"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

Recent trends support our previous forecast. Spot rates are falling into February and will likely experience ongoing downward pressure before finding a floor in late Q1 or early Q2. Meanwhile, the persistent spot-contract gap will continue putting downward pressure on contract rates up for negotiation throughout at least the year’s first half. Finally, demand is faltering as capacity continues to normalize to new levels, which should ultimately facilitate longer-term equilibrium conditions until a significant enough demand disruption impacts the market.

"*" indicates required fields

What’s Happening: Aside from a short-lived disruption caused by winter weather late in January, demand is following typical seasonal patterns.

Why It Matters: Our forecast remains that demand will continue moving gradually toward pre-pandemic levels throughout 2023.

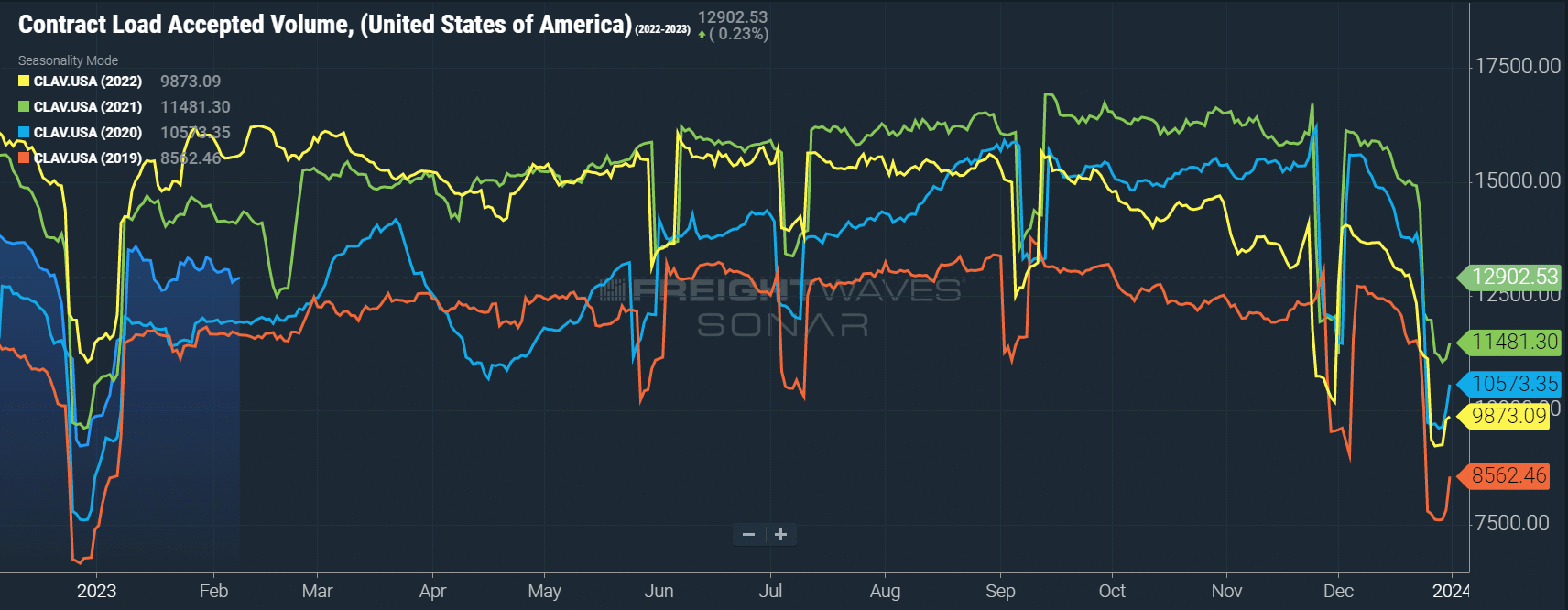

January truckload demand was in line with typical seasonal patterns for the most part. We believe the tightness early in the month was primarily the result of capacity trends, not a demand surge. Some severe winter weather throughout the month led to a slight spot activity increase relative to December, but year-over-year comparisons still highlight significant spot demand declines. Contract indices illustrate a slight pullback from late 2022, but a seasonal downshift is normal and expected in the first quarter.

The FreightWaves SONAR Outbound Tender Volume Index (OTVI), which measures contract tender volumes across all modes, was down 31% year-over-year, or 18% when measuring accepted volumes after the significant decline in tender rejection rates. This large decline is inconsistent with other sources, providing further evidence that FreightWaves data is likely heavily skewed toward retail freight rather than the overall market. Though unconfirmed by FreightWaves, considering retail-related demand has slowed substantially since Q4 2021, it would help explain the significant drop in volumes.

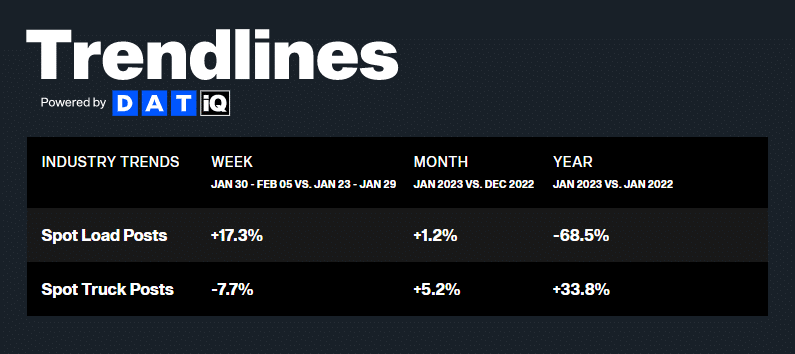

Contract freight still leads the way and spot volumes continue to suffer as shippers experience more strong routing guide compliance. DAT data shows year-over-year spot volumes declined 68.5% in January, despite increasing 1.2% month-over-month from December. The increase in spot posts was likely due to disruption caused by widespread severe winter weather and carriers taking time off around the holidays and into the month.

What’s Happening: Tender rejection rates are historically low as carriers and brokerages deliver on service to protect contract volumes.

Why It Matters: Carriers and brokers will continue to accept freight and provide outstanding service as a means of protecting themselves against broader economic uncertainty.

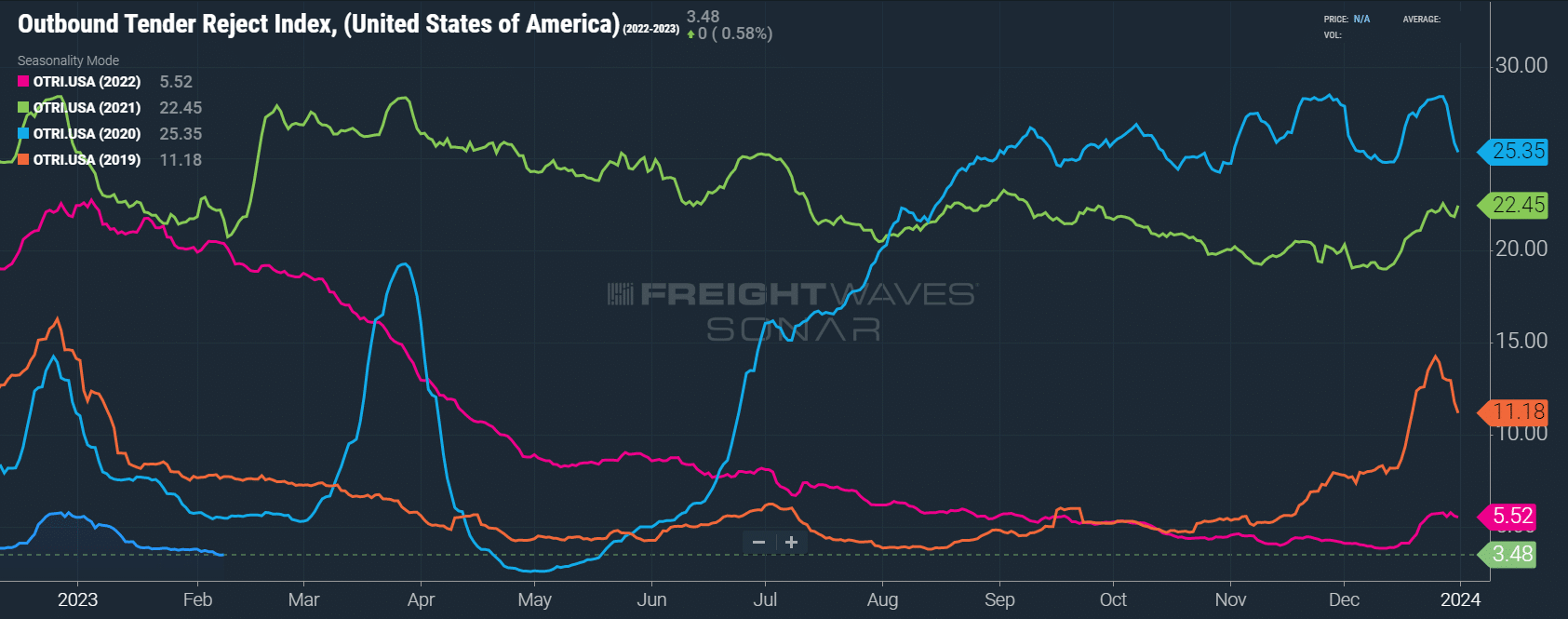

Conditions in the first quarter are typically the softest they will be all year. After several weeks of lingering holiday disruptions, the market has loosened up right on queue, and capacity remains more than sufficient to meet current demand.

