasonality following the holiday, we believe it may have been sparked primarily by shippers preparing for the potential rail strike. Therefore, it is unlikely that trend will continue through the month as it has in past years. So, given current conditions, we anticipate only minimal tightening due to increased urgency from shippers and carriers taking time off for the holidays.

What’s Happening: The spot market has responded to seasonal and other market trends, but contract rates continue to move relative to longer-term expectations.

Why It Matters: As we enter Q1 and the seasonal surge slows, shippers can expect deflationary conditions to return.

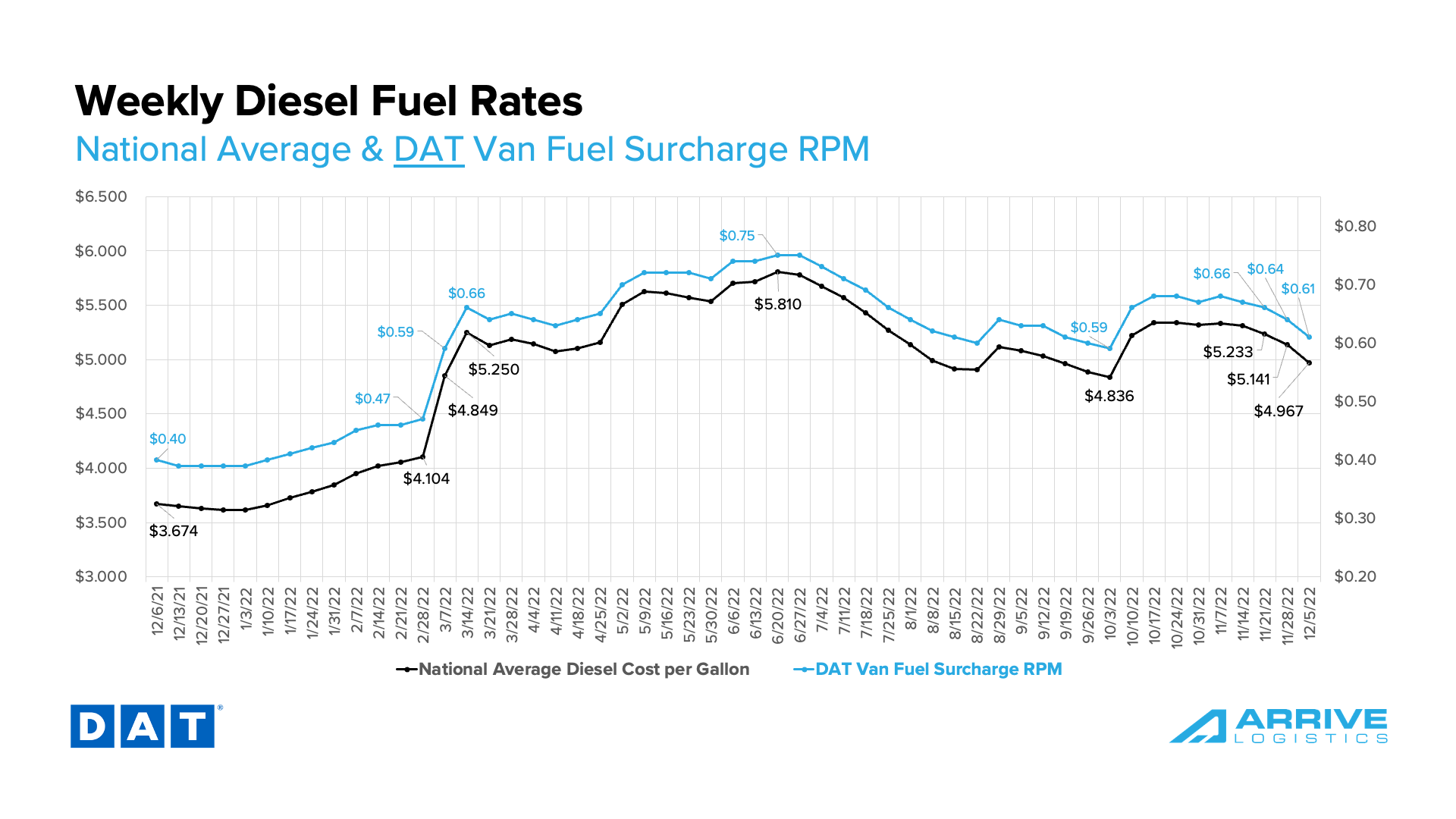

All-in spot rates, including linehaul and fuel costs, firmed up for dry van equipment in early December but continue to show sequential month-over-month declines for reefer and flatbed equipment. With the monthly average fuel surcharge, according to the DAT, down $0.05 per mile from November, the $0.02 increase in dry van rates is being driven by a $0.07 per mile increase in the linehaul component of the rate.

Though somewhat unexpected, three factors can help explain the sudden rise in linehaul rates: Typical seasonal tightness, the short-term demand surge caused by the threat of a rail strike in early December and the inflationary effect of declining fuel prices on spot linehaul rates. However, the fact that reefer and flatbed rates have continued to trend down rapidly leads us to believe that the inflationary effect of falling fuel prices is minimal.