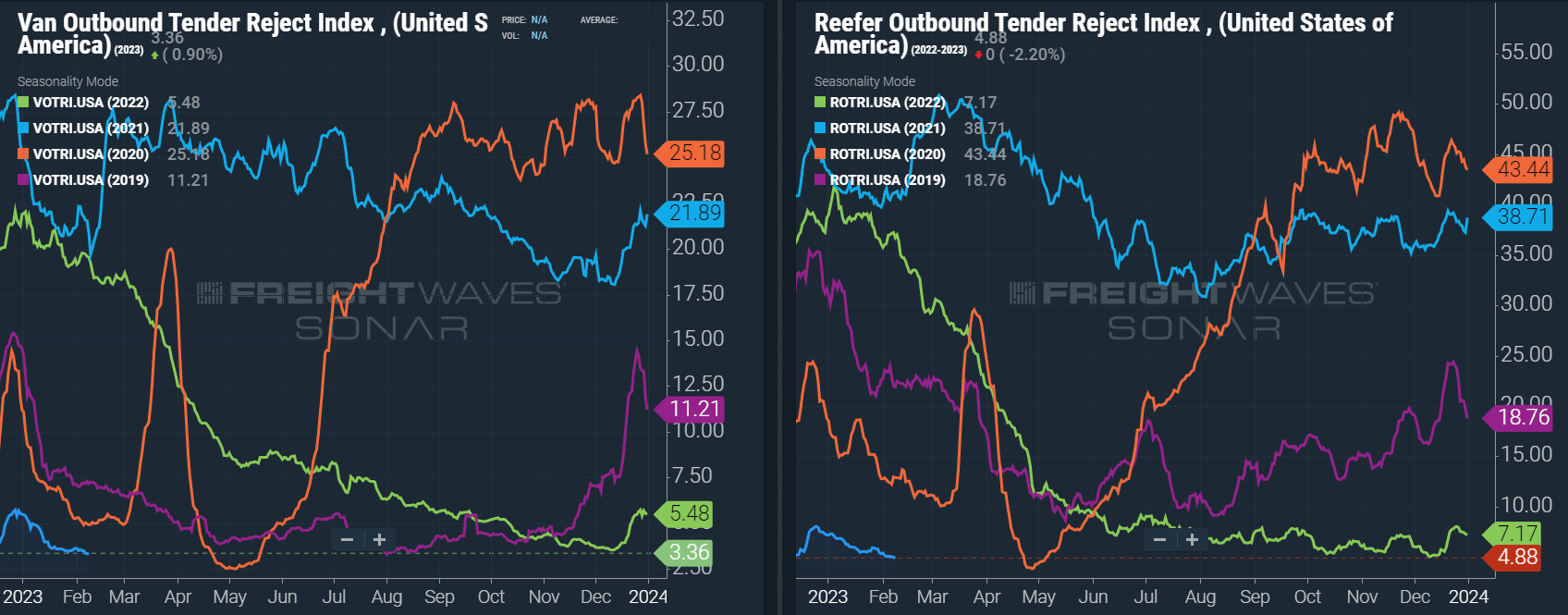

The Sonar Outbound Tender Reject Index (OTRI) measures the rate at which carriers reject the freight they are contractually required to take. The rate declined steadily throughout the month, from 5.5% in early January to 3.47% in early February, indicating that shippers are still seeing good routing guide compliance on contractual freight. Reefer tender rejections aligned with van rejections, easing throughout the month.

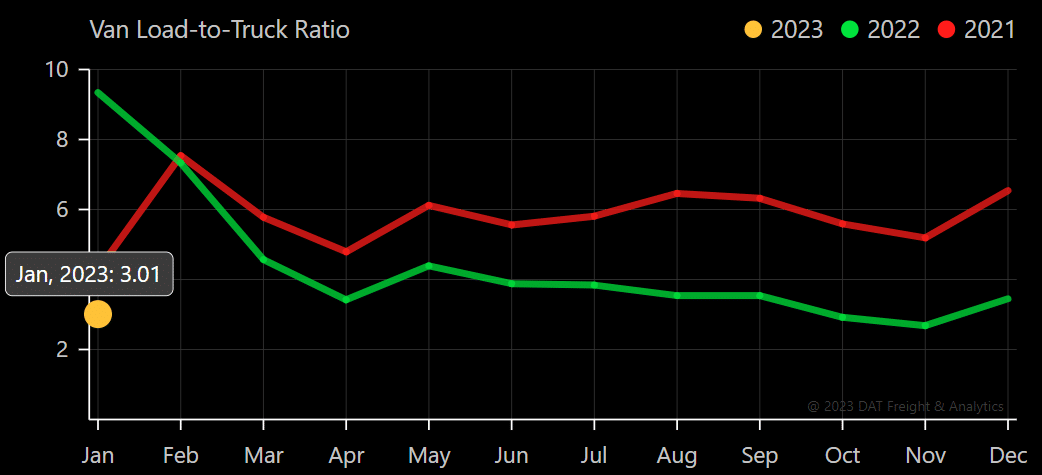

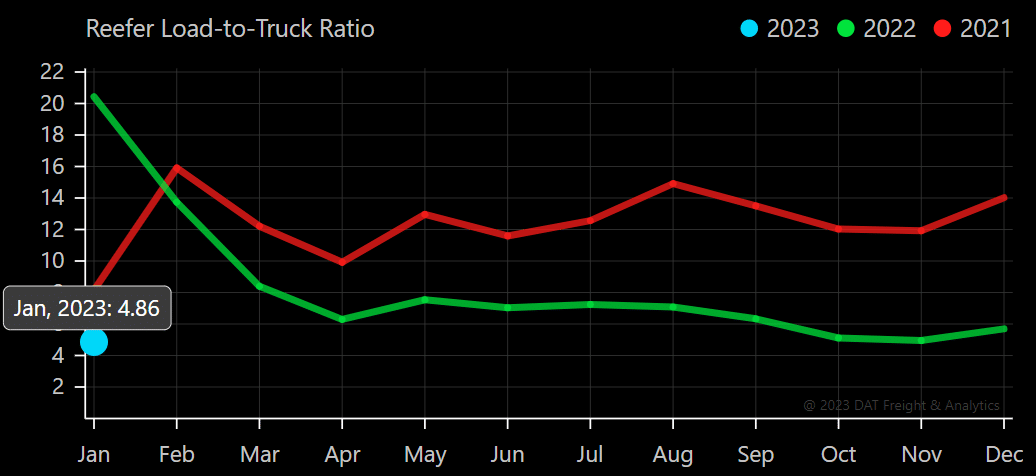

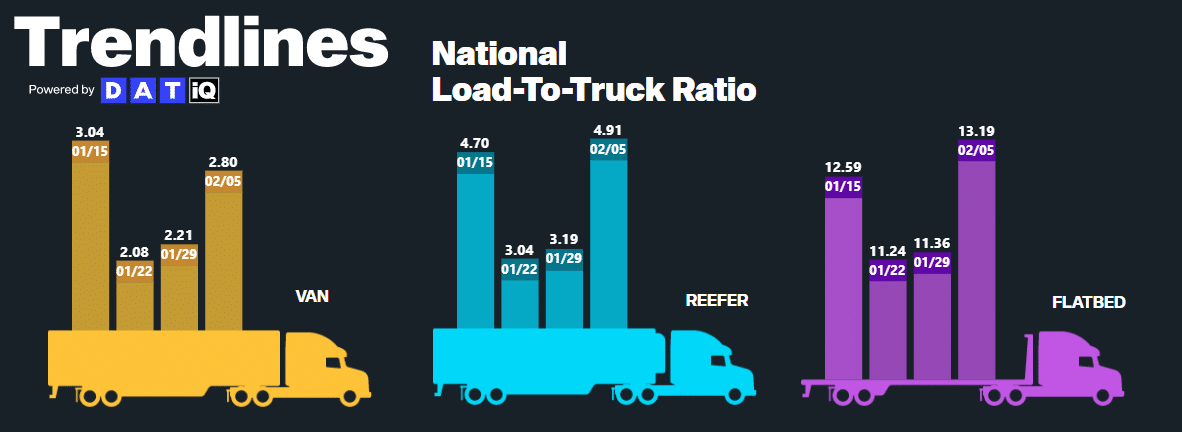

The DAT Load-to-Truck Ratio measures the total number of loads relative to the total number of trucks posted on their spot load board. In January, the Dry Van Load-to-Truck Ratio decreased 13% month-over-month and remained down 68% year-over-year. At 3.01 loads per truck, current levels are typical of equilibrium market conditions. Likewise, the Reefer Load-to-Truck Ratio decreased month-over-month, falling 14.6% from December and remaining down 76% year-over-year.

Weekly Load-to-Truck Ratio trends help illustrate the easing that occurred late in January before widespread winter weather increased spot activity in the first week of February. As we progress deeper into first-quarter seasonal slowdowns, conditions will likely moderate further in February.

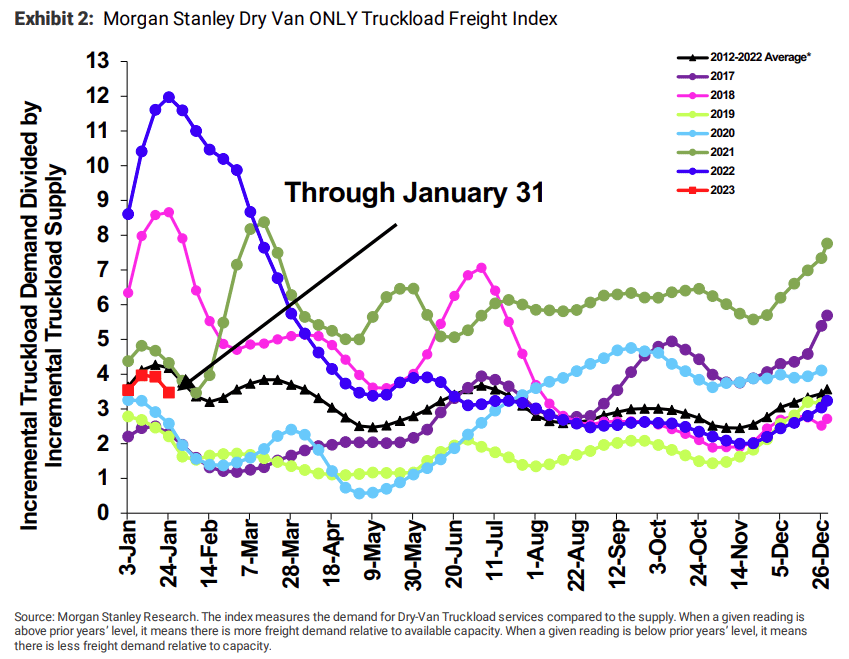

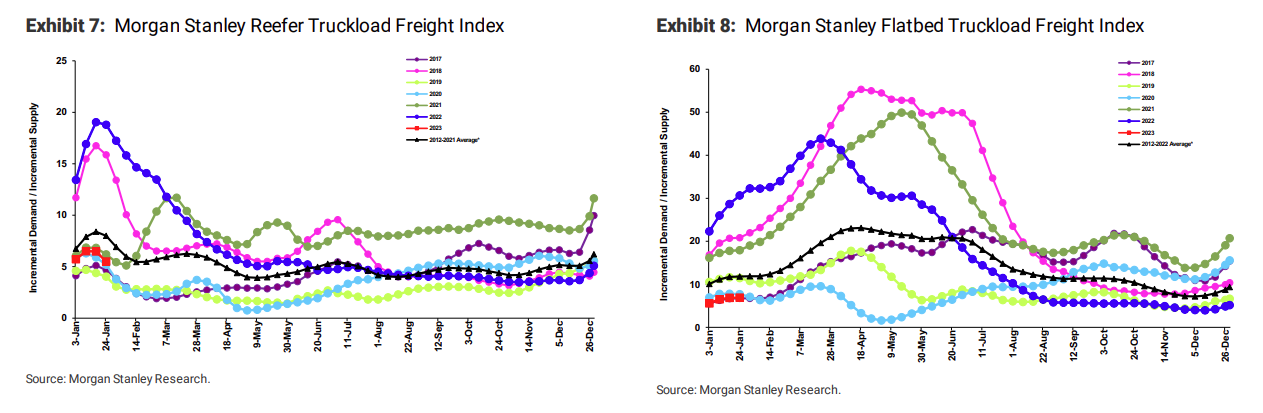

The Morgan Stanley Dry Van Freight Index is another measure of relative supply; the higher the index, the tighter the market conditions. The black line with triangle markers on the chart provides a great view of what directional trends would be in line with normal seasonality based on historical data dating back to 2007.

January trends underperformed typical seasonality, indicating that conditions softened more than usual before the early February winter weather disruptions. We anticipate further softening throughout February, followed by possible disruption due to the early produce season in mid-March.

What’s Happening: Rates are following normal seasonal patterns, and it appears that all-in rates, including fuel, across all three equipment types have hit their cycle low.

Why it Matters: Shippers can still lock in contract capacity at lower rates as we rapidly approach the floor.

Following the same trend as capacity, rates eased throughout January after some short-lived year-end volatility. When looking at Truckstop’s weekly rate chart, it’s clear the holiday surge was significant, but as in previous years, it lasted only a few weeks. In turn, rates responded to rapidly normalizing capacity conditions as the month progressed.

Figure 12: Truckstop Weekly Dry Van Spot Rates

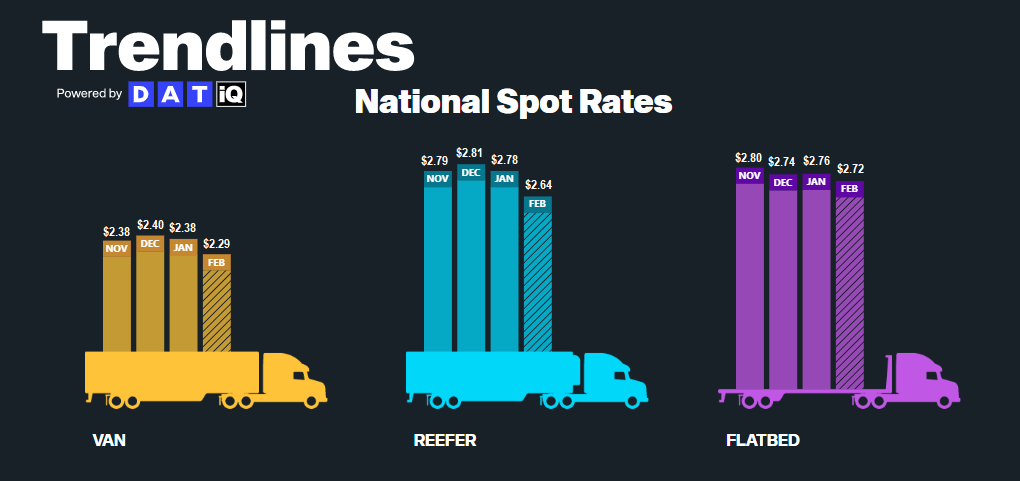

According to DAT, all-in spot rates, including linehaul and fuel costs, are down across all three modes in early February, mirroring the trend demonstrated in recent capacity data and weekly Truckstop data. As of February 10th, van and reefer equipment have seen greater decreases than flatbed equipment, falling by $0.09 and $0.14, respectively, compared to just $0.04 for flatbed.