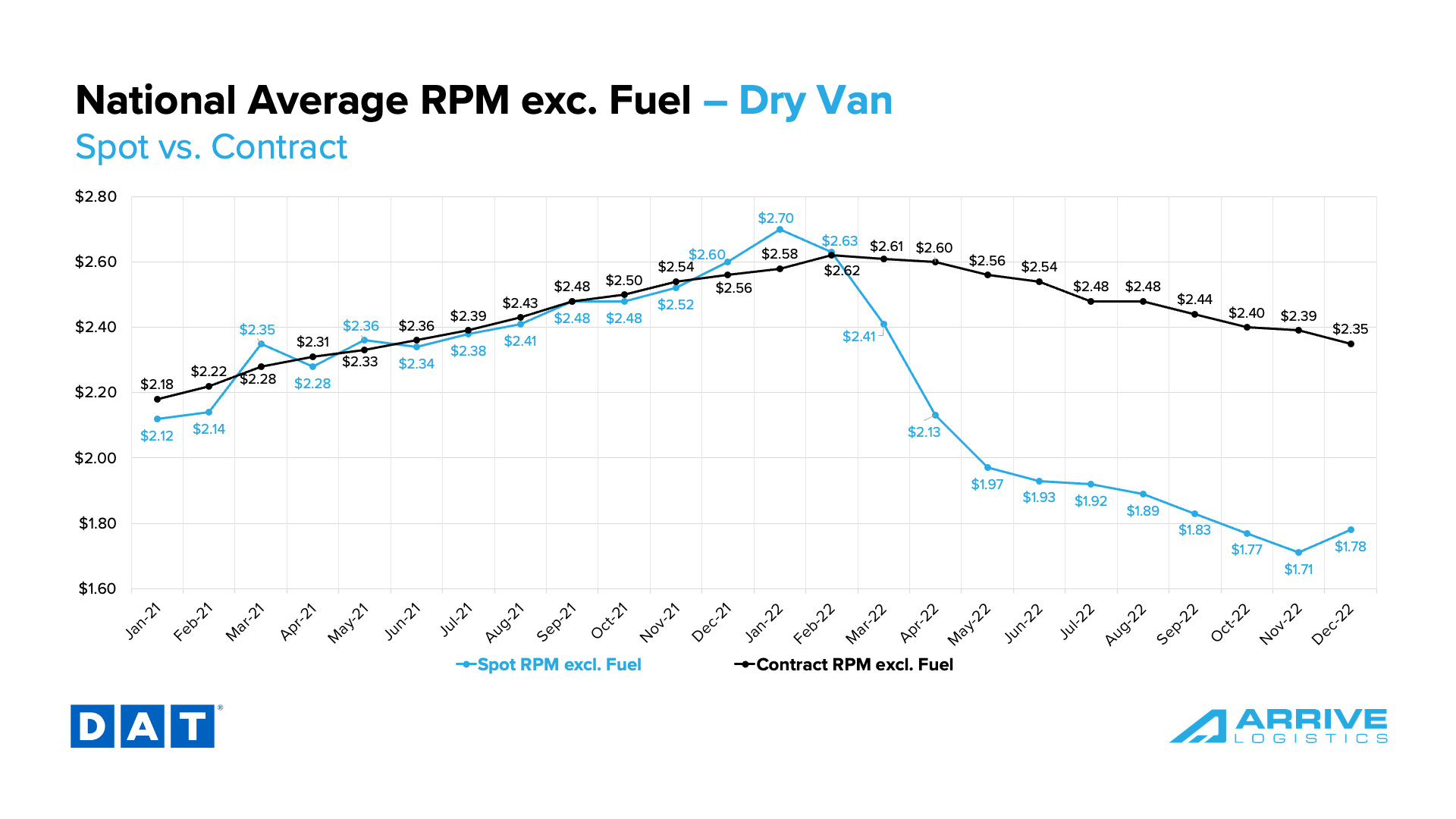

Early December linehaul rates show the spot market has responded to recent seasonal and other market trends, but contract rates continue to move relative to longer-term expectations. As a result, we have seen the gap between the two close by $0.11 per mile; this is significant, but a large disparity remains and should continue to drive downward pressure on contract rates for the foreseeable future.

The recent rise in spot rates does not change our 2023 forecast. We expect further spot declines in the first quarter and contract to continue to fall in the coming months as more shippers lock in lower pricing and as new business goes live.

The current dry van contract rate is $2.35 per mile, excluding fuel — a decrease of 8.2% from $2.56 per mile in December 2021. Although linehaul rates are down year-over-year, all-in contract rates are flat due to increased fuel costs. We did see a 10.3% decline from the peak of contract rates, excluding fuel, in February of 2022, with no signs of reaching a floor in the months that followed.

Following a similar pattern to van rates, reefer contract rates trended down early in the month, but reefer spot rates have yet to see the same upward movement. The current reefer contract rate is $2.56 per mile, excluding fuel, making for the seventh straight monthly decline. The current reefer spot rate is $2.05 per mile, excluding fuel — a 33% decrease from $3.04 per mile in December 2021. Contract rates are now down by $0.10 per mile, excluding fuel, over the same period.

The flatbed market continues to experience spot rate declines, with the current rate at $2.01 per mile, excluding fuel — a 23% decrease from $2.60 per mile in December 2021. Flatbed contract rates remained level in early December, with the current rate at $2.85 per mile, excluding fuel. Flatbed contract rates are now down by just $0.01 from $2.86 per mile, excluding fuel, in December 2021.