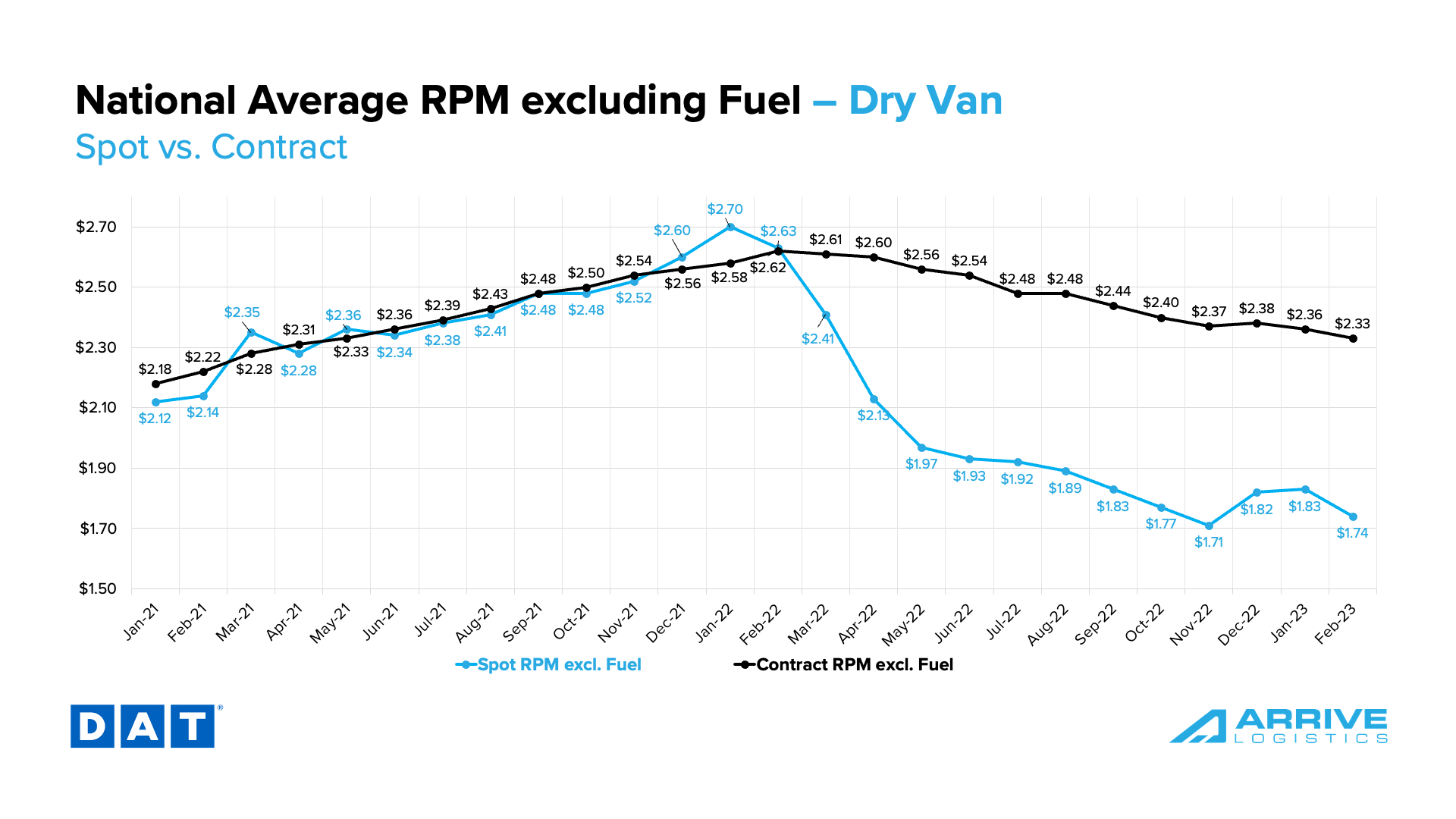

Early February linehaul data shows spot and contract rates have resumed the downward trend of the past year. Though the holiday surge was more significant than anticipated, recent trends are falling closely in line with our forecast. We anticipate spot rate declines to continue over the next month and contract rates to follow suit for several more months as more shippers lock in lower pricing and as new business goes live.

Recent spot rate spikes helped close the spot-contract gap to $0.53 in January, but declining rates in early February quickly drove it back up to $0.59. As a result, downward pressure on contract rates should continue for the foreseeable future, even if the market experiences some seasonal pressures in the back half of the second quarter.

All-in spot rates are down 26% on a year-over-year basis, and linehaul spot rates are down nearly 34%. All-in contract rates are down 6.5% year-over-year, and linehaul contract rates are down 11.1% from their February 2022 peak.

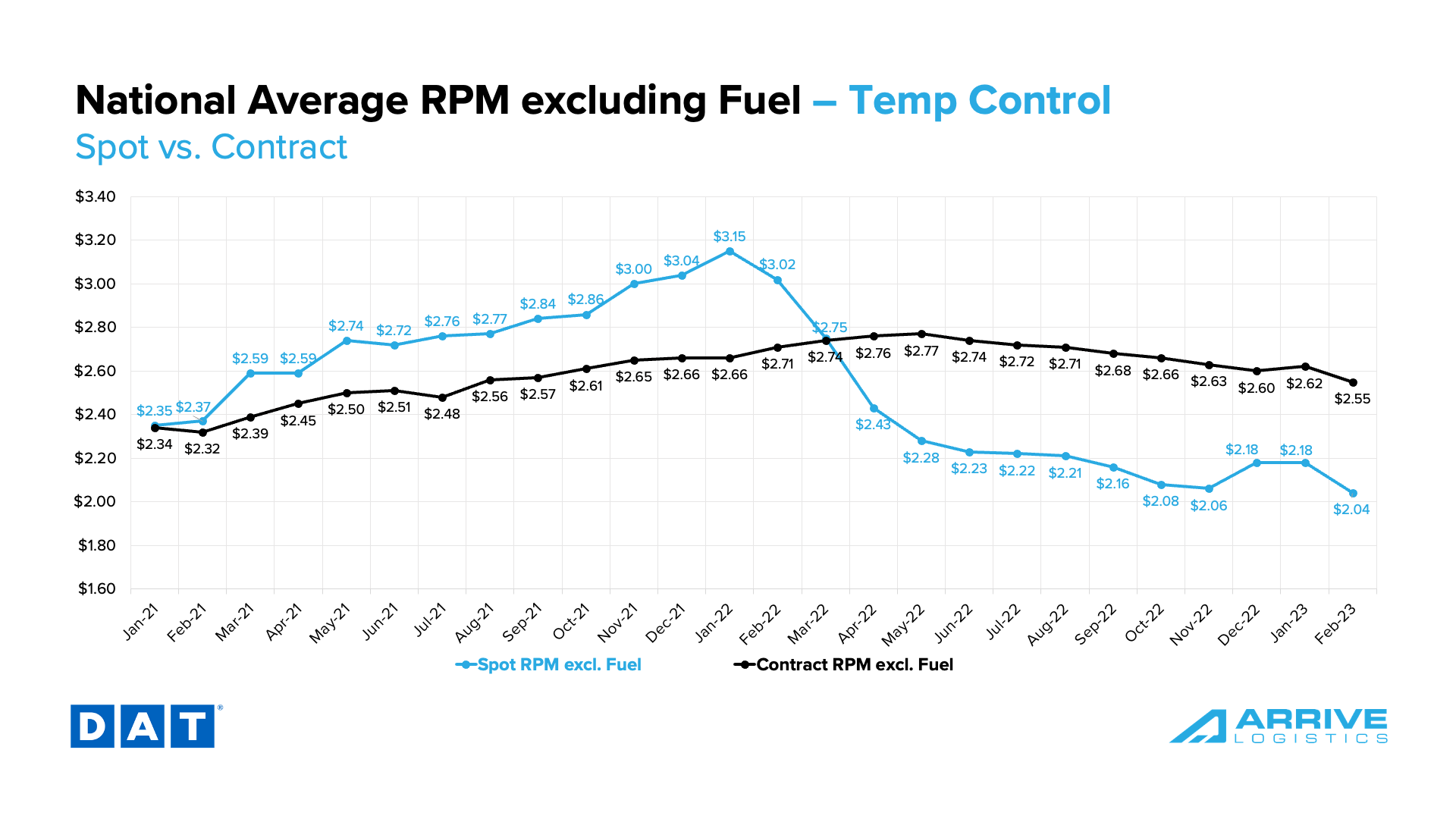

Following a similar pattern to van rates, reefer spot and contract linehaul rates are down early in the month. The current reefer contract rate is $2.55 per mile, excluding fuel, while the current reefer spot rate at $2.04 per mile, excluding fuel — a 35% decrease from $3.15 per mile in January 2022, the peak for reefer spot rates. Contract rates are now down by $0.22 per mile, excluding fuel, from their peak of $2.77 in May 2022.

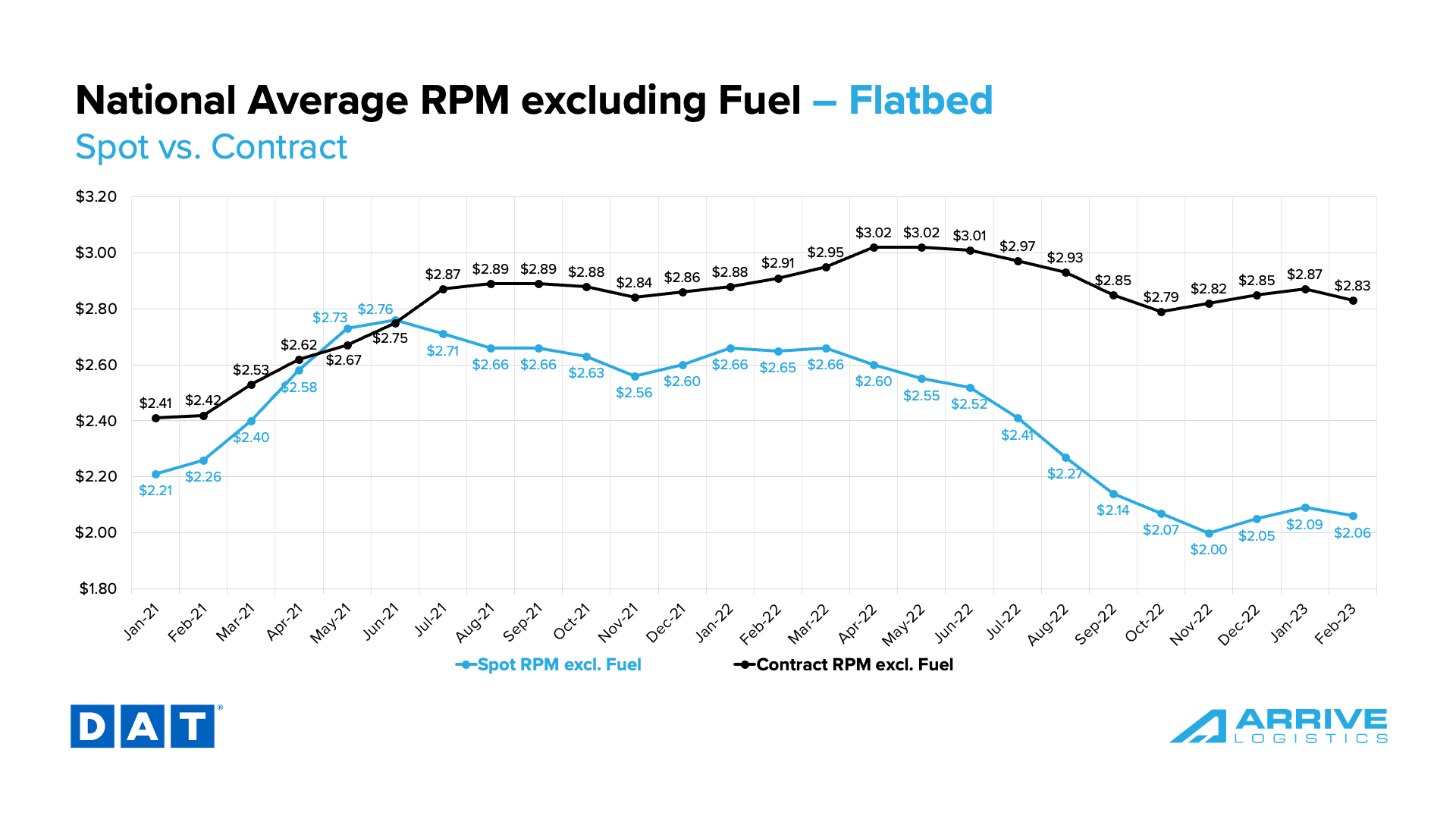

In the flatbed market, both spot and contract rates decreased after increasing for several months. The current spot rate is $2.06 per mile, excluding fuel. Flatbed contract rates are currently $2.83 per mile, excluding fuel.

What’s Happening: LTL carriers are still seeing low volumes.

Why It Matters: Though strong pricing offers some relief, more pullbacks in manufacturing or other major sectors could worsen conditions before they get better.

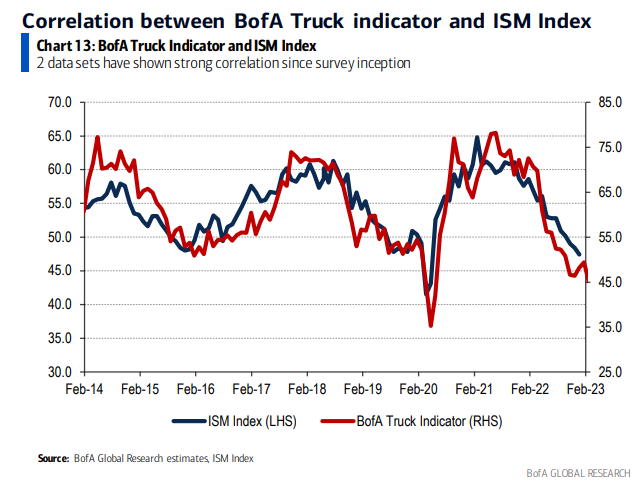

The January ISM PMI was 47.4%, which is lower than December and indicates the manufacturing economy is trending toward contraction territory.

What’s Happening: Mexico’s produce season is officially underway.

Why It Matters: Capacity will likely tighten as produce season drives increased cross-border volume.

What’s Happening: As worsening trucking conditions continue to shift the driver landscape, shippers with contract freight are enjoying the service and pricing benefits of the ample capacity environment.

Why It Matters: Over time, this trend will likely leave the market vulnerable to significant disruptions.