What’s Happening: With significantly lower volumes of peak holiday freight in the pipeline this year, LTL carriers are feeling the impact of soft demand.

Why It Matters: As equilibrium conditions set in, things might get worse for carriers before they get better.

What’s Happening: Northbound capacity is plentiful — for now.

Why It Matters: Tightness is likely as volumes pick up in Q1 2023 due to produce season starting and more carriers looking to capitalize on opportunities closer to the U.S. border.

Two conflicting trends we’re watching are the slowdown in the U.S. market and increasing instances of nearshoring. Companies are continuing to invest in building closer to home to reap USMCA benefits, and Mexico continues to be a top U.S. trading partner because of these opportunities.

On one side, Mexico is catching up to the U.S. market as soft conditions drive shippers to revisit rates with asset carriers who charged a premium when capacity was tight amid skyrocketing demand. On the other, with nearshoring increasing and news of stateside semiconductor chip manufacturing investments ramping up, we expect that the U.S. will still have more capacity available than Mexico. Significant portions of materials for the semiconductor plant and production will likely be sourced from Mexico, creating additional northbound demand over the next several years.

It is also worth noting that we expect tighter capacity and longer transit times for a 2-4 week period beginning in mid-December because most Mexico-based carriers and automotive OEMs take holiday time off, causing a ripple effect with their supplier base and demand in the market.

What’s Happening: Owner-operators continue to take company jobs with large assets.

Why It Matters: If 2023 demand declines due to broader economic factors, assets may slow or cease hiring, leaving many drivers with nowhere to go.