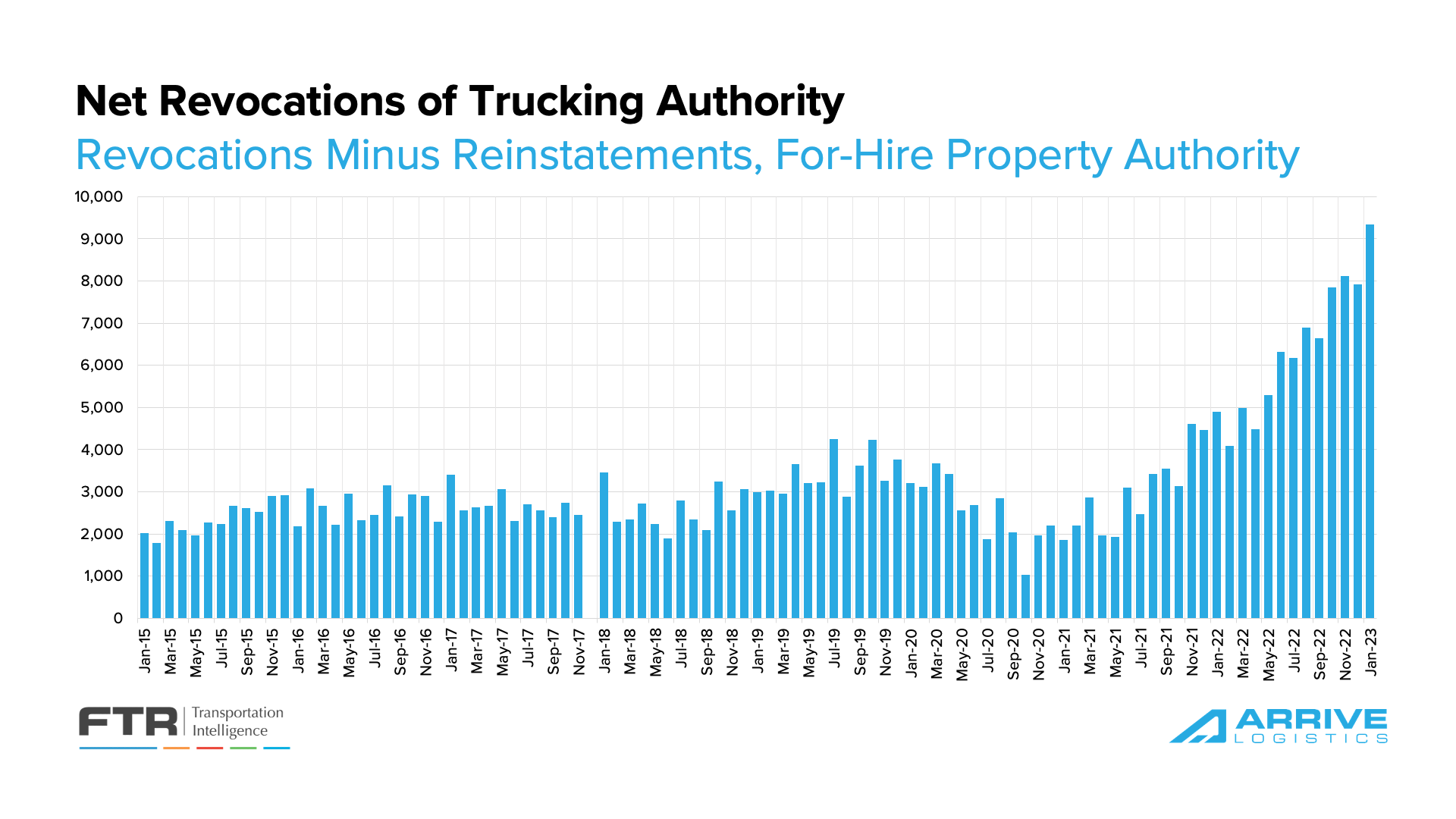

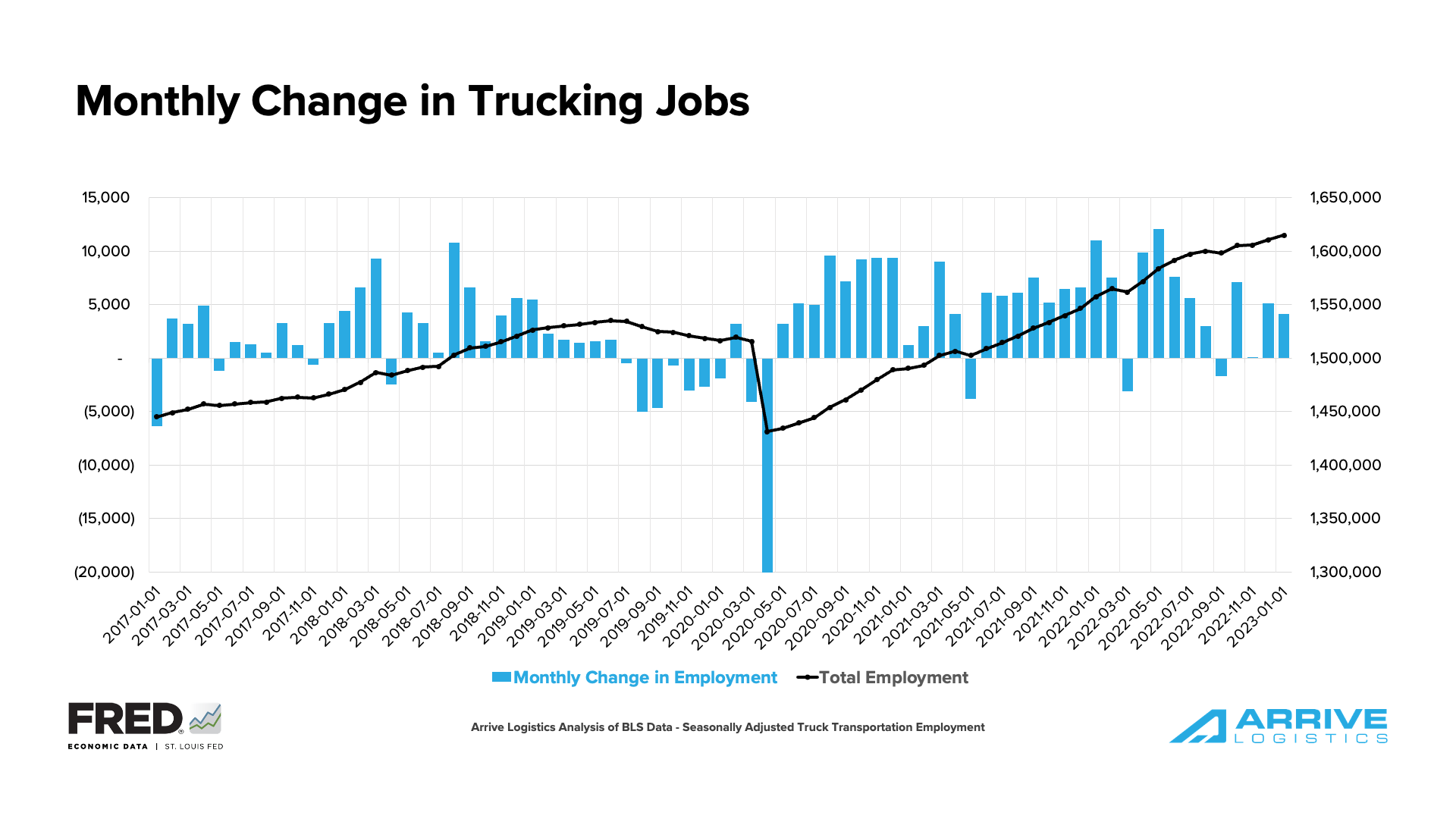

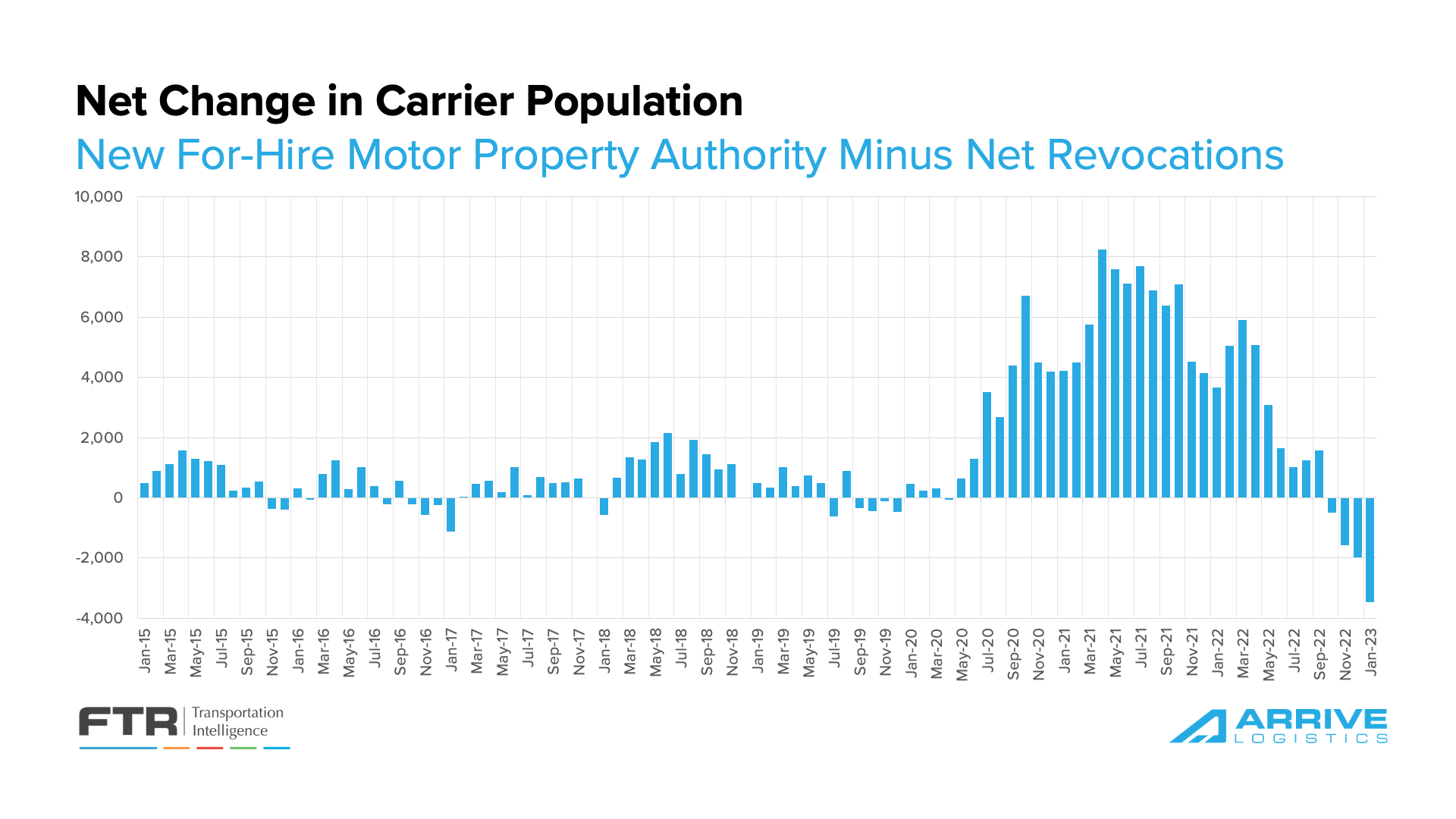

Revocations of trucking authority, as calculated by FTR, remain at historically high levels as trucking conditions have worsened. Up to this point, we believe this trend supports the theory that many owner-operators are taking company jobs with larger assets instead of trying to survive independently. It proves that turnover is high in the carrier space but not high enough to say with certainty that capacity is leaving the market — at least not yet. In fact, total trucking jobs ticked up slightly to a new all-time high in January.

The job growth that started during the pandemic has held steady in recent months, indicating that the number of drivers leaving the market is not yet surpassing the total number of owner-operators taking company jobs. Since employment data does not include the owner-operator headcount, these individuals are represented in the trucking employment numbers as they sign on with larger asset carriers.

If demand falls as 2023 rolls on, larger carriers will likely slow their driver hiring efforts. In that case, trucking employment would likely trend in the opposite direction, leaving a depleted workforce and the market vulnerable to future demand surges.

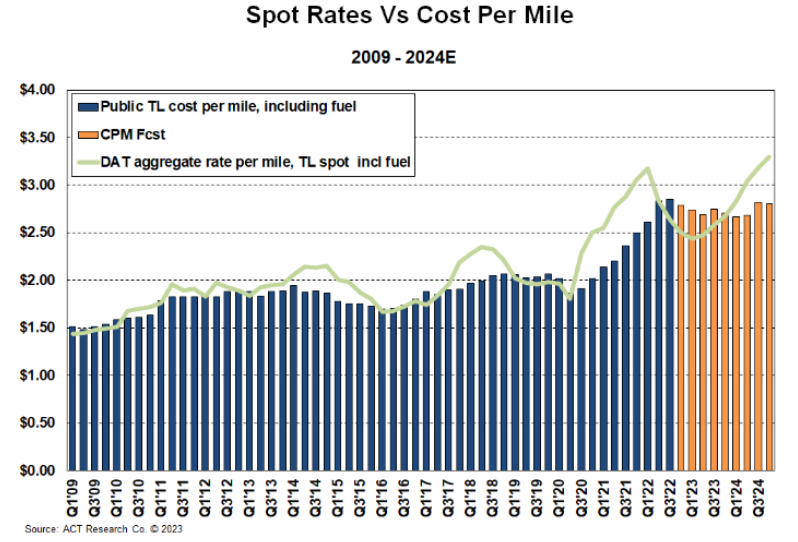

One trend that could account for why more and more carriers, especially those with high spot exposure, are closing up shop is that the all-in spot rate per mile is now below the average cost per mile of operation for publicly traded carriers. Historically, we see capacity normalize when this happens, and spot rates rise relatively quickly.

A recent trend we’re watching is the number of revocations starting to outpace net new carriers entering the market, leading to three straight months of total carrier reduction. Until trucking jobs begin to decline, this trend is likely additional evidence to support the idea that owner-operators are moving to company jobs.

According to FTR, New Class 8 truck orders fell for the fourth straight month to 21,600 in January. However, FTR noted that this was not a surprise as backlogs are already filling most of the production slots at OEMs for the year and while orders have fallen off, they remain higher than a year ago. Current levels remain above what is required to replace aging equipment but below recent production levels, meaning backlogs should ease slightly in the coming months. In January, however, the average time from order to delivery increased from 9.1 to 9.48 months.

Shippers in Arrive’s network continue to note the value of drop trailers in creating warehouse efficiencies amid labor challenges and overstocked inventories. The ability to plan has limited unnecessary dwell times and detention payments to carriers. Drop trailers also benefit carriers, who are getting increased asset utilization on tractors by spending less time waiting for freight to be loaded or unloaded. As a result, trailer orders jumped 47% to hit new record levels in December.

What’s Happening: Demand is shrinking across several sectors amid broader economic uncertainty, leading to declining capital investment and leaving inventories with no place to go.

Why It Matters: It is unclear what type of demand shift will turn things around and when, which means these conditions could persist for some time.

Indicators of future freight demand are not showing many bright spots in 2023, as trends that emerged in the back half of 2022 remain core themes early in the new year.

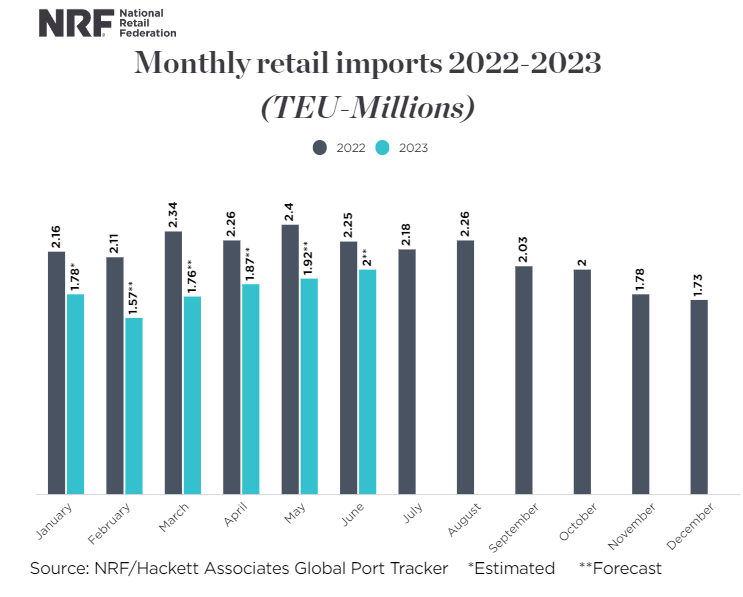

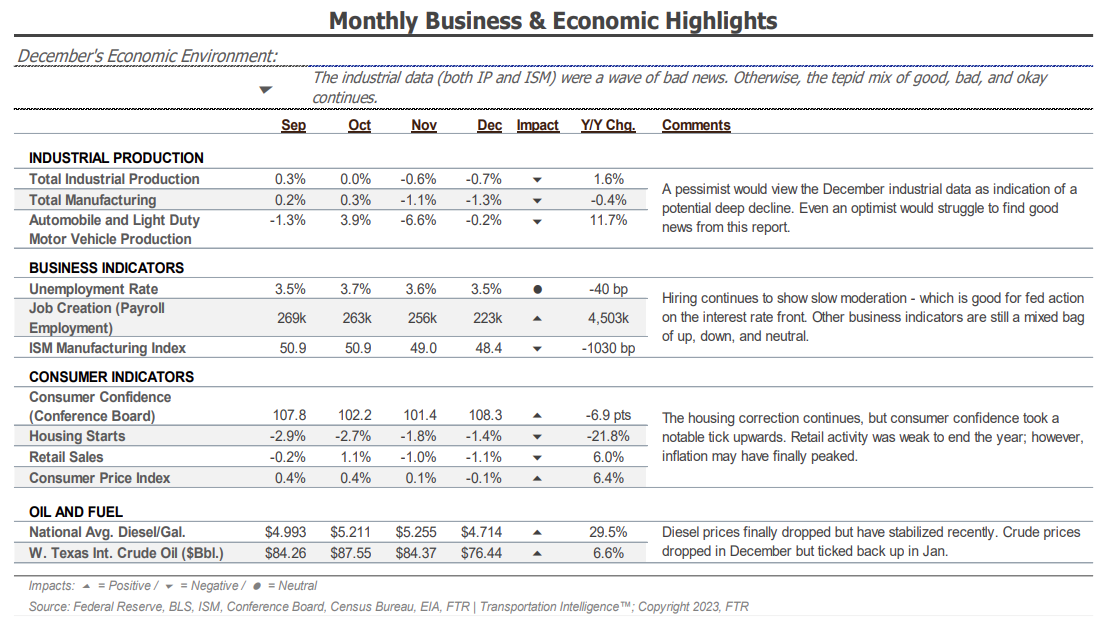

The FED has been relatively successful in slowing inflation by raising interest rates, which we believe is putting downward pressure on demand. The ISM showed the manufacturing sector posted its third consecutive month of contraction, and imports, a key contributor to overall truckload demand, dropped below two million TEUs for the first time in nearly two years. Projections anticipate import levels to remain below two million TEUs through most of the spring, with February likely to post the lowest number in three years. The NRF reports that retailers are importing less merchandise while they wait and see how the economy shapes up in the months ahead.

The ISM manufacturing report indicated easing backlogs as new orders contracted sharply, despite production also contracting. The new orders index fell to 42.5% in manufacturing, its lowest value since the height of the pandemic lockdowns in May 2020. The ISM has indicated that issues causing new order slowdowns should be resolved by the second quarter, but the trend is concerning nonetheless. Manufacturing was forecasted to be one of the main volume drivers in 2023; if contraction persists, demand will likely fall further than previously forecasted. That said, there is still significant pent-up demand in the space that should enable healthy volumes in the near term.

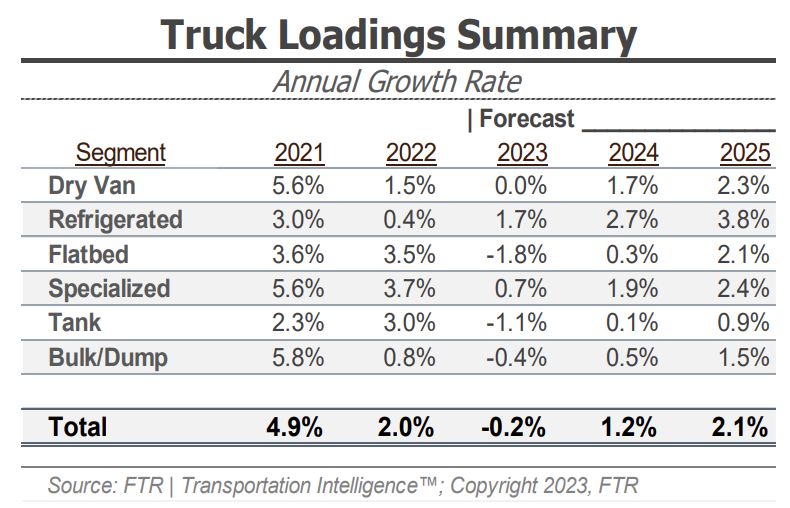

According to the previous report, FTR’s latest truck loadings showed a 2.0% year-over-year increase for 2022, down slightly from an estimated 2.1% heading into January. The 2023 forecast has been revised downward and shows a 0.2% decline from the 0.6% growth reported in the last update. In the latest forecast, weaker outlooks for automotive, chemicals and various other commodities more than offset strong food and construction loadings.

What’s Happening: Economic data shows enough strength to support demand.

Why It Matters: Current conditions should keep the market from falling off a cliff.