Revocations of trucking authority, as calculated by FTR, remain at historically high levels due to declining rates and the rising cost of operations. Up to this point, we believe this trend supports the theory that carriers are taking company jobs with larger assets instead of trying to survive independently as owner-operators. It proves that turnover is high in the carrier space but not high enough to say with certainty that capacity is leaving the market. In fact, total jobs in trucking reached a new all-time high in November.

The job growth during the pandemic appears to be flattening in recent months, indicating that the number of drivers leaving the market is beginning to surpass the total number of owner-operators taking company jobs. These individuals are now represented in the trucking employment numbers as they sign on to the larger asset carriers since the owner-operator headcount is not included in employment data.

If demand falls in the new year, larger carriers will begin to see less need to add drivers. In that case, we would expect to see trucking employment trend in the opposite direction, leaving a depleted workforce vulnerable to future surges in demand.

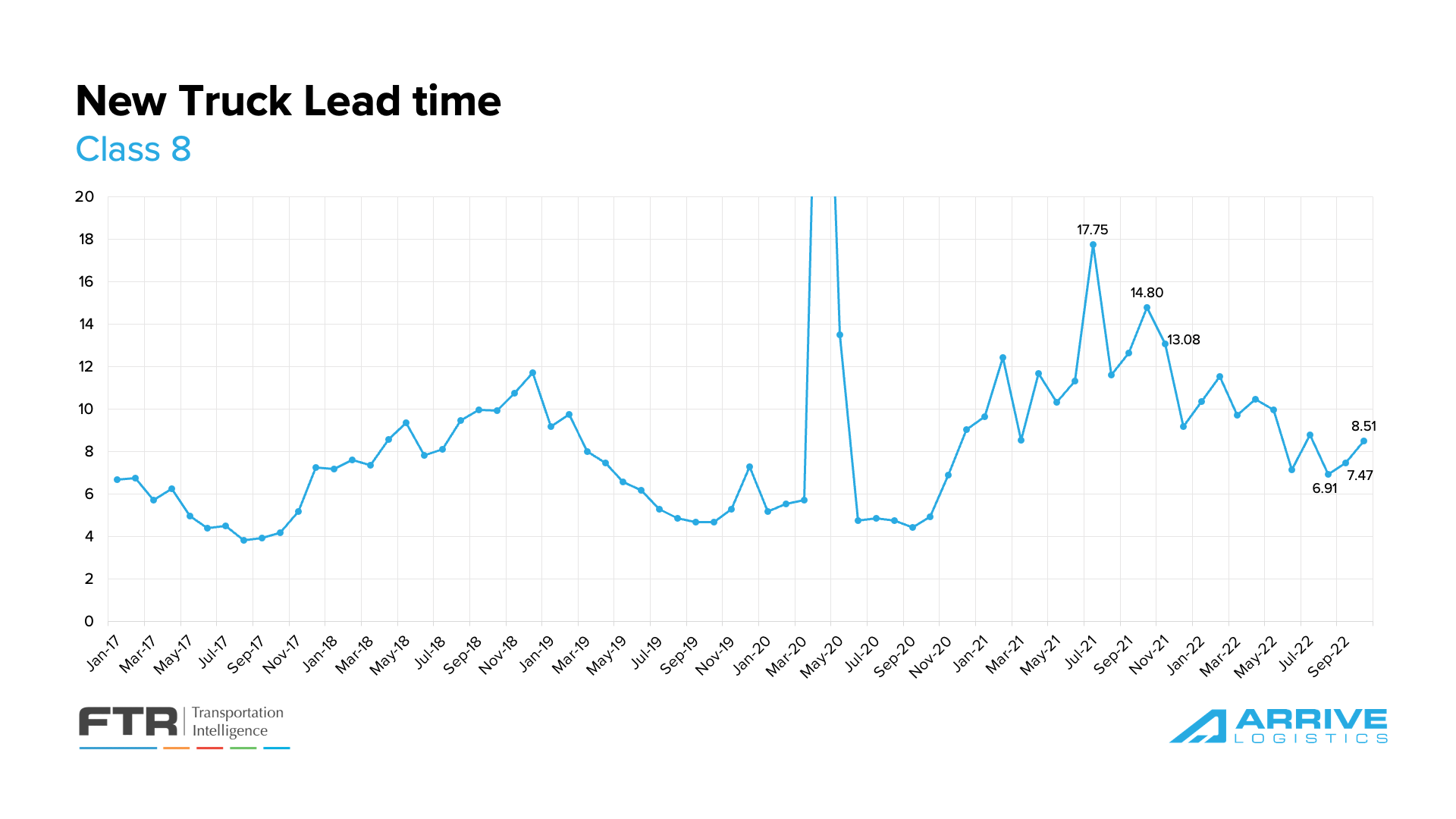

According to FTR, New Class 8 truck orders fell to 34,300 in November. Demand for new equipment remains relatively strong, driven by pent-up replacement demand due to several years of limited production that prevented many fleets from replacing aged equipment.

However, FTR indicated that most OEM build slots for 2023 are full, and these production limitations likely mean new orders will fall in the coming months. From this perspective, we do not consider new truck orders a good indicator of carrier sentiment about future demand. Healthy order numbers are required to replace aging equipment, and OEM’s are metering the actual number of orders based on their production capabilities. Despite declining orders, growing backlogs have resulted in an increase in the average time from order to delivery from 7.5 to 8.1 months.

Shippers in Arrive’s network continue to note the value of drop trailers in creating warehouse efficiencies amid labor challenges and overstocked inventories. The ability to plan has limited unnecessary dwell times and detention payments to carriers. Drop trailers also benefits carriers, who are getting increased asset utilization on tractors by spending less time waiting for loads to be loaded or unloaded. As a result, trailer orders jumped 91% month-over-month, maxing out filling build slots through the first quarter of 2023. Net orders are now up 161% year-over-year.

What’s Happening: The manufacturing sector contracted for the first time after 29 consecutive months of growth.

Why It Matters: We were expecting manufacturing-related volume to bolster demand in 2023; if current pullbacks continue, risks to the downside increase.

Future demand indicators are slightly less optimistic than a month ago due to persistently high inflation and the FED increasing interest rates, which will eventually lead to declining volumes. Additionally, imports are forecasted to trend as low double-digit negative growth in early 2023, and the manufacturing sector, as measured by ISM, is slipping into contraction for the first time since the start of the pandemic.

On a positive note, consumer spending remains strong enough to hold demand above historical levels despite dipping below 2021 highs; this is in line with our view that volumes will continue to ease in 2023 but do so gradually.

Import levels, a key contributor to overall truckload demand, are projected to fall 7.5% month-over-month and 12.3% year-over-year to 1.85 million TEUs in November. The decline is partially due to elevated inventories in the retail sector, where surpluses and full warehouses have forced pullbacks in new shipments from overseas; this is supported by strong retail spending. However, the National Retail Federation is forecasting more pullbacks in early 2023, with an annual decrease greater than 20% expected in February.

The ISM manufacturing report indicated easing backlogs as production increased and new orders slowed. The sector contracted for the first time after 29 straight months of expansion. Manufacturing was forecasted to be one of the main drivers behind continued volume strength in the new year; if contraction persists, it becomes more likely demand will fall further than previously forecasted.

According to the previous report, FTR’s latest truck loadings forecast of a 2.2% year-over-year increase in 2022 is down from 2.5% last month. The 2023 forecast continues to show an increased risk to the downside and has been revised to -0.1% growth from 0.9% as of the last update and 2.0% before that. A widely weaker forecast explains the decline for most major commodity groups.

What’s Happening: Bank of America data showed softer consumer spending in November, but labor reports were positive.

Why It Matters: A strong labor market should encourage consumers to maintain current spending levels, preventing truckload demand from heading off a cliff.

Although November CPI data has yet to be released at the time of this report, BofA is estimating that headline CPI increased by 0.2% month-over-month in November, and as a result, year-over-year growth would decline from 7.7% to 7.3%. Year-over-year core CPI growth is also expected to fall from 6.3% to 6.1%; BofA noted that improvements in energy prices were a factor but that food price inflation would remain “sticky-high” at 0.6%.