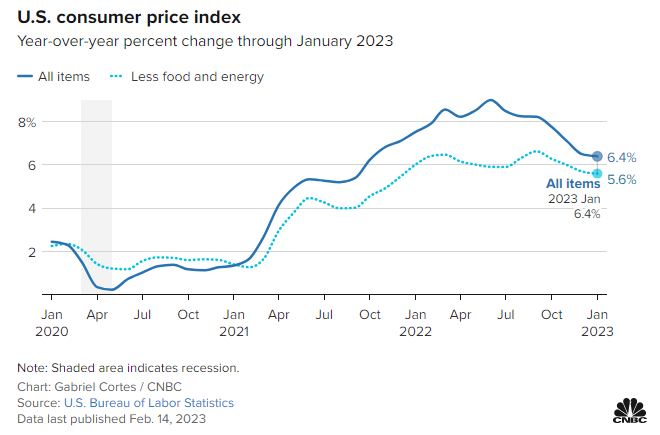

Largely in line with expectations, early February CPI data showed inflation slowed in January, falling from 6.5% to 6.4% year-over-year growth (5.6% when excluding food and energy). Rising shelter costs, which account for nearly 40% of the CPI index, made up about half of the monthly 0.5% increase from December. Rising energy costs also had a significant impact on the results.

As for what these trends mean for future interest rate increases, there is probably no change to the FED’s plan. The current readings show some improvement, but indicate the FED still has some work left to do. There is light at the end of the tunnel, however, as any improvement means we are moving in the right direction.

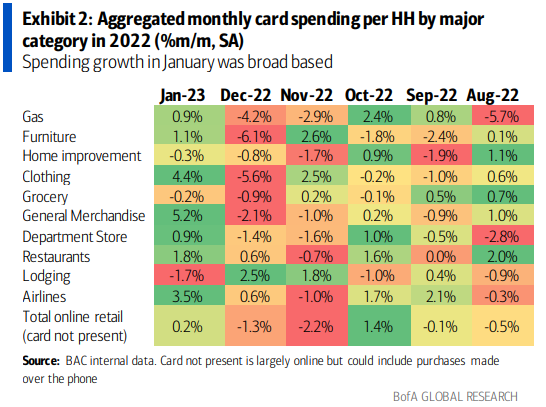

According to Bank of America card data, year-over-year consumer spending grew by 5.1% in January. That’s up from 2.2% year-over-year growth in December after increasing 1.7% month-over-month on a seasonally adjusted basis in January. BofA noted spending growth in January was broad-based, as seasonably adjusted increases appeared across most retail categories.

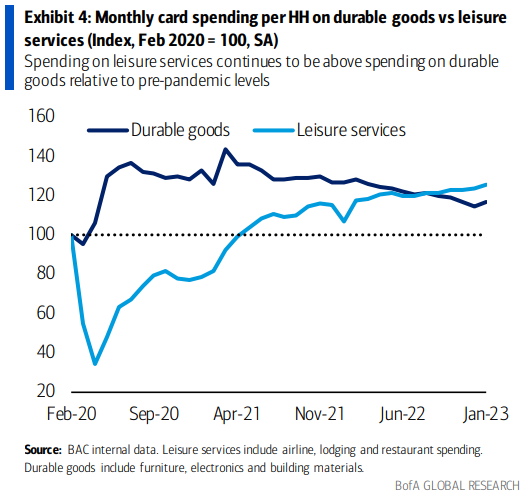

Consumer spending on durable goods improved in January and remains elevated. However, it is still being outpaced by leisure services spending relative to pre-pandemic levels. Airline travel is a category that has continued to see significant growth and supports this trend.

BofA also indicated that while the spending data from January is positive, most factors are short-lived and unlikely to generate an extended acceleration in economic activity. The bottom line, they noted, is that this trend will not prevent the economy from slipping into a recession but could help push the timeline into the back half of 2023.

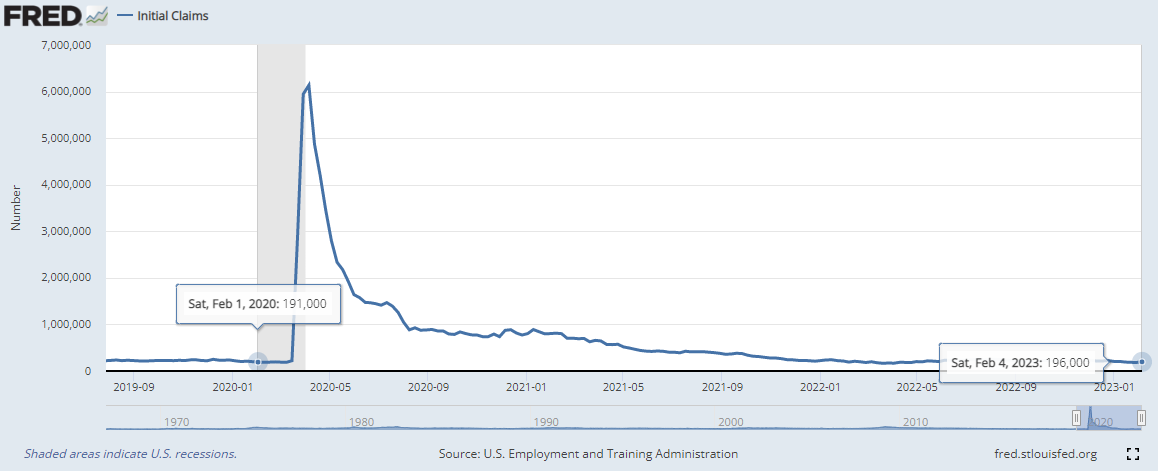

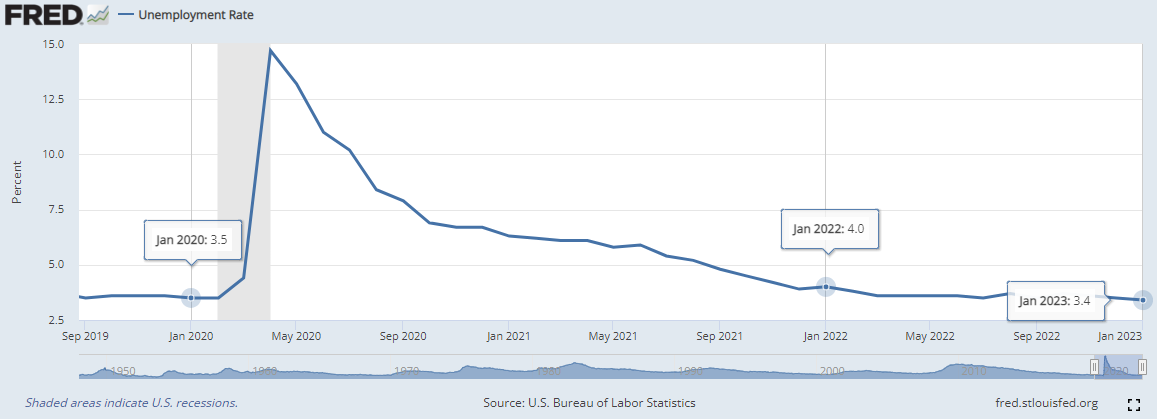

Initial jobless claims were mostly flat into early February and remain very close to what they were this time last year and even before the pandemic. The unemployment rate was also nearly flat compared to January 2020 and down from January 2022, a sign that the labor market remains tight despite recent reports of layoffs.

The strong labor market continues to signal confidence in consumers’ ability to maintain current spending levels and prevent any crash that could suddenly lead truckload demand off a cliff.

Freight market conditions eased quickly after a brief bout of year-end volatility, indicating capacity is still sufficient to support demand. Strong contract routing guide compliance throughout that volatility proved carriers and brokers are prioritizing service in hopes of gaining access to more contract freight as shippers go to bid throughout the first half of the year.

Our 2023 rate forecast remains unchanged. We expect spot rates to find their floor relatively quickly — likely by late Q1 or early Q2 — and to remain stable throughout the year, fluctuating as expected on a seasonal basis. Contract rates will continue to experience deflationary pressure due to the unprecedented spot-contract rate gap.

We see relatively equal risks to the forecast in both directions. In general, downside risks are more likely, but rates can only fall so far before carriers reach their break-even point and profitability suffers.

As the year goes on and capacity continues to moderate, the market will become more and more vulnerable to disruptive events. However, the short-lived periods of recent volatility highlight that the market is still oversupplied with capacity and, therefore, is unlikely to experience any long-term disruptions until at least late Q3.

The Arrive Monthly Market Update, created by Arrive Insights, is a report that analyzes data from multiple sources, including but not limited to FreightWaves SONAR, DAT, FTR Transportation Intelligence, Morgan Stanley Research, Bank of America Internal Data, Journal of Commerce, Stephens Research, National Retail Federation and FRED Economic Data from the past month as well as year-over-year. We know market data is vital in making real-time business decisions. At Arrive Logistics, we are committed to giving you the data and insights you need to better manage your freight.