According to Bank of America card spending data, year-over-year consumer spending grew by 1.7% in November. That’s down from 3.1% year-over-year growth in October after rising just 0.1% month-over-month on a seasonally adjusted basis. BofA notes sizable decreases in many retail categories, including gas, online retail and home improvement, as factors for the change.

Consumer spending on durable goods remains elevated but is being outpaced by leisure services spending relative to pre-pandemic levels. Airline travel, in particular, is a category that has seen significant growth and is a sign consumers are traveling more.

BofA concluded its analysis with the view that spending is gradually softening and the expectation that consumers will remain relatively resilient as long as the labor market stays tight.

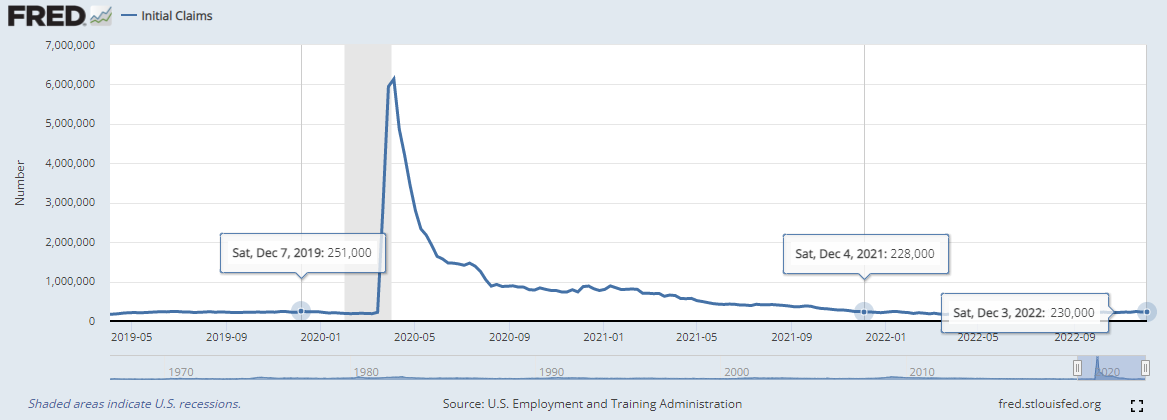

Initial jobless claims rose slightly in the first week of December; however, they were almost exactly the same as a year ago and actually down from pre-pandemic levels. The unemployment rate was also nearly flat compared to November 2019 and down from November 2021, a sign that the labor market remains tight despite recent reports of layoffs.

The strong labor market signals confidence in consumers’ ability to maintain current spending levels and prevent any crash that could suddenly lead truckload demand off a cliff.

With just a few weeks remaining in a relatively uneventful peak season, shippers should expect a smooth finish to the year.

Though low outbound freight volumes for inbound drivers have made it difficult to find spot coverage on some lanes, particularly on long hauls to the West Coast, contract compliance has barely seen any movement. Strong routing guide compliance and declining contract rates illustrate how carriers are working to protect volumes heading into the new year; we expect this trend will continue as long as uncertainty about future demand persists.

Our 2023 rate forecast remains unchanged. We expect spot rates to find a floor relatively quickly — likely by late Q1 or early Q2 — and to remain stable throughout the year, fluctuating as expected on a seasonal basis. Contract rates will continue to experience deflationary pressures due to the unprecedented spot/contract rate gap.

Capacity is likely to continue becoming more established on contract freight as good rates drive more owner-operators and smaller fleets toward company jobs. As a result, we expect strong routing guide compliance to continue.

Risks to the forecast remain present in both directions but are leaning more toward the downside as broader economic data still shows slowing economic growth. However, factors such as global tensions, ongoing labor negotiations at the ports and severe weather also present realistic upside risks.

The Arrive Monthly Market Update, created by Arrive Insights, is a report that analyzes data from multiple sources, including but not limited to FreightWaves SONAR, DAT, FTR Transportation Intelligence, Morgan Stanley Research, Bank of America Internal Data, Journal of Commerce, Stephens Research, National Retail Federation and FRED Economic Data from the past month as well as year-over-year. We know market data is vital in making real-time business decisions. At Arrive Logistics, we are committed to giving you the data and insights you need to better manage your freight.